Industry: Food and Beverages

Published Date: June-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 148

Report ID: PMRREP33440

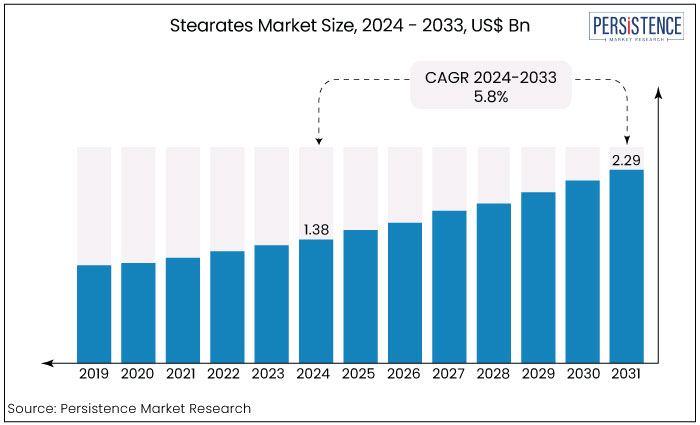

The global stearates market is projected to rise from US$1.38 Bn in 2024 to US$2.29 Bn by the end of 2033. The market is anticipated to secure a CAGR of 5.8% during the forecast period from 2024 to 2033.

|

Attributes |

Key Insights |

|

Market Size (2024E) |

US$1.38 Bn |

|

Projected Market Value (2033F) |

US$2.29 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2033) |

5.8% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

3.6% |

Key Highlights of the Market

Advancements in product innovations and manufacturing technologies are the key factors significantly contribute toward stearates market expansion.

Improving the performance characteristics of stearates including their and compatibility and dispersibility with different polymers and sustainability profiles is the focus area of the continuous research and development.

The market has been shaped by increasing consumer awareness of stearate-based products, which are used as emulsifiers, lubricants, and detergents. This trend has been observed in both developed and developing countries.

The thriving construction sector is another primary factor for market growth. Stearates are crucial in construction materials such as concrete, paints, coatings and sealants where they enhance workability, durability and weather resistance.

The demand for stearates in construction applications continues to rise owing to ongoing urbanization and infrastructure development in emerging countries. This factor contributes to market growth.

The shift towards bio-based stearates derived from renewable sources addresses growing environmental concerns and regulatory pressures, further stimulating market expansion.

Stearates have been extensively approved as additives in plastics, rubber, pharmaceuticals, personal care products, paints & coatings, textiles, and construction materials.

Such a broad application base has provided a stable demand foundation over the years. The market for stearates recorded a CAGR of 3.6% during the historical period.

The market for stearates is projected to continue expanding at a moderate pace. There are numerous factors contribute to the future growth of the market.

Industries such as plastics, rubber, and construction are projected to grow due to urbanization, infrastructure development, and increasing consumer demand. This growth is estimated to drive the demand for stearates as essential additives that improve processing efficiency, product performance, and durability.

There is a growing preference for sustainable and eco-friendly products globally.

The shift toward bio-based stearates derived from renewable sources aligns with these sustainability trends and presents new growth opportunities for manufacturers. Sales of stearates are anticipated to secure a CAGR of 5.8% during the projection period from 2024 to 2033.

Lubricant and Hydrophobic Properties of Stearates

Stearates are being increasingly used across various industries and for different applications, such as preventing water absorption by detergents and solid washing powders. Metallic stearates serve various purposes in different industries.

In the textile industry, stearates act as antistatic agents and are used for dry impregnation. The printing ink industry uses stearates as additives for pigments, taking advantage of their swelling and suspension properties. Their lubricant properties make them useful as release agents for pastels and as matting agents for gravure inks.

The exceptional oil-binding properties of these substances make them suitable for use in cement and fillers. In the production of waxes and liquid wax components, their hydrophobic properties make them ideal as suspension agents, enhancing water repellency.

They are also frequently added as anti-caking agents for different fillers and hygroscopic salts to enhance water resistance. Use of stearates in the metallic processing industry involves employing them as lubricants, dry-film lubricants, and release agents. As a result of the broadened range of applications for stearates, the global market has exhibited strong growth dynamics.

Emollient and Emulsification Properties of Stearates

Lubrication is one of the primary properties associated with stearate salts and their ability to retard emulsions from phase separation between the water and oil fractions. Stearate salts also increase the viscosity of the lipid (oil) portion of various cosmetics and other personal care products while reducing the clear/transparent appearance of the finished product.

