Industry: Healthcare

Published Date: February-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 167

Report ID: PMRREP33267

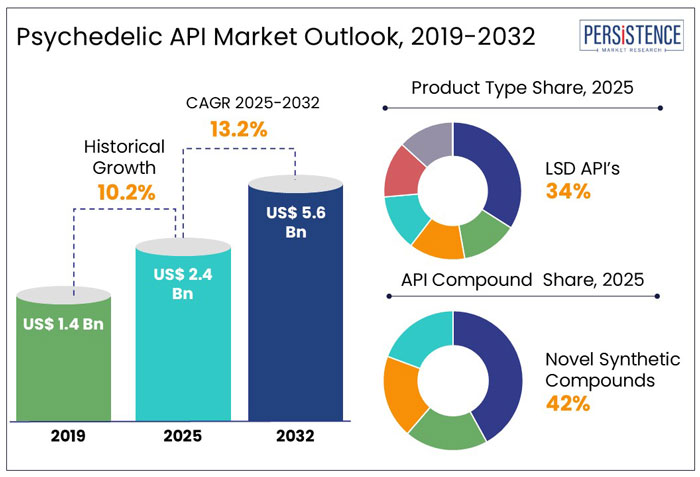

The global psychedelic API market size is anticipated to rise from US$ 2.4 Bn in 2025 to US$ 5.6 Bn by 2032. It is projected to witness a CAGR of 13.2% from 2025 to 2032.

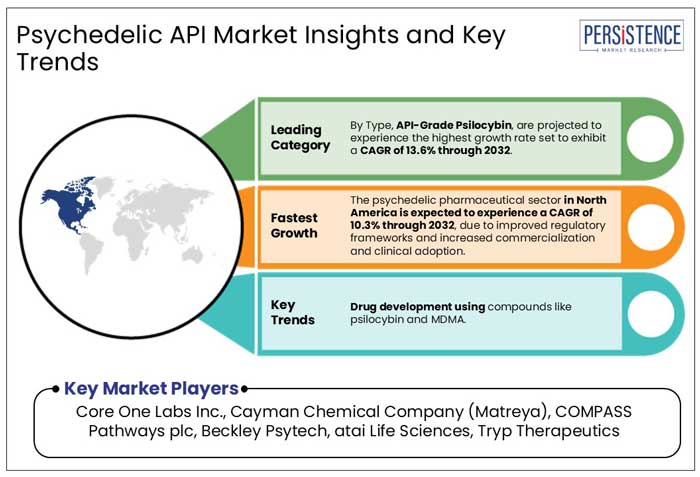

The focus on psychedelic-assisted therapy is driving demand for pharmaceutical-grade psychedelic active pharmaceutical ingredients like psilocybin, MDMA, LSD, and DMT. Clinical research has demonstrated the efficacy of psychedelics in treating mental health disorders, particularly treatment-resistant depression (TRD), PTSD, and anxiety.

Pharmaceutical companies like Compass Pathways and MindMed are investing in synthetic psychedelic API production and novel drug delivery systems to enhance therapeutic applications.

As per Persistence Market Research, the global psychedelic drug market is projected to reach US$ 8.3 Bn by 2028, with increasing partnerships between API manufacturers and pharmaceutical firms to streamline scalable production methods and cost-effective manufacturing of clinical-grade materials.

Key Highlights of the Psychedelic API Market

|

Global Market Attributes |

Key Insights |

|

Psychedelic API Market Size (2025E) |

US$ 2.4 Bn |

|

Market Value Forecast (2032F) |

US$ 5.6 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

13.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

10.2% |

UN Regulations on Research Transforms Psychedelic API Market

From 2019 to 2024, United Nations entities have intensified efforts to regulate prohibited substances in drug formulations, with organizations like the WHO advocating for alternative psychedelic drug forms to reduce misuse risks. In the observed period, the global psychedelic API industry witnessed a CAGR of 10.2%, with a strong emphasis on research and development for psychedelic drugs and medications.

