Industry: Chemicals and Materials

Published Date: October-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 183

Report ID: PMRREP34874

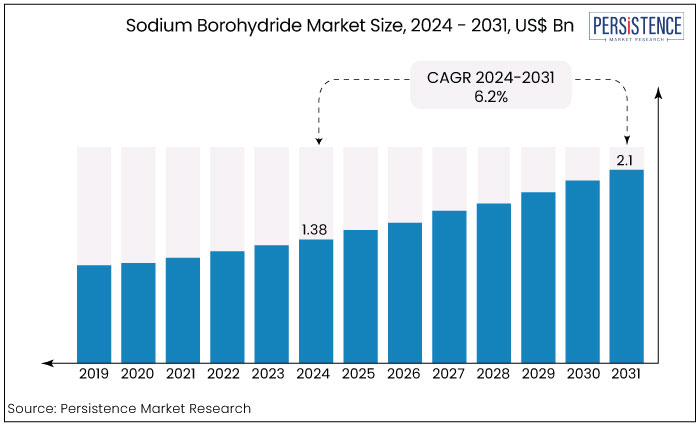

The sodium borohydride market is estimated to increase from US$ 1.38 Bn in 2024 to US$ 2.1 Bn by 2031. The market is projected to record a CAGR of 6.2% during the forecast period from 2024 to 2031.

Sodium borohydride demand is projected to be driven by increasing use in pharmaceuticals, wastewater treatment, and eco-friendly industrial applications. Surging need for high-quality reducing agents and high demand for clean energy technologies are encouraging the adoption of this chemical compound.

Increasing partnerships and collaborations between domestic and international organizations are further estimated to propel demand. In October 2024, for instance, the Indian Institute of Technology Delhi (IIT Delhi) and the International Energy Agency (IEA) joined hands to innovate clean energy technologies with an aim to reduce emissions. Similar partnerships and product launches are anticipated to create new opportunities in the market.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Sodium Borohydride Market Size (2024E) |

US$ 1.38 Bn |

|

Projected Market Value (2031F) |

US$ 2.1 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

6.2% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

5.5% |

|

Region |

Market Share in 2024 |

|

North America |

28% |

North America is set to retain its dominant position in the global sodium borohydride industry through 2031. It is likely to be driven by extensive use in pharmaceutical and chemical manufacturing applications. The chemical compound is widely used as a reducing agent in the production of antibiotics, which is a significant part of the pharmaceutical industry in the region.

The U.S., in particular, holds a substantial share of the market due to the presence of leading pharmaceutical and chemical companies. At the same time, significant investments in research and development, especially in drug discovery and innovation, are likely to create new opportunities. Demand for sodium borohydride is also set to be supported by its applications in environmental protection, such as in wastewater treatment processes, which are increasingly prioritized by industries in North America.

|

Category |

Market Share in 2024 |

|

Type- Powder |

65% |

Based on type, the market is classified into powder, pellets, and granules. Among these, the powder segment dominates with 65% of the total market share in 2024.

Powdered NaBH4 is highly popular in the market as it is exceptionally adaptable, user-friendly, and offered at a competitive price. Its solubility in various solvents and dispersibility in different mediums make it particularly appealing to the pharmaceutical pulp and paper manufacturing sector.

Powdered NaBH4 is not only user-friendly, but it also facilitates business operations by allowing control and customization of dosing according to the requirements of each production process. Furthermore, most end users need not concern themselves with durability or stability, which instills confidence regarding the longevity of their stored items.

Customers may optimize their inventory management and reduce waste by minimizing the danger of decomposition. Regarding safety, powdered NaBH4 is highly safe to manipulate. Enhanced handling and storage protocols reduce the likelihood of disruptions within the supply chain.

|

Category |

Market Share in 2024 |

|

Application- Pulp and Paper |

36% |

Based on applications, the market is divided into pharmaceuticals, pulp and paper, textiles, and chemical. Out of these, the pulp and paper segment dominates the market.

Sodium borohydride is one of the key elements of the pulp and paper industry as it is used as a bleaching agent, particularly in the mechanical pulping process. The grinding of wood chips into pulp enables the retention of lignin, a compound that can lead to yellowing and brittleness in paper over time.

