- Executive Summary

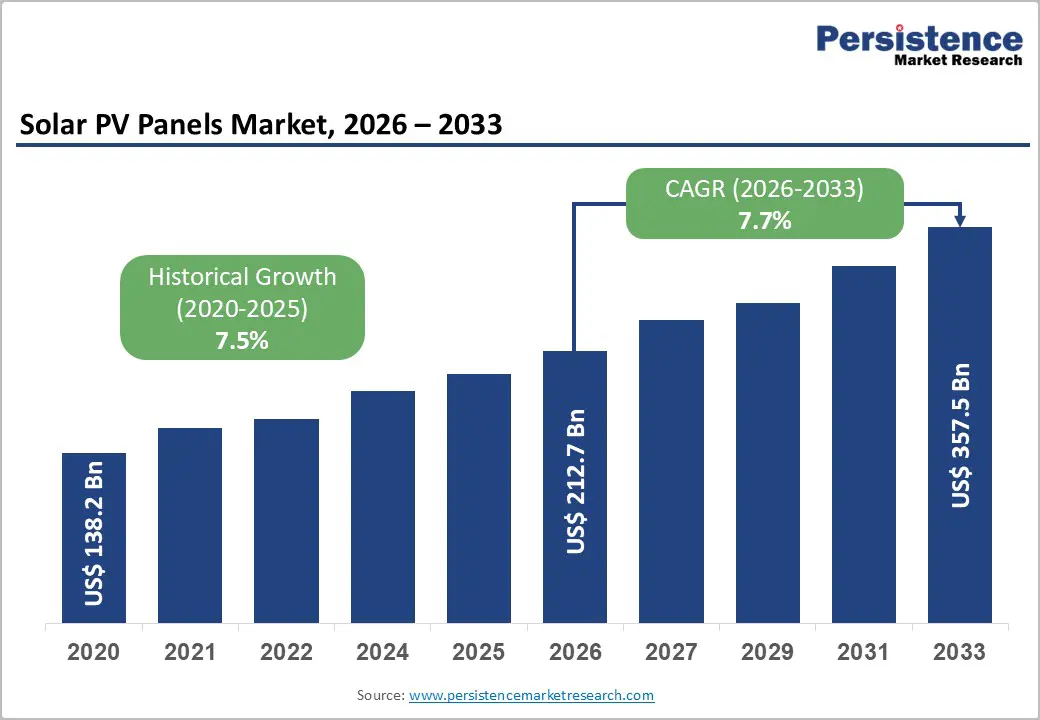

- Global Solar PV Panels Market Snapshot, 2026and 2033

- Market Opportunity Assessment, 2026 - 2033, US$ Bn

- Key Market Trends

- Future Market Projections

- Specialty Clinics Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- Opportunity

- Key Trends

- Macro-Economic Factors

- Global Sectorial Outlook

- Global GDP Growth Outlook

- COVID-19 Impact Analysis

- Forecast Factors - Relevance and Impact

- Value Added Insights

- Treatment Type Adoption Analysis

- Regulatory Landscape

- Value Chain Analysis

- Key Deals and Mergers

- PESTLE Analysis

- Porter’s Five Force Analysis

- Global Solar PV Panels Market Outlook:

