Industry: Semiconductor Electronics

Published Date: July-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 201

Report ID: PMRREP34653

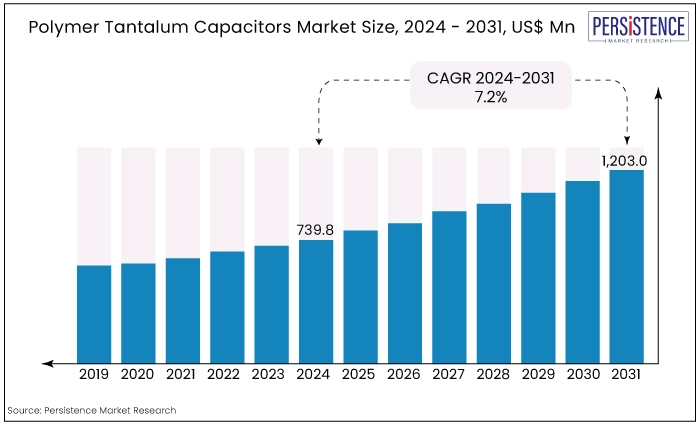

The global polymer tantalum capacitors market is estimated to value at US$1,203.0 Mn by the end of 2031 from US$739.8 Mn recorded in 2024. The market is expected to secure a CAGR of 7.2% in the forthcoming years from 2024 to 2031.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Polymer Tantalum Capacitors Market Size (2024E) |

US$739.8 Mn |

|

Projected Market Value (2031F) |

US$1,203.0 Mn |

|

Forecast Growth Rate (CAGR 2024 to 2031) |

7.2% |

|

Historical Growth Rate (CAGR 2018 to 2023) |

2.3% |

Polymer tantalum capacitors are known for their high capacitance per unit volume and stable performance, making them suitable for various high-reliability applications.

These capacitors utilize a solid polymer electrolyte instead of the traditional liquid electrolyte found in standard tantalum capacitors, resulting in improved performance and stability. Their compact size and high efficiency make them ideal for modern electronic devices that demand high performance and reliability.

Key players in this market, including KEMET Corporation, AVX Corporation, and Vishay Intertechnology are continually innovating to enhance capacitor technology, addressing the ongoing trends of miniaturization and the need for high-performance electronic components.

Mounting EV sales in recent years has been indicated directly related to uplifting the market demand. In 2023, nearly 14 million new electric cars were registered worldwide, representing an impressive 35% increase from the previous year. This brings the total number of electric cars on the roads to 40 million, closely following the projections of the Global EV Outlook (GEVO-2023).

The remarkable rise in EV sales, which have grown more than sixfold since 2018, highlights a robust market transition towards electric mobility. The escalating demand for EVs is mirrored by the growing need for advanced electronic components, including polymer tantalum capacitors, essential for their performance and reliability.

In 2023, most of electric vehicle sales were concentrated in China, Europe, and the US, accounting for 95% of global registrations. China led the market with 8.1 million new electric car registrations, a 35% increase over 2022, indicating the country’s dominant role in the EV market.

This rapid growth has been driven by continuous advancements in EV technology and a significant shift in consumer preference towards electric vehicles, despite the end of national subsidies for EV purchases.

The drive for energy efficiency in system designs is increasing demand for tantalum capacitors with lower Equivalent Series Resistance (ESR).

ESR, caused by various resistances within the capacitor, particularly from the material contacting the negative side of the tantalum dielectric, is a key performance factor.

While low-ESR MnO2 capacitors are being developed, the high resistivity of MnO2 limits significant ESR reduction. In contrast, tantalum polymer capacitors address this by using an organic conductive polymer instead of MnO2, resulting in much lower ESR.

The market has seen substantial growth over the past few decades due to advancements in technology and increasing demand for high-performance, reliable electronic components.

