Wound Antiseptics Market Segmented By PHMB, Povidone Iodine, Hydrogen Peroxide Type in Sprays, Solutions, Foams, Wipes, Gel Form for Antiseptics for Acute Wounds, Antiseptics for Chronic Wounds, Wound Antiseptics for Burns

Industry: Healthcare

Published Date: May-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 235

Report ID: PMRREP33075

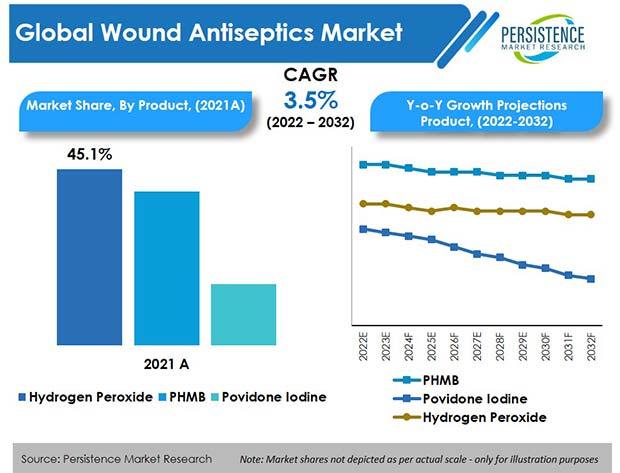

Revenue from the global wound antiseptics market reached US$ 544.7 Mn in 2021. With the market projected to expand at a steady 3.5% CAGR, industry valuation is set to reach US$ 794.4 Mn by the end of 2032.

Sales of wound antiseptic products accounted for nearly 30.7% of the global wound cleansers market in 2021.

| Attribute | Key Insights |

|---|---|

|

Wound Antiseptics Market Size (2021) |

US$ 544.7 Mn |

|

Projected Market Value (2032) |

US$ 794.4 Mn |

|

Global Market Growth Rate (2022-2032) |

3.5% CAGR |

|

Top 5 Countries by Share |

53.4% |

The treatment of wounds, mainly chronic wounds, is a big challenge for physicians. It is projected that chronic wounds are a problem in more than 1.5% of the population across the globe. In wound management, complete local treatment is very essential, which includes the use of wound antiseptics.

Growing incidence of wounds will lead to increased penetration and adoption of wound antiseptics among the middle-class population in emerging countries. To boost their revenue growth, leading manufacturers of wound antiseptics are focusing on geographical expansion in emerging economies such as India and China.

Increase in the geriatric population worldwide and subsequent rising incidence of diabetes and obesity are directly linked to the rising occurrence of chronic wounds. Traditional methods of wound care and wound cleansing require an extended healing period as well as more regular changes to the dressing, and thus cause trauma in some patients.

Advanced wound antiseptic products come with less contamination to the wound surface and require less time for healing. These advantages of wound antiseptics are expected to supplement market growth going forward.

Leading manufacturers are actively engaging in inorganic activities such as collaborations to increase research and development activities, which are anticipated to boost demand growth of wound antiseptics over the forecast period.

The global wound antiseptics market expanded at 3.1% CAGR over the past 5 years, and is expected to expand even faster over the next ten years at a CAGR of 3.5% and offer an absolute $ opportunity of US$ 21 Mn.

“Shift to Advanced Wound Care Treatment Options”

The incorporation of consistent procedures for wound management in medical institutions results in shorter hospital stays and decreases the rate of chronic wound infections.

Thus, extended approval of treatment protocols among medical professionals as well as the patient pool with chronic wounds has given escalation to the shift in wound care treatment from traditional wound management methods to advanced wound care treatments that are supported by clinical as well as economic data.

“Focus on Developing Market – Latin America & Asia Pacific”

Compared to developed markets, Latin America and Asia Pacific are unexploited markets for wound antiseptics and have enormous growth potential. Due to this, several key players are focusing on strengthening their market presence in these regions.

Furthermore, huge patient pool and growing elder population in developing regions offer significant growth opportunities for manufacturers of wound antiseptics.

“High Cost of Advanced Wound Antiseptics and Increasing Product Recalls”

The treatment cost for chronic wounds is high if the per-unit cost is considered for advanced wound antiseptics. Physicians and patients want to opt for cost-effective advanced wound management products.

Although there are many bio-engineered dressings available, physicians and patients, especially in developing regions, tend to opt for traditional and basic wound care products due to their low costs. Apart from this, growing number of product recalls owing to component inconsistency, product failure, and packaging problems may hinder the growth of the wound antiseptics market to some extent.

“Lack of Awareness about Wound Care Management in Developing Regions”

Chronic wounds such as diabetic foot ulcers, leg ulcers and pressure ulcers can become severe due to late diagnosis, which can also lead to amputations. Incidence of delayed diagnosis is significantly more in developing countries such as Brazil, India, and China as compared to developed countries.

