Industry: Consumer Goods

Published Date: December-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 188

Report ID: PMRREP34988

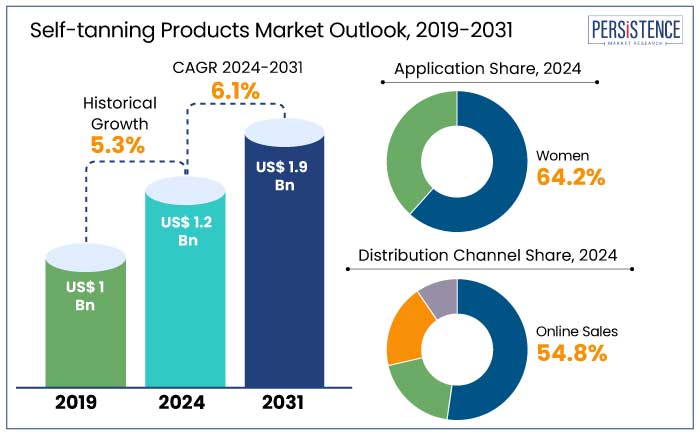

The global self-tanning products market is anticipated to reach a size of US$ 1.2 Bn by 2024. It is predicted to witness a CAGR of 6.1% during the forecast period to attain a value of US$ 1.9 Bn by 2031.

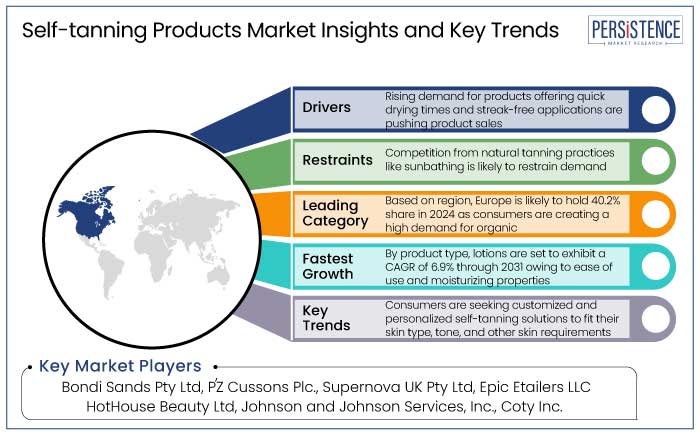

As consumers become aware of the long-term effects of sun exposure, they are posing a surging preference for sunless tanning solutions. They are mainly seeking products that offer customized results while rejuvenating the skin.

There is a rising demand for clean formulations that are free from harsh chemicals, resulting in the popularity of organic, vegan, and cruelty-free self-tanning products. Nearly 25% of consumers worldwide prioritize organic and cruelty-free beauty products, thereby driving innovation in the industry. Growing trend toward sustainability has led brands to adopt eco-friendly packaging, including recyclable and biodegradable materials.

Growth of e-commerce platforms will likely continue to benefit the global market as consumers turn to online platforms to purchase these products. Online sales are estimated to hold about 54.8% in 2024 in terms of the self-tanning products market share. This is owing to their high convenience and accessibility.

Key Highlights of the Industry

|

Market Attributes |

Key Insights |

|

Self-tanning Products Market Size (2024E) |

US$ 1.2 Bn |

|

Projected Market Value (2031F) |

US$ 1.9 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

6.1% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

5.3% |

The self-tanning products market in North America is estimated to hold a share of 44.7% in 2024. The region is home to some of the most prominent beauty markets globally, with the U.S. emerging as the top spender in personal care and skincare products. The U.S. beauty and personal care industry was valued at US$ 91.5 Bn in 2023.

Consumers in North America are becoming aware of the risks associated with sun exposure. This health-consciousness has shifted the demand toward safe alternatives like self-tanning products. For instance,

Europe self-tanning products market is predicted to hold a value share of 40.2% in 2024. The region has a rich history of beauty and skincare traditions as consumers are particularly focusing on personal grooming.

Consumers in Europe are increasingly drawn toward self-tanning products featuring natural, organic, and cruelty-free ingredients. Several brands in the region are responding to this demand by formulating products with plant-based ingredients, eco-friendly packaging, and organic certifications. Around 32% of consumers in the region actively seek eco-friendly and natural self-tanning options.

Social media influencers, makeup artists, and beauty bloggers also play a key role in shaping beauty trends across Europe. About 68% of women in Europe are influenced by beauty influencers while choosing beauty and skincare products, including self-tanners.

Self-tanning lotions are witnessing high demand owing to their ease of application compared to sprays or mousses. Their creamy texture enables controlled and even distribution. These are projected to witness a CAGR of 6.9% through 2031.

Lotions usually combine tanning agents with hydrating ingredients like hyaluronic acid, shea butter, and aloe vera. This dual functionality appeals to consumers looking to simplify their skincare routine, thereby making lotions a preferred choice. These also cater to a wide range of users, including those with dry or combination skin who prefer a hydrating product over drying alternatives.

Women worldwide are inclined toward achieving sun-kissed glow as a part of beauty standards. The segment is projected to hold a share of 64.2% in 2024. Nearly 56% of women aged 18 to 24 consider a tan essential for looking healthy and attractive.

