Switzerland Sports Nutrition Market

Industry: Food and Beverages

Published Date: December-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 179

Report ID: PMRREP34986

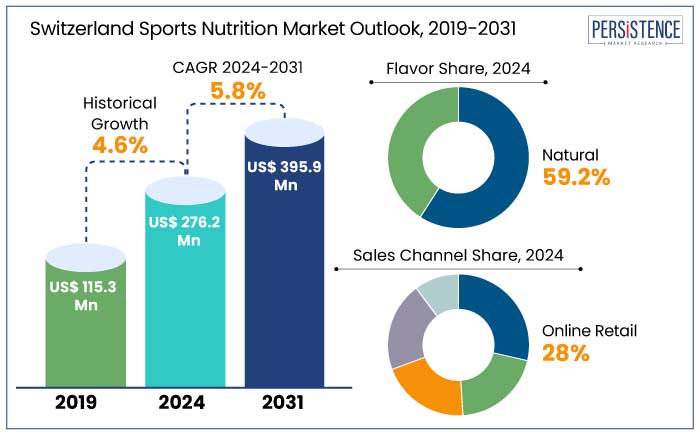

The Switzerland sports nutrition market is anticipated to rise from US$ 276.2 Mn in 2024 to US$ 395.9 Mn by 2031. The market is projected to experience a CAGR of 5.8% during the forecast period from 2024 to 2031.

The market is rising rapidly due to increased health awareness, surging fitness activity participation, and high demand for functional foods. Key products include protein supplements, energy drinks, and specialized supplements for performance and recovery. Young adults and fitness enthusiasts are driving this demand across Switzerland.

A notable trend in the market is the shift toward clean-label, natural, and sustainable products. Consumers increasingly prefer options free from artificial additives and with a lower environmental impact. It is further promoting the use of organic ingredients, plant-based proteins, and eco-friendly packaging.

The popularity of vegan and vegetarian diets has further boosted demand for plant-based proteins. Brands like Nutriathletic® are hence extending their plant-based offerings. Innovations like high-protein bars featuring diverse plant-based ingredients and unique flavors have gained significant traction.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Switzerland Sports Nutrition Market Size (2024E) |

US$ 276.2 Mn |

|

Projected Market Value (2031F) |

US$ 395.9 Mn |

|

Switzerland Market Growth Rate (CAGR 2024 to 2031) |

5.8% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

4.6% |

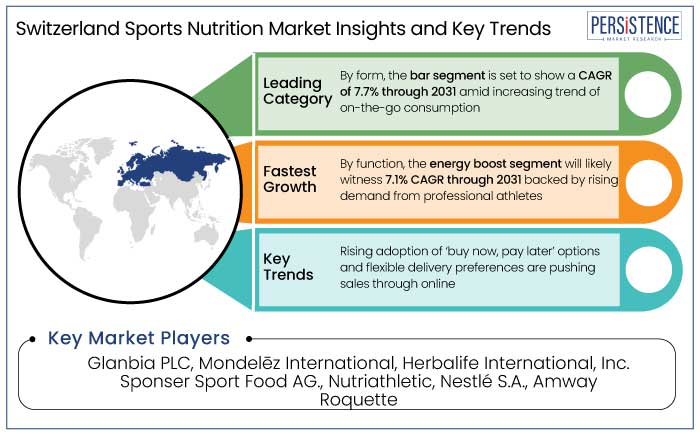

Switzerland’s increasing involvement in fitness activities, endurance sports, and outdoor pursuits has created a rising demand for energy-boosting products. These appeal to a diverse range of consumers, right from professional athletes to casual fitness enthusiasts. Through 2031, the energy boost segment will likely exhibit a CAGR of 7.1%.

As the population becomes more health-conscious, modern consumers are actively seeking clean-label and natural energy products. These are usually free from artificial additives, thereby reflecting broader trends in the sports nutrition business.

Demand for energy-boosting products is also set to be pushed by the busy and on-the-go lifestyles of several consumers who need quick and reliable energy solutions. Items like energy drinks, energy gels, and functional snacks have gained popularity for their portability and immediate effects. These features are making them essential components of pre- and mid-workout routines.

The rapid shift toward plant-based and sustainable nutrition has further spurred innovation in the market. Several brands are introducing energy supplements derived from natural sources such as green tea extract, ginseng, and plant-based caffeine alternatives.

Naturally flavored sports nutrition products are poised to hold around 59.2% of the Switzerland sports nutrition market share in 2024. It is set to be fueled by increasing health awareness and a preference for clean-label, natural options. Local consumers are becoming conscious of artificial additives, leading them to choose products perceived as healthier and more authentic.

Demand for these products is also driven by rising sports participation and the adoption of plant-based diets. Flavors derived from natural sources, such as fruits, nuts, and herbs, appeal to health-conscious consumers who prioritize taste and quality. Popular flavors like vanilla, chocolate, berry, and coconut are particularly sought after in protein powders, energy drinks, and snack bars.

Sustainability influences purchasing decisions, with consumers favoring products made from ecologically sourced ingredients. Brands like MyProtein and Sponser Sport Food AG are successfully integrating natural flavors into their offerings, meeting modern consumer expectations. As a result, naturally flavored sports nutrition products are gaining a competitive edge and are likely to solidify their presence in the market in the next ten years.

Growing emphasis on fitness and health across all demographics is driving demand for sports nutrition products in Switzerland. This trend is being driven by several factors, including increasing number of fitness enthusiasts, high popularity of endurance sports, and surging knowledge of the advantages of sports nutrition.

Running, cycling, skiing, and hiking are among the regular physical activities that have seen a sharp increase in involvement in recent years, according to the Swiss Federal Office of Sport. Products like protein drinks, energy bars, and hydration supplements are becoming necessary components of people's routines as they strive to enhance their performance and recuperation.

