Pyrogen Testing Market Segmented By Recombinant Factor C Assay, Monocyte Activation Assay, Limulus Amebocyte Lysate Test, Rabbit Pyrogen Test Type in form of Injectable Therapeutics, Vaccines, Orally Dosed Pharmaceuticals, Implantable Medical Devices

Industry: Healthcare

Published Date: March-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 444

Report ID: PMRREP4259

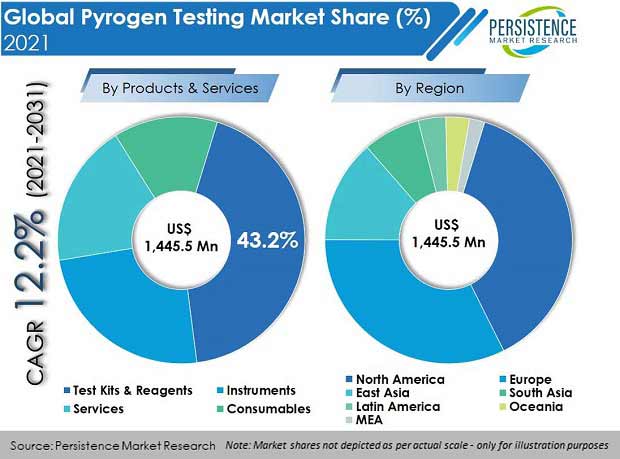

The global pyrogen testing market was valued at US$ 1.45 Bn in 2021, with a projected CAGR of 12.2% for the next ten years, which indicates highly positive market growth. Detailed industry analysis reveals that revenue from pyrogen testing will surge to a market valuation of US$ 4.58 Bn by the end of 2031.

| Attribute | Key Insights |

|---|---|

|

Pyrogen Testing Market Size (2021) |

US$ 1.45 Bn |

|

Projected Market Value (2031) |

US$ 4.58 Bn |

|

Global Market Growth Rate (2021-2031) |

12.2% CAGR |

|

Share of Top 5 Countries |

61.6% |

According to Persistence Market Research, animal-based sources enjoyed a market value of US$ 1.25 Bn in 2021, accounting for nearly three-fourth overall market share. Pyrogen testing accounted for 32% share in the global pharmaceutical quality control market in 2021.

The global market for pyrogen testing expanded at a CAGR of 8% over the last five years (2016-2020).

Increasing burden of chronic illnesses needs standard requirements for approval of medical products and services through various tests. The pyrogen test determines the presence or absence of pyrogen in parenteral medicines, and is governed by several standards by organizations such as the Food and Drug Administration (FDA), United States Pharmacopeia (USP), and European Pharmacopoeia (EP).

The Limulus Amebocyte Lysate test was incorporated as one of the most reliable and accurate tools for quality testing in the pharmaceutical industry. It is approved by the European Pharmacopoeia and other pharmacopoeias.

The Rabbit Pyrogen Test (RPT) measures the rise in rabbit body temperature after an intravenous injection of the tested product. RPT gives qualitative results and is very insensitive. The robustness of the study is also limited due to repeated injections to the rabbit during the study or the development of pyrogen resistance after stress.

Introduction of the Monocyte Activation Test (MAT) was the latest development in the field of pyrogen testing in pharmaceutical and medical products & services. MAT is an alternative to animal-based methods for detecting both, endotoxin and non-endotoxin pyrogens. Due to its higher sensitivities toward all the pyrogens compared to other tests, and better quantitative results & accuracy, these are being preferred by all healthcare product manufacturers. They are used in testing pyrogens in pharmaceuticals, biologics, vaccines, and many other therapeutic areas.

The global pyrogen testing products market is predicted to surge ahead at a CAGR of 12.2% and record sales worth US$ 4.58 Bn by the end of 2031.

“Increasing Incidence of Chronic Diseases & Tech Advancements in Products”

The forecast period is set to witness many lucrative opportunities for manufacturers of pyrogen testing systems around the world. Emerging economies are offering numerous opportunities for key players to expand their businesses.

According to figures released on the statistician’s website, around 2 million cardiac pacemakers were marketed globally in 2021. Pyrogenecity testing is one of the standard requirements for medical product and service approval.

As a result, increased burden of chronic diseases and high prevalence of infectious diseases will lead to an increase in market opportunities. Furthermore, various advancements will provide manufacturers with attractive options to expand their business in this field.

“Increasing Regulations on Animal-based Pyrogen Testing across Regions”

According to the European Pharmacopoeia's general chapter 2.6.30, the rabbit pyrogen test will gradually be replaced by other pyrogen tests, which is a significant step forward in terms of animal welfare, in accordance with the Council of Europe's European Convention for the Protection of Vertebrate Animals Used for Experimental and Other Scientific Purposes.

Following the European Pharmacopoeia's introduction of this reform, a number of other regulatory bodies throughout the world followed suit. In the near future, demand for rabbit pyrogen testing will greatly reduce.

MAT is the most recent advancement in the pyrogen testing industry. There isn't enough money in developing countries to invest in cutting-edge technology when they emerge. As a result, adoption of novel technology is slower in these regions.

Why are Pyrogen Testing Providers Targeting the U.S. Market?

“Frequent FDA Approvals in the U.S.”

North America held a market share of 38% by value in the global pyrogen testing systems market in 2021, of which, the U.S. accounted for a market share of 94.2%. Increased rate of approvals by the U.S. FDA regulatory body leads to more product launches, making the U.S a high revenue-generating country.

How is Demand for Pyrogen Testing Shaping Up in Germany?

“Several Leading Pyrogen Testing Industry Players Present in Germany”

In terms of value, Germany accounted for 23.1% of the Europe pyrogen testing market. This high market share percentage is due to the fact that many major players in this industry are active in Germany, which increases the availability of products in the country.

As of June 2021, the European Pharmacopoeia Commission announced its decision with regards to the Rabbit Pyrogen Test (RPT). According to the commission, they have started the process to replace RPT in approximately 5 years down the line and have decided to focus on other alternatives to expand their market more rapidly.

Why is China Emerging as a Prominent Market for Pyrogen Testing?

“High level of Research Activities Ongoing in China”

In 2021, the China pyrogen testing market was valued at US$ 85.2 Mn, and held a market share of 43.7% in East Asia.

Development of medical infrastructure and strategic planning to collaborate for expansion are key factors that will have a positive impact on the growth of this industry in China.

For instance, the National Research Council of Canada announced a collaboration with CanSino Biologics, a China-based facility to innovate a vaccine against COVID-19.

Such research activities will help the market in China for pyrogen tests provide lucrative opportunities for local manufacturers.

What is the Outlook for India Regarding Pyrogen Testing?

“High Presence of Qualified Staff and Low Manpower Costs”

India accounted for 48.3% of the total value of the South Asia pyrogen testing market, valued at US$ 52.3 Mn in 2021.

The Indian market has ample skilled labor and qualified manpower at affordable costs, thereby increasing the scope for attracting the outsourcing of pyrogen testing services.

As of July 2018, IPC replaced the used of rabbit pyrogen tests with the bacterial endotoxin test or monocyte activation test, which should be carried out in-vitro.

Increasing global burden of disease and associated rise in the patient pool ratio are set to call for growth in demand for pyrogen testing as key manufacturers continue to manufacture new drugs. This is expected to drive the pyrogen testing systems market in India over the forecast period.

Which Pyrogen Testing Product is Driving High Market Growth?

“High Demand for Pyrogen Tests Kits & Reagents Leads Market Growth”

The test kits & reagents segment amongst all products and services accounted for the highest market share of 43.2% by revenue in 2021.

Sudden emergence of COVID-19 increased diagnostic activities, treatment procedures, and R&D activities for the development of diagnostics, such as molecular tests and point-of-care tests, among others.

Which Pyrogen Testing Type is Most Preferred?

“Animal-based Pyrogen Tests Continue to Remain Most Preferred”

Animal-based tests are mostly preferred for detecting pyrogens. The animal-based segment, by source, is driving demand in this market, and accounted for more than 86.5% market share in 2021.

Pyrogen detection started with the test performed on rabbits, which had limited sensitivity and accuracy, but since it is a traditional method, it holds a high market share.

Which End User Benefits the Most Through the Employment of Pyrogen Testing?

“Market Expansion being Driven by Pharmaceutical Companies”

Pharmaceutical companies accounted for the largest market share of 44.7%, by value, in the year 2021. This can be attributed to the fact that pharmaceutical companies are focused on the steady transition to other pyrogen testing methods due to the low sensitivity provided by RPT and the fact that the results obtained are not human-specific and inherently qualitative.

The pharmaceutical companies segment in this market is also expected to surge at a CAGR of 12.8% over the period of 2021 to 2031.

Gaining approvals from regulatory authorities, product launches, and acquisitions for increasing market presence are focussed on by key pyrogen testing device manufacturers.

Similarly, recent developments related to companies manufacturing pyrogen testing systems and devices have been tracked by the team at Persistence Market Research, which are available in the full report.

| Attribute | Details |

|---|---|

|

Forecast Period |

2021-2031 |

|

Historical Data Available for |

2016-2020 |

|

Market Analysis |

US$ Million for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon Request |

Pyrogen Testing Market by Product & Service:

Pyrogen Testing Market by Source:

Pyrogen Testing Market by Application:

Pyrogen Testing Market by End User:

Pyrogen Testing Market by Region:

To know more about delivery timeline for this report Contact Sales

The global pyrogen testing market was valued at US$ 1.45 Bn in 2021, and is expected to grow 3.2X by 2031.

The pyrogen testing industry is set to witness a high growth rate of 12.2% over the forecast period and be valued at US$ 4.58 Bn by 2031.

The market expanded at 8% during 2016 through 2020, as pyrogen testing devices is highly preferred by healthcare professionals.

Fujifilm Wako Chemicals U.S.A. Corporation, Sanquin Reagents B.V., and Thermo Fisher Scientific are key suppliers of pyrogen testing products.

Tests kits & reagents are driving most demand and held 43.2% market share in 2021.

The U.S., China, Germany, France, and U.K. are expected to drive most demand growth of pyrogen testing products.

The U.S. accounts for 94.2% of the North America market share.

The Europe market for pyrogen testing is expected to record a CAGR of 10.5% over the forecast period, with Germany accounted for the highest share of 23.1%.

The U.S. and Germany are major manufacturers of pyrogen testing devices.

The China market holds a share of 43.7% in the East Asia pyrogen testing market, whereas India accounts for 48.3% of the South Asia market share.