Industry: Healthcare

Published Date: February-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 183

Report ID: PMRREP20914

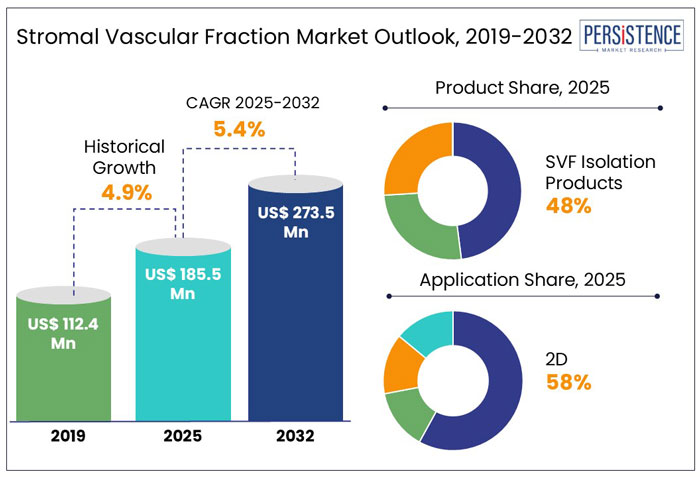

The Global Stromal Vascular Fraction Market is expected to grow from US$ 185.5 Mn in 2025 to 273.5 Mn in 2032. The market is expected to grow at a substantial CAGR of 5.2% from 2025 to 2032.

According to Persistence Market Research analysis, the Stromal Vascular Fraction (SVF) market is expanding rapidly due to increased demand for regenerative medicine and cell-based therapies. SVF, generated from adipose (fat) tissue, contains a high concentration of mesenchymal stem cells (MSCs), endothelial cells, pericytes, and growth factors, making it a viable option for a variety of medical applications such as orthopedics, dermatology, cardiology, and wound healing.

|

Market Attributes |

Key Insights |

|

Stromal Vascular Fraction Market Size (2024) |

US$ 172.9 Million |

|

Projected Market Value (2032) |

US$ 273.5 Million |

|

Global Market Growth Rate (2025-2032) |

5.2% CAGR |

|

Market Share of Top 5 Countries |

65.4% |

The global market recorded a historic CAGR of 4.0% in 2019 to 2024.

Over the last decade, the stromal vascular fraction (SVF) industry has transformed, driven by advances in regenerative medicine, an increased emphasis on autologous therapies, and the rising prevalence of chronic diseases. Historically, SVF has been studied largely for its use in cosmetic and orthopedic applications, with early success in aesthetic medicine, particularly fat grafting and skin rejuvenation. Research into SVF's regenerative qualities led to its application in musculoskeletal problems, wound healing, and even cardiovascular conditions.

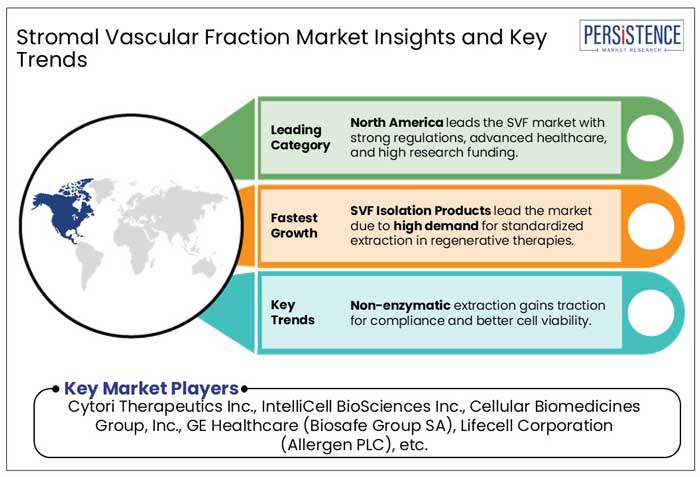

The SVF market is expected to grow significantly in the next years due to ongoing research, the development of regulatory frameworks, and increased interest from the biopharmaceutical industry. The increased acceptance of stem-cell therapies in mainstream medicine is predicted to increase demand for SVF in orthopedic, dermatological, and neurological applications.

“Development of New Automated Point-of-care (POC) Devices”

The increasing development of automated point-of-care (POC) devices is significantly accelerating the growth of the stromal vascular fraction (SVF) market by enhancing the efficiency, accessibility, and safety of cell-based therapies. Traditionally, SVF isolation from adipose tissue required complex, multi-step laboratory procedures, limiting its clinical adoption. However, next-generation automated POC devices now enable rapid, closed-system SVF processing, reducing contamination risks and procedural variability while ensuring higher cell yields.

These innovations are particularly benefiting regenerative medicine applications in orthopedics, dermatology, and wound healing, where real-time SVF isolation is crucial for same-day procedures. For example, companies like Tissue Genesis and Cytori Therapeutics have introduced compact, fully automated systems that allow clinicians to extract and deploy SVF within an hour, eliminating the need for off-site processing. Additionally, regulatory advancements supporting minimally manipulated cell therapies are driving demand for these devices, particularly in aesthetic and musculoskeletal treatments.

“Variability in Production”

The inherent heterogeneity in production affects the consistency, efficacy, and regulatory approval of SVF-based treatments, imposing one of the main limitations in the stromal vascular fraction (SVF) market.