Stearic acid, a waxy substance that serves as a precursor to many stearates, possesses emollient and emulsification properties. It can help make the skin feel softer and ensure that ingredients in a formulation mix homogeneously.

Zinc stearate, which is derived from stearic acid and zinc, offers additional benefits such as hydration and improved texture due to its ability to increase slip in cosmetic products.

It is commonly used as a soap, emulsifier, or binder in various cosmetics and can also act as a pigment or coloring agent. Zinc stearate is considered generally safe and not associated with adverse reactions.

Increasing Use of Metallic Stearates as Release Coatings in Rubber Industry

The rubber industry has increasingly utilized metallic stearates for their unique properties in recent years. One of their primary functions in this context is their ability to prevent rubber from adhering to molds and to itself. Rubber manufacturers have found diverse applications for metallic stearates.

Such applications include their use in rubber formulations as release coatings to prevent vulcanized rubber from sticking to molds and preventing uncured rubber from adhering to itself. This is made possible by the combination of the chemical and physical properties of metallic stearates.

There has been an increase in demand for polymers from developing countries such as India, and China over the past few years. India is anticipated to exhibit significant growth in polymer demand over the next five years, outperforming China market and other emerging economies.

There is significant investment taking place in developing countries in the petrochemical, polymer, and plastic processing industries. This investment is expected to accelerate the demand for polymers and plastics during the forecast period.

Polymers are one of the rapidly growing industries in developing countries, with immense potential in terms of infrastructure, capacity, and skilled labor. This industry expands the demand for metallic stearate used in the plastic and polymer industries.

India’s polymer industry is emerging rapidly in this regard. It is expected to account for around 3% market share of the global polymer export market in the next three to four years.

Consumers’ Increasing Preference for Naturally Derived Products

Increasing use of chemicals in everyday products and the risks associated with them have made consumers more conscious of their utility.

This factor resulted in the growing demand for naturally derived and similar products devoid of artificial chemicals. This is further estimated to result in reduced demand for stearates in the cosmetics and food & beverages sectors.

Minorito, a Norwegian food supplement brand, has invested in a new technology that allows the company to produce tablets without magnesium stearate.

The technology allows the company to ensure high-quality products with excellent consistency. This step was taken by the company to limit the usage of magnesium stearate, an artificial additive.

Growing Demand in Plastics Industry

Stearates are widely used as lubricants and release agents in plastic processing. With the expanding plastics industry globally, there is a consistent demand for stearates to enhance processing efficiency and product quality.

Stearates, such as calcium stearate, zinc stearate, and magnesium stearate, are widely used in the plastics industry as lubricants and processing aids. They help improve the flow properties of polymers during processing, reduce friction between polymer particles and processing equipment, and prevent sticking or agglomeration. This enhances manufacturing efficiency and reduces energy consumption.

Stearates find applications across various segments of the plastics industry, including extrusion, injection molding, blow molding, and film production. They are used in the production of a wide range of plastic products, from packaging materials and consumer goods to automotive components and construction materials.

Expansion in Pharmaceutical and Personal Care

Stearates, such as magnesium stearate and calcium stearate, are commonly used in pharmaceuticals as lubricants, binders, and flow agents in tablet and capsule formulations.

In personal care products, they serve as emulsifiers, stabilizers, and thickeners in creams, lotions, and cosmetics. The demand for stearates in these applications is driven by their ability to improve product consistency, texture, and stability.

There is an increasing expenditure on healthcare and personal care products, driven by aging populations, rising incomes, and growing health awareness. This translates into high demand for pharmaceuticals and personal care items that utilize stearates for their functional properties.

The pharmaceutical and personal care markets are expanding globally, with significant growth observed in emerging economies. As these markets develop, there is an increasing opportunity for stearates manufacturers to penetrate new regions and cater to diverse consumer needs.

Pharmaceutical Industry to Rise at a CAGR of 6.5%

Stearates are widely used in the pharmaceutical and food and beverage industries. Demand for stearates from the pharmaceutical segment of the market is expected to rise at a CAGR of 6.5% during the forecast period.

It is driven by the growth of the industry in developing countries like India, and China. Use of stearates as anticaking and mold-release agents is a prevalent factor contributing to their wide use in the pharmaceutical industry.

