Rigid Polyurethane Foam Market

Industry: Chemicals and Materials

Published Date: January-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 184

Report ID: PMRREP35038

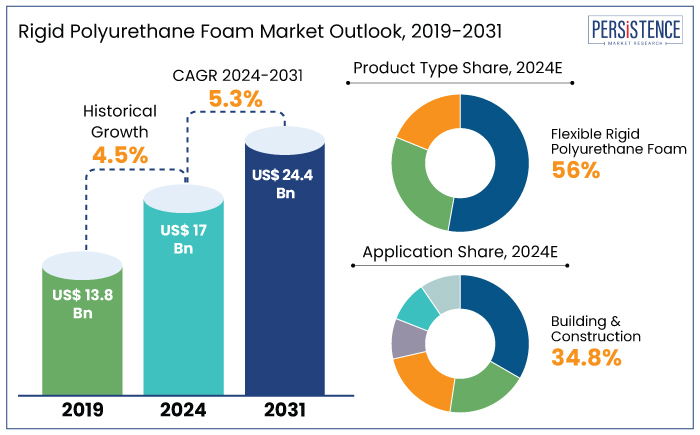

The global rigid polyurethane foam market is projected to witness a CAGR of 5.3% during the forecast period from 2024 to 2031. It is anticipated to increase from US$ 17 Bn recorded in 2024 to a decent US$ 24.4 Bn by 2031.

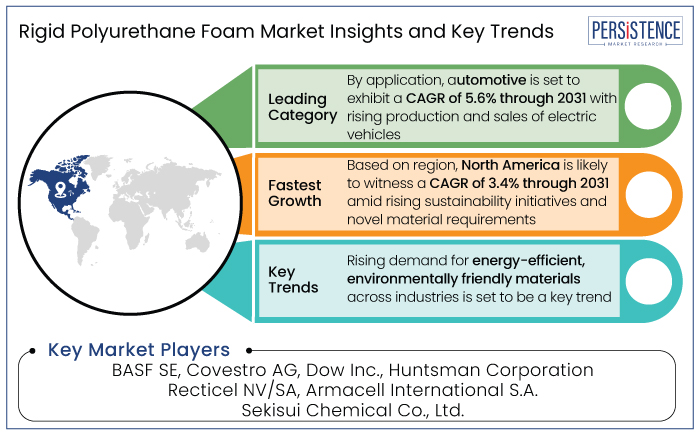

Demand for polyurethane foam is accelerating, fueled by its extensive use in sectors like automotive, construction, and appliances. In 2022, for instance, global motor vehicle production reached 85.4 million units. This has made the automotive industry a key consumer as it relies on the material for insulation, energy efficiency, lightweighting, and noise reduction.

In construction, the focus on energy-efficient buildings and reducing CO2 emissions has further raised demand, with insulation materials playing a pivotal role in meeting these goals. The push for sustainable and energy-efficient solutions across industries underscores the product's relevance in these sectors.

Market growth is also driven by increasing need for lightweight materials in automotive applications, high focus on building energy efficiency, and developments in eco-friendly foam technologies. Despite these drivers, challenges such as fluctuating raw material prices and the complexities of recycling pose hurdles.

Rising adoption of recyclable foam materials and the trend toward energy-efficient buildings present substantial opportunities. Demand for high-performance and sustainable solutions across diverse industries ensures a dynamic growth trajectory for this market.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Market Size (2024E) |

US$ 17 Bn |

|

Projected Market Value (2031F) |

US$ 24.4 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

5.3% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

4.5% |

North America is anticipated to witness steady growth in the rigid polyurethane foam market, with a CAGR of 3.4% during the forecast period. Demand from the construction and automotive sectors, driven by sustainability initiatives and novel material requirements, underscores the region’s pivotal role in shaping the global polyurethane industry.

North America’s construction industry is a key driver of polyurethane material demand, fueled by increasing spending on nonresidential projects. With total construction spending reaching US$ 1.98 trillion in 2023, demand for polyurethane in applications such as roofing, walls, and insulation has surged.

The material's thermal insulation properties align with the region's growing focus on energy efficiency and sustainability. It is further solidifying its adoption across commercial building projects.

