PHO and Non-PHO based Oils and Fats Market Segmented By Partially Hydrogenated Oils, Non-Partially Hydrogenated Oils in Food and Beverages Industry, Personal Care and Cosmetics, Commercial, Household

Industry: Food and Beverages

Published Date: August-2018

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 266

Report ID: PMRREP24178

According to the U.S. FDA (Food and Drug Administration), PHOs are defined as oils and fats which have been hydrogenated, however, not to complete or near complete saturation, and with an iodine value (IV) greater than 4. PHOs are the primary dietary source of industrially-produced trans-fatty acids as unlike other edible oils, PHOs inherently contain trans-fats and are intentionally produced to affect the function and properties of the oils and the characteristics of the food to which they are added.

According to the WHO (World Health Organization), the intake of trans-fat leads to over 500,000 deaths annually resulting from cardiovascular diseases which is also attributed to the increasing health awareness triggering the demand for non-PHO based oils and fats in the food and beverage industry.

Owing to the rise in some fatal diseases caused due to the consumption of fatty food products, concerned food safety authorities and organizations have been taking steps on limiting the use of trans-fatty acids in most food products that are being consumed. The WHO is one of the frontrunners in taking initiatives on limiting the use of trans-fatty acids in food production which has resulted in a sharp decline in the demand of PHO oils thus triggering the demand for non-PHO based oils and fats. Countries like Austria, Denmark, Hungary, Iceland, Norway, and Singapore have limited industrially-produced trans-fat content in all foods to 2 percent of fats and oils. Moreover, the U.S. and Canada have implemented nationwide bans on PHOs, which are considered as the main sources of industrially-produced trans-fats, by the end of 2018.

Furthermore, FSSAI (Food Safety and Standards Authority of India), the food safety regulatory body in India, which happens to be one of largest markets for fats and oils, has laid down guidelines to limit trans-fats in oil by 2% by 2022 in response to the WHO guidelines against the consumption of trans-fats, while the currently permitted level for trans-fat is 5%. These regulations are covered in detail in the report on global PHO and non-PHO based oils and fats market and include the latest information on regulations against trans-fatty acids of key countries that have implemented them. Moreover, leading food and non-alcoholic beverage companies are also committing to phase out trans-fats in their products in compliance with the WHO’s goal of eliminating industrially produced trans-fat by 2023.

For instance, the International Food and Beverage Alliance, which represents companies like Nestlé, Kraft, Unilever, PepsiCo, Mars, Kellogg, General Mills, Ferrero and others, have committed to reduce the industrially produced trans-fatty acids from PHO in all of their products across the globe to not more than one gram trans-fatty acid per 100 grams of the product by the end of 2018.

The majority of food and beverage manufacturers are opting for palm oil and oils blended with palm oil fractions as PHO replacement. Palm oil has emerged as the most attractive replacement attributed to its low cost, abundant supply and flexibility in various formulations. Moreover, palm oil has a neutral taste, has a high smoking point and melting point which makes it ideal for frying. These factors are anticipated to drive the growth of palm oil over the forecast period. However, companies are also using hard fat blends and interesterified soybean oil as a PHO replacement oil.

Trait modified high oleic soybean and canola oil are also being introduced in the market by key players. In December 2017, Cargill, which is a U.S.-based provider of food, agricultural, financial, and industrial products across the globe, introduced lowest saturated fat, high oleic canola oil commercially available to a number of food customers, globally. This oil is made up of a canola hybrid containing 4.5% or less saturated fatty acid while maintaining extended shelf life, improved taste, and freshness. Apart from this, the oil also reduces 35% of saturated fat content in comparison to other canola oils available in the market.

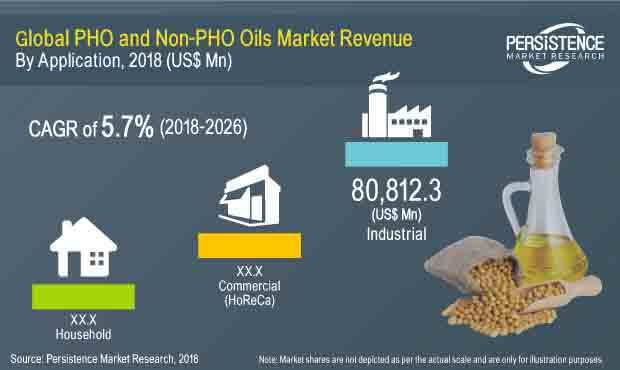

Global PHO and non-PHO based oils and fats market is moving at a decent pace and will catch up on major opportunities, our analysis revealed. The market conditions are developing and scaling up with growing demand for non-PHO based oils and fats as more and more countries are implementing bans on trans fats, competitors in the market are making an investment in alternative technologies such as interesterification, enzymatic inter-esterification, and fractionation to cater the growing demand of non-PHO based oils and fats.

However, to phase out the trans-fats from the food supply will require more resources–technical, human, and financial and regulatory checks and infrastructure especially in underdeveloped and developing countries.

| Attribute | Details |

|---|---|

|

By Product Type |

|

| By Application |

|

| By Region |

|

To know more about delivery timeline for this report Contact Sales