Industry: Chemicals and Materials

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Report Type: Ongoing

Report ID: PMRREP23848

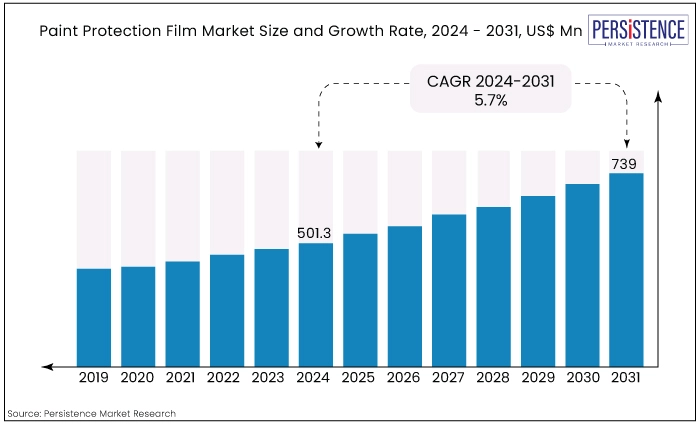

The global paint protection film market is anticipated to increase from US$501.3 Mn in 2024 to US$739 Mn by the end of 2031. The market is anticipated to secure a CAGR of 5.7% during the forecast period from 2024 to 2031.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

Paint Protection Film Market Size (2024E) |

US$501.3 Mn |

|

Projected Market Value (2031F) |

US$739 Mn |

|

Forecast Growth Rate (CAGR 2024 to 2031) |

5.7% |

|

Historical Growth Rate (CAGR 2019 to 2023) |

4.8% |

Paint protection films belong to automotive protective coating type, which involves adhesion of a transparent film composed of polymers on the exterior surface of an automotive vehicle.

Paint protection films have been employed in passenger based vehicles by the end users around the globe. These films ensure durability of paint and coating base and preserves it against extreme climatic conditions which can cause fading of color shade or corrosion of the vehicle body.

Paint protection films are clear or colored polyurethane films applied to the exterior surfaces of vehicles to protect them from abrasions, stone chips, insect acids, and weathering. The paint protection film market is estimated to gain significant traction. It is owing to associated trade margins and profits earned by service providers as well as automotive OEMs thus encouraging its use.

The paint protection films (PPF) market is primarily well established in high capita income countries in terms of automobiles. The scope of opportunity for paint protection films lies in commercial vehicles, aircrafts and off-road equipment in the upcoming years.

On the flip side, stringent government regulation pertaining to emissions by paint protection film and low rate of product adoption regions of low-capita income can prove to be a restraint for market.

With the developing market of paint protection film market, the industry has been undergoing a series of product developments incorporated suitable compositions to offer superior performance characteristics and aesthetics in the long run.

The paint protection film market witnessed accelerated growth during the historical period as economies began to recover from the pandemic-induced slowdowns. Demand surged as consumers prioritized vehicle protection against road debris, UV rays, and environmental damage.

Technological advancements such as self-healing films and improved optical clarity gained traction, further boosting market penetration. Expansion into new geographical regions and increased adoption in commercial vehicles and fleet applications contributed to market expansion further.

The PPF market had consolidated its position as a vital segment within the automotive protective coatings industry. The market witnessed further innovation in sustainable materials and eco-friendly solutions to meet stringent environmental regulations.

Market players continued to invest in research and development to address evolving consumer demands for durable and high-performance PPFs. Expansion into new application areas such as electronics and industrial equipment presented additional growth opportunities.

Increasing Consumer Awareness, and Demand for Vehicle Protection

A significant driver of growth in the PPF market is the increasing awareness among consumers about the benefits of vehicle protection and maintenance. As vehicle ownership rates rise globally, consumers are becoming more proactive in preserving the aesthetic appeal and resale value of their vehicles.

PPFs are particularly appealing to owners of high-end and luxury vehicles, who prioritize maintaining the pristine condition of their investments. The ability of PPFs to shield vehicles from stone chips, road debris, insect acids, and minor abrasions resonates strongly with this demographic.

