Industry: Chemicals and Materials

Published Date: October-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 190

Report ID: PMRREP34873

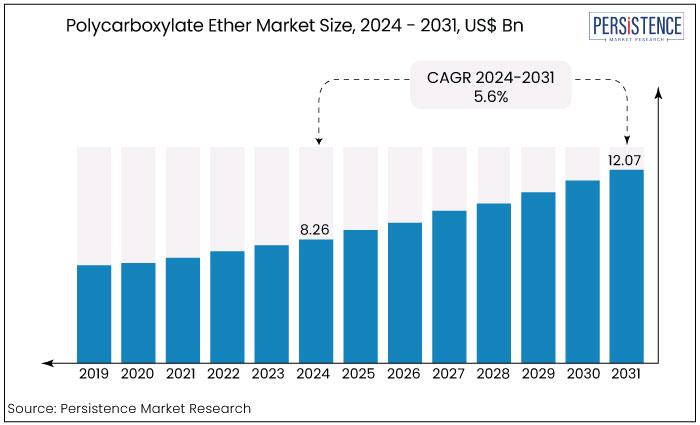

The polycarboxylate ether market is estimated to increase from US$ 8.26 Bn in 2024 to US$ 12.07 Bn by 2031. The market is projected to record a CAGR of 5.6% during the forecast period from 2024 to 2031.

The polycarboxylate ether market is set to be driven by a growing demand for eco-friendly construction materials, especially in developing regions like Asia Pacific. The entry of several international companies in countries like China and India is also anticipated to augment demand. In July 2024, for instance, Nemetschek Group, a renowned Building Information Modeling (BIM) software developer, headquartered in Germany, announced its plan to enter India to enhance the skyrocketing infrastructure development.

Government initiatives to push the development of green buildings in countries like India are further expected to create novel opportunities for polycarboxylate ether (PCE)s manufacturers. The Union Budget 2024, for example, recently introduced a roadmap that would enable India to achieve a net-zero footprint by the end of 2070. It is hence projected to boost sales of liquid polycarboxylate ether for infrastructure applications, reflecting a significant shift toward sustainability in the construction industry.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Polycarboxylate Ether Market Size (2024E) |

US$ 8.26 Bn |

|

Projected Market Value (2031F) |

US$ 12.07 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

5.6% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

5.1% |

|

Region |

Market Share in 2024 |

|

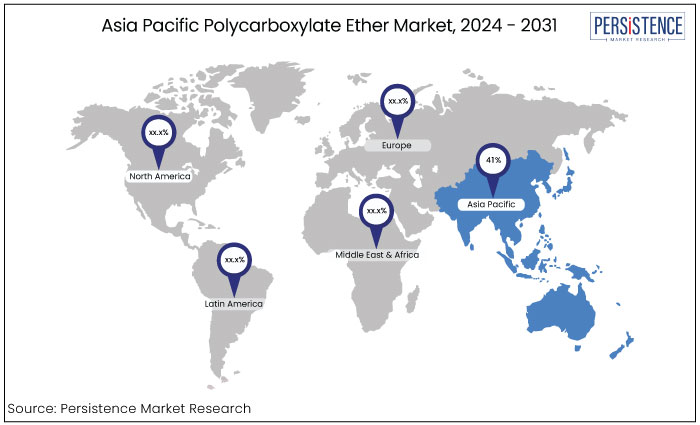

Asia Pacific |

41% |

Asia Pacific accumulated a significant market share, attributed to its swift urbanization and industrialization. This resulted in an increased demand for PCE in construction endeavors. As per UN Habitat, in the last 20 years, cities in China have added approximately 31,900 km2 of built area. In 2018, the average urbanization rate in the country recorded 59.6%.

The numbers are likely to rise, creating a favorable environment for PCE production. Concrete, the key material required for construction, is anticipated to boost demand. The ability of PCE to enhance the workability and strength of concrete makes it a significant material.

The presence of several principal PCE manufacturers in China is projected to augment the accessibility and utilization of PCE in the region. The booming construction industry, supported by government investments in infrastructure projects such as highways, railways, residential complexes, and smart cities, further increases demand for concrete admixtures like PCE.

Rapid industrial growth in countries like China, India, and Vietnam is leading to the surging construction of manufacturing facilities. Advanced concrete technology plays a key role in these facilities, thereby expanding the need for PCE-based products.

|

Category |

Market Share in 2024 |

|

Product Type- Solid |

60% |

Based on product type, the market is divided into solid and liquid. Out of these, the solid product type category dominates the market. Solid PCE is more convenient to transport and store than liquid form. Under solids, the powder form allows for extended shelf life and less logistical complexity, making it a highly convenient option for manufacturers and construction companies.