The chemical compound possesses reducing characteristics that make it effective for bleaching mechanical pulp. It helps in improving the brightness, thereby fortifying the paper. Furthermore, the superiority of the compound over alternative bleaching agents enhances its significance in the pulp and paper industry. It demonstrates remarkable selectivity by primarily targeting undesirable coloring chemicals while minimally affecting cellulose fibers, which are crucial for high paper strength.

Sodium borohydride, also called sodium tetra-hydriodoborate, is one of the most adaptable reducing agents in various industrial sectors. It is considered an upright reducing agent that exhibits sustained performance and selective reduction.

Pharmaceutical synthesis and wastewater remediation are among the most significant applications. Hence, it is anticipated that the market for NaBH4 will expand at a higher single-digit CAGR during the forecast period.

Demand for the compound is projected to be driven by the increasing adoption of novel sewage treatment techniques from the food and beverage industry and the production of various antibiotics in the pharmaceutical industry. It is anticipated that the market will experience steady growth due to the increasing use of NaBH4 as a bleaching agent in the pharmaceutical industry, which has a high sustainability rate.

In mid-2023, several key pharmaceutical manufacturers announced expanded use of NaBH4 for antibiotic production, particularly in North America. Companies such as Vertellus and Kemira increased their production capacities to meet the demand driven by drug manufacturing and synthesis.

The sodium borohydride industry witnessed a CAGR of 5.5% in the historical period from 2019 to 2023. It was mainly driven by its applications in pharmaceuticals, pulp and paper bleaching, and wastewater treatment.

Growth was also largely fueled by the increasing demand for antibiotics in the pharmaceutical industry and the use of NaBH4 as a reducing agent in chemical synthesis. Rising emphasis on sustainability and water purification boosted its adoption in wastewater treatment plants. However, growth during this period was constrained to a certain extent by high production costs and competition from alternative reducing agents.

Over the forecast period, the market is projected to witness accelerated growth, with a CAGR of 6.2% through 2031. The pharmaceutical industry is expected to rise due to the surging prevalence of chronic diseases and an aging population. It will likely lead to increased production of antibiotics and other pharmaceutical products that rely on NaBH4.

Strict environmental regulations globally, particularly in Europe and North America, are anticipated to boost its application in wastewater treatment and eco-friendly industrial processes. Technological advancements in sodium borohydride production, improving its efficiency and reducing costs, will also likely contribute to its post-2024 growth trajectory.

Development of Clean Energy Technologies Using Sodium Borohydride to Propel Demand

Sodium borohydride (NaBH4) is considered a viable hydrogen storage medium for fuel cells and other renewable energy technologies. The rising emphasis on renewable energy and the shift toward a low-carbon economy is anticipated to push the need for hydrogen storage technologies.

The capacity of NaBH4 to liberate hydrogen through regulated breakdown makes it a viable option for these applications. Consequently, the increasing demand for sustainable energy technologies is augmenting growth.

The growing need for energy-efficient and sustainable solutions in portable devices, electric cars, and backup power systems is fueling demand for compact power systems. Sodium borohydride, with its high energy density and ability to release hydrogen gas for power generation, is a promising compound for these applications. The development of lightweight and efficient hydrogen generation and fuel cell systems using sodium borohydride is set to further boost demand for clean energy technology.

Increasing Use of NaBH4 as a Reducing Agent to Positively Influence the Market

Sodium borohydride is extensively employed as a reducing agent in chemical synthesis, particularly for lowering carbonyl compounds, including aldehydes and ketones. It specifically transforms carbonyl groups into their respective alcohols, making it a key reagent in synthesizing medicines, agrochemicals, and fine chemicals.

Sodium borohydride is projected to be utilized in reductive amination processes, facilitating the conversion of imines or Schiff bases into primary and secondary amines. It is expected to be essential to produce various medicines, dyes, and other chemical molecules.

