Transradial Access Devices Market

Industry: Healthcare

Published Date: September-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 182

Report ID: PMRREP34825

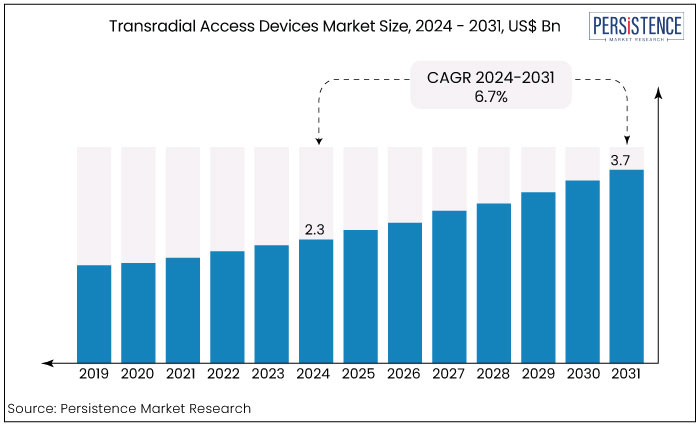

The transradial access devices market is estimated to increase from US$2.3 Bn in 2024 to US$3.7 Bn by 2031. The market is projected to record a CAGR of 6.7% during the forecast period from 2024 to 2031. This market growth is fueled by a growing preference for minimally invasive procedures among healthcare providers and patients. Another key factor driving market growth is the increasing prevalence of cardiovascular diseases globally.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

Market Size (2024E) |

US$2.3 Bn |

|

Projected Market Value (2031F) |

US$3.7 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

6.7% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

3.4% |

|

Region |

Market Share by 2024 |

|

Asia Pacific |

25.45% |

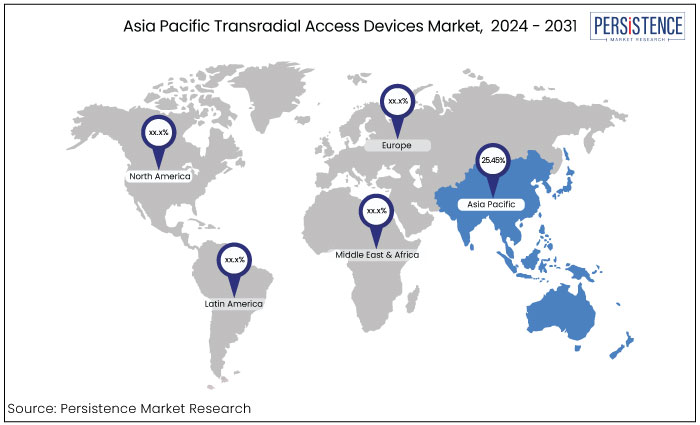

Asia Pacific market is expected to hold a dominant revenue share of 25.45%. This region is becoming increasingly lucrative due to a large patient population with cardiovascular diseases, improved healthcare infrastructure, and heightened awareness of radial artery access among healthcare professionals.

Rapid growth is observed in countries like China, India, and Japan, fueled by rising awareness of minimally invasive procedures. Additionally, collaborations between medical device manufacturers and local healthcare facilities are enhancing product accessibility and affordability further supporting market expansion in the Asia Pacific region.

|

Region |

CAGR through 2031 |

|

North America |

8.3% |

The market is projected to expand at a CAGR of 8.3% during the forecast period. This growth is driven by the rising prevalence of cardiovascular diseases, advancements in healthcare infrastructure, and a preference for minimally invasive procedures.

The U.S. leads the market due to its high adoption of advanced medical technologies and a robust healthcare system. Additionally, the increasing geriatric population and awareness of radial access benefits enhance demand. Notably, in September 2021, Medtronic received CE mark approval for its radial artery access portfolio, boosting market growth.

|

Category |

Market Share by 2024 |

|

Product - Catheters |

33.68% |

Catheters are predicted to account for the largest market share of 33.68% by 2024 fueled by the increasing prevalence of cardiovascular diseases and the demand for minimally invasive procedures. As per the transradial access devices market update, innovations in catheter design and materials, along with the increasing use of transradial access for angiography and angioplasty, enhance patient comfort and reduce complications.

Notably, in July 2023, ALVIMEDICA gained CE Mark approval for its Alvision Kaplan curves radial portfolio, promoting a safer transradial approach with advanced designs that improve stability and patient outcomes, further propelling market growth.

|

Category |

Market Share by 2024 |

|

End Use - Hospitals |

40.47% |

Hospitals sector is expected to capture the largest market share at 40.47% by 2024, driven by the increase in cardiovascular diseases and the demand for minimally invasive procedures. Benefits like few complications, short hospital stays, and quick recovery times promote the adoption of transradial access devices.

The growth is supported by advanced medical facilities and favorable reimbursement policies for hospital surgeries. Notably, in October 2022, EmblemHealth introduced a new reimbursement policy for hospital treatment room billing, further encouraging the use of transradial access devices and contributing to the segment's rapid expansion.

The transradial access devices market overview shows that the sector is expanding significantly with exhibitig steady CAGR. Transradial access devices are innovative medical tools used primarily in interventional cardiology and radiology procedures. These devices allow healthcare professionals to guide catheters and other instruments through the radial artery, enabling minimally invasive procedures such as angioplasty and stent placement.

The primary uses of transradial access devices include diagnostic angiography, percutaneous coronary interventions, and peripheral vascular interventions, making them essential in modern cardiovascular care.

The sector is witnessing significant growth driven by several key trends. Among healthcare providers and patients, one of the foremost market trends are the increasing preference for minimally invasive procedures. This shift is primarily attributed to the growing awareness of the benefits associated with transradial access, including lower bleeding risks and shorter hospital stays.

Technological advancements are leading to developing more sophisticated and user-friendly devices enhancing procedural efficacy and patient outcomes. There is a rising trend in adopting transradial access in various clinical settings beyond cardiology, such as neurology and peripheral vascular interventions. This diversification highlights these devices' versatility and growing acceptance among interventional specialists.

Expanding training programs and educational initiatives aimed at medical professionals fosters great expertise and confidence in using transradial techniques further propelling the market growth.

The transradial access devices market has displayed steady boost over the past few years with a CAGR of 3.4% during the period from 2019 to 2023. This growth can be attributed to the increasing adoption of transradial procedures in interventional cardiology, driven by the advantages of reduced complications and faster recovery times compared to traditional femoral access methods.

As healthcare providers and patients recognize this approach's benefits, the demand for transradial access devices has steadily risen leading to a more significant market presence. The sector is projected to accelerate significantly, with an anticipated CAGR of 6.7% during the forecast period from 2024 to 2031. This optimistic outlook is fueled by several factors, including ongoing advancements in medical technology, which enhance the design and functionality of these devices.

As manufacturers innovate to create more efficient and user-friendly products, the appeal of transradial access is expected to broaden, attracting more healthcare professionals to adopt this technique. Additionally, expanding training programs and educational initiatives will likely increase the proficiency of medical practitioners in performing transradial procedures, further driving market growth.

The rising prevalence of cardiovascular diseases and the growing emphasis on minimally invasive surgical techniques will also create several transradial access devices market opportunities. As healthcare systems prioritize patient safety and comfort, the market is well-positioned for robust growth in the coming years, reflecting a transformative shift in interventional practices.

Increasing Preference for Minimally Invasive Procedures

One of the primary growth drivers for the market expansion is the increasing preference for minimally invasive procedures among healthcare providers and patients. Transradial access offers significant advantages, such as reduced bleeding risks, shorter recovery times, and enhanced patient comfort compared to traditional femoral access methods.

As awareness of these benefits grows, more interventional cardiologists and radiologists are adopting transradial techniques, leading to a higher demand for specialized access devices. This trend reflects a broader shift in the healthcare landscape towards safer and more efficient surgical practices.

Technological Advancements

Technological advancements in medical devices are significantly propelling the growth of transradial access devices market demand. Innovations in device design, such as improved catheter materials and enhanced delivery systems, are making procedures safer and more efficient. These advancements facilitate more accessible access to the vascular system and minimize complications associated with traditional methods.

As manufacturers continue to invest in research and development, the introduction of next-generation transradial access devices is expected to attract more healthcare professionals, further driving market expansion and improving patient outcomes.

Rising Incidence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases globally is another critical driver for the transradial access devices market growth. As the prevalence of conditions such as coronary artery disease and peripheral artery disease increases, the demand for effective interventional procedures rises correspondingly.

Transradial access has emerged as a preferred approach for many of these interventions due to its safety profile and patient benefits. Consequently, healthcare systems are increasingly adopting transradial techniques to address the growing burden of cardiovascular diseases, fueling the market for transradial access devices and related technologies.

Limited Awareness and Training

One significant factor impeding the growth of the transradial access devices market sales is the need for more awareness and training among healthcare professionals.

Despite the advantages of transradial access, many interventional cardiologists and radiologists may still prefer traditional femoral access due to familiarity and established protocols. This reluctance can stem from a need for more comprehensive training programs emphasizing the benefits and techniques associated with transradial procedures. As a result, the slow adoption of these devices in clinical practice can hinder market growth, as healthcare providers may need to fully utilize the potential of transradial access.

Complications and Technical Challenges

Another factor that challenges the market growth is the potential for complications and technical difficulties associated with the procedure. While transradial access is generally considered safe, issues such as radial artery spasm, hematoma formation, and access site complications can occur, leading to adverse patient outcomes.

The technical skill required to perform transradial procedures effectively may deter some practitioners from adopting this approach. These complications can create hesitancy among healthcare providers, limiting the widespread acceptance and utilization of transradial access devices in various interventional settings.

Increase in New Clinical Applications

One significant future opportunity for the transradial access devices market growth lies in the expansion into new clinical applications beyond traditional cardiology. As healthcare providers increasingly recognize the versatility of transradial access techniques, there is potential for their adoption in various fields, including neurology and peripheral vascular interventions.

Manufacturers can tap into new revenue streams by developing specialized devices tailored for these applications and address the growing demand for minimally invasive procedures across diverse medical disciplines. This expansion can enhance the overall market landscape and encourage broader clinical adoption of transradial techniques.

Integration of Advanced Technologies

Integrating advanced technologies into transradial access devices market presents a promising opportunity for market growth. Innovations such as robotics, artificial intelligence, and real-time imaging can enhance the precision and effectiveness of transradial procedures.

By incorporating these technologies, manufacturers can develop devices that improve procedural outcomes, reduce complications, and streamline workflows for healthcare professionals.

Combining transradial access with telemedicine solutions could facilitate remote consultations and monitoring, further expanding the potential applications of these devices and attracting a more comprehensive range of healthcare providers to adopt transradial techniques.

The competitive landscape of the market is characterized by several key players striving to innovate and capture market share. For instance, Terumo Corporation launched the Glidecath® 6F Radial Access Catheter in 2022, enhancing the ease of access and maneuverability during procedures. These innovations reflect the ongoing efforts of companies to develop advanced, user-friendly devices that cater to the growing demand for minimally invasive procedures, thereby driving competition within the market.

Recent Developments in the Transradial Access Devices Market

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Country Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Product

By End-use

By Region

To know more about delivery timeline for this report Contact Sales

The market is predicted to rise from US$2.3 Bn in 2024 to US$3.7 Bn by 2031.

TERUMO CORPORATION, Medtronic, Boston Scientific Corporation, BD, and Cordis are some leading companies in this industry.

Catheters segment is leading in the industry and is predicted to account for the largest market share.

Asia Pacific is the dominant regional market for transradial access devices.

The increasing preference for minimally invasive procedures is a key trend in the market.