Industry: Healthcare

Published Date: February-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 191

Report ID: PMRREP14128

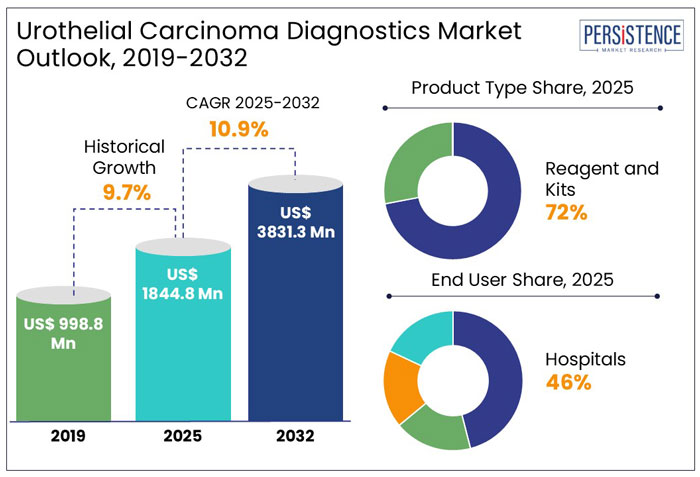

The global urothelial carcinoma diagnostics market size is anticipated to rise from US$ 1,844.8 Mn in 2025 to US$ 3,831.3 Mn by 2032. It is projected to witness a CAGR of 10.9% from 2025 to 2032.

Growing awareness of early diagnosis and treatment, together with the rise in bladder cancer incidence around the globe, are propelling the demand for urothelial carcinoma diagnostics.

The growing demand from seniors for healthcare is driving the demand for sophisticated diagnostic methods like liquid biopsy and molecular diagnostics.

Key Highlights of the Urothelial Carcinoma Diagnostics Market

|

Global Market Attributes |

Key Insights |

|

Urothelial Carcinoma Diagnostics Market Size (2025E) |

US$ 1,844.8 Mn |

|

Market Value Forecast (2032F) |

US$ 3,831.3 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

10.9% |

|

Historical Market Growth (CAGR 2019 to 2024) |

9.7% |

Raising Awareness for Bladder Cancer Amid Pandemic Advances Diagnosis Therapies

The global urothelial carcinoma diagnostics industry witnessed a CAGR of 9.7% in the historical period between 2019 and 2024. The COVID-19 pandemic impacted the bladder cancer therapeutics and diagnostics market across the world, with almost a 20% drop in diagnoses during the first wave but a return to pre-COVID levels by the end of 2020. However, treatment-related alterations were minimal, and surgical volume was not compromised.

Initiatives like the World Bladder Cancer Patient Coalition's 'Don't Go Red' campaign aim to raise awareness about bladder cancer, a prevalent global health issue, which is among the top 10 high-intensity cancers in the observed period.

Research in Bladder Cancer Diagnostics to Improve Diagnosis Rehabilitations through 2032

In the estimated timeframe from 2025 to 2032, the global market for urothelial carcinoma diagnostics is likely to showcase a CAGR of 10.9%. The bladder cancer diagnostics market is expanding due to advancements in biomarker research and early detection methods. Traditional diagnostic techniques such as urine cytology, cystoscopy, and biopsy remain widely used, but newer non-invasive urine-based biomarker tests are gaining traction due to their accuracy and ease of use.

Companies like Bio-Techne, Abbott, and Cepheid are investing in biomarker-based diagnostics to improve early detection. Cepheid’s Xpert Bladder Cancer test, launched in 2023, provides rapid and reliable results. Similarly, Pacific Edge’s CxBladder is gaining popularity for detecting urothelial carcinoma with high sensitivity.

Rising bladder cancer incidence, more funding for research, and the use of non-invasive screening are projected to contribute to the diagnostics market's significant expansion in the projected period.

Growth Drivers

Awareness of Early Urothelial Cancer Screening Shows Novel Prospects

The need for early detection and monitoring tools for urinary tract cancers is becoming increasingly urgent due to a rise in urothelial carcinomas and bladder cancer. Urothelial tumors are now recognized as the tenth most common cancer worldwide. Thanks to advancements in molecular diagnostic tools, bladder cancer, which was the sixth most common cancer in 2020, can now be more accurately characterized. Early identification of benign tumors is crucial, as it allows for effective eradication.

The heightened risk associated with benign lesions further emphasizes the demand for improved diagnostic testing for urothelial carcinoma. The development of immunotherapies and cancer biomarkers, alongside clinical oncology molecular diagnostic tests, is expected to drive the need for enhanced urothelial carcinoma diagnostics.

In regions with high prevalence, leading companies are developing diagnostic companions to enhance their market share and expand their presence.

Limitation of Skilled Workforce Hampers the Adoption of Novel Cancer Diagnostics

The demand for urothelial carcinoma diagnostics faces several challenges despite advancements in technology. One significant issue is the shortage of qualified laboratory staff, which hinders effective testing and analysis.

Although next-generation sequencing, proteomics, and metabolomics show promise for detecting urothelial carcinoma, several obstacles remain. Problems with data reproducibility, analytical validation, and standardization limit their integration into clinical practice. Additionally, tumor heterogeneity and the evolution of clones complicate molecular diagnostics.

In order to address the industry-wide limitations, increased research funding and training initiatives are vital. Companies like Roche, Bio-Techne, and Cepheid are also investing in automated diagnostic systems to reduce reliance on manual expertise.

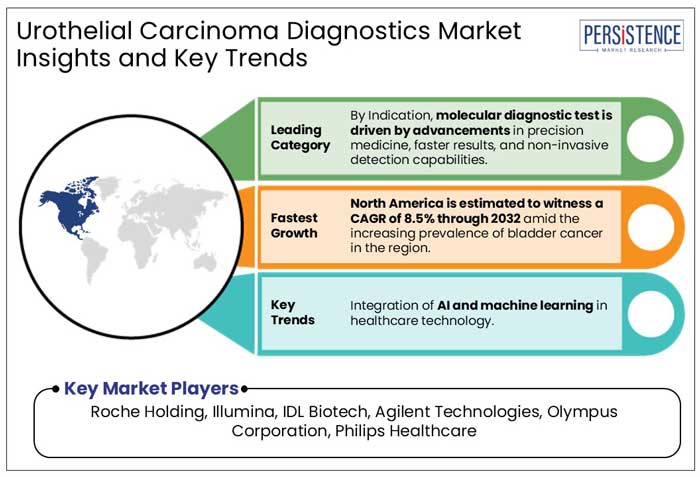

Integration of AI and Machine Learning Presents Investment Prospects in Healthcare Industry

The integration of AI in the diagnosis of urothelial carcinoma is transforming the detection and classification of lesions, enhancing the accuracy and efficiency of disease identification. AI-powered tools, such as machine learning algorithms and deep learning models, are being utilized in digital pathology and cytology imaging to improve early-stage detection.

Innovations in visualization techniques, such as narrow-band imaging (NBI) and blue-light cystoscopy (BLC), have improved the sensitivity of detecting flat, non-muscle invasive bladder tumors (NMIBC).

Companies like Olympus and Karl Storz are developing high-definition imaging systems aimed at improving patient outcomes, reducing false negatives, and streamlining workflows. The advancement of AI in diagnostics is expected to decrease the need for biopsies and increase the rates of early intervention for urothelial carcinoma.

Product Insights

Reagents and Kits Lead Urothelial Cancer Diagnostics with Advanced Molecular Testing

In 2025, the reagents and kits segment dominated the urothelial carcinoma diagnostics market, accounting for 72% of the market share, driven by their crucial role in cancer detection, tumor behavior prediction, and targeted therapies.

The focus on biomarker-driven diagnostics has fueled the demand for highly specific reagents and kits that enable accurate and early urothelial cancer detection.

Companies like Thermo Fisher Scientific, Roche Diagnostics, and Abbott Laboratories have introduced next-generation molecular testing kits, improving sensitivity and specificity in bladder cancer diagnosis.

Innovations in automated diagnostic platforms and high-resolution imaging technologies are helping the instruments category, which is controlled by Olympus Corporation and BD, increase its market share. To improve visualization and diagnostic precision, these businesses are investing in digital pathology tools, fluorescence imaging equipment, and cystoscopy instruments.

