Industry: Healthcare

Published Date: April-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 217

Report ID: PMRREP4226

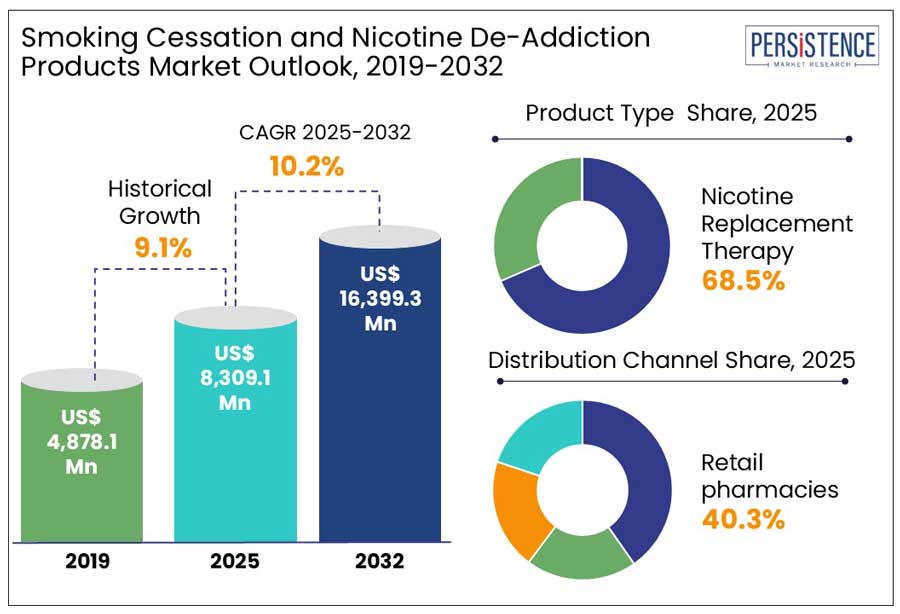

The global smoking cessation and nicotine de-addiction products market is anticipated to reach a value of US$ 8,309.1 Mn in 2025 and is set to witness a CAGR of 10.2% with projected value of US$ 16,399.3 Mn by 2032. The growth is primarily driven by the increasing prevalence of smoking-related diseases, expanding government-backed cessation initiatives, and growing public awareness of smoking hazards.

Additionally, pharmaceutical advancements in nicotine replacement therapies (NRTs) and prescription drug treatments are enhancing the effectiveness of smoking cessation programs. In August 2024, the National Institutes of Health (NIH) reported over one billion people worldwide engage in smoking habits resulting in approximately six million tobacco-related deaths annually, including fatalities from passive smoking.

Key Industry Highlights

|

Market Attribute |

Key Insights |

|

Smoking Cessation and Nicotine De-Addiction Products Market Size (2025E) |

US$ 8,309.1 Mn |

|

Market Value Forecast (2032F) |

US$ 16,399.3 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

10.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

9.1% |

Global initiatives such the WHO Framework Convention on Tobacco Control (FCTC), along with local government measures such as higher tobacco taxes and smoking bans are driving the adoption of smoking cessation therapies. For example, higher tobacco taxes have led to decreased smoking rates in many countries, pushing smokers to seek support through cessation products. In the U.S., the FDA's approval of smoking cessation products and public health campaigns such as "Tips from Former Smokers" further encourage the use of therapies such as nicotine replacement products and prescription medications. These government interventions play a crucial role in reducing tobacco consumption and promoting the use of smoking cessation therapies to help people quit.

Prescription-based smoking cessation therapies like varenicline (Chantix) and bupropion (Zyban) can be expensive, which limits their accessibility, particularly for lower-income smokers. For example, the cost of varenicline can range from $150 to $200 per month without insurance, making it unaffordable for many individuals. This high cost often leads smokers to opt for over-the-counter nicotine replacement therapies (NRTs) such as gums or patches, which are more affordable but may offer less targeted support. The expense of prescription medications, therefore restricts their widespread use, especially in price-sensitive markets, hindering the overall effectiveness of smoking cessation efforts.

The rise of AI-driven tools and mobile applications presents a significant opportunity to improve smoking cessation efforts. These platforms can track users' progress, provide personalized guidance, and offer constant support, making quitting more accessible and manageable. For example, Quit Genius, an AI-powered app, uses cognitive behavioral therapy (CBT) to help users quit smoking. Another example is the quitSTART app, developed by Smokefree.gov, a resource created by the National Cancer Institute in collaboration with the FDA. This app, designed with input from tobacco control professionals, experts, and ex-smokers, offers tailored tips and support to help users quit smoking. By providing real-time assistance and personalized strategies, these digital tools enhance engagement and success rates, making smoking cessation more effective, especially in remote or underserved areas.

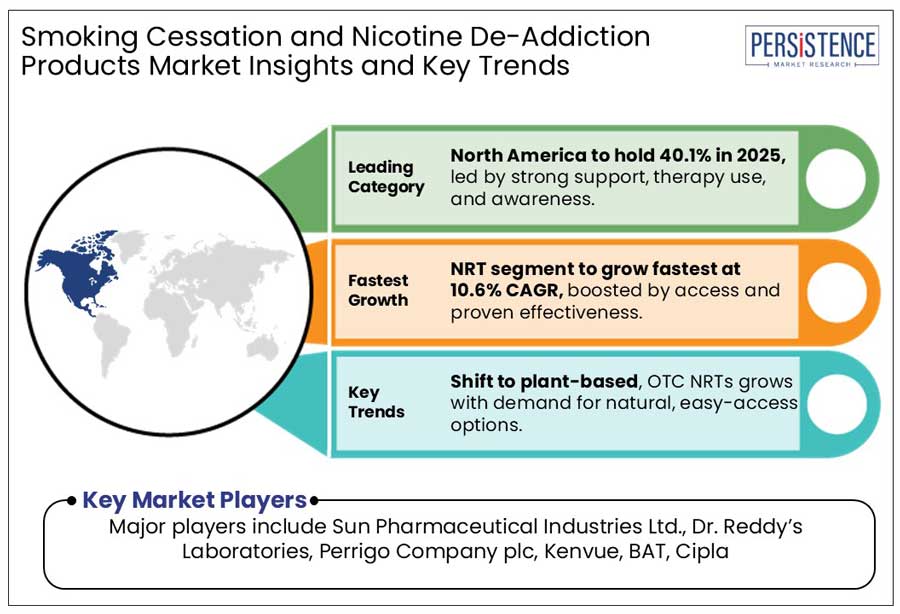

Nicotine Replacement Therapy (NRT) is expected to dominate the market, accounting for around 68.5% of the share in 2025. NRT products such as gums, patches, and lozenges are popular due to their effectiveness, ease of use, and availability without a prescription. For example, nicotine patches provide a steady dose to curb cravings. In contrast, Drug Therapy, including medications like varenicline (Chantix) and bupropion (Zyban), holds a smaller share due to the need for prescriptions, higher costs, and potential side effects. NRT's accessibility and affordability drive its market dominance.

Retail pharmacies are expected to hold the higher market share, approximately 40.3%, in 2025. This segment leads due to its widespread accessibility, with customers easily able to purchase products such as nicotine gums, patches, and lozenges over the counter. Retail pharmacies offer immediate access to these products, often with a wide range of options and expert advice.

For example, a customer can quickly purchase nicotine patches at a local pharmacy without a prescription. As online pharmacies are growing, they still account for a smaller portion due to shipping times and limited access, while hospital pharmacies and supermarkets/hypermarkets make up smaller segments because of less focus on specialized smoking cessation products.

