Industry: Chemicals and Materials

Published Date: June-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 151

Report ID: PMRREP33160

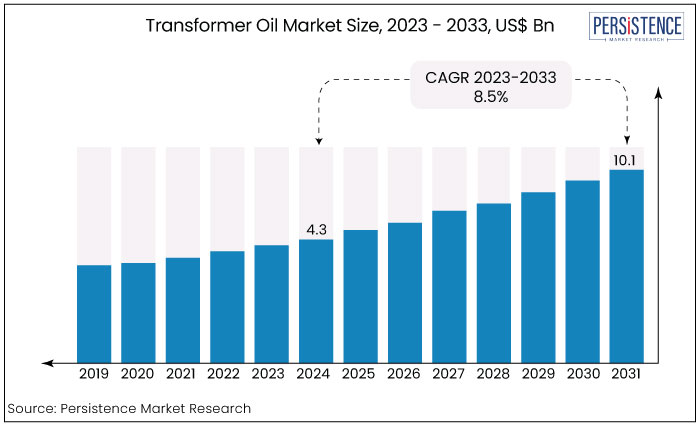

The market is estimated to reach a valuation of US$10.1 bn by the year 2033, at a CAGR of 8.5%, during the forecast period 2024 to 2033.

Key Highlights of the Market

|

Attribute |

Details |

|

Market Size (2023) |

US$4.3 Bn |

|

Market Size (2033) |

US$10.1 Bn |

|

Forecast Growth Rate (CAGR 2023 to 2033) |

8.5% |

|

Historical Growth Rate (CAGR 2019 to 2022) |

8% |

Transformer oil plays a crucial role in the efficient operation and longevity of electrical transformers and several other electrical equipment.

It is also known as insulating oil, which is essential for cooling and insulating electrical components within transformers, ensuring they operate safely and reliably.

The global market is estimated to have robust growth over the forecast period driven by increasing investments in the power sector and infrastructure, primarily in emerging economies like India, China, Japan, Canada, and Italy, and the rising demand for electricity worldwide.

As industries expand and urbanization speeds up, the need for reliable electricity transmission and distribution systems will become more crucial than ever.

The developing trend for long distance transmission is shaping the market growth.

The growing significance of ultra-high voltage DC transmission lines for the transmission of high power over extremely long distances exceeding 1000 km creates the need for ultra-high voltage power transformers.

With the increased need for high-voltage power transformers, the need for transformer oil has surged, which eventually enhances the transformer oil market share.

Further, the rising global energy demand is expanding the limits of traditional resources and necessitating the extraction of resources from distant locations to meet this demand.

The maximum utilization of renewable energy sources, such as solar energy, wind energy and hydropower, for energy generation is increasing. As these renewable energy sources are geographically constrained, long-distance transmission is the only viable option.

Long-distance transmission necessitates the use of Ultra-High Voltage (UHV) power transformers, which can employ around 2 kilo litres of transformer oil.

The growing need for long-distance transmission is expected to influence the direction of the transmission oil industry and eventually lead to a surge in transformer oil demand.

The transformer oil market witnessed a CAGR of 8% during the historic period from 2019 to 2022 and is said to maintain the growth momentum during the forecast period 2023 to 2033.

Significant increase in the growth rate for the forecast period is due to the increasing number of power generation and distribution projects across the world.

The market was significantly impacted by the outbreak of the COVID-19 pandemic owing to country-wise shutdown of manufacturing and industrial industries, postponement of ongoing projects, and various other factors.

With the power sector's rapid progress, expansion of electric networks in developing nations, and the modernization of power grids in industrialized economies, the market is anticipated to witness high growth rate.

Due to investments made by developing nations such as China, India, and Brazil for the expansion of T&D systems and grid networks, the market is likely to experience higher growth potential over the forecast period.

Despite a promising future, the transformer oil industry will likely face several obstacles, including the move toward renewable energy sources, stringent environmental regulations, and the shift toward organic oils.

