Industry: Automotive & Transportation

Published Date: January-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 193

Report ID: PMRREP35051

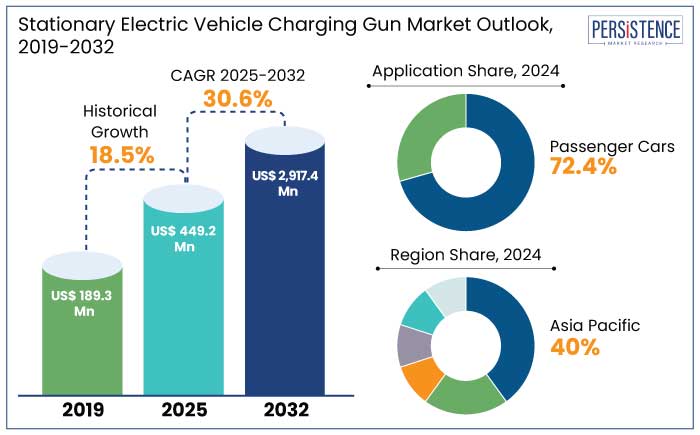

The global stationary electric vehicle charging gun market is estimated to reach a size of US$ 449.2 Mn in 2025. It is predicted to rise at a CAGR of 30.6% through the assessment period to reach a value of US$ 2,917.4 Mn by 2032.

The demand for stationary EV charging guns is expanding notably, charged by rising electric vehicle adoption, increased government incentives, and the need for efficient charging infrastructure.

Governments are investing in charging infrastructure to boost EV adoption, with the European Union allocating US$ 29.16 Bn in 2023 to expand it across member countries. In 2022, the U.S. government launched the US$ 7.5 Bn EV Charging Infrastructure Deployment Program, aiming to increase the accessibility of residential charging points.

Low-cost, reliable stationary charging guns become essential for meeting the needs of a growing eco-conscious consumer base as consumers seek affordable and convenient charging options.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Stationary Electric Vehicle Charging Gun Market Size (2025E) |

US$ 449.2 Mn |

|

Projected Market Value (2032F) |

US$ 2,917.4 Mn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

30.6% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

18.5% |

Europe is set to dominate the stationary electric vehicle charging gun market and accounted for 27.3% of the market share in 2024, driven by government policies promoting carbon neutrality and fuel-efficient vehicles. For instance, the European Union's Fit for 55 plan mandates a 55% reduction in greenhouse gas emissions by 2030, accelerating the shift to EVs.

Belgium has introduced its Hydrogen Electrification Strategy (2023) to bolster the adoption of hydrogen-powered EVs and complement its decarbonization goals. In terms of EV penetration, Germany and Norway are at the top, with Norway reaching 87% sales in 2023.

Europe is a leading player in the global EV industry due to its growing infrastructure, which includes 1.2 Mn public charging stations by 2023, and battery technological breakthroughs that are boosting customer trust.

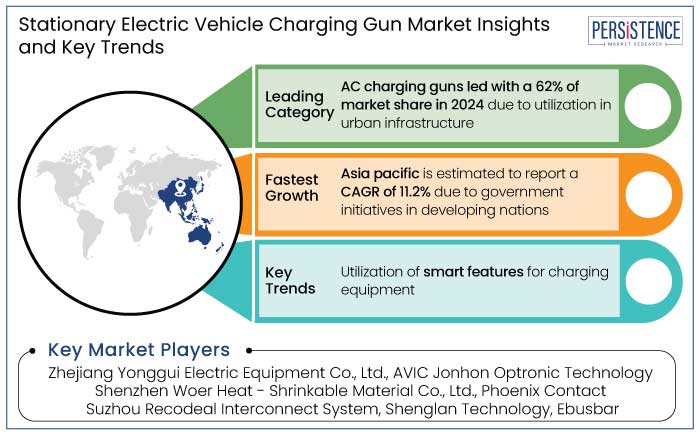

In 2024, Asia Pacific held a market share of 40% in the stationary electric vehicle charging gun market. Countries like China, Japan, South Korea, and India are leading the charge, with China alone accounting for nearly 60% of the region's EV sales in 2023.

Government programs, such as China's "New Energy Vehicle Subsidy Program" and India's "Faster Adoption and Manufacturing of Electric Vehicles (FAME)" scheme, have significantly boosted EV sales and infrastructure development.

The stationary EV charging gun market in Asia Pacific is expected to report a CAGR of 11.2% from 2025 to 2032, fueled by the rising demand for cost-effective and efficient charging solutions.

The passenger car segment dominated the stationary electric vehicle charging gun market in 2024 and accounted for a 72.4% market share due to government incentives, environmental regulations, and rising fuel prices. For instance, governments across the EU, the U.S., and China are offering substantial subsidies, tax credits, and rebates to encourage EV adoption, with the EU targeting 100% zero-emission new car sales by 2035.

Rising awareness about climate change and policies such as China’s New Energy Vehicle (NEV) mandate continue to fuel demand for passenger EVs. The increase in global fuel prices, which surged by 12% in Q3 2023, has further incentivized consumers to transition to EVs for cost savings.

Tesla's Model 3 launch in September 2023, with a 350-mile range, demonstrates the increasing popularity of EVs. This, along with a wide range of affordable models, ensures sustained growth in the passenger car EV segment.

The AC charging gun segment dominated the stationary electric vehicle charging gun market, in 2024 accounting for 62% of the global share due to affordability, user-friendly design, and compatibility with standard household electrical outlets. In urban and suburban locations where rapid charging is not essential, AC charging systems are popular for overnight charging since they are affordable, simple to install, and effective.

