Industry: Food and Beverages

Published Date: April-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 166

Report ID: PMRREP19588

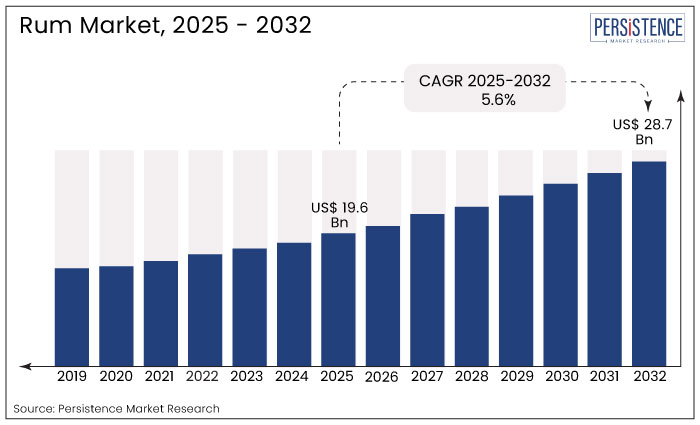

The global rum market is projected to witness a CAGR of 5.6% during the forecast period from 2025 to 2032. It is anticipated to increase from US$ 19.6 Bn recorded in 2025 to a staggering US$ 28.7 Bn by 2032.

Rising demand for premium beverages and surging inclination of millennial consumers toward exotic alcoholic beverages are projected to create novel opportunities for key rum producers. Launch of sugar-free rum in both developed and developing countries is also expected to boost sales as health consciousness rises.

The International Diabetes Federation (IDF), for instance, found that in 2021, around 10.5% of individuals belonging to the age group of 20 to 79 years were living with diabetes. The organization estimates that 1 in 8 adults will have diabetes by 2045. With the numbers rising, consumers are likely to become more conscious of what they consume regularly, creating avenues for rum companies.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Rum Market Size (2025E) |

US$ 19.6 Bn |

|

Projected Market Value (2032F) |

US$ 28.7 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

5.6% |

|

Historical Market Growth Rate (CAGR 2019 to 2024) |

7.1% |

|

Country |

CAGR through 2032 |

|

U.S. |

4.9% |

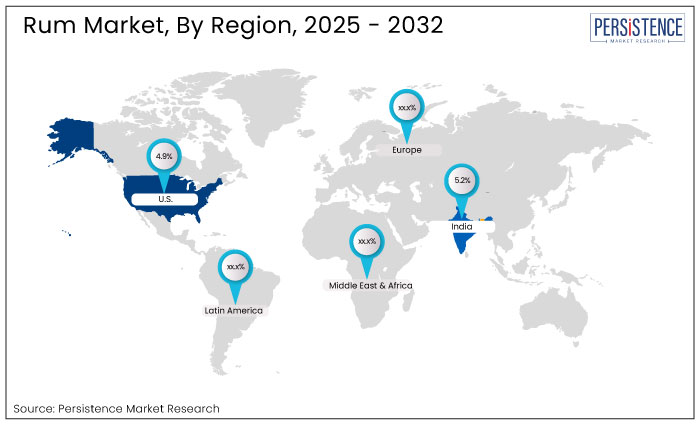

In North America, the United States is anticipated to record a considerable CAGR of 4.9% through 2032. It is attributed to the presence of several supermarkets and hypermarkets in the country that sell rum from different brands and price ranges. Competitive pricing and high product availability are the two main factors why millennials incline toward these sales channels.

The high popularity of e-commerce platforms has also created immense popularity of rum as it has become convenient for consumers to check out product features and reviews before making a purchasing decision. Ongoing enhancements in the logistics of alcohol are further anticipated to augment demand.

Retail giants like Walmart, for instance, extended its alcohol delivery locations across the U.S. to 1,500 in 2021 from only 200 in 2019. The pandemic had also positively influenced sales through e-commerce platforms as brick-and-mortar stores were shut down due to lockdown norms.

|

Country |

CAGR through 2032 |

|

India |

5.2% |

In Asia Pacific, the rum market growth is estimated to rise in India, which is set to exhibit a CAGR of around 5.2% through 2032. The booming bar and pub culture in India backed by high disposable income is projected to create new opportunities.