- Key Highlights

- Market Size (US$ Bn) and Y-o-Y Growth

- Absolute $ Opportunity

- Market Size (US$ Bn) Analysis and Forecast

- Historical Market Size (US$ Bn) Analysis, 2020-2025

- Market Size (US$ Bn) Analysis and Forecast, 2025-2033

- Global Solar PV Panels Market Outlook: By Technology Type

- Introduction / Key Findings

- Historical Market Size (US$ Bn) Analysis, By Technology Type,2020-2025

- Market Size (US$ Bn) Analysis and Forecast, By Technology Type, 2026- 2033

- Crystalline Silicon

- Thin-Film

- Others

- Market Attractiveness Analysis: By Technology Type

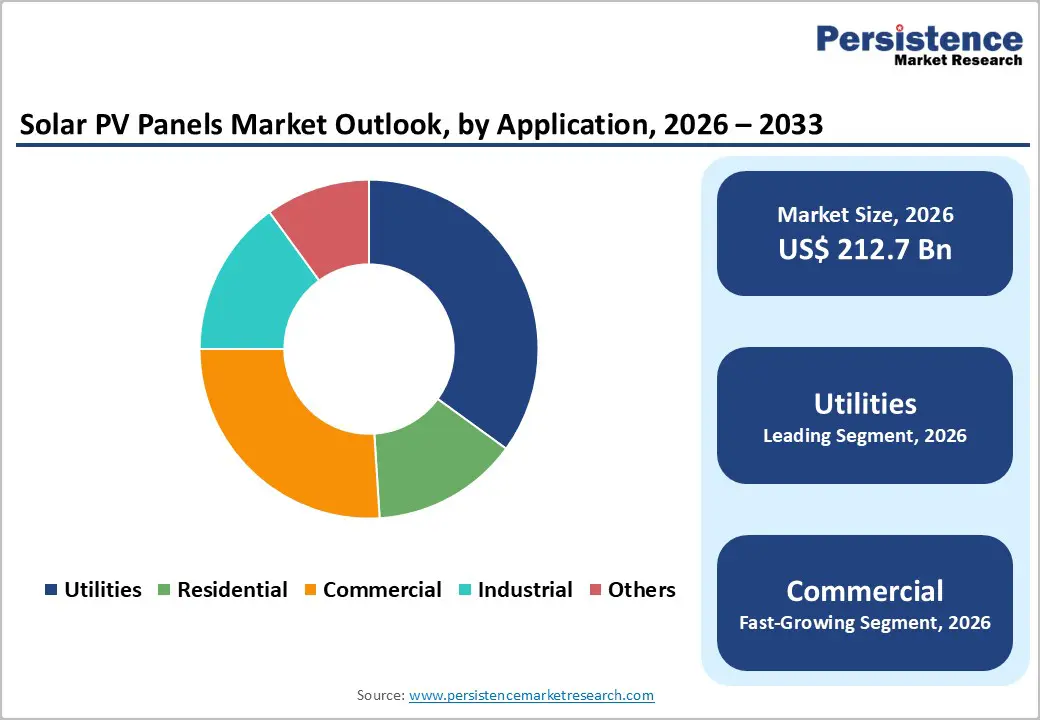

- Global Solar PV Panels Market Outlook: By Application

- Introduction / Key Findings

- Historical Market Size (US$ Bn) Analysis, By Application,2020-2025

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2026- 2033

- Residential

- Commercial

- Industrial

- Utilities

- Others

- Market Attractiveness Analysis: Indication

- Key Highlights

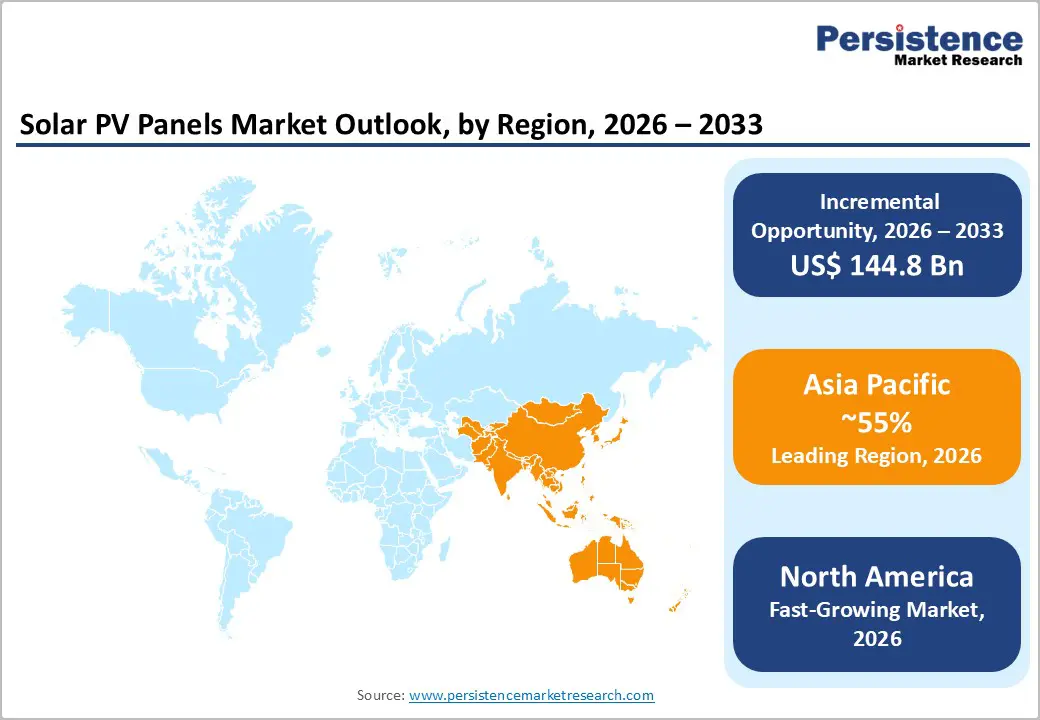

- Global Solar PV Panels Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Region,2020-2025

- Market Size (US$ Bn) Analysis and Forecast, By Region, 2026- 2033

- North America

- Europe

- East Asia

- South Asia and Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Solar PV Panels Market Outlook:

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market,2020-2025

- By Country

- By Technology Type

- By Application

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2026- 2033

- U.S.

- Canada

- Market Size (US$ Bn) Analysis and Forecast, By Technology Type, 2026- 2033

- Crystalline Silicon

- Thin-Film

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2026- 2033

- Residential

- Commercial

- Industrial

- Utilities

- Others

- Europe Solar PV Panels Market Outlook:

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market,2020-2025

- By Country

- By Technology Type

- By Application

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2026- 2033

- Germany

- France

- U.K.

- Italy

- Spain

- Russia

- Türkiye

- Rest of Europe

- Market Size (US$ Bn) Analysis and Forecast, By Technology Type, 2026- 2033

- Crystalline Silicon

- Thin-Film

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2026- 2033

- Residential

- Commercial

- Industrial

- Utilities

- Others

- East Asia Solar PV Panels Market Outlook:

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market,2020-2025

- By Country

- By Technology Type

- By Application

