Pharmacy Benefit Manager Market Segmented By Retail Pharmacy Services, Specialty Pharmacy Services, Benefit Plan Design and Consultation, Drug Formulary Management for Government Heath Programs, Employer-sponsored Programs, Health Insurance Management

Industry: IT and Telecommunication

Published Date: September-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 210

Report ID: PMRREP24595

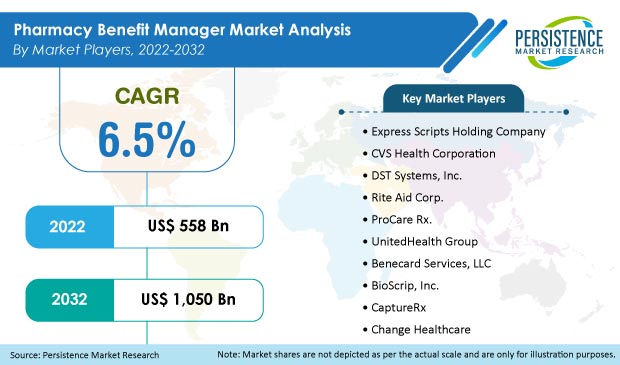

The global pharmacy benefit manager market is expected to evolve at a CAGR of 6.5% and increase from its current market value of US$ 558 Bn to become a trillion-dollar industry by the end of 2032.

The United States accounts for 66.5% share of the global pharmacy benefit manager market. Furthermore, the retail pharmacy services segment holds 27.6% share of the global market.

|

Pharmacy Benefit Manager Market Size (2022) |

US$ 558 Bn |

|

Projected Market Value (2032) |

US$ 1,050 Bn |

|

Global Market Growth Rate (2022-2032) |

6.5% CAGR |

|

Market Share of Top 4 Countries |

71.3% |

Over the 2016-2021 historical period, the global pharmacy benefit manager market rose at a CAGR of 6%.

The healthcare sector has always been on the rise, but in recent years, as the income of the urban population in developing nations has increased, the demand for effective healthcare infrastructure management has grown dramatically.

Diagnostic device and pharmaceutical makers, as well as government agencies, are increasingly relying on the concept of pharmacy benefit managers (PBMs), which are primarily third-party administrators of prescribed drug distribution programs for commercial health care providers, self-insured employers, and federal or state employee health benefit plans.

These pharmacy benefit managers are in charge of developing and monitoring contracting processes with pharmacies and negotiating prices with drug makers.

Large enterprises used the pharmacy benefit manager concept more than a decade ago. Small and medium-sized businesses have also accepted this concept due to cost-effective services and solutions and improved benefit plans.

All levels of businesses commonly utilize pharmacy benefit managers to simplify employee health and pharmacy benefits. As a result, pharmacy benefit managers are becoming increasingly important in a variety of commercial industries.

During the forecast period (2022 to 2032), the global pharmacy benefit manager market is estimated to rise at a CAGR of 6.5%.

“Massive Increase in Drug Prices to Boost Target Market Growth”

The increasing frequency of chronic disorders around the world is driving up the demand for treatment options. Consequently, several large pharmaceutical corporations are focusing their efforts on producing high-priced branded medicines to treat chronic disorders. This has resulted in a massive surge in pharmaceutical spending in recent years.

This, combined with an increase in prescription registrations in recent times for a wide variety of chronic conditions such as chronic lung disease, cardiovascular disease, and others, is driving up healthcare costs.

Thus, a massive increase in drug prices, coupled with a rise in the number of prescriptions filed worldwide, is increasing the healthcare burden. This has led to the growing demand for and acceptance of pharmacy benefit managers to lower drug prices and control pharmaceutical spending globally.

Such aspects are expected to boost the growth of the global pharmacy benefit manager market during the forecast period.

“Incorporation of Machine Learning (ML) and Artificial Intelligence (AI) to Offer New Growth Prospects”

The increasing usage of pharmacy benefit managers among pharmaceutical manufacturers, retail pharmacy chains, and insurance companies is moving service providers' preferences from traditional workflow to an advanced workflow using modern technology such as machine learning and artificial intelligence (AI).

As a consequence, the companies can quickly provide a simplified supply chain, speedy mail delivery service, and serve a vast number of insurance and retail pharmacy chains.

Hence, the incorporation of machine learning and artificial intelligence (AI) technology into the workflow enables businesses to reduce medical costs while improving the effectiveness of coverage procedures.

This is anticipated to open up new prospects for growth in the global pharmacy benefit manager market.

“Global Market Benefitted from COVID-19 Outbreak”

Rising healthcare expenditures as a result of the worldwide introduction of costly specialty medications and COVID-19 vaccinations increased the demand for price management of prescription and OTC drugs.

As a result, a large number of insurance companies depend on pharmacy benefit managers to bargain prescription prices with retail pharmacy units and cut the cost of the drugs included in the insurance coverage.

Moreover, rising measures, such as expanding mail order delivery services and developing distribution networks in rural locations, led to the increased acceptance of pharmacy benefit managers.

As a result, the leading manufacturers' actions and rising demand for specialty medications fueled the global pharmacy benefit manager market growth during the COVID-19 pandemic.

“Mounting Concerns Regarding Transparency to Impede Market Expansion”

Increasing drug prices are among the important factors expected to drive the global pharmacy benefit manager market. Nevertheless, concerns regarding transparency related to business models are constantly a subject of worry in pharmacy benefit manager services.

These services' sources of revenue are rarely revealed to drug makers, retail pharmacy units, or insurance providers. As a result, a significant amount of medical expenses is passed on to pharmacy benefit managers.

As a result, insurance companies and drug makers are experiencing a huge drop in profits. Consequently, most insurance companies have abandoned the idea of partnering with pharmacy benefit managers, whereas those that have yet to do so are hesitant.

As a result, the rate of adoption of these services is decreasing, which is expected to impede the global pharmacy benefit manager market growth during the forecast period.

“Poor Literacy Rates and Lack of Information in Developing Regions”

The population in underdeveloped and developing nations has limited penetration and adoption of healthcare insurance policies due to poor literacy rates and a lack of information about the advantages of insurance policies.

This is another significant obstacle predicted to impede the global pharmacy benefit manager market growth during the forecast period.

Will the Mature Health Insurance Scene in the United States Support Market Growth?

The United States controls 66.5% of the global pharmacy benefit manager market. The United States is home to major insurance providers, pharmaceutical makers, retail pharmacy chains, and pharmacy benefit manager service providers.

The rising adoption of health insurance is projected to aid market growth in the United States. Over half of the US population is likely to be afflicted by one or more chronic illnesses. The increasing cost of healthcare and the growing adoption of insurance policies is estimated to bolster the growth of the pharmacy benefit manager market in the United States.

As a result, the large penetration of health insurance providers has resulted in the expansion of the pharmacy benefit manager market in the United States.

Moreover, the majority of patients in the United States rely on reimbursements to receive treatment for various disorders. The government's favorable reimbursement rules are also expected to support market expansion in the United States.

How is the Growth of Online Retail Pharmacies Driving the Need for Retail Pharmacy Services?

The retail pharmacy services segment accounts for 27.6% of the global pharmacy benefit manager market. The increasing number of retail pharmacy units worldwide, combined with the growing penetration of online pharmacies, is predicted to drive the expansion of this segment.

The increasing internet penetration, smartphone use, and popularity of e-commerce are supporting the expansion of online retail pharmacies, which is likely to spur the growth of the retail pharmacy services segment during the forecast period.

Online pharmacies provide easy payment choices, speedy home delivery, simple refunds and replacements, and big discounts. This is a primary reason for the increased demand for online retail pharmacies.

This is projected to further accelerate the expansion of this segment in the global pharmacy benefit manager market.

Leading players in the pharmacy benefit manager market are aggressively adopting marketing methods such as investments, collaborations, new product introductions, technological developments, R&D activities, and acquisitions to strengthen and extend their overseas footprint.

For instance:

|

Attribute |

Details |

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2016-2021 |

|

Market Analysis |

USD Million for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon Request |

By Service:

By Demand Determinant:

By Region:

To know more about delivery timeline for this report Contact Sales

The global pharmacy benefit manager market is projected to expand at a CAGR of 6.5% from 2022 to 2032.

The global market for pharmacy benefit managers is expected to reach US$ 1,050 Bn by 2032.

The United States accounts for the largest market share of 66.5%.

Massive increase in drug prices is the main aspect expected to drive the global market for pharmacy benefit managers.

Mounting concerns regarding transparency of business models is a major factor likely to impede market growth.

Express Scripts Holding Company, BioScrip, Inc., UnitedHealth Group, CVS Health Corporation, Benecard Services, LLC, DST Systems, Inc., Rite Aid Corp., CaptureRx, ProCare Rx., and Change Healthcare are leading players in the global pharmacy benefit manager market.