NaBH4 also enables the reduction of metal ions to their elemental state, thereby permitting subsequent separation and purification. Increasing demand for reducing agents in end-use industries is enhancing the dynamics of the sodium borohydride market growth.

Fluctuations in Raw Material Prices May Hinder Demand

The sodium borohydride market research report states that it is encountering a significant challenge. The expense and accessibility of raw materials are hindering progress. Current production methods depend on components like boron dichloride, sodium hydride, and other compounds whose prices might fluctuate significantly.

The price of sodium hydride has fluctuated between $150 and $300 per kilogram during the past decade. These fluctuations frequently lead to significant alterations in the production costs of sodium borohydride, disrupting the market and ultimately affecting profitability throughout the entire supply chain.

When vital raw materials become scarce or their export is prohibited, production costs will undoubtedly be affected. If inadequately addressed, these expenses could be disastrous for producers globally who mainly depend on a single source or are yet to initiate efforts to enhance their raw material use.

The risks can be mitigated by diversifying suppliers, hedging purchases, or investing in research to enhance these procedures comprehensively. Furthermore, corporations may consistently investigate alternate synthetic pathways that utilize less expensive raw materials, leading to more stable production prices over time.

Regardless of the selected strategy, it is crucial to be vigilant for potential opportunities to reclaim vital resources. This journey of NaBH4 is indeed arduous, but it also presents opportunities for growth and innovation.

Rising Demand for Antibiotics and Antiviral Drugs to Create Potential Opportunities

One of the most transformative opportunities for the sodium borohydride industry lies in its important role in the pharmaceutical industry, particularly in the synthesis of antibiotics and other complex drug formulations. Its ability to selectively reduce compounds makes it essential in producing high-purity pharmaceuticals.

With the increasing global demand for antibiotics, antiviral medications, and treatments for chronic diseases, the market is expected to benefit from the pharmaceutical industry’s expansion. Advancements in drug discovery and production technologies, where sodium borohydride's properties are increasingly indispensable, especially in North America and Europe, are also projected to fuel demands.

As per the Observatory of Economic Complexity (OEC), in 2022, India was the leading importer of antibiotics across the globe with Italy, the U.S., Germany, and China following behind. These numbers are projected to rise in the coming years, thereby creating novel opportunities.

In the paper and pulp industry, sodium borohydride is gaining prominence as a bleaching agent. With a shift toward eco-friendly and sustainable production methods, there is a growing need to replace traditional, environmentally harmful chemicals with green alternatives.

Sodium borohydride’s less hazardous profile and efficiency in pulp bleaching offers a competitive edge. This demand is particularly rising in Europe, where regulatory pressures encourage the adoption of sustainable chemical solutions. The Asia’s Linear Infrastructure safeGuarding Nature (ALIGN) Project, which is funded by the U.S. Agency for International Development (USAID), found that Europe manufactured around 104 million tons of paper and 45.7 million tons of pulp in 2021. The increasing push for environmentally responsible paper and pulp production opens a long-term growth opportunity in the market.

The market for sodium borohydride is moderately competitive, with a few key players dominating the global landscape. Major companies include Kemira, Vertellus, Arkema, and Guobang Pharmaceutical Group. These players hold substantial shares due to their strong production capacities, established supply chains, and high focus on research and development.

Kemira and Vertellus lead in pharmaceutical and industrial applications, benefiting from innovations in drug synthesis and water treatment technologies. Arkema focuses on chemical manufacturing, leveraging NaBH4 in diverse industrial processes.

Small-scale regional players compete by offering low-cost alternatives. However, they often tend to face scalability and product quality challenges. The market is also witnessing increasing competition due to growing demand and expanding applications, encouraging further innovations and strategic partnerships.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Type

By Application

By Region

To know more about delivery timeline for this report Contact Sales

It is estimated to be valued at US$ 2.1 Bn by 2031.

It is estimated to exhibit a CAGR of 6.2% over the forecast period.

Anhui Jin’ao Chemical Co Ltd., Jiangsu Huachang Chemical Co Ltd., and Kemira are a few manufacturers.

It is primarily used in the synthesis of several popular drugs.

It is prepared from trimethyl borate and sodium hydride.