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2026- 2033

- China

- Japan

- South Korea

- Market Size (US$ Bn) Analysis and Forecast, By Technology Type, 2026- 2033

- Crystalline Silicon

- Thin-Film

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2026- 2033

- Residential

- Commercial

- Industrial

- Utilities

- Others

- South Asia & Oceania Solar PV Panels Market Outlook:

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market,2020-2025

- By Country

- By Technology Type

- By Application

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2026- 2033

- India

- Southeast Asia

- ANZ

- Rest of South Asia & Oceania

- Market Size (US$ Bn) Analysis and Forecast, By Technology Type, 2026- 2033

- Crystalline Silicon

- Thin-Film

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2026- 2033

- Residential

- Commercial

- Industrial

- Utilities

- Others

- Latin America Solar PV Panels Market Outlook:

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market,2020-2025

- By Country

- By Technology Type

- By Application

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2026- 2033

- Brazil

- Mexico

- Rest of Latin America

- Market Size (US$ Bn) Analysis and Forecast, By Technology Type, 2026- 2033

- Crystalline Silicon

- Thin-Film

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2026- 2033

- Residential

- Commercial

- Industrial

- Utilities

- Others

- Middle East & Africa Solar PV Panels Market Outlook:

- Key Highlights

- Historical Market Size (US$ Bn) Analysis, By Market,2020-2025

- By Country

- By Technology Type

- By Application

- Market Size (US$ Bn) Analysis and Forecast, By Country, 2026- 2033

- GCC Countries

- Egypt

- South Africa

- Northern Africa

- Rest of Middle East & Africa

- Market Size (US$ Bn) Analysis and Forecast, By Technology Type, 2026- 2033

- Crystalline Silicon

- Thin-Film

- Others

- Market Size (US$ Bn) Analysis and Forecast, By Application, 2026- 2033

- Residential

- Commercial

- Industrial

- Utilities

- Others

- Competition Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping by Market

- Competition Dashboard

- Company Profiles (Details - Overview, Financials, Strategy, Recent Developments)

- JinkoSolar

- Overview

- Segments and Treatment Types

- Key Financials

- Market Developments

- Market Strategy

- JA Solar

- Trina Solar

- LONGi Solar

- Canadian Solar

- Hanwha Q-CELLS

- Risen Energy

- GCL-SI

- First Solar

- SunPower Corporation

- JinkoSolar

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment