Industry: Healthcare

Published Date: June-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 160

Report ID: PMRREP16030

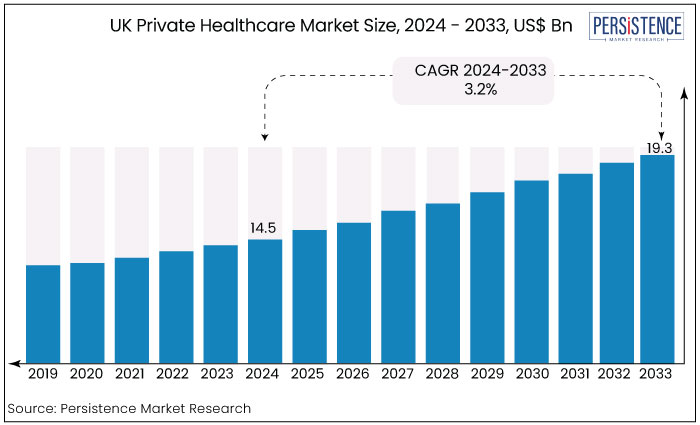

The UK market for private healthcare is expected to rise from US$14.5 Bn in 2024 to US$19.3 Bn by the end of 2033. The market is anticipated to secure a CAGR of 3.2% during the forecast period from 2024 to 2033.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

Market (2024E) |

US$14.5 Bn |

|

Projected Market Value (2033F) |

US$19.3 Bn |

|

Forecast Growth Rate (CAGR 2024 to 2033) |

3.2% |

|

Historical Growth Rate (CAGR 2019 to 2023) |

2.9% |

The UK private healthcare market is driven by different prominent factors. One of the key factors driving the market in the UK is the persistent strain on the National Health Service (NHS), arising from capacity issues, long hours waiting for treatments and consultations and funding limitations.

This factor has led several people to look out for alternatives in the private sector, where they are able to access fast specialist care, different treatment options and appointments.

There is increasing preference amid people to invest in their health with growing health consciousness and rising disposable incomes.

Private healthcare services are seen as a premium offering providing medical treatment however also amenities including personalized care plans, concierge services and personalized plans. This appeals to people who prioritize convenience, and holistic approach to healthcare.

Advancements in medical technology is another prominent factor drives demand for private healthcare, as patients seek access to cutting-edge treatments, diagnostic tools, and digital health solutions that may not be readily available in the public sector.

The convergence of these factors underscores the increasing significance and growth potential of the UK private healthcare market.

The UK private healthcare market has grown steadily over the past few decades fueled by factors such as demand for private healthcare services has increased.

This increase was due to long waiting times in the public healthcare system, great consumer awareness, and aging population seeking elective procedures. The UK private healthcare market expanded at a CAGR of 2.9% during the historical period from 2019 to 2023.

Increasing healthcare expenditure, both public and private, has supported growth in the private healthcare sector. Individuals and employers have been willing to spend more on private health insurance and out-of-pocket expenses for quick access to healthcare services.

There are numerous other factors expected to shape the future growth outlook for the UK private healthcare market.

One of the key factors is the aging population, which is expected to drive increased demand for healthcare services, including elective procedures and long-term care, which could benefit the private healthcare sector.

The market is expected to secure a CAGR of 3.2% during the forecast period from 2024 to 2033. Continued advancements in medical technology, telemedicine, digital health, and personalized medicine are likely to drive growth and innovation in the private healthcare market.

Moreover, the evolution of private health insurance offerings, including tailored and flexible plans, could attract a wide customer base and drive market growth.

Rising Trend of Self-Pay

The increased interest of patients to self-pay for various ailments in recent times is expected to advance the private healthcare market in the UK. Moreover, private hospitals are coming up with package price and fixed consultant fees for certain types of treatment and after care, which allows patients to choose best offerings in the market.

Private hospitals give choices to patients to take this self-pay route for non-urgent operations. Increase in self-pay elective procedures is driven by growing NHS waiting list and growth is supported by packaged pricing and marketing initiatives of private hospitals in the UK.

Increasing e-Referrals Propel the UK Private Healthcare Industry

The private healthcare sector is witnessing a strong growth in NHS GP referrals owing to long NHS waiting list, which is increasingly turning patients to the private sector.

The e-Referrals system allows patients to choose the time, date, and hospital/clinics for the required treatment, thus helping patients make informed decisions. For instance,

Growing Aging Population, and Increasing Healthcare Needs

There is an increased demand for healthcare services with the growing aging population particularly for age-related conditions and chronic diseases.

The elderly demographic segment tends to have increasing healthcare needs and may seek private healthcare to receive personalized care and expedited treatment.

Individuals they tend to experience a higher prevalence of chronic illnesses, degenerative conditions, and age-related health issues such as arthritis, cardiovascular disease, and dementia with aging.

The increasing burden of these conditions among the aging population leads to increased demand for healthcare services, including specialist consultations, diagnostic tests, and ongoing medical management.

Aging population need to opt for private healthcare services to avoid long waiting times for specialist appointments, diagnostic tests, and elective procedures within the National Health Service (NHS).

Private healthcare providers typically provide short wait times and expedited access to care, addressing the immediate healthcare needs of older adults who prioritize timely treatment and convenience.

A Lull in Growth of PMI

Private medical insurance (PMI) is the largest payer of healthcare services in the UK private healthcare market. The ongoing decline in medical cover pay-outs to hospitals and clinics over the past five years and decline in individual purchase of private medical insurance are expected to hinder the private healthcare market over the medium term.

Decline in PMI funded inpatient and day case caseload owing to ongoing funder cost management and additional premium tax are expected to impact the private healthcare market negatively.

Apart from the aforementioned factors, relatively few companies offer continued support for private medical insurance beyond retirement age, and individual premiums rise sharply with age and medical history.

People who benefit from private medical insurance are thus concentrated in the 30- to 64-year age group with relatively few people covered past retirement age, which may affect the market negatively during the forecast period.

Disparities in Access to Healthcare Services Available in the UK

Inequalities in access to healthcare services exist within the UK, with certain population groups facing obstacles to accessing private healthcare because of geographic location, socioeconomic factors, and health insurance coverage.

Health inequality may restrict the uptake of private healthcare services amid marginalized or underserved communities.

Health inequality is also likely to contribute to disparities in the distribution of healthcare providers, with private healthcare facilities being concentrated in affluent urban areas while underserved rural or disadvantaged urban areas have restricted access to private healthcare services.

Geographic maldistribution of healthcare providers can exacerbate health inequality by limiting access to timely and quality healthcare services for vulnerable populations living in areas with limited healthcare infrastructure.

Increasing NHS Waiting Time for Different Treatments and Procedures

Increasing waiting times for various treatments and procedures at NHS is prompting patients to adopt private healthcare services in the UK.

The rising waiting time beyond 18-week target would provide significant opportunities for private healthcare providers to bridge the ongoing gap between NHS targets and infrastructure.

According to NHS England, the number of patients not receiving treatment within 18 weeks of referral has gone up by 100,000 since January 2016. For instance,

Analysis by the Royal College of Surgeons found that over the past year an average of 193,406 people a month did not get surgery within 18 weeks of being referred.

Moreover, the number of patients waiting for operations is expected to increase significantly in the years to come, which is expected to create growth opportunities for private healthcare providers.

Growing Demand for Convenience, and Evolving Consumer Preferences

Increasing demand for convenience and changing customer preferences bring opportunity for the private healthcare providers in the UK for providing flexible service models such as virtual consultations, healthcare services and subscription based plans.

There are several consumers willing to pay for personalized, concierge-style healthcare services that offer enhanced convenience, personalized attention, and expedited access to care.

The UK private healthcare market is segmented based on service type, application and end user. Based on service type, the market is classified into private acute care hospitals, private patient care clinics, private specialist services, private diagnostics and imaging centers, private urgent care centers and others.

On the basis of application, the market is further divided into trauma and orthopedics, general surgery, oncology, maternity and OB-Gyn, cardiology, urology, and others. Based on end user, the market is categorized into international tourists, NHS referrals & PMI, and self-pay individuals.

Rising Overseas Patient Visits Fuel the UK Private Healthcare Market

The UK fascinates tourists across the world who look for advanced treatments, high-quality healthcare services and renowned specialists.

Private healthcare providers take the advantage from medical tourism by catering to international patients that look for specialized treatments and second opinions.

The increasing confidence among foreign patients regarding the private healthcare sector in the UK is expected to boost the market over the forecast period. To address the increasing needs of foreign patients, several large London based hospitals have increased intensive care facilities.

Government initiatives like upfront charges for NHS foreign patients and long NHS waiting times are expected to prompt foreign patients to avail private healthcare services in the UK.

Growth is being driven by an increase in self-paying overseas patients, particularly from Middle Eastern countries, as London builds on its reputation as a global center for healthcare excellence.

2023

The demand for private healthcare is accelerating in the UK with patients hugely turning away from NHS beset with chronic backlogs. According to the Private Healthcare Information Network (PHIN), 898,000 admissions were recorded in 2023 to private hospitals than in any year since records started in 2016. This revealed a 7% increase in the number of times that people looked for private treatment since 2022, when the number stood at 836,000.

2024

PureHealth, the leading and one of the largest healthcare platforms in the Middle East made planned acquisition of Circle Health Group, the largest independent hospital provider in the UK. It marks a notable milestone in the global expansion strategy of the company. This deal’s completion indicates unique operational capabilities of PureHealth to international growth.

Companies like Bupa, Spire Healthcare, Nuffield Health, and BMI Healthcare are the leading players in the UK private healthcare sector. These organizations operate hospitals, clinics, and other healthcare facilities across the country.

Companies that provide telemedicine platforms, electronic health records (EHR) systems, remote monitoring solutions, and digital health apps contribute to the competitive landscape.

They provide innovative tools and services to improve access to healthcare, enhance patient engagement, and optimize healthcare delivery.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2033 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Country Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Service Type

By Application

By End User

To know more about delivery timeline for this report Contact Sales

The market is expected to rise from US$14.5 Bn in 2024 to US$19.3 Bn by the end of 2033.

Increasing affluence and health consciousness is a key driver for market growth.

A few of the key players of the market are Fabri-Tech Inc, Airtecnics, and Meech International.

The high cost of private insurance premiums, consultations, treatments is restraining the market growth.

An opportunity lies in the increasing NHS waiting time for different treatments and procedures.