North America is projected to account for 40.1% share in 2025. The strong regulatory environment and commitment to public health in North America have played a crucial role in shaping the smoking cessation market. A prime example of this initiative is the Tobacco Control Act, which has significantly contributed to both reduced smoking rates and the growing market share for smoking cessation therapies. In addition, in October 2024, leaders from the NIH and FDA called for innovation in developing new therapeutic approaches to smoking cessation, further underlining the importance of expanding treatment options for individuals trying to quit smoking.

Europe is projected to occupy 22.3% of the share in 2025 due to the stringent tobacco control regulations and a growing focus on public health. For example, the European Union's Tobacco Products Directive, which includes measures such as graphic health warnings on cigarette packs and restrictions on tobacco advertising, has contributed to a decrease in smoking rates and increased demand for cessation products. Additionally, the U.K. has introduced comprehensive smoking cessation programs, such as the NHS Quit Smoking Service, which further boost the adoption of smoking cessation therapies. These efforts are expected to drive the region's market share in the coming years.

By 2025, market share for Asia Pacific in smoking cessation products is expected to reach 15.4%, driven by significant policy changes and growing health awareness. Japan’s Health Promotion Act (HPA), enacted in 2020, banned smoking in indoor public spaces, effectively reducing smoking rates, particularly in public areas. According to the WHO, China is the world's largest producer and consumer of tobacco, with over 300 million smokers-nearly one-third of the global total-yet smoking cessation services remain limited. However, the government launched the China Cessation Platform in 2021 to expand resources and support. These efforts, combined with a large smoker population and rising demand for cessation products, position East Asia as a rapidly growing and lucrative market for smoking cessation solutions.

Latin America's market is a growing segment, driven by increasing health awareness and government efforts. In Brazil, the National Commission for FCTC Implementation (Conicq) has been instrumental in implementing tobacco control measures, including smoking cessation programs. The commission, which was updated in August 2023, helps consolidate and evaluate actions to reduce smoking rates. These efforts are encouraging greater adoption of smoking cessation products in Brazil and the wider region. As public health initiatives expand and smoking rates decrease, Latin America presents a growing market for nicotine de-addiction solutions.

The Middle East and Africa (MEA) region is becoming an increasingly lucrative market for smoking cessation products due to high smoking rates and the growing economic burden of tobacco use. In the UAE, smoking costs the economy an estimated 10,946,488,360 UAE dirhams, covering both healthcare and lost productivity, as reported by the Tobacco Atlas 2022. In Saudi Arabia, public health initiatives like higher tobacco taxes and a goal to reduce smoking rates to 5% by 2030 are also driving demand for cessation products. A key development in this effort is MS Pharma's exclusive licensing agreement with Bioventure in November 2022 to commercialize Varenicline in Saudi Arabia, helping address the country’s shortage of reliable smoking cessation options. Together, these actions highlight the region’s growing need for effective nicotine de-addiction solutions, positioning the MEA as a promising market.

The global smoking cessation and nicotine de-addiction products market is competitive, with key players such as Pfizer, GSK Plc, Cipla, and Perrigo driving innovation. Advanced prescription therapies and over-the-counter nicotine replacement products enhance treatment effectiveness. Digital solutions like Quit Genius and the quitSTART app provide AI-driven support, improving user adherence.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

The global Smoking Cessation and Nicotine De-Addiction Products market is estimated to increase from US$ 8,309.1 Mn in 2025 to US$ 16,399.3 Mn in 2032.

The global smoking cessation and nicotine de-addiction products market is driven by rising health awareness, government regulations like the WHO FCTC, increasing tobacco taxation, advancements in cessation therapies, and the growing adoption of digital and AI-driven quitting solutions.

The market is projected to record a CAGR of 10.2% during the forecast period from 2025 to 2032.

Major players include Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories, Perrigo Company plc, Kenvue, BAT, Cipla among others

The Smoking Cessation and Nicotine De-Addiction Products market presents opportunities in AI-driven digital cessation tools, expanding government-backed smoking cessation programs and growing demand for alternative nicotine-free solutions.