As regulatory pressure increases, businesses are developing synthetic alternatives to circumvent restrictions. Governments worldwide are also reconsidering psychedelic-assisted therapy, with Australia legalizing psilocybin and MDMA in July 2023. If successful, UN-backed regulations will reshape the psychedelic API market, pushing manufacturers toward compliant, medically approved formulations and fostering new drug development strategies in the mental health sector.

Psychedelic Substances Gains Traction for Mental Health Treatment with Promising Prospects

In the estimated timeframe from 2025 to 2032, the global market for psychedelic APIs is likely to showcase a CAGR of 13.2%. The World Health Organization highlights the rising incidence of mental health disorders such as PTSD, addiction, depression, and anxiety as a driving force behind the psychedelic substances market.

Traditional treatments like antidepressants and psychotherapy often have limitations, particularly for treatment-resistant conditions, leading researchers to explore psychedelics as alternative therapies.

With growing scientific validation, psychedelic-assisted therapy is gaining regulatory support. In July 2023, Australia became the first country to approve MDMA and psilocybin-assisted treatments for mental health disorders, setting a precedent for global adoption. This shift is reshaping psychiatric care, fueling demand for psychedelic APIs in the forthcoming period.

Growth Drivers

Psychedelic Drug Development Expands Push Demand for High-Purity APIs

The rising investment in psychedelic-assisted therapies is accelerating the demand for high-purity research materials like psilocybin, MDMA, and LSD APIs. Leading pharmaceutical companies and research institutions are exploring their therapeutic potential in mental health disorders such as PTSD, depression, and substance abuse.

LSD API is projected to constitute 34% of the market, driven by increasing research into microdosing for depression and anxiety. Ketamine API, which is already in medical use, is predicted to hold 15% of the market, bolstered by the success of Spravato, an FDA-approved ketamine-based treatment for depression.

The demand for clinical research on mental disorders is envisioned to boost the demand for innovative psychedelic drugs in the upcoming period.

High Production Cost and Current Limitations in Patient Scalability

The production of psychedelic drugs encounters challenges in extracting active compounds from multi-compound organic sources, such as magic mushrooms. This process demands precise cultivation techniques to ensure chemical consistency.

The FDA has highlighted the high risk of abuse and the potential for addiction, which necessitates strict regulatory oversight. Furthermore, psychedelic-assisted therapy requires supervised psychotherapy, limiting the scalability of the market.

The production cost of naturally sourced substances for psychedelic APIs is estimated to reach approximately US$ 675 Mn in 2024. According to studies, naturally sourced APIs are projected to account for 55% of the market by 2025. In contrast, the production and maintenance costs of synthetically sourced and bio-synthetically sourced APIs are comparatively higher.

Despite this, these substances tend to have lower market penetration than naturally sourced APIs. The higher production and maintenance costs of these substances may present challenges for market players with limited financial resources.

Pharma-API Collaborations Presents Prospects for Psychedelic Drug Development

In an effort to promote psychedelic-based treatments, pharmaceutical firms and API manufacturers are collaborating strategically, emphasizing cost-effective and scalable production techniques for high-purity substances for clinical trials and therapeutic applications. For instance,

With the rising prevalence of mental health disorders, such collaborative efforts are essential in reducing production costs, improving drug accessibility, and expediting regulatory approvals across the globe.

Companies like ATAI Life Sciences and Cybin are investigating novel formulations, and technical improvements and increasing clinical research expenditure are projected to fuel the growth of the worldwide psychedelic API market.

API Compound Insights

Rise of Novel Synthetic Compounds in the Global Market Shows Avenues

In 2025, novel synthetic compounds are projected to account for 42% of the global market, dominating the segment due to their increasing production and availability as legal highs. These designer drugs, including phenethylamines, synthetic cathinones, and tryptamines, are often marketed as alternatives to traditional stimulants and hallucinogens.

Meanwhile, active plant components are expected to hold a 30% market share, driven by demand for natural psychoactive substances in clinical research and therapeutic applications.

Pharma manufacturers are projected to expand their research and development efforts for the improvements of innovative treatments for several mental disorders. For instance,

Similarly, MindMed partnered with MAPS to explore MDMA derivatives, strengthening the market for psychedelic-assisted therapy. Such initiatives are destined to prosper the consumer base for novel synthetic compounds in the projected period.

Grade Insights

Safety and Quality Maintenance in Accordance to Regulations Boost Demand for GMP-Grade Psychedelic APIs

The pharmaceutical industry's reliance on stringent manufacturing standards for psychedelic drug research, which ensure safety, effectiveness, and quality in clinical trials and therapeutic uses, is highlighted by the prediction that GMP-grade psychedelic APIs will account for 96% of the worldwide market in 2025.

Meanwhile, the non-GMP segment, consisting of research-based and experimental compounds outside regulated pharmaceutical pipelines, is expected to account for 4% of the market.

To obtain approvals for the production of psychedelic drugs, drug manufacturers are predicted to improve the production facilities and processes across the world. For instance,

Such industry developments signal strong investment in controlled psychedelic drug manufacturing, ensuring regulatory approval and market expansion for therapeutic psychedelics.

North America Leads the Psychedelic API Industry with Strong Regulatory Oversight

In 2025, North America is projected to hold 48% of the global psychedelic API market, with the U.S. alone accounting for 78% of the region’s market share. The dominance of psychedelics is attributed to strict regulatory oversight, increased investments in research and development, and increasing acceptance for mental health treatments.

The pharmaceutical manufacturing hubs in the region, particularly in New York-New Jersey, California, and Massachusetts, employ over 130,000 industry professionals and house numerous biotech and pharmaceutical giants. These professionals have leveraged the extensive knowledge and research available within the industry. For example,

With a projected CAGR of 7.3% from 2025 to 2032, North America’s psychedelic pharmaceutical sector is expected to thrive as regulatory pathways become clearer, driving commercialization and clinical adoption of psychedelic-based medicines.

Europe Expands Psychedelic Drug Research with Landmark Investments

Europe is rapidly emerging as a key market for psychedelic drug research, driven by increasing clinical studies on LSD, MDMA, and ketamine for mental health disorders. For instance,

Pharmaceutical firms like Compass Pathways and atai Life Sciences are leading clinical trials on psilocybin and MDMA for treatment-resistant depression in countries like the U.K. and Netherlands. With rising regulatory support and investment in psychedelic medicine, Europe is poised to become a major hub for psychedelic-based therapies, significantly expanding the region’s mental health treatment landscape.

Asia Pacific Magnifies Psychedelic Drug and Biopharmaceutical Innovation for Mental Health

In the Asia Pacific, the development of psychedelic medications is projected to yield promising results for several mental disorders. In 2025, China's role as a leading API producer continues to expand, with investments in biopharmaceutical manufacturing to meet growing regional demand.

The region’s pharmaceutical sector is strengthening, with major biologics companies developing commercial-scale facilities for advanced drug production, including cell and gene therapies.

Additionally, India's advancements in cell therapies are shaping the future of personalized medicine, potentially leading to groundbreaking treatments for cancer and rare diseases in the Asia Pacific.

As regulatory oversight strengthens, Asia Pacific's role in API production and next-generation therapies is set to grow in the upcoming years.

Companies in the global psychedelic Active Pharmaceutical Ingredient (API) industry are focusing on offering a diverse range of APIs and actively participating in the development of new psychedelic drugs.

Venture capital firms are showing considerable interest and making significant investments in start-ups that are creating psychedelic medicines for various conditions, including PTSD and smoking cessation.

Partnerships between pharmaceutical companies and API manufacturers accelerate the development of psychedelic-based medications. Investment in scalable production methods improves manufacturing efficiency and reduces costs for clinical-grade materials.

Key Industry Developments

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Product Type

By API Compound

By Source

By Grade

By Application

By Region

To know more about delivery timeline for this report Contact Sales

The market is set to reach US$ 2.4 Bn in 2025.

New York-New Jersey is home to over 3,200 life science companies, with 13 of the top 20 biopharmaceutical companies having their headquarters or major facilities in the region.

Core One Labs Inc., Cayman Chemical Company (Matreya), COMPASS Pathways plc, and Beckley Psytech are a few leading players.

The industry is estimated to rise at a CAGR of 13.2% through 2032.

North America is projected to hold the largest share of the industry in 2025.