India is home to few of the reputed rum brands namely, Amrut, Bacardi, Zacapa, Mount Gay, and Captain Morgan. They are constantly investing in research and development activities to come up with novel beverages infused with new ingredients without compromising on taste or quality.

The premium rum segment is also likely to gain traction among India’s millennials. Apart from India, Thailand, Malaysia, and Indonesia are estimated to showcase steady growth through the forecast years. It is mainly attributed to the surging tourism industry and rapid expansion of retail travel.

|

Category |

CAGR through 2032 |

|

Product Type- Dark and Golden Rum |

3.6% |

In terms of product type, the dark and golden rum category is anticipated to lead in the foreseeable future by capturing a CAGR of around 3.6%. The surging desire to consume aged, premium spirits among millennials is likely to bolster demand.

The booming cocktail culture across developing countries is another key factor estimated to create opportunities for dark and golden rum providers. Well-known brands are set to utilize traditional production techniques to maintain the authenticity of rum options.

In September 2024, for instance, Badachro, a popular craft distillery from Scotland, launched its innovative rum named Surfing Puffin Rum, which is inspired by the Scottish Highlands. As per the company, the rising shift toward experimentation in the U.K. has resulted in this launch.

|

Category |

CAGR through 2032 |

|

Distribution Channel- On-trade |

3.1% |

Based on distribution channel, the on-trade segment is projected to exhibit a CAGR of 3.1% during the period from 2025 to 2032. With rising number of nightclubs, hotels, restaurants, and bars in both developed and developing countries, the demand for unique rum has skyrocketed.

On-trade establishments mentioned above are often targeted at youngsters seeking cutting-edge social experiences or those who are outgoing. The emergence of new nightclubs and pubs with out-of-the-box concepts is another important factor pushing demand.

Shanghai has opened the door to its first state-of-the-art nightclub named Tango Livehouse. It is an indoor cycling studio where classes are conducted in both English and Chinese.

The innovative smart bikes installed in the studio provide real-time information about an individual’s steps and motivates them to keep up with the beats of music. Such new ideas are projected to create novel opportunities for on-trade channels.

The demand for rum is expected to skyrocket in the next ten years due to the trend for drinking the beverage on a trip to tropical areas. Young travelers have popularized rum-producing places like Latin America and the Caribbean. The practice of purchasing rum to reminisce about the vacation or as a souvenir is also projected to accelerate demand.

The rapid expansion of experimental retails across various parts of the globe has further created new opportunities. Both international and domestic brands are planning to unveil experimental alcohol retail outlets in metro cities to increase rum sales.

The global cocktail scene is buzzing igniting a spirit market of adventure in drink enthusiasts everywhere. Rum, with its remarkable versatility has emerged as a favorite in vibrant cocktails such as mojitos, piña coladas, and daiquiris. As the cocktail culture evolves and expands, the appetite for rum has soared making it a must-have in bars and home mixes alike.

The global rum industry recorded a decent CAGR of 5.6% in the historical period from 2019 to 2024. Key alcoholic beverage brands invested a lot of money in research and development activities back in the historical period to increase sales that were otherwise hampered by the pandemic. They constantly experimented with their ingredients and formulations to create novel drinks.

Alcoholic brands also started focusing more on consumer’s changing needs and updated themselves to cater to varying needs. They also targeted whiskey and Cognac enthusiasts by preparing rum in cutting-edge casks. For instance,

Sales of rum are estimated to record a CAGR of 7.3% during the forecast period between 2025 and 2032.

Craft Rum Demand to Skyrocket with Need for Authenticity in Terms of Flavor

Millennial consumers have recently started looking for genuine alcoholic beverages, which are set to accelerate sales of craft spirits, including rum. Several beverage producers are nowadays promoting their craft rum ranges through social media platforms like Instagram and Facebook to gain momentum.

Demand for commercial rum has declined in the past few years as craft rum provides a highly authentic flavor profile, superior quality, and smooth taste. Hence, craft rum producers are expected to manufacture their drinks in small batches to control the experience, quality, and taste of the rum. For instance,

Desire for Cakes with Superior Texture Fuels Sales of Industrial Rum

The emergence of cocktail culture across the globe has resulted in a surging demand for nuanced and complex beverages, thereby augmenting industrial rum sales. The desire to consume flavorful and unique drinks is set to propel the infusion of industrial rum into other ingredients and spirits.

The food and beverage industry is further anticipated to demand industrial rum for applications, such as flavorings and baking. Several bakeries often use this type of rum to enhance the flavor and texture of cakes. For example,

Intense Competition from Alternatives and High Taxation to Hamper Demand

In those countries where there is an easy availability of a wide range of beverage options, the competition for rum makers can be very high. Manufacturers are set to find it difficult to differentiate their in-house products to stand out from their competitors.

In certain parts of the world, health-conscious consumers are looking for beverages with low-alcohol content, such as wine and beer. It is estimated that this factor will hamper rum sales in the near future.

Another key factor that is set to hinder sales is high taxes on rum. It often tends to raise the cost of the final product for consumers. Owing to this tax burden, distributors and manufacturers are anticipated to be in a difficult situation to distribute their products at competitive prices.

Companies like Bacardi Focus on Spiced Rum to Gain Competitive Edge

Spiced rum, with its unique mixture of spices and fruits, such as cherries, star anise, and cinnamon, is projected to gain impetus through 2032. The booming artisan spirits market in the U.S. and U.K. is expected to create new growth avenues for leading beverage manufacturers. Young adults are anticipated to mainly prefer this type of rum for social gatherings owing to its adventurous appeal.

Bacardi Limited, for instance, provides premium spiced rum made with vanilla, pineapple, cinnamon, coconut blossom sugar, and coconut water. The company had incorporated various marketing tactics, such as tasting events, in-store displays, and digital marketing campaigns during the launch.

Bolstering Trend for Flavored Rum to Open the Door to Success

The inclination of millennials toward flavored rum has rapidly increased in recent years. They are mainly preferring varieties in terms of flavor, such as mango, pineapple, and coconut. This type of modern rum is estimated to create new growth potential in the foreseeable future backed by the focus of distilleries, bars, and pubs on mixology.

Several educational institutions are also offering different types of courses on mixology that teach the art of making cocktails. Flavored rum is hence extensively used by mixologists to prepare a wide range of exotic cocktails. The launch of limited-edition flavored rum by prominent brands and celebrities is also projected to create opportunities for expansion.

In India, for instance, Bacardi Limited recently unveiled four new flavored rums, namely, Caribbean Spiced, Mango Chili, Green Lime, and Ginger Rum. With this launch, the company aims to attract creative beverage lovers who want to have a wonderful drinking experience.

The global rum market is highly competitive in nature owing to the presence of several large- and small-scale companies. Most of the big brands are focusing on bringing innovative formulations to the table to cater to varying consumer needs. They are primarily focusing on reducing sugar and artificial ingredients in their drinks backed by surging health concerns among modern consumers.

Local players are aiming for high shares by either selling their in-house products on online platforms or participating in trade fairs to exhibit their offerings. The industry is estimated to witness the entry of multiple start-ups in the near future. TV shows like Shark Tank that have gained immense popularity worldwide are set to help them gain the required funds to support their initial launch.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

| Market Analysis Units | Value: US$ Bn/Mn, Volume: As applicable |

|

Key Regions Covered |

|

| Report Highlights |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Product Type

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

The global rum market is expected to grow at a CAGR of 5.6% from 2025 to 2032.

The global rum market is projected to reach US$ 28.7 billion by 2032.

Rising demand for premium beverages, increasing millennial interest in exotic drinks, and the introduction of sugar-free rum are key growth drivers.

From 2019 to 2024, the global rum market grew at a CAGR of 7.1%.