Electric Grid Expansion

Expansion and development of electric grids in developing countries and the upgrading of electric grids in established economies due to increased industrialization and urbanization, is one of the primary drivers of the global transformer oil market.

Expansion of grid networks and T&D systems in developing countries is anticipated to accelerate the demand brought on by rapid industrialization and urbanization.

Throughout the forecast period, the market for transformer oil will experience growth due to the installation of new transformers and switchgear because of the expansion of grid networks and transmission & distribution systems.

Further, the technological advancements and increasing R&D efforts by leading transformer oil manufacturers have also contributed to the market's recent success, in terms of revenue generation.

Growing Electricity Demand

The rise of electric vehicles is prompting government entities to expand their utility infrastructure, leading to a global demand for more electric grids.

In 2022, the global electric vehicle fleet consumed approximately 110 TWh of electricity, which accounted for less than 0.5% of the total global electricity consumption, as reported by the International Energy Agency.

The quantity appears to be compact, but the widespread acceptance of electric vehicles worldwide is expected to generate a massive need for new transmission and distribution transformers.

With the growing number of new and high-power transformers, the demand for transformer oils is predicted to increase over the forecast period, which will eventually aid the market size globally.

Stringent Environmental Regulations

Since paraffinic and naphthenic mineral oils are made from petroleum that has been thoroughly refined, purified, and processed, they are incredibly non-biodegradable.

The biodegradability of mineral oil, which comes from a non-renewable resource, ranges from 0% to 40%.

Regulations to reduce industry volatile organic carbon emissions, the registration, evaluation, authorization, and restriction of chemicals regulations or REACH regulations of the Europe Council address the production and use of chemicals such as mineral oils and their potential effects on people and the environment.

Mineral oil is an environmental pollutant since it is toxic in both soil & water and is not easily degradable. The transformer oil market is also restricted by the erratic nature of crude oil prices, which eventually raises the cost of transformer oil.

It is anticipated that the current volatility in crude oil prices will affect how quickly the white oil sector grows.

Both developed and developing economies are moving toward implementing green and ecological-friendly technologies. This makes leak protection and subsequent disposal easier.

In a nutshell, this change might prevent the use of mineral-based transformer oils, and in the long run, it might limit the market.

Increased Investments in HVDC Transmission Systems

The global economies are experiencing a swift change towards the adoption of renewable energy sources, including solar, onshore and offshore wind, biomass, hydropower, and geothermal power, which requires additional power plants, creating a wide range of opportunities for transformer oil companies.

Due to the remote locations of these resources, which are far from populated areas, transformer oil companies utilize HVDC transmission lines to connect these power generation sources and reduce transmission losses.

The HVDC transmission system is significant due to its ability to efficiently transmit large amounts of power over vast distances.

Further, HVDC transmission systems provide improved stability, dependability, and transmission capacity. Therefore, they are essential components of the electrical power system and aid the overall growth and development of the global market.

Mineral Oil Dominates by Oil Type with 60% Market Share

|

Market Segment by Oil Type |

Market Value Share (2023) |

|

Mineral Oil |

60% |

Based on oil type segmentation, the transformer oil market is further sub-segmented into mineral oil, silicone oil and bio-based oil, where the mineral oil sub-segmentation dominates the market share.

Due to its high efficiency, low cost, outstanding thermal cooling capacity, good pouring point at low temperatures, and easy market accessibility, mineral oil has been the most popular liquid for power transformer insulation.

The market for transformer oil is projected to continue to be dominated by this category, which is anticipated to rise at 8% CAGR during the forecast period.

The primary causes of this rise are increasing environmental concerns and the global demand for environment-friendly products.

Increasing investments in the production of renewable and ecologically friendly products are also anticipated to support segment growth.

Transformers Remain the Key Application Segment with 55% Share

|

Market Segment by Application |

Market Value Share (2023) |

|

Transformers |

55% |

Based on application, the transformer oil market is further classified into transformers, switchgear and reactors, where the transformers segment dominates the market share.

Transformer oil is a very effective liquid that provides great insulation for electrical systems, making it a preferred choice for all sorts of transformers.

Oils play a crucial role in oil-type transformers by preserving conductivity and temperature, thereby guaranteeing the efficient functioning of the transformer. Due to its significant usage in transformers, it is the most prominent consumer segment in terms of application.

Further, transformers play a vital role in power industries and require insulation to ensure their operational effectiveness. Transformer oils serve as an insulating material, which helps to regulate the temperature of the transformer and safeguard it from damage caused by wear and corrosion.

Moreover, the need for transformer oil filtration also aids the market for transformer oils with some additional devices and equipment. The oils are additionally employed in high-voltage electrical components such as transformers, capacitors, switches, and circuit breakers.

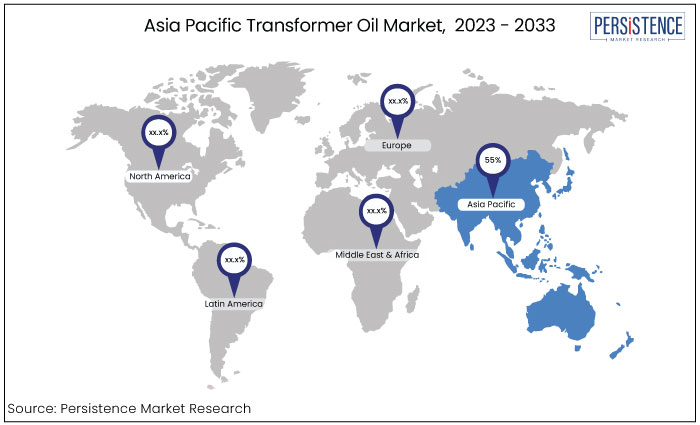

Asia Pacific Maintains the Leadership Position, Holds 55% Market Share

|

Region |

Market Value Share |

|

Asia Pacific |

55% |

The Asia Pacific region held the largest market share in the transformer oil market industry, accounting for about 55.2% of the total revenue, which can be linked to an increase in the demand for power in Australia, as well as in developing countries like China, India, and Japan.

Moreover, the expansion of the commercial and industrial sectors is expected to lead to a rise in the number of substations, thus driving up the demand for transformers and eventually aiding the transformer oil demand.

The electricity sector is seeing market penetration by Chinese manufacturers due to the rise in investments. Furthermore, the substantial increase in renewable energy generation capacity in countries like India, and China is driving the demand for sub-transmission infrastructure.

Foreign markets have a significant obstacle when trying to join the Asia Pacific region due to the existence of robust indigenous transformer oil manufacturers.

May 2022 -

Nynas AB signed a collaboration deal with KONCAR, one of the leading instrument transformer manufacturers in Croatia, to test its NYTO BIO 300X on KONCAR's instrument transformers.

June 2022 -

Luberef, a Saudi Aramco-based oil company, signed a memorandum of understanding (MOU) with APAR Industries Ltd. for the construction of a transformer oil factory to assist the localization of specialty products in KSA.

June 2023 –

M&I Material Ltd introduced their new product in the range of ester transformer fluids by recycling the in-service fluid to make it environment friendly.

The major competitors in the transformer oil market are primarily evaluated based on their product or service offerings, their financial statements, developments and the approaches implemented, the company's position in the global market scenario and its geographical reach.

|

Attributes |

Details |

|

Forecast Period |

2024 - 2033 |

|

Historical Data Available for |

2019 - 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Countries Covered |

|

|

Key Companies Profiled |

|

|

Pricing |

Available upon request |

By Oil Type

By Application

By End Use

By Region

To know more about delivery timeline for this report Contact Sales

Transformers are the key application segment of transformer oil, accounting for 55% of the market share.

The transformer oil market value in 2022 was around US$4 billion.

The estimated growth rate for this market during the forecast period is 8.5%.

The transformer oil market size in 2033 is estimated to be valued at US$10.1 billion.

Royal Dutch Shell, Exxon Mobil Corporation, Repsol, Nynas AB, and Sinopec Lubricant Company, are some of the leading players in the market.