Industry: Industrial Automation

Published Date: November-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 201

Report ID: PMRREP33179

According to Persistence Market Research, revenue from the global open top meat membrane skinning machine market totaled US$ 66.4 Mn in 2021. The top four manufacturers of open top meat membrane skinning machines accounted for around 62% share of the market in 2021. The industry is expected to reach US$ 109.8 Mn by 2032, expanding at a CAGR of 4.7% from 2022 to 2032.

The market for these machines will experience significant growth opportunities with growing hygiene standards, rising disposable income, advancements in technology, and the ever-growing meat demand across the world. These machines efficiently remove meat skin, fat, and membrane, resulting in a highly appealing finished product while also maximizing operator productivity, yield, and efficiency. Manufacturers are incorporating cutting-edge technology into their machine designs, which further simplifies the steps needed to manufacture processed meat.

Consumers' increasing emphasis on food safety and their preference for premium meat products are two factors that will support industry expansion in the years ahead. Open top meat membrane skinning machines account for 40%-45% share of the global meat membrane skinning machine market on a value basis.

|

Open Top Meat Membrane Skinning Machine Market Size (2021A) |

US$ 66.4 Mn |

|

Estimated Market Value (2022E) |

US$ 69.1 Mn |

|

Projected Market Value (2032F) |

US$ 109.8 Mn |

|

Value CAGR (2022-2032) |

4.7% |

|

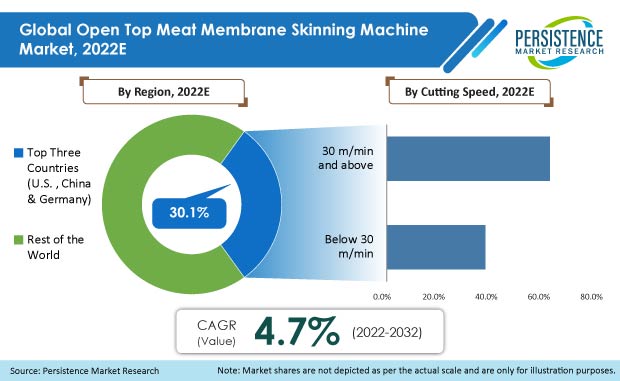

Collective Value Share: Top 3 Countries (2021) |

30.1% |

From 2017 to 2021, sales of open top meat membrane skinning machines increased at 1.5% CAGR and are anticipated to witness Y-o-Y growth of 4.1% in 2022.

The expansion of the retail food sector, coupled with an increase in hygiene standards due to the COVID-19 pandemic, has resulted in higher market growth. Factors such as increased meat consumption and recovery of the processed food market will play a pivotal role in market expansion over the coming years.

Fresh meat is regarded as healthy and fulfills the expectations of quality-oriented customers. The fresh meat market expansion over the past several years has been accelerated by the rising production and consumption of products such as sausages, patties, meatballs, and others in developed and developing nations. With increasing technological advancements in the cold chain, transportation, and distribution channels, the fresh meat market is expected to witness a healthy growth rate over the forecast period.

Open top meat membrane skinning machines are increasingly being used for fresh meat for their membrane skinning since these machines remove skin or membranes from fresh meat very effectively and without any damage to the inner meat. As a result, growth in fresh meat consumption will call for more membrane skinning machines, which will optimistically impact the target market.

Image represents the share of cutting speed and region in the market. The 30 m/min and above segment accounts for a larger share, whereas, the usage of these machines is the highest in the U.S., China, and Germany.

The foundation for innovation and the creation of new products in the global food and beverage industry is a set of strong natural, health, and sustainability credentials. Consumers, especially those with better incomes and older consumers in developed countries, are drawn to products created from healthier ingredients, labeled to guarantee little processing, or clearly show the health benefits of natural substances.

In reaction to this trend, there have been a variety of investments in new product development by established manufacturers of meat membrane skinning machines from around the world. Due to rising wages and the trend of healthier eating, nations such as China, the U.S., and India are anticipated to make significant contributions to the expansion of the global meat and poultry business.

Manufacturers have progressively invested in product modification and expanded their vast range of product offerings in response to the rising consumer demand for fresh and nutritious processed meat products.