Test Insights

Molecular Diagnostic Tests Drives Early Cancer Detection with Market Expansion

Molecular diagnostic tests are projected to capture 44% of the market share in 2025. These tests play a vital role in the early identification of cancer by utilizing advancements in proteomics, genomics, and bioinformatics, which improve detection accuracy and patient outcomes.

Companies such as Roche Diagnostics and Thermo Fisher Scientific are investing in next-generation sequencing (NGS) and polymerase chain reaction (PCR) technologies to enhance diagnostics for urothelial cancer.

At the same time, urinalysis tests continue to be widely used due to their non-invasive and cost-effective screening capabilities.

As assessed by Persistence Market Research, biomarker tests like UroVysion, CxBladder, and Xpert Bladder Cancer are gaining a market share of 16% because of their higher specificity and sensitivity in detecting bladder cancer.

Market growth is expected to be further accelerated by Qiagen's liquid biopsy and urine-based molecular testing, along with the increasing use of precision medicine and AI-driven diagnostic tools.

Robust Healthcare Infrastructure of North America Cultivates the Research Initiatives

In 2025, North America is expected to be the prevalent market for bladder cancer treatments and tests, with a 42% share. This is because of more research, a strong healthcare system, and many companies developing new medicines. The market is forecasted to report a CAGR of 8.5% from 2025 to 2032.

The market is likely to expand due to important studies like the EV-103 trial, which is testing PADCEV for a serious form of bladder cancer, and the approval of nivolumab for treating urothelial carcinoma in North America.

Asia Pacific Presents Prospects with Innovation in Personalized Medication

The rise of personalized medicine is fueling the growth of companion diagnostics in the Asia Pacific, particularly for targeted therapies in oncology. The region is estimated to account for 23% of the global scale.

This approval marks a significant milestone in the treatment of advanced bladder cancer, offering new options for patients with urothelial carcinoma.

The increasing adoption of biomarker-driven treatments in countries like Japan, China, and South Korea is driving demand for advanced diagnostics, enabling precise patient stratification and improving treatment efficacy.

The development of customized medicine solutions is being accelerated by the high rise in cancer cases in Asia Pacific, where companion diagnostic procedures like NGS and IHC are essential for customizing medicines to patient profiles.

Government Support Caters Advancement in Healthcare Technology in Europe

Rising healthcare expenditures and expanded insurance coverage are improving access to cancer diagnostics across Europe.

This regulatory milestone highlights Europe's commitment to precision oncology and targeted therapies, further driving demand for companion diagnostics and biomarker testing.

Countries such as Germany, France, and the UK are increasing investments in cancer screening programs, integrating advanced diagnostic technologies like liquid biopsy and next-generation sequencing.

Europe is making insurance more accessible, which helps people afford new cancer diagnostic tests. This change leads to earlier detection of cancer and improves patient outcomes. It also strengthens the region's position in cancer diagnostics through personalized medicine and partnerships between the public and private sectors.

The market for diagnostics, therapies, and treatments aimed at combating bladder cancer features several key players and exhibits a moderate level of competition. Prominent companies such as F. Hoffmann-La Roche Ltd., Novartis, and Pfizer are at the forefront of this industry, vying for greater market share. In a bid to enhance their positions, these major players are focusing on a range of strategies, including the development of innovative products, expanding their business operations, exploring untapped markets, and strengthening their core competencies.

As they strive to capture a larger portion of the global urothelial carcinoma diagnostics market, these leading companies are anticipated to invest in research and development initiatives aimed at discovering novel treatments that can be deployed on a worldwide scale. This emphasis on innovation not only reflects their commitment to advancing medical science but also underscores the competitive nature of the bladder cancer therapeutic sector.

Key Industry Developments

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product

By Test

By End User

By Region

To know more about delivery timeline for this report Contact Sales

The market is set to reach US$ 1,844.8 Mn in 2025.

Urine cytology analyzes urine samples for cancer cells, while imaging tests like CT urograms or retrograde pyelograms examine urinary tract structures.

Roche Holding, Illumina, IDL Biotech, and Agilent Technologies are a few leading players.

The industry is estimated to rise at a CAGR of 10.9% through 2032.

North America is projected to hold the largest share of the industry in 2025.