This is due to lack of awareness among people regarding hard-to-heal wounds, limited access to well-developed healthcare facilities, and lack of established guidelines and action plans by government organizations.

For example, a report published in the journal of foot and ankle surgery states that, in the Asia Pacific region, specifically in India, most patients are delayed by more than one month up to one year in the diagnosis of foot ulcers, including diabetic and neuropathic ulcers.

Thus, delayed diagnosis of advanced and chronic wounds limits the adoption of wound antiseptic products in emerging countries.

Why is the U.S. a Huge Market for Wound Antiseptics?

The U.S. wound antiseptics market dominated the North American region with a market share of 86.7% in 2021, and is expected to continue its high-growth trajectory going forward.

The burden of chronic wounds is growing rapidly in the U.S.; approximately 4.5 million people are affected in the U.S. due to increasing ageing population and a sharp rise in diabetes and obesity. With rising prevalence of chronic wounds such as diabetic foot ulcers, there is high demand growth of wound antiseptics.

Due to the availability of reimbursements by Medicaid and Medicare Services, demand for wound antiseptic solutions has witnessed a surge, popularized by the pay-for-scale model.

Will the U.K. Be a Lucrative Market for Wound Antiseptic Providers in Europe?

The U.K. dominated the Europe wound antiseptics market with a share of 21% in the year 2021.

Leading wound antiseptic product manufacturers in the U.K. are focusing on the development of innovative wound management products by increasing their ability to maintain moisture balance and prolonged oxygen permeability and antimicrobial activity, which will be responsible for the robust growth of the market in the country over the next ten years.

How Will Market Players Benefit from the Emerging China Wound Antiseptics Market?

China held 50.3% share in East Asia wound antiseptics market in 2021, which is projected to increase further over the decade.

Injury is the fifth-leading cause of death in China, though an increasingly growing elderly population, mainly susceptible to wounds, means a growing proportion of Chinese people going for wound management.

Many more suffer from chronic, non-healing wounds owing to difficulties from diabetes, cardiovascular disease, and obesity, which are expected to increase intensely, and thus, demand for wound antiseptic solutions will increase over the coming years.

Which Wound Antiseptic Product is Driving High Market Growth?

By product type, the hydrogen peroxide segment is set to expand at a CAGR of 1.8% through the forecast period.

Increasing adoption of hydrogen peroxide on account of stringent infection-control policies implemented by hospitals is anticipated to drive demand for hydrogen peroxide-based wound antiseptics.

Furthermore, surging demand for hydrogen peroxide as a strong wound antiseptic to sterilize surgical wounds is expected to enable high growth in developed countries.

Which Type of Wound Care Accounts for Significant Market Share?

Acute wounds accounted for a revenue share of 50.8% in 2021, with the segment projected to hold on to this high market share through 2032.

Key factors that are expected to increase demand for acute wound care are increase in the geriatric population, rising prevalence of diabetes, surge in investments in wound care research, growing R&D activities in acute wound care products, and increasing wound care awareness programs.

Key manufacturers of wound antiseptics are mainly focusing on advancing wound management treatment by improving drug discovery, disease diagnostics, and the delivery of advanced wound care products, to gain market traction.

For example-

Moreover, leading manufacturers such as B. Braun, ConvaTec Group, Coloplast and 3M Company are constantly launching new wound antiseptic products and are also involved in collaborations to enhance the manufacturing process of wound cleansers.

| Attribute | Details |

|---|---|

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2017-2021 |

|

Market Analysis |

US$ Mn for Value |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Pricing |

Available upon Request |

Wound Antiseptics Market by Product Type:

Wound Antiseptics Market by Form:

Wound Antiseptics Market by Wound Type:

Wound Antiseptics Market by End User:

Wound Antiseptics Market by Region:

To know more about delivery timeline for this report Contact Sales

The global wound antiseptics market is worth US$ 565.1 Mn and is set to expand 1.4X over the next ten years.

Consumption of wound antiseptics is expected to reach US$ 794.4 Mn by the end of 2032.

From 2017 to 2021, wound antiseptics market growth was recorded at 3.1% CAGR.

Increase in advanced wound care product adoption and acceptance of innovative treatment protocols by healthcare professionals are key trends in this marketplace.

The U.S., India, China, U.K., and Germany drive highest demand for wound antiseptic products.

The U.S. accounted for 86.7% of the North American market share in 2021.

Demand for wound antiseptics in Europe is expected to register a CAGR of 3.3% over the next ten years.

The U.S., India, and China are major suppliers of wound antiseptic products.

The China wound antiseptics market held a share of 50.3% in East Asia in 2021, while Japan held 41.4% market share.