The automotive sector in North America continues to rely on lightweight and energy-efficient solutions, with vehicle sales showcasing strong performance. In October 2024, regional sales reached 1.33 million units, supported by an 11.7% rise in light truck sales. Shift toward electric vehicles and demand for novel materials for battery insulation and soundproofing have further raised polyurethane's role in enhancing vehicle efficiency and reducing weight.

South Asia and Oceania rigid polyurethane foam market is set for robust growth, with an anticipated CAGR of 5.9% through 2031. India's automotive industry saw strong momentum in FY 2022 to 2023, producing 25.93 million vehicles, up from 23.04 million the previous year.

India's construction sector, projected to reach US$ 1.4 trillion by 2025, is a key contributor to the country’s polyurethane demand. Initiatives like the National Infrastructure Pipeline are driving adoption of energy-efficient and thermally optimized materials to support rapid urbanization. Polyurethane’s versatile properties make it essential in modern building applications such as insulation, roofing, and structural enhancements.

The industrial and packaging segments in the region are also pivotal to market growth. India's domestic electronics production surged from US$ 29 Bn in 2014 to 2015 to US$ 101 Bn in 2022 to 2023, supported by the Production Linked Incentive (PLI) scheme. This growth has increased demand for unique polyurethane insulation solutions, vital for temperature control and moisture protection in sensitive manufacturing processes.

High-density rigid polyurethane foam holds a significant market share due to its superior insulation properties, durability, and structural support benefits. It is projected to witness a CAGR of 5.3% through 2031.

The material is prominently used in construction applications such as insulation panels for walls, roofs, and floors, where thermal insulation and energy efficiency are paramount. Its demand is further fueled by India's surging construction industry. It is projected to reach US$ 1.4 trillion by 2025, alongside government-backed initiatives such as the Smart City Mission that drive urban development and modern infrastructure.

The segment’s growth reflects increasing adoption of energy-efficient solutions in construction, cold storage, and refrigeration sectors. It is positioning the foam product as a critical material in both commercial and residential development initiatives.

The building and construction industry holds the most prominent share of 34.8% in the global rigid polyurethane foam industry in 2024. The segment is projected to witness a CAGR of 5.7% through 2031.

This is due to rising demand for energy-efficient and sustainable building materials. This material is widely used in insulation applications, particularly in residential and commercial buildings, where it provides excellent thermal insulation properties.

Increasing emphasis on sustainable and green buildings, which aim to reduce energy consumption and CO2 emissions, directly benefits the rigid foam segment. With the construction sector contributing to 40% of global CO2 emissions, adoption of energy-efficient materials is a key strategy to meet environmental goals. Focus on sustainability, combined with the industry's need to meet rising demand despite labor shortages and material cost increases, supports the dominance of the construction sector.

The rigid polyurethane foam industry is experiencing notable shifts, largely driven by sustainability efforts. Companies are increasingly developing eco-friendly solutions by incorporating recycled materials, producing low-emission products, and advancing foam recycling techniques.

Integrating digital technologies is enhancing production efficiency and reducing costs, making the manufacturing process more sustainable. Rising demand for lightweight, durable solutions in automotive and construction applications highlights the adaptability of this material to meet industry-specific needs.

Growth of the Electric Vehicle (EV) industry is also fueling demand for foams, particularly for EV battery applications. As manufacturers seek high-performance materials that offer superior thermal and structural protection for battery packs, innovation in the foam segment is accelerating.

Companies are extending their portfolios to meet the diverse needs of sectors ranging from automotive and construction to refrigeration. They are ensuring this versatile product continues to evolve with changing demands.

From 2019 to 2023, the global rigid polyurethane foam market recorded a considerable CAGR of 8.8%. This growth was driven by increased adoption of energy-efficient and environmentally friendly insulation solutions, particularly in the construction and automotive sectors. Rising demand for energy-efficient buildings, developments in automotive insulation, and surging investments in sustainable technologies contributed significantly to this growth trajectory.

Sales of rigid polyurethane foam are estimated to surge at a CAGR of 5.3% from 2024 to 2031. This growth is set to be driven by continued developments in manufacturing processes and increasing demand for sustainable and energy-efficient insulation solutions. Emphasis on circular economic practices, coupled with regulatory support for sustainable materials, will likely boost market expansion during this period.

Rising Adoption of Recycled Materials Worldwide to Bolster Demand

Product launches and sustainability initiatives are pivotal in the growth of the rigid polyurethane foam industry. BASF's introduction of Elastopor®, Elastopir®, and Elastospray® systems, which utilize recycled PET, reflects the demand for sustainable insulation in construction. These products meet rigorous sustainability criteria without compromising performance.

