- Executive Summary

- Global Railway Sleepers Market Snapshot 2025 and 2032

- Market Opportunity Assessment, 2025-2032, US$ Bn

- Key Market Trends

- Industry Developments and Key Market Events

- Demand Side and Supply-Side Analysis

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definitions

- Value Chain Analysis

- Macro-Economic Factors

- Global GDP Outlook

- Global Railway Industry Overview

- Global Population Overview

- Forecast Factors - Relevance and Impact

- COVID-19 Impact Assessment

- PESTLE Analysis

- Porter's Five Forces Analysis

- Geopolitical Tensions: Market Impact

- Regulatory and Technology Landscape

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Trends

- Price Trend Analysis, 2019 - 2032

- Region-wise Price Analysis

- Price by Segments

- Price Impact Factors

- Global Railway Sleepers Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

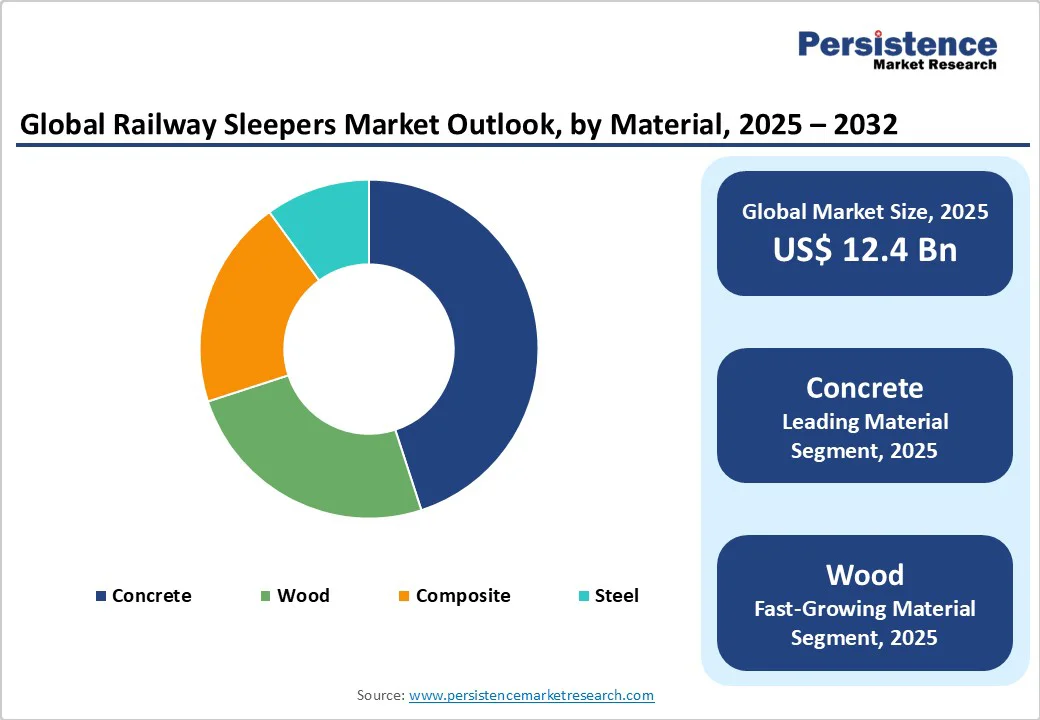

- Global Railway Sleepers Market Outlook: Material

- Introduction/Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by Material, 2019-2024

- Current Market Size (US$ Bn) and Volume (Units) Forecast, by Material, 2025-2032

- Wood

- Concrete

- Composite

- Steel

- Market Attractiveness Analysis: Material

- Global Railway Sleepers Market Outlook: Track Type

- Introduction/Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by Track Type, 2019-2024

- Current Market Size (US$ Bn) and Volume (Units) Forecast, by Track Type, 2025-2032

- Tangents

- Turnouts

- Bridges

- Tunnels

- Market Attractiveness Analysis: Track Type

- Global Railway Sleepers Market Outlook: Line Type

- Introduction/Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by Line Type, 2019-2024

- Current Market Size (US$ Bn) and Volume (Units) Forecast, by Line Type, 2025-2032

- Main Line

- Transit

- Industrial

- Market Attractiveness Analysis: Line Type

- Global Railway Sleepers Market Outlook: Application

- Introduction/Key Findings

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by Application, 2019-2024

- Current Market Size (US$ Bn) and Volume (Units) Forecast, by Application, 2025-2032

- Heavy Haul Railways

- High-speed Railways

- Urban Transit Systems

- Regional and Commuter Railways

- Market Attractiveness Analysis: Application

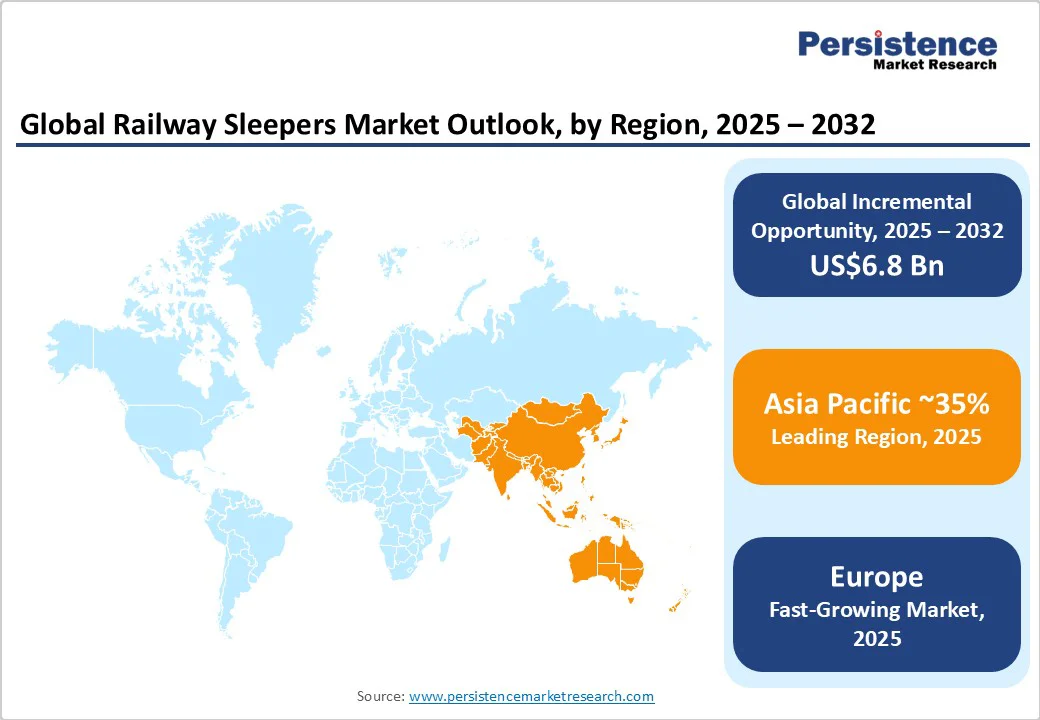

- Global Railway Sleepers Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Bn) and Volume (Units) Analysis by Region, 2019-2024

- Current Market Size (US$ Bn) and Volume (Units) Forecast, by Region, 2025-2032

- North America

- Europe

- East Asia

- South Asia & Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Railway Sleepers Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Pricing Analysis

- North America Market Size (US$ Bn) and Volume (Units) Forecast, by Country, 2025-2032

- U.S.

- Canada

- North America Market Size (US$ Bn) and Volume (Units) Forecast, by Material, 2025-2032

- Wood

- Concrete

- Composite

- Steel

- North America Market Size (US$ Bn) and Volume (Units) Forecast, by Track Type, 2025-2032

- Tangents

- Turnouts

- Bridges

- Tunnels

- North America Market Size (US$ Bn) and Volume (Units) Forecast, by Line Type, 2025-2032

- Main Line

- Transit

- Industrial

- North America Market Size (US$ Bn) and Volume (Units) Forecast, by Application, 2025-2032

- Heavy Haul Railways

- High-speed Railways

- Urban Transit Systems

- Regional and Commuter Railways

- Europe Railway Sleepers Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Pricing Analysis

- Europe Market Size (US$ Bn) and Volume (Units) Forecast, by Country, 2025-2032

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- Rest of Europe

- Europe Market Size (US$ Bn) and Volume (Units) Forecast, by Material, 2025-2032

- Wood

- Concrete

- Composite

- Steel

- Europe Market Size (US$ Bn) and Volume (Units) Forecast, by Track Type, 2025-2032

- Tangents

- Turnouts

- Bridges

- Tunnels

- Europe Market Size (US$ Bn) and Volume (Units) Forecast, by Line Type, 2025-2032

- Main Line

- Transit

- Industrial

- Europe Market Size (US$ Bn) and Volume (Units) Forecast, by Application, 2025-2032

- Heavy Haul Railways

- High-speed Railways

- Urban Transit Systems

- Regional and Commuter Railways

- East Asia Railway Sleepers Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Pricing Analysis

- East Asia Market Size (US$ Bn) and Volume (Units) Forecast, by Country, 2025-2032

- China

- Japan

- South Korea

- East Asia Market Size (US$ Bn) and Volume (Units) Forecast, by Material, 2025-2032

- Wood

- Concrete

- Composite

- Steel

- East Asia Market Size (US$ Bn) and Volume (Units) Forecast, by Track Type, 2025-2032

- Tangents

- Turnouts

- Bridges

- Tunnels

- East Asia Market Size (US$ Bn) and Volume (Units) Forecast, by Line Type, 2025-2032

- Main Line

- Transit

- Industrial

- East Asia Market Size (US$ Bn) and Volume (Units) Forecast, by Application, 2025-2032

- Heavy Haul Railways

- High-speed Railways

- Urban Transit Systems

- Regional and Commuter Railways

- South Asia & Oceania Railway Sleepers Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Pricing Analysis

- South Asia & Oceania Market Size (US$ Bn) and Volume (Units) Forecast, by Country, 2025-2032

- India

- Southeast Asia

- ANZ

- Rest of SAO

- South Asia & Oceania Market Size (US$ Bn) and Volume (Units) Forecast, by Material, 2025-2032

- Wood

- Concrete

- Composite

- Steel

- South Asia & Oceania Market Size (US$ Bn) and Volume (Units) Forecast, by Track Type, 2025-2032

- Tangents

- Turnouts

- Bridges

- Tunnels

- South Asia & Oceania Market Size (US$ Bn) and Volume (Units) Forecast, by Line Type, 2025-2032

- Main Line

- Transit

- Industrial

- South Asia & Oceania Market Size (US$ Bn) and Volume (Units) Forecast, by Application, 2025-2032

- Heavy Haul Railways

- High-speed Railways

- Urban Transit Systems

- Regional and Commuter Railways

- Latin America Railway Sleepers Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Pricing Analysis

- Latin America Market Size (US$ Bn) and Volume (Units) Forecast, by Country, 2025-2032

- Brazil

- Mexico

- Rest of LATAM

- Latin America Market Size (US$ Bn) and Volume (Units) Forecast, by Material, 2025-2032

- Wood

- Concrete

- Composite

- Steel

- Latin America Market Size (US$ Bn) and Volume (Units) Forecast, by Track Type, 2025-2032

- Tangents

- Turnouts

- Bridges

- Tunnels

- Latin America Market Size (US$ Bn) and Volume (Units) Forecast, by Line Type, 2025-2032

- Main Line

- Transit

- Industrial

- Latin America Market Size (US$ Bn) and Volume (Units) Forecast, by Application, 2025-2032

- Heavy Haul Railways

- High-speed Railways

- Urban Transit Systems

- Regional and Commuter Railways

- Middle East & Africa Railway Sleepers Market Outlook: Historical (2019 - 2024) and Forecast (2025 - 2032)

- Key Highlights

- Pricing Analysis

- Middle East & Africa Market Size (US$ Bn) and Volume (Units) Forecast, by Country, 2025-2032

- GCC Countries

- South Africa

- Northern Africa

- Rest of MEA

- Middle East & Africa Market Size (US$ Bn) and Volume (Units) Forecast, by Material, 2025-2032

- Wood

- Concrete

- Composite

- Steel

- Middle East & Africa Market Size (US$ Bn) and Volume (Units) Forecast, by Track Type, 2025-2032

- Tangents

- Turnouts

- Bridges

- Tunnels

- Middle East & Africa Market Size (US$ Bn) and Volume (Units) Forecast, by Line Type, 2025-2032

- Main Line

- Transit

- Industrial

- Middle East & Africa Market Size (US$ Bn) and Volume (Units) Forecast, by Application, 2025-2032

- Heavy Haul Railways

- High-speed Railways

- Urban Transit Systems

- Regional and Commuter Railways

- Competition Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping

- Competition Dashboard

- Company Profiles

- Vossloh AG

- Company Overview

- Product Portfolio/Offerings

- Key Financials

- SWOT Analysis

- Company Strategy and Key Developments

- RailWorks Corporation

- Patil Group

- Kirchdorfer Group

- L.B. Foster Company

- PCM RAIL.ONE AG

- The Indian Hume Pipe

- Wegh Group

- IntegriCo Composites

- CEMEX Rail Products

- Salcef Group S.p.A.?

- GPT Infraprojects Limited

- Vossloh AG

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment