PMR Foresees a Promising Growth Outlook for the Global Protective Coatings Market in the Light of Escalating Demand from Industrial Commercial, and Architectural Sectors Alike

Industry: Chemicals and Materials

Published Date: June-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 167

Report ID: PMRREP3082

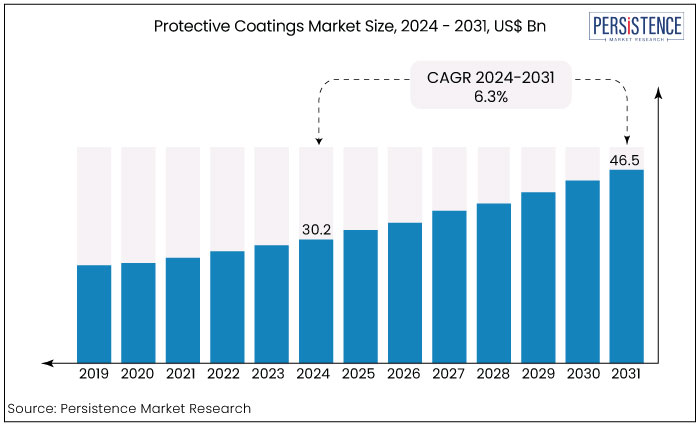

The global market for protective coatings reached US$30.2 Bn in 2024 and is expected to reach US$46.5 Bn in value by 2033-end. The protective coatings market report projects a promising CAGR of 6.2% for the market during 2024-2033.

|

Attributes |

Key Insights |

|

Market Size (2024E) |

US$ 30.2 Bn |

|

Projected Market Value (2033F) |

US$ 46.5 Bn |

|

Forecast Growth Rate (CAGR 2024 to 2033) |

6.3% |

|

Historical Growth Rate (CAGR 2018 to 2023) |

6.1% |

Protective coatings, extensively used in consumer products as well as heavy machinery, maritime, and oil & gas industries are typically categorized by the fundamental resin types they are made of epoxy, alkyd, acrylic, or polyurethane.

More specifically, they are a liquefiable, liquid, or mastic substance that, when applied to a surface, hardens into a protective, practical adherent film, or decorative. Protective coatings are applied to surfaces in order to stop the deterioration of the substrate.

In the field of civil engineering and infrastructure development, protective coatings are applied to surfaces like flooring, wood finishes, internal and external walls, bridges, swimming pools, doors, and ceilings.

In general, coatings are thought of as a thin layer of solid material that is placed on a surface to enhance its protective, aesthetically pleasing, or useful properties.

In industrial, commercial, and architectural sectors, coatings are crucial for asset protection. Rising demand from the machinery sector is substantially building up the market for protective coatings.

Increased spending on infrastructure construction, and more renovations of existing structures are anticipated to bolster the demand for protective coatings across the globe.

On the other hand, the rising need across the globe for harnessing power from alternative sources such as solar, wind, and geothermal has resulted in the increased installation of plants to harness these resources.

Growth in the power sector is directly associated with the growth of the protective coating market as these units need to withstand harsh conditions, and highly corrosive elements.

According to the historical analysis, demand for protective coatings expanded at a CAGR of 4.0% from 2017 to 2022. The COVID-19 pandemic caused a significant drop in the growth of the market, owing to production and supply chain disruptions, but consumption volume recovered as the economy after the pandemic been contained.

Over the upcoming years, the market is estimated to expand at a CAGR of 6.3% over the forecast timeframe influenced by a number of factors, including a surge in investments in infrastructure development along with the rise in the refurbishing of old buildings and growing innovations in product and technology a with focus on eco-friendly and cost-efficient solutions.

Key Trends Shaping the Market

Increasing Demand from a Range of End-Use Industries

The demand for protective coatings, which ensure corrosion resistance, durability, and operational efficiency, is projected to increase as the number of housing projects on the drawing board rises.

To meet the needs of various applications, the construction industry requires a variety of protective coating formulations. Some of the most commonly used protective coating products in the industry are high-temperature, abrasion, and wear-resistant, intumescent, and water-resistant coatings.

Protective coatings are also applied to various construction equipment to ensure corrosion and wear and tear resistance, durability, and operational efficiency. Moreover, the growing concerns about wastewater treatment are also anticipated to boost the demand for protective coatings across the globe.

Since wastewater contains dangerous materials including human waste, oils, food scraps, chemicals, soaps, and others that need to be treated before being released to the environment, wastewater treatment has grown in popularity around the world as a means of preventing environmental damage.

Concrete is used to make water tanks because it has a higher water retention capacity. However, when concrete is exposed to chemicals for an extended period of time, it becomes damaged. To prevent such long-term damage, protective coatings are applied over the substrate, which has increased the demand for protective coatings.

A Flourishing Spike in Demand for Cost-Efficient Solutions

Manufacturers' focus has shifted from improving existing products to exploring opportunities to introduce newer and more innovative products to the market as a result of the existing strict regulatory framework.

The introduction of multi-purpose and hybrid coatings, as well as eco-friendly advanced products such as nano-coatings and green coatings, are factors expected to drive growth in the global protective coatings market.

Opportunities for innovation and new products exist in extreme temperature applications, which is a major area of focus for researchers across the globe and is expected to open up new and promising opportunities in the near future.

With the increasing demand from the construction industry, prominent manufacturers are gearing up to tap the market by expanding their presence across regions and improving their product portfolio.

Key players in the market are focusing on strengthening their supply chain to stay at the forefront of the market competition.

Most of the key players are also focusing on the acquisition of small players, whereas small-scale companies need to make significant investments in R&D to introduce new products and enhance their presence across the globe.

Fluctuating Raw Materials Prices, and Stringent Regulations Targeting VOC Contents

Protective coatings production is a bit expensive, and their pricing increases in tandem with the cost of energy. Due to rising crude oil prices and fluctuating currency exchange rates, raw material costs have gone up.

The price of the raw materials needed to create protective coatings varies significantly. Acrylic is the cheapest among them. Epoxies are the most expensive type of barrier coating.

A rise in energy taxes, on top of the cost of raw materials, imposes additional expenses on manufacturers, resulting in higher operating costs and decreased profit margins.

Additionally, the strict regulations regulating VOC and hazardous solvent emissions due to their detrimental effects on the environment and human health are anticipated to have an impact on demand for solvent-borne protective coatings and limit market expansion during the anticipated period.

However, growing technology development, the introduction of bio-solvents, and the use of water-borne protective coatings owing to rising environmental concerns are stimulating market growth in the forecast period.

Prohibitive Costs of Specialized Coatings

These coatings often use unique resins, pigments, and additives to achieve their specific properties. Advanced materials can be more expensive to produce than standard paint ingredients.

Creating these high-performance coatings may involve specialized manufacturing processes or equipment, driving up production costs.

Applying some specialized coatings requires skilled labor and specific techniques, adding to the overall project cost. This high cost can be a barrier for some industries or projects, especially those looking for the most budget-friendly option.

Shifting Preferences Towards Environmentally Friendly Solutions

Stringent environmental regulations are pushing the demand for water-borne coatings with lower VOC emissions. Manufacturers can invest in developing high-performance water-borne coatings that match the durability of solvent-borne options, catering to a more sustainable future.

Material Science Innovations

Advancements in material science can lead to the development of next-generation coatings with improved performance, self-healing capabilities, or extended lifespans. Manufacturers who invest in R&D can stay ahead of the curve and capture new market segments.

|

Market Segment |

Market Share (2023) |

|

By Resin – Epoxy |

50.2% |

|

By Technology – Solvent-Based |

xx% |

|

By End Use - Infrastructure |

21.4% |

Prominence of Epoxy Resins Intact

Extensively employed in key industry verticals like automotive, and marine, epoxy resins continue to be the most sought-after category in the protective coatings industry.

The segment currently represents around 50.2% share of the market value on the back of its advantage of drying rapidly, reducing production stops while the coating cures.

Epoxy is also highly resistant to surface scratches, exposure to chemicals, and all forms of leaks. This stops the coating from aging and eliminates the need for frequent maintenance.

Epoxy reigns supreme due to its exceptional chemical resistance, and mechanical strength, making it ideal for harsh environments. However, epoxies can be brittle in cold weather and more expensive.

A strong contender is polyurethane. It offers flexibility for wider temperature ranges and good chemical resistance, sometimes with a clear or glossy finish. However, polyurethanes may have slower curing times and limited abrasion resistance.

Solvent-Borne Coatings Lead by Technology

The protective coatings market is dominated by solvent-borne coatings, prized for their fast drying, strong adhesion, and durability. However, high VOC emissions, and health concerns are driving a shift towards water-borne options.

While these offer a greener solution with lower VOCs and improved worker safety, they may have slower drying times, and potentially lower performance in specific situations.

Infrastructure Projects Consume the Largest Portion of Market Pie

The infrastructure segment is identified to utilize 21.4% of the protective coatings produced globally. The fundamental objective of protective coatings is to shield structures against humidity, dust, fungi, solvents, corrosion, and other hazards that could comprise their stability and functionality.

Protective coatings assist in preventing water leaks in addition to providing waterproofing solutions. Due to protective coatings that serve as a protective barrier, structures such as dams, wells, bridges, floors, buildings, wood finishes, and exterior and interior walls may all function in difficult situations and circumstances.

Surging demand for new infrastructure and increased spending on maintenance of existing infrastructure in developing and developed economies such as Germany, Italy, France, China, India, Brazil, South Africa, and GCC has led to an increased demand for protective coatings in the infrastructure segment.

In addition, the rising number of manufacturing and production facilities due to industrial relocation in countries such as China is expected to bolster the demand for protective coatings in the infrastructure segment.

|

Market Segment by Country |

Projected CAGR (2023-2033) |

|

US |

xx% |

|

UK |

xx% |

|

China |

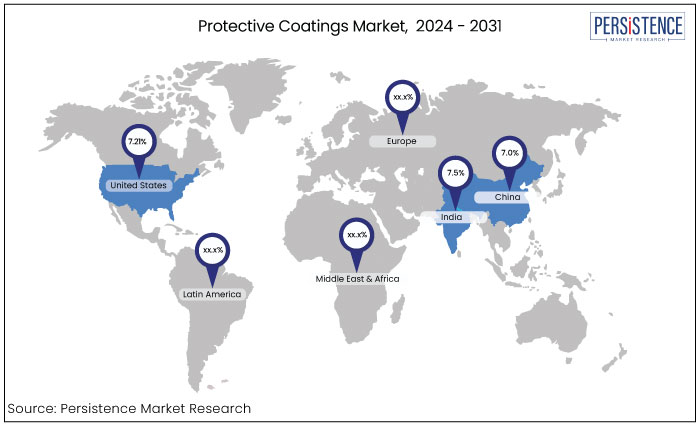

7.0% |

|

India |

7.5% |

Developed Western Markets Hold the Promise

Both North America, and Europe exhibit a promising outlook for the protective coatings market. The US leads the way in North America, while Germany, UK, and Russia representing the major forces in Europe.

The US, currently accounting for nearly 20% of the global protective coatings market, is the globally leading one. This growth is fueled by increased investments in construction and infrastructure projects.

Residential and non-residential buildings, bridges, rail networks, and structural parts all require protective coatings, driving demand.

On the other hand, developed economies like Germany, UK, and Russia are the key contributors to Europe, generating nearly half of the region's total sales.

The demand for protective coatings here is expected to rise due to growth in key end-use industries like automotive, aerospace, and power generation. These industries rely heavily on protective coatings for their products and infrastructure.

China, and India Stand out in Asia Pacific's Protective Coatings Market

China stands out as the dominant force in East Asia's protective coatings market. Its booming manufacturing and industrial sectors, particularly in construction, power, and marine applications, drive significant demand.

The Chinese market is projected for a healthy 7% growth rate, fueled by rapid industrialization, and the construction and infrastructure boom.

India is on the brink of emerging as the fastest-growing market in Asia Pacific. The growth rate is expected to be a stellar 7.5% through 2033, driven by thriving infrastructural developments, and exceptional industrial growth.

February 2024

Evonik announced the launch of its novel curing agent Ancamine 2844 that is specifically designed for use in protective coatings. Ancamine 2844 cures quickly even in cold weather, which makes it ideal for winter applications. The cured coating is also resistant to chemicals and corrosion. The company made it available globally in the Q2 of 2024.

June 2022

The Polynt Group announced the expansion of its coating resin production capacity to serve the North American coatings market. With this expansion, the company aims to meet the growing needs of the paint and coatings industry with alkyd, polyester, copolymer, emulsion, and urethane resin technologies.

June 2022

AkzoNobel announced to acquire of Kansai Paint’s paints and coatings business to strengthen its market presence in Africa.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2033 |

|

Historical Data Available for |

2018 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Technology

By Resin

By Application

By Region

To know more about delivery timeline for this report Contact Sales

The global market of protective coatings reached a valuation of US$25.2 Bn in 2023.

The protective coatings demand is anticipated to witness a growth rate of 6.3% over the forecast period of 2023 and 2033 in terms of value.

Some of the top companies in this market are Sherwin-Williams Company, Akzo Nobel N.V., Kansai Paints Co. Ltd., BASF Coatings, Jotun, Hempel, and Beckers Group.

The infrastructure sector remains at the forefront in the market by application.

The top countries driving the global protective coatings demand are India, China, and the US.