BASF’s collaboration with KraussMaffei, RAMPF, and REMONDIS on recycling polyurethane foams from old refrigerators underscores a commitment to a circular economy. It helps in effectively reducing waste and reintegrating recycled materials into production, minimizing the environmental footprint.

Dow's mass-balance polyurethane solutions like SPECFLEX™ C and VORANOL™ C highlight a shift toward sustainable materials, incorporating recycled feedstock from the mobility sector. This supports automotive manufacturers in meeting strict sustainability regulations and reducing reliance on fossil fuels.

Demand for energy-efficient, environmentally friendly materials across industries such as construction and automotive continues to rise. It is further driving market growth as companies prioritize circular economy principles and eco-friendly innovations.

Launch of Unique Materials for Construction and Insulation Industries Fuels Demand

New product launches are key drivers of growth in the rigid polyurethane foam industry, catering to rapidly evolving needs in sectors like Electric Vehicles (EVs), construction, and insulation. For instance,

In the construction sector, companies like BASF and Dow are accelerating the development of high-performance insulation and sealing solutions. BASF’s launch of SLENTITE® highlighted a polyurethane material with superior insulation properties.

Dow’s GREAT STUFF PRO™ Window and Door Insulating Foam Sealant enhanced the market in Canada. It addressed the demand for energy-efficient, sustainable building materials. These innovative solutions meet the needs of both residential and commercial construction by enhancing thermal efficiency and sustainability, supporting continued market growth.

High Production Costs Limit Affordability of Polyurethane Foam in Emerging Areas

The production cost of rigid polyurethane foam remains a significant restraint for the market. Raw materials required for manufacturing, such as polyols and isocyanates, can be expensive, driving up the total cost of production.

Fluctuations in the prices of these raw materials, influenced by global supply chain disruptions, increase the unpredictability of costs. These high production costs can limit the affordability of rigid polyurethane foam. It is especially evident for small-scale construction projects or companies operating with tight budgets. It is anticipated to further hinder market growth in certain price-sensitive regions.

Companies Launch New Products to Meet Sustainability and Cost-efficiency Needs

Product launches, exhibitions, and developments in technology are creating significant opportunities in the polyurethane foam sector. Companies are addressing demands for sustainability, energy efficiency, and cost reduction. Key players like BASF, Dow, and Huntsman are reshaping the landscape with innovative solutions. For instance,

Together, these developments enable cost-effective, high-performance solutions across industries like construction, automotive, and packaging.

Mergers and Acquisitions to Create Favorable Growth Opportunities

Strategic acquisitions and mergers are significantly reshaping the rigid polyurethane foam industry as companies seek expansion and product enhancement. For example,

Such strategic initiatives exemplify how companies are leveraging acquisitions and diversification to boost technological capabilities. They are also extending existing offerings and gaining growth opportunities across diverse applications.

The global rigid polyurethane foam market is characterized by a fragmented competitive landscape with a mix of large multinational corporations and regional players. Key manufacturers, such as BASF, Dow, Huntsman, and Covestro, are increasingly focusing on sustainable solutions. They are driven by the rising demand for eco-friendly and energy-efficient products.

Companies are also investing heavily in circular economic initiatives, such as recycling technologies for polyurethane foams and developing products made from recycled materials. They are emphasizing product innovations, such as low-emission and lightweight solutions, particularly for use in industries like automotive and construction.

The trend is reshaping the competitive dynamics as firms seek to capitalize on regulatory support and evolving consumer preferences for sustainability. Despite the dominance of a few global leaders, the market remains highly competitive. Several regional and small-scale players are extending their footprint through strategic partnerships, acquisitions, and product diversification.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By Application

By Region

To know more about delivery timeline for this report Contact Sales

The market is projected to rise from US$ 17 Bn in 2024 to US$ 24.4 Bn by 2031.

The market is anticipated to showcase a CAGR of 5.3% through 2031.

North America is poised to dominate with a CAGR of 3.4% through 2031.

South Asia and Oceania is predicted to witness a CAGR of 5.9% through 2031.

BASF SE, Covestro AG, Dow Inc., Huntsman Corporation, Recticel NV/SA, and Armacell International S.A. are the leading manufacturers.