In the upcoming years, the market is expected to continue its robust growth trajectory. Factors such as technological advancements, expanding applications across various sectors, and increasing demand for high-performance electronic components will drive polymer tantalum capacitors market growth.

Emerging Application Potential in Automotive Industry

The global automotive industry stands as a cornerstone of economic activity, influencing various sectors and driving technological advancements. In recent years, its impact on the polymer tantalum capacitors market has been particularly noteworthy.

With global automotive sales reaching approximately 81 million units in 2022, and Asia emerging as a dominant force, accounting for more than half of the passenger vehicle sales worldwide, the demand for electronic components within vehicles has surged.

Following a stable period in 2022, global car sales experienced a significant rebound in 2023, surpassing 72 million units and marking a nearly 10% growth. This resurgence was particularly evident in Europe, where sales increased by 18.6%, driven by both EU and Eastern European markets.

Notable growth was observed in regions like Russia, Ukraine, and Türkiye, which showcased impressive recovery rates. Meanwhile, North America maintained consistent sales, with the US recording a remarkable 14.4% growth in new car sales, highlighting sustained demand in the region.

In South America, Brazil emerged as a key market driver, contributing to the region's stability amidst fluctuating trends in other markets like Chile and Colombia.

The Asian market, spearheaded by China and India, witnessed substantial growth, with China alone representing nearly a third of global car sales. This growth trajectory is further supported by the estimated 2.9% CAGR projected for the automotive industry between 2023 and 2030.

With Asia, including China and India, expected to dominate vehicle production with a 57.1% market volume share by 2022 end, the demand for electronic components, including tantalum capacitors, is set to soar.

Growing Need for Enhanced Durability and Efficiency in Industrial Automation and Robotics

The growing adoption of polymer tantalum capacitors in automation and robotics drives the market forward, fuelled by the demand for improved durability and efficiency in these sectors.

Industrial automation and robotics are witnessing rapid growth as industries seek to improve productivity, streamline operations, and reduce manual intervention.

Polymer tantalum capacitors offer distinct advantages that cater to the demanding requirements of these applications, making them a preferred choice for manufacturers and system integrators alike.

Industrial automation and robotics often operate in challenging environments characterized by temperature variations, vibrations, and electromagnetic interference.

Polymer tantalum capacitors are renowned for their robust construction and ability to withstand harsh conditions, making them well-suited for use in industrial automation and robotics. Their durability ensures reliable performance over extended periods, minimizing downtime and maintenance costs associated with system failures.

Limited Availability of Tantalum Ore, and Voltage Limitations

Tantalum, a rare and geographically concentrated metal, is essential to produce these capacitors. Its extraction primarily occurs in politically and economically unstable regions like the Democratic Republic of Congo, leading to a precarious supply chain.

The limited availability of tantalum ore results in high costs and supply volatility, complicating the procurement process for manufacturers.

Ethical concerns about the mining of tantalum, particularly its association with conflict minerals, add further complexity.

The issues necessitate responsible sourcing practices and compliance with international regulations, which increase operational costs and can limit the availability of tantalum for capacitor production.

Expansion of 5G Technology and IoT Fueling Demand for High-Frequency and Stable Capacitors

The rapid expansion of 5G technology and the widespread adoption of the Internet of Things (IoT) present a significant opportunity for the market of high-frequency and stable polymer tantalum capacitors.

As the global telecommunications landscape evolves with the deployment of 5G networks, there arises a crucial need for electronic components capable of supporting the demanding requirements of these advanced systems.

Polymer tantalum capacitors, renowned for their reliability and performance, emerge as essential components in the infrastructure of 5G networks, facilitating the transmission of data at unprecedented speeds and ensuring seamless connectivity.

The proliferation of IoT devices across various industries signifies a paradigm shift in how we interact with technology. From smart homes to industrial automation, IoT devices rely on stable and high-frequency capacitors to enable real-time data transmission and processing.