Users who purchase any machine have to deal with installation, repair, and maintenance costs. In machinery, wear and tear is an inevitable and normal consequence of daily operations. For efficiency, high performance, and extended lifetime of equipment, new sales of machinery are increasing.

To maintain the machines, fully-trained service professionals are needed to provide quick and efficient services for these machines. Hence, the high cost of machinery, repair and maintenance costs, and the need for a fully professional workforce are some of the factors that may hamper the sales of open top meat membrane spinning machines to some extent.

Europe accounts for more than 40% share of the market on a value basis. However, this regional market is estimated to lose 250 basis points through 2032.

More than 70% of open top meat membrane skinning machine manufacturers are headquartered in the region. High demand for faster meat skinning and strict hygiene standards, among others, have resulted in a growing manufacturing base within the region.

Germany is anticipated to dominate the market through the forecast period and progress at a CAGR of 3.1%. The German food processing industry is known for its state-of-the-art technology and top hygiene standards. Companies manufacturing open top meat membrane skinning machines comply with the strict demands of the EU as well as German hygiene regulations regarding quality assurance systems.

Will High Labor Costs in the U.S. Be a Driver for Market Growth?

The United States market is estimated to expand at 4.4% CAGR during the forecast period of 2022-2032 and create an absolute dollar opportunity worth US$ 5.5 Mn.

Prominent market drivers for these machines in the U.S. are factors such as the rise in meat protein and fresh meat consumption. Also, end users prefer more advanced and automated machines that save time and improve efficiency, which has further pushed the market’s growth in the country.

In the U.S., labor cost is one of the key growing concerns among industry participants, and these machines have provided a solution to that, owing to which, many butcheries, restaurants, and commercial kitchens are increasingly using these machines for meat skinning applications.

What Makes China a Lucrative Market for Open Top Meat Membrane Skinning Machine Manufacturers?

Over the forecast period, the market in China is projected to expand at a CAGR of 5.3%.

Due to factors such as rising demand from the meat and fish processing sectors, China is expected to be one of the most promising countries for the target market. These industries are forecasted to drive the country's open top meat membrane skinning machine market growth. Also, the market is anticipated to be driven by rising investments by manufacturers and increasing disposable income among consumers.

Why are Below 500 mm Open Top Meat Membrane Skinning Machines Most Widely Used?

Below 500 mm cutting width open top meat membrane skinning machines are projected to account for more than 58% of the market share on a value basis by the end of the forecast period.

These machines are most frequently used with a 430 mm cutting width and are good for high output. These machines are widely used for skinning pork, beef, veal, lamb, turkey, and other meats. Also, these machines are comparably more cost-effective than machines with a cutting width greater than 500 mm, which gives the segment an advantage in the industry.

Which Cutting Speed Machines are Most Sought-after by End Users?

30 m/min and above cutting speed open top meat membrane skinning machines are anticipated to create an absolute dollar opportunity worth US$ 18.9 Mn, with the segment expanding at a CAGR of 5.1% through the forecast period.

Growing focus on operational efficiency and volume are key factors driving the demand for open top meat membrane skinning machines with more than 30m/min, particularly 37m/min cutting speed machines.

Manufacturers of open top meat membrane skinning machines are focusing on providing a wide range of products to their customers for different applications. Key players are manufacturing machines that comply with the latest industry standards. European machines will remain dominant in the market. Many companies are partnering with regional dealers and distributors for increased customer reach around the world.

|

Attribute |

Details |

|

Forecast Period |

2022-2032 |

|

Historical Data Available for |

2017-2021 |

|

Market Analysis |

|

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon Request |

By Cutting Width:

By Cutting Speed:

By Region:

To know more about delivery timeline for this report Contact Sales

The global open top meat membrane skinning machine market was valued at US$ 66.4 Mn in 2021.

Sales of open top meat membrane skinning machines are slated to increase at a CAGR of 4.7% from 2022 to 2032.

Spain, the U.K., and Argentina are lucrative markets; however, East Asia is anticipated to hold the largest market share of 13.4% by 2032.

Nock Maschinenbau GmbH, Marel, Cretel, Grasselli S.p.A., and Varlet Machines accounted for 66.7% market share in 2021.

The China market for open top meat membrane skinning machines is projected to expand at 5.3% CAGR through 2032.

Together, France and Italy currently account for 12.3% of the global market share.