Skincare routines of women are complex with an emphasis on products offering multiple benefits. About 65% of women prefer self-tanning products that provide moisturizing or skincare properties, thereby underscoring their preference for multifunctional products.

Eco-friendly formulations and packaging are estimated to attract environmentally conscious consumers. AI-powered shade matching and personalized products will likely boost adoption rates. Hybrid products that combine self-tanning with skincare benefits like SPF, anti-aging, and hydration are likely to gain traction in the assessment period.

Businesses are broadening their target demographic to include men and non-binary consumers. Rising disposable income coupled with a surging awareness regarding self-care drives expansion. Social media also plays a key role in influencing consumer preferences toward self-tanning products.

The self-tanning products market witnessed a steady CAGR of 5.3% during the historical period. The period showed a shift from traditional tanning methods to safe alternatives.

The COVID-19 pandemic further impacted consumer behavior as restrictions on outdoor activities and closure of salons increased demand for at-home self-tanning solutions. The beauty industry also embraced e-commerce and digital platforms to cater to changing shopping behaviors.

Innovations like streak-free formulas and eco-friendly options attracted more users. The period also witnessed an increasing adoption of quick-drying, natural-looking, and hybrid skincare self-tanners, thereby pushing demand.

Rising knowledge of UV-related risks resulted in consumers to shift from sunbathing and tanning beds to safer alternatives. Development of odor-free, streak-free, and customizable products improved user experiences.

Market to be Shaped by Seasonal and Event-based Demand

Sales of self-tanning products typically witness a sharp increase during spring and summer as people prepare for vacations and outdoor activities. A study found that 40% of annual self-tanning product sales occur during these months.

Weddings happening in late spring and summer often drive demand for self-tanning products as the wedding party as well as guests seek radiant skin tone for photographs.

Rising Adoption of Influencer Marketing to Help Build Brand Credibility

Social media platforms like Instagram, YouTube, TikTok, and Pinterest are instrumental in showcasing self-tanning products through tutorials and user-generated content. About 87% of beauty consumers use social media to discover new products.

Influencers play a key role in building brand credibility and driving conversions for self-tanning products. Brands like Bondi Sands and Isle of Paradise leverage endorsement from high-profile influencers and celebrities to boost brand awareness.

High Competition from Natural Tanning to Restrain Growth

Consumers associate natural tanning with a genuine and long-lasting glow compared to results achieved with self-tanning products. A recent study revealed that 43% of consumers believe natural tan looks more realistic compared to self-tanning products.

Sunbathing and outdoor tanning are also low-cost alternatives, thereby appealing to budget-conscious consumers. Sunbathing remains a popular activity, especially in regions that have warm climate. For example,

Tan is often perceived as a status symbol of a relaxed, outdoorsy lifestyle, especially in Western cultures.

Innovations in Application Methods to Create New Growth Avenues

Modern consumers value self-tanning products that simplify application process while decreasing mess, time, and risk of uneven results. Around 45% of self-tanning product users prioritize ease of application as a key factor in their purchasing decisions.

Lightweight and easy to spread mousses are among the popular format, accounting for 35% of sales, owing to their quick-drying properties. Mitts are widely used to ensure even application and avoid staining hands. Nearly 65% of self-tanning users consider mitts essential for achieving professional results at home.

Products designed to develop quickly, almost within 1 to 2 hours, are highly sought after by busy consumers. Research revealed that express self-tanners witnessed a 20% increase in sales between 2021 to 2023. A study by Global Web Index also stated that 72% of beauty consumers are willing to try new formats if they promise ease of use and performance.

Launch of Customized and Personalized Solutions to Forge Opportunities

Consumers are seeking products that cater specifically to their individual requirements, including skin tone, type, and desired tanning intensity.

Personalization assists in solving challenges like mismatched shades, uneven application as well as intensity control. Over 62% of self-tanning product users expressed interest in products that could be tailored to their specific skin tone, according to a survey.

A few bands use AI tools and quizzes to recommend products based on factors like skin undertone, type, and tanning goals. For example, Isle of Paradise’s online quiz personalizes product recommendations based on user input.

Companies in the self-tanning products market are introducing products made with organic, vegan, or natural ingredients to appeal to health-conscious consumers. They are developing streak-free, long-lasting, or quick drying formulas to enhance effectiveness and usability. They are also offering personalized self-tanning products that cater to different skin tones and types.

Businesses are incorporating smart features like apps to guide users on applications or devices for even tanning. They are leveraging online sales channels, including brand websites, Amazon, and other marketplaces to reach a global audience. They are also using social media platforms for tutorials, user-generate content, and viral challenges to increase brand awareness.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Skin Type

By Application

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

The market is anticipated to reach a size of US$ 1.9 Bn by 2031.

Self-tanning creams use dihydroxyacetone (DHA) as an active agent to produce temporary staining of the skin.

Self-tan products have a lifespan of 6 to 12 months.

Some of the prominent manufacturers in the market are Bondi Sands Pty Ltd, PZ Cussons Plc, and Supernova UK Pty Ltd.

The market is estimated to witness a CAGR of 6.1% through the assessment period.