Solid PCE is also considered relatively cost-effective in large-scale construction projects due to reduced shipping costs. Being more concentrated than liquid PCE, it is set to showcase high demand from bulk buyers and industries looking to optimize costs.

Solid PCE can be easily mixed with water or other solvents at the construction site, offering superior flexibility in adjusting the concentration to meet specific project requirements. This versatility makes it suitable for various residential, commercial, and infrastructure projects.

|

Category |

Market Share in 2024 |

|

End Use- Infrastructure |

40% |

Based on end use, the polycarboxylate ether market is trifurcated into residential buildings, commercial buildings, and infrastructure, where the infrastructure segment dominates globally. Governments worldwide, particularly in Asia Pacific and other developing regions, are set to heavily invest in infrastructure development, such as highways, bridges, airports, and railways.

The aforementioned projects demand high-performance concrete, where PCE is widely used as a superplasticizer to enhance the workability and strength of concrete. It is anticipated to make the infrastructure sector the largest end user of PCE out of the three.

Demand for PCE in roads, transportation networks, and public infrastructure has skyrocketed in developing countries. Rapid public infrastructure development, backed by government investments to modernize cities and improve connectivity is expected to create new opportunities.

Infrastructure projects require durable and long-lasting concrete. PCE admixtures help achieve high strength and durability by reducing water content while maintaining workability. This characteristic makes it ideal for infrastructure applications that prioritize longevity.

Polycarboxylate ether (PCE) is set to be extensively used to construct slabs, bridges, roadways, and general civil engineering projects. The primary and secondary chains of PCE can be altered to achieve certain characteristics in the final product.

The qualities subject to optimization encompass adsorption rate, water reduction with elevated initial liquefaction or workability, and slump retention without retardation. The high water-reducing capacity, compatibility with any cement grade, and expedited formwork recycling are some other characteristics of polycarboxylate ether anticipated to propel growth.

The expanding construction sector in emerging regions, including Middle East and Africa, Asia Pacific, and Latin America, is anticipated to drive demand for concrete admixtures and polycarboxylate ethers. Countries in the Middle East and Africa as well as Asia Pacific are likely to prioritize enhancing their construction expenditures and infrastructure throughout the forecast period.

The polycarboxylate ether (PCE) market exhibited a 5.1% CAGR during the historical period from 2019 to 2023. It was mainly driven by increasing demand from the construction industry, particularly in developing regions like Asia Pacific. Additionally, rising infrastructure development projects and increasing environmental concerns prompted the use of PCE for sustainable construction.

The adoption of PCE-based admixtures, known for enhancing concrete strength and reducing water usage, supported the industry's expansion. Leading construction activities in China, India, and Middle Eastern countries are projected to increase demand during the forecast period.

The market is expected to surge at a CAGR of 5.6% during the period from 2024 to 2031. It will likely be driven by increasing investments in smart cities, launch of high-performance concrete solutions, and green building initiatives. The push for sustainable infrastructure as well as innovations in nanotechnology and self-healing concrete admixtures will likely enhance demand for PCE.

Stringent environmental regulations in construction projects are expected to further accelerate PCE adoption globally. Asia Pacific is likely to dominate through 2031 due to rising infrastructure projects and industrial expansion. Developed regions like North America and Europe, on the other hand, are anticipated to focus on sustainability over the forecast period.

Increasing Large-scale Infrastructure Projects Globally to Boost Sales of PCE

The increasing global emphasis on infrastructure development particularly in emerging economies is a key driver of the polycarboxylate ether market. PCE is widely used as a superplasticizer in concrete admixtures, enhancing concrete's strength. It also reduces the need for water, which is considered a significant environmental benefit. This unique property makes PCE indispensable for large-scale infrastructure projects, such as highways, bridges, and airports, which demand durable, high-performance concrete.

Countries like China and India, which are investing significantly in urbanization and infrastructure have raised demand for PCE. Rising construction activities driven by population growth in the above-mentioned countries have further propelled the need for efficient building materials solidifying the PCE market expansion.

Emergence of New Admixture Formulations with Self-healing Features to Augment Demand

Innovations in admixture formulations are driving growth for the PCE market. Integrating nanotechnology into concrete admixtures has led to the development of unique formulations that significantly enhance concrete durability and resistance to environmental factors.

PCE-based admixtures, for instance have been developed to improve the flow ability of concrete while reducing shrinkage and cracking, which is essential for modern, high-performance buildings. Developing self-healing concrete containing capsules or microorganisms that repair cracks over time reshapes the construction landscape.

In September 2024, for instance, U.S.-based Restoration Partners LLC, a sustainable construction company, introduced Basilisk Self-Healing Concrete. These innovations have not only increased demand for PCE but also expanded its applications in commercial, residential, and industrial buildings.

Difficulty in Maintaining Consistent Production Levels to Hamper Sales

The production of polycarboxylate ether relies on specific raw materials. Some of these are subject to volatile price fluctuations or availability issues due to global supply chain disruptions.

Factors such as geopolitical tensions, trade restrictions, and fluctuating costs of crude oil can significantly impact the supply and pricing of PCE products. For example, disruptions in significant supply chains during events like the COVID-19 pandemic exposed vulnerabilities in sourcing raw materials for various industries, including construction chemicals.

Manufacturers may need help in maintaining consistent production levels affecting the market. These supply chain challenges and dependence on raw materials from particular regions can limit the PCE market's ability to scale globally. ?

Production Complexity-induced High Cost May Restrict Polycarboxylate Ether Admixture Demand

The high initial cost of PCE-based admixtures compared to traditional alternatives like lignosulfonates or naphthalene-based admixtures is projected to act as a significant restraint. PCE formulations, though highly effective in improving concrete performance often come at a high price point due to the complexity of manufacturing and raw material costs.

In price-sensitive markets particularly in developing countries, this cost disparity can be a significant barrier to adoption. Construction companies with small-scale projects or regions with limited budgets may be reluctant to invest in these cutting-edge admixtures opting instead for cheap alternatives. As a result, while PCE provides long-term value in terms of performance and durability, the upfront expense may slow its penetration in cost-conscious sectors.

Expansion of Smart City Projects and Infrastructure Development to Create New Opportunities

One of the most transformative opportunities in the market is the ongoing expansion of smart city initiatives and large-scale infrastructure projects particularly in Asia Pacific and the Middle East.

Countries like China, India, and Saudi Arabia are investing significantly in infrastructure modernization, including high-speed rail, urban transit systems, and green city initiatives. PCE plays a key role in these developments by enhancing concrete structures' quality, durability, and sustainability.

The global push for more resilient and long-lasting infrastructure creates an enormous opportunity for PCE manufacturers as demand for high-performance concrete grows with urbanization. Governments prioritizing climate resilience and environmental sustainability in their construction policies further increase PCE adoption for green infrastructure.

Exploration of New Application Areas like Nuclear Energy Infrastructure to Accelerate Demand

Another key opportunity in the PCE market is the advancement of innovative admixture technologies. New developments, such as self-healing concrete and nanotechnology, are driving demand for more sophisticated chemical admixtures.

PCE-based formulations are increasingly being integrated into these next-generation concrete solutions to improve performance, enhance durability, and reduce maintenance costs. These innovations are set to open new avenues for polycarboxylate ether manufacturers to explore cutting-edge applications in high-rise buildings, roads, and even specialized areas like nuclear energy infrastructure and offshore constructions.

As the industry evolves toward smarter, more efficient materials, PCE's role in advancing the quality and performance of these products will be central to its growth.

The global market for polycarboxylate ether is highly competitive, with key players vying for leading shares through product innovation, strategic partnerships, and expansion initiatives.

Reputed companies include BASF SE, Sika AG, Arkema SA, Mapei S.p.A., and GCP Applied Technologies. They dominate due to their extensive global presence, strong research and development capabilities, and broad product portfolios. These companies focus on enhancing product efficiency and sustainability to cater to the growing demand for eco-friendly construction solutions.

Regional firms, particularly in Asia Pacific, also play a significant role due to the booming construction sector in countries like China and India. Competitive strategies include the development of tailored solutions to meet local construction standards and government regulations.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Product Type

By End Use

By Region

To know more about delivery timeline for this report Contact Sales

It is estimated to be valued at US$ 12.07 Bn by 2031.

The industry is estimated to exhibit a CAGR of 5.6% over the forecast period.

Sika AG, BASF SE, and Abadgaran Group are a few key players.

Venki Chem is a key manufacturer of polycarboxylate ether in India.

It is mainly used in the manufacturing of precast, self-compacting, and ready-mix concrete.

It is capable of lowering the water content in concrete.