The Industrial Grade Holds a Notable Market Share of 58.6%

The global stearate market is categorized into different grades, including food grade, pharmaceutical grade, and technical (industrial) grade. The industrial grade currently holds a leading market share of 58.6%.

This can be attributed to the numerous properties that make stearates highly versatile, including their oil-binding, suspension, water repellency. Oil binding and anti-caking properties of technical (industrial) grade stearates fuels their consumption.

Increasing Investments in Polymer Production Makes India a Lucrative Market

India accounts for 35.8% of the South Asia and Pacific stearate market and is a rapidly growing market for stearates. Demand for stearates in India is anticipated to rise at a CAGR of 5.5% during the forecast period.

Developing nations are making considerable investments in petrochemicals, polymer production, and plastic processing industries, which is likely to drive the demand for polymers and plastics during the forecast period.

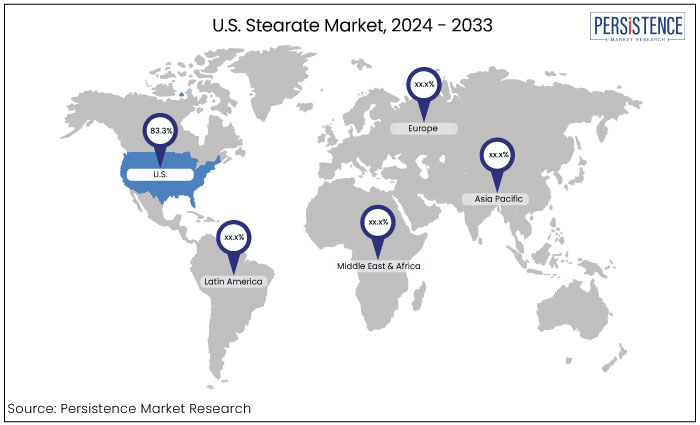

Strong Presence of Prominent Market Players Fuels the Stearates Market in US

Demand for stearates in the United States reached US$ 223.1 million in 2023 and occupy 83.3% of the North American market.

Key players have established a significant presence in the United States due to the growing demand for stearate across various end-use sectors. These sectors include personal care and cosmetics, food and beverages, plastics and rubber, and pharmaceuticals.

Companies are focusing on offering high-quality standards and grades of stearates with the utilization of advanced and state-of-the-art manufacturing techniques.

Companies operating in the market are focusing on expanding their product portfolio and extending their reach into new geographical territories. Several key players in the market are developing products that align with evolving consumer trends.

March 2023

Renwa Abrasive's new zinc stearate sandpaper is revolutionizing the woodworking industry. This innovative product features anti-clogging properties, extending the lifespan of sandpaper and improving finishes. Its ability to prevent overheating during high-speed sanding and grinding operations is gaining widespread acclaim for its durability and efficiency.

November 2022

Peter Greven GmbH & Co. KG established its new production line in Penang, Malaysia. The new facility produces metallic soaps using the patented COAD technology, increasing the capacity and efficiency of its metallic soap production.

August 2022

SK Capital, a private investment firm, successfully acquired Valtris Specialty Chemicals. This partnership is expected to help Valtris strengthen its specialty chemicals and pharmaceutical segments.

June 2022

Sanyo Corporation of America has launched new metallic soaps, including calcium stearate and zinc stearate, targeting the North American market. These products, manufactured in Vietnam, are primarily used as heat stabilizers and lubricants for PVC resins, and as plasticizers in various plastic applications. This introduction aims to enhance the performance and stability of PVC materials.

December 2021

Dover Chemical Corporation, a subsidiary of ICC Industries, signed a distribution agreement with Ravago Chemicals North America to broaden its product range in the North America Midwest region. This expansion is expected to enhance the company's product portfolio and provide opportunities to improve the stability and value of its customer supply chains.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2033 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Type

By Grade

By End-use Industry

By Region

To know more about delivery timeline for this report Contact Sales

Expanding polymer industry in developing countries is a primary growth driver for market.

A few of the leading players operating in the market are Akrochem Corporation, Baerlocher GmbH, and FACI SPA.

Growing demand in plastics industry remains a key opportunity in the market.

The global stearates market is projected to rise from US$1.38 Bn in 2024 to US$2.29 Bn by the end of 2033.

Strong presence of prominent market players fuels the United States Market.