The need for effective protection against damage becomes more critical as vehicles become more technologically advanced and incorporate sensitive paint finishes or advanced materials,

Social media and online forums have played a pivotal role in spreading awareness about PPFs, with influencers and automotive enthusiasts showcasing the benefits of these protective coatings. This has contributed to a growing consumer base that actively seeks out PPF solutions as part of their vehicle maintenance regimen.

The automotive aftermarket sector has seen a surge in demand for PPF installation services. Specialty shops and automotive detailing professionals are expanding their service offerings to include PPF installation, capitalizing on the growing consumer demand. These professionals often emphasize the quality of installation and use of premium PPF products to differentiate themselves in the competitive market.

Technological Advancements and Product Innovation

Technological advancements have been a cornerstone of growth in the paint protection film market, driving innovation and expanding the capabilities of protective coatings.

Recent years have witnessed significant strides in the development of advanced PPF technologies, which are enhancing durability, optical clarity, and performance characteristics.

One of the notable advancements in PPF technology is the development of self-healing films. These films are engineered with elastomeric polymers that have the ability to "heal" minor scratches and swirl marks when exposed to heat or ambient temperatures. This self-healing capability not only prolongs the lifespan of the protective film but also maintains the aesthetic appearance of the vehicle over time.

Manufacturers have been refining these technologies to improve effectiveness and durability, thereby meeting the high standards expected by consumers.

Moreover, a few advancements in adhesive technology have contributed to easier installation processes and better adhesion to vehicle surfaces. This has reduced the occurrence of edge lifting and improved overall performance in various environmental conditions.

Improvements in UV resistance have addressed concerns about yellowing or discoloration of PPFs over prolonged exposure to sunlight, ensuring long-term clarity and protection. Innovation has also extended to the customization options available to consumers.

Manufacturers now offer a range of PPF products with different finishes, including gloss, matte, and satin. This allows vehicle owners to personalize the appearance of their vehicles while benefiting from enhanced protection against chips, scratches, and stains.

High Costs of Installation and Maintenance

One of the primary barriers hindering widespread adoption of paint protection films is the relatively high cost associated with both installation and maintenance.

PPFs are considered a premium aftermarket product, and the paint protection film cost can vary significantly depending on factors such as the size of the vehicle, complexity of installation, and type of film chosen.

Professional installation is recommended for achieving optimal results and ensuring proper adhesion without issues such as bubbles or lifting. The labor-intensive nature of PPF installation, which involves meticulous cleaning, precise cutting, and skillful application, contributes to high costs.

Moreover, installation prices can vary regionally, with urban areas generally charging higher rates than rural areas.

While PPFs are designed to be durable and provide long-lasting protection, they are not completely maintenance-free. Over time, PPFs may require occasional cleaning and maintenance to preserve their appearance and effectiveness. This includes using specific cleaning products and techniques to avoid damaging the film or compromising its protective properties.

Additionally, if the PPF sustains damage beyond its self-healing capabilities, repair or replacement can incur additional costs.

The high upfront and ongoing costs associated with PPF installation and maintenance may deter price-sensitive consumers or those who perceive the investment as prohibitive. This restraint is particularly significant in mass market segments where cost-effectiveness is a key consideration for purchasing decisions.

Advancements in Material Technology

There will be opportunities for manufacturers to develop more advanced PPF materials as technology continues to evolve. One of the significant advancements in PPF technology is the development of self-healing films.

These films can repair minor scratches and swirl marks automatically when exposed to heat or sunlight. This feature significantly extends the lifespan of the PPF and reduces the need for frequent replacements, offering cost savings to consumers and increasing the attractiveness of PPF as a protective solution.

Future market trends might include self-healing films that can repair scratches with heat or UV light, films with enhanced optical clarity, or materials that are easy to apply and remove. Industry participants investing in research and development of such advanced materials can capture a competitive edge and meet the increasing demands for high-performance PPF solutions.

Advanced materials can also make PPF easy to apply and remove without leaving residue or damaging the underlying paint. This improves the installation process for professionals and reduces labor costs, while also enhancing the customer experience by minimizing inconvenience during removal or replacement of the film.

Technological advancements enable manufacturers to offer customized PPF solutions tailored to specific vehicle models or applications. This customization can include variations in thickness, tint options, and special formulations for different environmental conditions.