The process of isolating SVF from adipose tissue involves multiple steps, including enzymatic digestion or mechanical disruption, centrifugation, and cell extraction. However, factors such as donor variability, harvesting techniques, and processing methods create inconsistencies in the final SVF composition, leading to unpredictable therapeutic outcomes. Variability in donor age, health conditions, and fat tissue quality significantly influences the quantity and viability of regenerative cells, making it difficult to standardize protocols for clinical use.

Why is the U.S. Market Booming?

“Massive Pipeline of SVF-Derived Cell Therapies”

The U.S. is anticipated to be at a growth rate of 5.5% over the next 7 years.

SVF treatments in regenerative medicine have enormous potential, and extensive clinical trials are being conducted in the U.S. to assess their efficacy for various purposes. These clinical trials use proprietary SVF isolation, aspiration, and transfer devices, and thus, the growing number of active clinical trials fuels the demand for SVF products in the U.S. market.

The systems are installed at the site of clinical trials, and thus, as the number of clinical trials increases, the install base of SVF isolation devices will increase, creating more demand for consumables required in the processing of SVF samples in the U.S. According to these clinical trials, adipose-derived stem cell treatment for neurological and orthopedic conditions is the most promising.

Will India be a Lucrative Market?

“Increase in Research and Development Activities in India”

India is one of the most lucrative markets for SVF in the South Asian region and is anticipated to expand at a 4.8% CAGR through 2032.

This is due to the increase in research and development activities for developing innovative technologies and for SVF as an alternative option for better clinical solutions. This represents a continuous rise in demand for advanced technologies, and the expansion of private hospitals in rural areas boosted the demand for the market in the Asian region, which represents an attractive market.

How is Germany Emerging as a Prominent Market?

“Increasing Awareness of Stem Cell Therapy”

Owing to the rising aging population, musculoskeletal disorders, like osteoarthritis, are expected to drive demand in the country. Furthermore, awareness of stem cell therapy and demand for healthcare professionals are all factors expected to contribute to Germany's dominance in the global market.

SVF injections are an alternative to surgery used in orthopedics to treat musculoskeletal problems. The majority of German specialists expect a relaxation of legal constraints and an open-mindedness to stem-cell research and therapy in this country.

Hence, the country's market growth will be further boosted over the forecast timeframe.

Which Product is Driving Growth of the Global Market?

“Widely used in the isolation of SVF from lipoaspirate”

The SVF isolation products segment holds around 75.5% share of the total global market in 2024.

SVF isolation products dominate the Stromal Vascular Fraction (SVF) Market because they are required for the production of high-quality, viable cell populations for use in regenerative medicine and cosmetic applications. The demand for standardized, automated, and closed-loop isolation systems has increased as doctors and researchers seek faster, more efficient, and regulatory-compliant methods of extracting SVF from adipose tissue. Compared to old manual procedures, which can be uneven and labor-intensive, sophisticated isolation kits and equipment provide better cell yields, improved repeatability, and increased safety, making them widely preferred in clinical settings.

Which Application is Driving Growth of the Global Market?

“High Demand for Autologous Fat Grafting”

The cosmetic applications segment hold around 42.8% share of the global market in 2024.

Cosmetics are now the largest section of the Stromal Vascular Fraction (SVF) Market, owing to the increased demand for autologous fat grafting, skin rejuvenation, and anti-aging treatments. SVF is widely used in cosmetic procedures because of its regenerative properties, which help enhance skin elasticity, improve volume retention in fat grafting, and promote faster healing after aesthetic procedures. The growing preference for minimally invasive cosmetic treatments, coupled with the increasing acceptance of stem-cell-based therapies in dermatology, has significantly driven the dominance of this segment. Additionally, regulatory hurdles are relatively lower for autologous use in cosmetic applications than orthopedic and soft tissue treatments, facilitating wider adoption in aesthetic clinics and medical spas.

Which End User Poses a Greater Adoption of Viral Vectors?

“Major use in hospitals”

Hospitals hold the largest share of about 43.1% in 2024.

Hospitals are at the forefront of offering these treatments as SVF-based therapies gain traction in regenerative medicine, wound healing, orthopedics, and cosmetic procedures. Unlike standalone clinics, hospitals provide a more regulated and controlled environment, ensuring compliance with safety and quality standards, which is critical for cell-based therapies.

Hospitals have also established partnerships with medical device companies that manufacture SVF isolation systems, making them early adopters of automated SVF processing technologies.

Major market players concentrate on product launches, strategic alliances, mergers, and acquisitions to strengthen their market positions. In addition to this, one of the main strategies employed by the manufacturers is growth, or the opening of new facilities to increase the company's capacity for the production of new advanced products.

For instance:

Similarly, the team at Persistence Market Research has tracked recent developments related to companies manufacturing stromal vascular fraction, which are available in the full report.

|

Attribute |

Details |

|

Forecast Period |

2025-2032 |

|

Historical Data Available for |

2019-2024 |

|

Market Analysis |

US$ Mn for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

By Product:

By Application:

By End User:

By Region:

To know more about delivery timeline for this report Contact Sales

The global market is expected to grow US$ 185.5 in 2025.

Sales of the market are set to witness a high growth at a CAGR of 5.2% and be valued at US$ 273.5 Million by 2032.

The rising demand for regenerative medicine and stem cell-based therapies is fueling market growth.

The U.S. has a large number of clinical trials and a growing pipeline of SVF-based therapies, especially in orthopedics and neurology.

SVF isolation products lead the market due to their use in efficient and safe extraction of regenerative cells.