Advancements in safety mechanisms and user-centric features, such as automatic power cut-off during faults, have made AC charging guns appealing to consumers. Countries like China and India, with extensive EV adoption programs, are key contributors to the AC charger growth.

The global stationary electric vehicle charging gun market is experiencing notable growth, driven by the increasing adoption of EVs and supportive government policies worldwide. In 2024, EV sales are predicted to surpass 17 Mn units globally, marking a 35% year-on-year increase, driven by government incentives like tax benefits and subsidies in Europe and Asia Pacific.

The standardization of charging protocols, such as Combined Charging System (CCS) and CHAdeMO facilitates interoperability, encouraging broad adoption of EVs. Fast-charging capabilities, which enable rates of up to 350 kW, have been provided by technological breakthroughs, reducing user downtime.

Manufacturers are prioritizing features such as weather-resistant and vandal-proof designs, smart monitoring, and integrated payment solutions. For example, in October 2023, ABB launched a weatherproof charging gun designed for public and residential use.

Nearly 40% of EV owners currently charge at home, which is a sign of the growing residential sector and assures further market expansion.

The global stationary electric vehicle charging gun market recorded a CAGR of 18.5% in the historical period from 2019 to 2024. The pandemic has led to a gradual increase in EV sales, along with a temporary delay in the production of charging stations.

In response to the situation, governments have implemented subsidies and incentives to stimulate the market. For instance, Germany has introduced incentives for new electric vehicles. The pandemic has heightened interest in charging infrastructure, driven by a renewed focus on climate change and sustainability efforts.

The launch of new automobiles and heightened rivalry among manufacturers to satisfy complex product needs have created a favorable environment for the car charger industry. Demand for stationary charger for electric automotive is estimated to record a considerable CAGR of 30.6% during the forecast period between 2025 and 2032.

Adoption of EVs Globally Charges the Demand for Charging Equipment

The rapid expansion of electric vehicle adoption globally creates a growing demand for charging infrastructure and equipment. In 2024, global EV sales are expected to surpass 14 Mn units, representing nearly 18% of total vehicle sales, according to the International Energy Agency (IEA).

The surge is fueled by government incentives, stringent carbon emission targets, and the increasing affordability of EVs. For instance,

Advancements in charging technology, including ultra-fast chargers exceeding 350 kW, are addressing charging time concerns, emphasizing the importance of robust infrastructure in supporting the EV revolution.

Development in Charging Technology for Automotive Offers Innovative Options

Advancements in charging technologies, such as ultra-fast and wireless charging, are boosting the growth of the EV market.

Wireless charging, though in its nascent stages, is gaining momentum, with pilot programs in South Korea and Germany deploying road-embedded wireless charging systems. Smart features like IoT connectivity and energy management systems are revolutionizing the market by enabling real-time monitoring, optimizing charging schedules, and promoting grid integration. For instance,

In October 2024, Shell Recharge introduced chargers with IoT-enabled features for dynamic pricing and energy management, aligning with the global push for renewable energy integration.

Lack of Standardized Charging Infrastructure Availability Limits Market Production

The stationary electric vehicle charging gun market faces challenges due to the lack of standardized charging infrastructure. Different countries and regions use different connector types for EV charging, making it inconvenient for users and slowing down adoption.

EV charging infrastructure offers different charging speeds and power levels, but not all models support all options. This discrepancy complicates the design and production of charging guns that cater to different power levels and speeds.

Physical connections and guns are no longer necessary thanks to wireless charging technology, which is completely changing the charging infrastructure. Manufacturers of charging guns could have to look for substitutes when wireless charging develops, which might lower demand and limit market expansion throughout the projection period.

Standardization of Charging Protocols and Connectors Demand for Compatible Chargers

The need for suitable EV charging guns is rising due to the increasing standardization of charging protocols and interfaces. Globally recognized standards, such as CCS and CHAdeMO, ensure interoperability across various EV brands and charging networks, simplifying the charging experience for consumers.

Standardizations in infrastructure and production reduce costs and promote universal charging equipment development, leading manufacturers to focus on versatile, durable charging guns for seamless integration with EVs.

Growth of Commercial and EV Fleets to Open the Door to Modernization

Effective charging solutions are becoming increasingly necessary as EVs are used more often in fleet and commercial operations. For instance,

The expanding fleet need sophisticated energy management platforms, load management systems, and long-lasting, and quick charging options, such as DC fast chargers. To provide dependable network access for fleet operators, governments, such as the U.S. National Electric Vehicle Infrastructure Initiative, are spending US$ 5 Bn in 2024 to expand the charging infrastructure.

In the rapidly evolving global market for stationary electric vehicle charging guns, there is a noteworthy trend of strategic partnerships and collaborations that are driving innovation and broadening market access.

Leading automotive manufacturers are joining forces with charging infrastructure providers, creating synergies that enhance technology development and customer convenience. A wave of start-ups in the technology and automotive sectors is emerging, carving out their space in this burgeoning industry. These companies are bringing fresh ideas and disruptive solutions that contribute to the dynamic landscape of electric vehicle charging.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Type

By Application

By Region

To know more about delivery timeline for this report Contact Sales

The market size is set to reach US$ 2,917.4 Mn by 2032.

Electric cars lose 2 to 3% of their charge monthly while idle, requiring 4.5 to 7 miles to maintain charge, and should avoid extreme temperatures.

In 2024, Asia Pacific is set to attain a market share of 40%.

In 2025, the market is estimated to be valued at US$ 449.2 Mn.

A few of the key players in the market are Zhejiang Yonggui Electric Equipment Co., Ltd., AVIC Jonhon Optronic Technology, and Phoenix Contact.