Polymer tantalum capacitors, with their superior characteristics in stability and frequency response, emerge as the go-to solution to meet the stringent demands of IoT applications. Their ability to operate consistently in harsh environments and maintain performance integrity over extended periods positions them as key enablers of the IoT revolution.

This surge in demand for high-frequency and stable polymer tantalum capacitors presents an unprecedented opportunity for manufacturers in the electronics industry.

Notable Developments Related to Industry Leaders

The polymer tantalum capacitor market is currently witnessing a surge of opportunities propelled by notable advancements from industry leaders. These developments not only pave the way for market expansion but also signify a significant stride towards technological innovation and meeting the evolving demands of critical applications.

With a keen focus on enhancing reliability, performance, and efficiency, manufacturers are strategically leveraging acquisitions, innovative technologies, and the introduction of tailored products to cater to sectors such as military, aerospace, defense, and industrial.

This juncture presents an auspicious moment to delve into the pivotal role played by these developments in shaping the trajectory of the polymer tantalum capacitor market.

|

Category |

Market Size (2024E) |

Projected CAGR through 2031 |

|

Type - Surface-Mount |

US$436.94 Mn

|

7.9% |

|

Application - Consumer Electronics |

US$163.70 Mn

|

5.7% |

Surface-Mount Capacitors Reign Supreme

The surface-mount segment is projected to hold a substantial share of 59.1% in the polymer tantalum capacitors market in 2024.

As consumer electronics become smaller and more compact, there is a growing demand for surface-mount components that can fit into tighter spaces without compromising performance. This market trend towards miniaturization is driving the adoption of surface-mount polymer tantalum capacitors.

Surface-mount technology (SMT) components are smaller and lighter compared to through-hole components, making them ideal for modern electronics that demand miniaturization.

Surface-Mount polymer tantalum capacitors offer enhanced electrical performance, such as better frequency characteristics and lower equivalent series resistance (ESR), which are crucial for high-speed and high-frequency applications.

The development and adoption of advanced automated manufacturing technologies make the production of surface-mount capacitors more efficient and cost-effective. This technological advancement supports the growing demand for these components.

Consumer Electronics Industry Reflect Maximum Application Potential

The consumer electronics segment is projected to hold a substantial share of 22.1% in the polymer tantalum capacitors market in 2024 and is projected to grow at a CAGR of 5.7% during the forecast period.

Consumer electronics, such as smartphones, tablets, and wearables, are becoming increasingly compact. Polymer tantalum capacitors, particularly surface-mount types, are essential for these devices because they provide high capacitance in a small form factor.

Modern consumer electronics often include advanced features such as high-resolution displays, powerful processors, and wireless connectivity. Polymer tantalum capacitors support these features by providing reliable power delivery and signal integrity.

There is a growing market trend towards energy-efficient electronics. Polymer tantalum capacitors contribute to this trend by offering components that help manage power more effectively and reduce energy consumption. These factors collectively drive the significant growth of the consumer electronics segment within the polymer tantalum capacitors market.

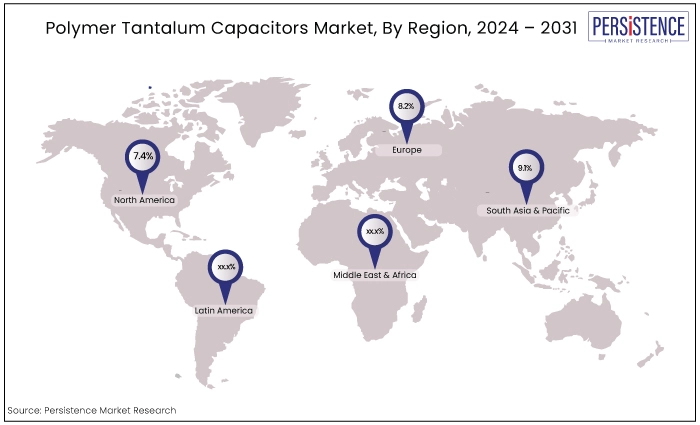

|

Region |

Market Size (2024E) |

CAGR through 2031 |

|

North America |

US$218.2 Mn |

7.4% |

|

East Asia |

US$172.0 Mn |

5.6% |

|

South Asia & Pacific |

US$84.5 Mn |

9.1% |

|

Europe |

US$200.9 Mn |

8.2% |

China to be the Epicenter of Activity

East Asia, especially China, is the most significant shareholder in the global market and is expected to hold the highest share of 12.5% in the global polymer tantalum capacitors market.

Countries like China, Japan, South Korea, and Taiwan are home to some of the world’s largest electronics manufacturers. This region has a well-established infrastructure for manufacturing of electronic components, including polymer tantalum capacitors.

China is the global hub for consumer electronics such as smartphones, laptops, tablets, and wearable devices. The increasing demand for these products drives the need for high-performance components like polymer tantalum capacitors.

China is at the forefront of technological innovation. The rapid advancements in technology and the development of next-generation electronic devices contribute to the growing demand for advanced capacitors that can meet stringent performance requirements.

The country’s combination of strong manufacturing capabilities, high demand for advanced electronics, and continuous technological advancements positions it as a key player in the global market.

Europe Gains from Technological Prowess in EV and Autonomous Driving

European market is projected to secure a CAGR of 8.2% in the forecast period from 2024 to 2031. Europe is home to a robust automotive industry, including leading EV manufacturers and experts in autonomous driving technologies.

These advancements drive the demand for high-performance capacitors used in automotive electronics for applications like power management, infotainment systems, and advanced driver-assistance systems (ADAS).

The European Union's focus on renewable energy and sustainable technologies increases the demand for energy-efficient electronic components. Polymer tantalum capacitors are used in power converters, inverters, and other applications within the renewable energy sector, supporting this market growth.

Key players engage in diverse strategies like acquisitions and partnerships to bolster their market presence and boost profitability.

The prominent companies in the market such as Vishay Intertechnology Inc., Kemet Corporation (now part of YAGEO Corporation), KYOCERA AVX Components Corporation, are introducing innovative features and designs to meet evolving customer demands, such as smaller form factors, higher capacitance values, and improved electrical characteristics.

To expand their tantalum polymer capacitor business, these companies seek new market segments or regions through partnerships, acquisitions, or alliances.

April 2024

Panasonic released the TQT Series POSCAP Conductive Polymer Tantalum Solid Capacitors, which come in a tiny case size and offer high voltage, big capacitance, and a long lifespan. These POSCAP Capacitors are appropriate for applications requiring high load current and SSD backup.

March 2024

KEMET introduces the first T581 polymer tantalum capacitors qualified under Military Performance Specification MIL-PRF-32700/2. This release marks the first market availability of such capacitors, reinforcing KEMET’s leadership in high-reliability defense and aerospace applications. The 35V-rated capacitors offer a crucial solution for military applications requiring MIL-PRF-qualified components and high volumetric efficiency.

March 2022

KYOCERA AVX, announced to acquire ROHM Semiconductor’s tantalum and polymer capacitor business assets. The two businesses recently came to a definitive agreement under which ROHM Semiconductor will give KYOCERA AVX all its tantalum and polymer capacitor business assets, including its manufacturing lines and pertinent intellectual property.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2018 to 2023 |

|

Market Analysis |

US$ Million for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Type

By Application

By Region

To know more about delivery timeline for this report Contact Sales

Growing demand of polymer tantalum capacitors in the automotive industry is driving the market growth.

The surface mount polymer tantalum capacitor records the most significant market share.

Expansion of 5G technology and IoT driving the market for high-frequency and stable polymer tantalum capacitors.

Asia Pacific continues to account for the largest share of the market.

YAGEO (Kemet), Vishay, Kyocera AVX Corporation, Panasonic, and Hitachi AIC are some of the leading industry players.