The Switzerland sports nutrition market grew at a decent CAGR of 4.6% between 2019 and 2023, driven by evolving dietary preferences and a focus on athletic performance and recovery. The rise of e-commerce played a significant role, making a wide range of products accessible to diverse consumer segments. Additionally, increasing adoption of plant-based diets boosted demand for vegan protein powders and natural supplements, resonating with health-conscious consumers. For example,

From 2024 to 2031, the market is likely to continue surging, shaped by emerging health trends and changing consumer demands. Personalized nutrition is set to take center stage, with brands offering tailored solutions for specific fitness goals and dietary requirements.

Sustainable and organic ingredient sourcing will likely become increasingly important, reflecting growing environmental awareness. Moreover, innovations in technology and digital marketing are set to improve consumer engagement and foster brand loyalty. These factors are anticipated to drive the ongoing success of the Switzerland sports nutrition market.

Surge of E-commerce to Pose High Demand in Switzerland

The rise of digital platforms has revolutionized the Switzerland sports nutrition market. These are offering consumers unprecedented access to products like protein supplements and energy bars, which were once confined to specialized stores.

Platforms such as Amazon and Swiss retailers like Digitec Galaxus have extended their offerings, catering to health-conscious individuals. The pandemic further accelerated the shift to online shopping, fostering loyalty to e-commerce retailers. Payment innovations like the TWINT app, with a 77% acceptance rate in online stores and 5 million users by 2023, have streamlined transactions.

Growing adoption of ‘buy now, pay later’ options and flexible delivery preferences, such as next-day or eco-friendly shipping, align with evolving consumer needs and sustainability goals. E-commerce platforms empower sports nutrition brands to target niche markets, such as vegan or gluten-free products, while leveraging data analytics for personalized marketing.

The ongoing shift has also enabled small-scale brands to thrive, meeting diverse consumer needs effectively. In terms of sales channel, the online retail or e-commerce category will likely hold a share of 28% in 2024.

Blooming Culture of Outdoor Recreation and Fitness to Spur Demand

Due to a culture that emphasizes outdoor recreation and fitness, Switzerland is seeing a booming involvement in several sports, such as football, cycling, hiking, and skiing. For example,

Sales of products made for endurance sports like marathons and alpine competitions have surged for Swiss brands like Sponser and Isostar. These products are designed to meet the needs of Switzerland's active population by offering appropriate hydration and sustained energy.

Unaffordability of Nutritional Products among Lower-income Groups

Switzerland's diverse population is shaped by various ethnic groups and cultural backgrounds. It faces significant challenges in addressing dietary preferences and restrictions influenced by cultural, religious, or personal beliefs. For instance,

Despite Switzerland’s strong food supply chain and high living standards, disparities persist in accessing specialized nutritional products, particularly in rural areas. Limited availability of health food stores and gyms, coupled with the high cost of healthy and sports nutrition products, creates barriers for several athletes. It is particularly evident among those from lower-income groups.

To address these challenges, organizations like the Swiss Sports Nutrition Association work to promote healthy eating habits and raise awareness about tailored sports nutrition plans. However, continuous efforts are necessary to improve affordability and accessibility, ensuring all athletes in Switzerland can access the nutritional resources they need.

Rising Demand for Eco-friendly and Recyclable Packaging Creates Opportunities

Switzerland-based consumers are increasingly prioritizing sustainability, driving demand for eco-friendly packaging solutions in the endurance supplements industry. With rising environmental awareness, brands have a prime opportunity to differentiate themselves by adopting recyclable, biodegradable, or compostable packaging.

Such initiatives resonate with eco-conscious consumers who value brands demonstrating a commitment to environmental responsibility. Sustainable packaging also aligns with consumer values and serves as a strong marketing tool.

Highlighting the use of eco-friendly materials can provide a competitive edge in the Switzerland sports nutrition market, where buyers are scrutinizing environmental credentials. Options like recycled materials or refillable packaging appeal to those seeking to reduce their ecological footprint.

Biodegradable and compostable packaging offers unique benefits, breaking down naturally to minimize landfill waste. Compostable options go further, turning into nutrient-rich compost that enhances soil quality. By embracing these solutions, sports nutrition brands can reduce their environmental impact and meet growing consumer demand for sustainability. For example,

The sports nutrition supplements business in Switzerland is highly competitive, with established brands and emerging players vying for consumer attention. Leading companies like Glanbia (Optimum Nutrition) and MyProtein dominate in terms of extensive product ranges, including protein supplements, pre-workouts, and recovery formulas.

Key companies leverage unique marketing strategies, athlete endorsements, and event sponsorships to sustain brand visibility and consumer loyalty. Meanwhile, small-scale brands and start-ups are gaining traction by targeting niche segments, such as plant-based or allergen-free products, appealing to specific consumer preferences.

The rise of e-commerce has further intensified competition, enabling both leading players and newcomers to extend their reach. Digital platforms and personalized marketing strategies have become essential tools for catering to the rising demand for sports nutrition products.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization and Pricing |

|

By Function

By Form

By Flavor

By Micronutrients

By Sales Channel

To know more about delivery timeline for this report Contact Sales

Yes, the market is set to reach US$ 395.9 Mn by 2031.

Glanbia PLC is considered the leading player in Switzerland.

The industry is projected to record a CAGR of 5.8% from 2024 to 2031.

Increasing use of product bundles, which enhance convenience for consumers while offering cost-effective options for purchasing multiple products together, is a key trend.

Around 45 to 65% of carbohydrates, 15 to 25% of protein, and 20 to 35% of fat.