Customized solutions, one of the key market trends, cater to niche markets and specific customer preferences, expanding the potential customer base for PP.

Automotive & Transportation Sector Continues to Offer Substantial Opportunities

The automotive & transportation sector continues to expand globally, with increasing production and sales of passenger vehicles, commercial vehicles, and luxury cars. Paint protection films (PPF) are essential in safeguarding vehicle exteriors from scratches, stone chips, and environmental damage, thereby enhancing their aesthetic appeal and resale value.

There is a growing awareness among consumers about the benefits of PPF in maintaining the pristine appearance of their vehicles. As car owners become more conscious of protecting their investments, the demand for high-quality PPF solutions grows, driving revenue in the automotive segment.

The automotive & transportation application segment led the market with a remarkable 69.3% share of total revenue in 2023. This stronghold is bolstered by robust sales in key automotive markets like India, China, and the United States where rising vehicle ownership rates are driving heightened demand for protective solutions

Regions with a significant automotive manufacturing base and a growing number of affluent consumers, such as North America, Europe, and Asia-Pacific, are key contributors to the automotive & transportation application segment's market share.

Advancements in PPF technology, such as self-healing films and improved optical clarity, cater specifically to the needs of automotive applications. These innovations not only offer superior protection but also meet the high standards expected in the automotive industry, further boosting market uptake.

Asia Pacific to be the Largest Consumer Region

Economic growth in countries like China, and India is leading to a surge in car ownership. With more vehicles on the road, there is growing demand for protecting them.

The region has a growing appetite for luxury cars, which are typically more expensive to maintain and repair. PPF offers a cost-effective way to preserve the pristine look and value of these vehicles.

Asia Pacific stands as the powerhouse driving the demand for paint protection films, poised to experience the highest growth rate in the coming years. This surge is fueled by the rising popularity of luxury automobiles across the region.

The used car market is booming in Asia Pacific. People buying pre-owned vehicles often invest in PPF to enhance the car's appearance and resale value. Consumers in this region are becoming increasingly aware of the benefits of PPF. This includes protection from scratches, UV rays, and other environmental damage.

Notably, China plays a fundamental role as both the large producer and consumer of thermoplastic polyurethane (TPU), the primary material used in manufacturing paint protection films.

The dual role underscores China's significant contribution to the market's expansion, highlighting its pivotal position in shaping the future landscape of automotive protection solutions in Asia Pacific, and beyond.

Market players have been following key strategies including new product launches, acquisitions and investments which have helped them to expand their businesses in potential markets.

Companies invest significantly in research and development to develop advanced PPF materials with features like self-healing properties, enhanced durability, and improved optical clarity. Innovations in installation technology and customization options also play a crucial role.

XPEL, Inc. operates at the forefront of the automotive aftermarket sector in the US, Canada, and the UK. The approach is centered around delivering comprehensive paint protection film solutions directly to independent installers and car dealerships. This includes not just cutting-edge XPEL protection films, but also encompasses tailored training programs, access to proprietary design software, robust marketing support, and lead generation initiatives.

July 2022

SWM, Inc., and Neenah, Inc., both renowned for their expertise in specialty materials, joined forces to establish Mativ Holdings, Inc. While maintaining their individual identities, this strategic merger aims to expand their global presence and fortify distribution channels.

By leveraging synergies, Mativ Holdings anticipates enhancing its market reach and delivering heightened value across diverse geographic markets, marking a significant milestone in the evolution of specialty materials innovation. By equipping their partners with these integrated solutions, XPEL empowers them to deliver superior automotive protection experiences, setting a benchmark for excellence in the industry.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Million for Value |

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Application

By Material Type

By Region

To know more about delivery timeline for this report Contact Sales

The market is projected to expand at a CAGR of 5.7% during the forecast period between 2024 and 2031.

Increasing awareness among consumers about the benefits of vehicle protection and maintenance is a key driver for market growth.

Some of the key players operating in the market are Schweitzer-Mauduit International, Inc., Avery Dennison Corporation, and Saint-Gobain S.A.

Advancements in material technology provides a promising opportunity in the market.

Asia Pacific to stand out in the paint protection film market.