ID: PMRREP34097| 201 Pages | 13 Dec 2025 | Format: PDF, Excel, PPT* | Food and Beverages

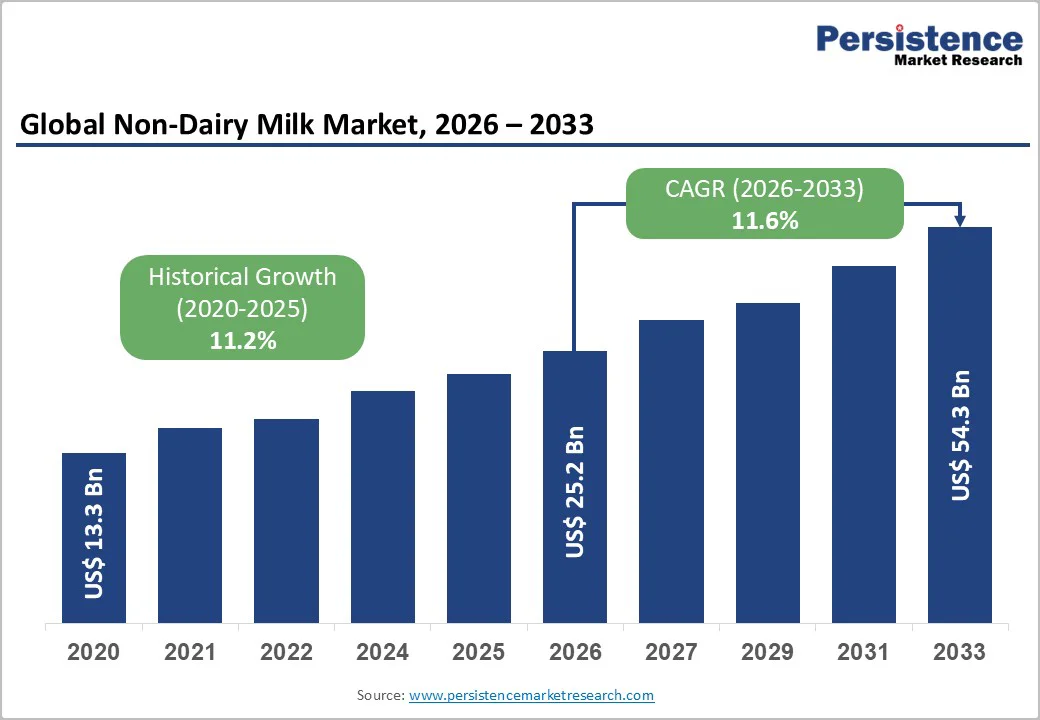

The global non-dairy milk market size is likely to be valued at US$ 25.2 billion in 2026 and is estimated to reach US$ 54.3 billion by 2033, growing at a CAGR of 11.6% during the forecast period 2026−2033. Demand growth is supported by rising lactose intolerance prevalence, expanding vegan populations, and rapid product innovations in plant-based beverages. Strong retail penetration and regulatory encouragement for sustainable diets continue to strengthen adoption. Consumer preference for functional, clean-label, and allergen-free alternatives further accelerates market expansion.

| Key Insights | Details |

|---|---|

| Non-Dairy Milk Market Size (2026E) | US$ 25.2 Bn |

| Market Value Forecast (2033F) | US$ 54.3 Bn |

| Projected Growth (CAGR 2026 to 2033) | 11.6% |

| Historical Market Growth (CAGR 2020 to 2025) | 11.2% |

Rising health consciousness is elevating consumer preference for plant-based beverages as individuals reassess the nutritional profile of their daily intake. Shifts toward clean-label products, reduced saturated fat, and natural fortification are prompting buyers to replace conventional dairy with alternatives perceived as lighter and easier to digest. A growing segment of urban professionals is adopting wellness-centric routines, prioritizing products that support weight management, heart health, and digestive balance. This shift strengthens the demand for plant-derived options that align with preventive health habits and flexible dietary patterns in modern lifestyles.

Lactose intolerance is amplifying this transition by expanding the consumer base seeking dairy-free formulations for physiological comfort and dietary inclusivity. Global health surveys indicate that nearly 68% of adults experience some degree of lactose malabsorption, according to the National Institute of Diabetes and Digestive and Kidney Diseases, reinforcing the need for accessible substitutes. This condition drives consistent demand for products that eliminate gastrointestinal discomfort while offering familiar taste and functional versatility. As retailers, cafes, and foodservice operators integrate broader selections into menus and shelves, plant-based beverages are becoming a standard choice for consumers seeking reliable, digestive-friendly nutrition aligned with long-term wellbeing.

Premium pricing limits broader adoption as plant-based beverages carry higher production and sourcing expenses, with ingredients such as almonds, oats, and specialty fortification inputs requiring processing steps that elevate operational costs and push retail prices above traditional options. This price gap discourages value-sensitive households, restricts frequent consumption, and reinforces the perception of these products as premium lifestyle choices rather than everyday staples. The resulting affordability divide concentrates demand among health-driven and higher-income consumers, reducing mass-market appeal and slowing the transition from occasional trial to routine purchase.

Affordability barriers also slow transition in emerging and price-elastic regions where consumers prioritize volume, utility, and familiarity in staple purchases. Higher unit prices limit trial, create lower repeat rates, and reduce demand depth across lower-income demographics. Retailers face slower turnover for premium stock keeping units (SKUs), resulting in constrained shelf exposure and fewer promotional cycles. Brand owners must invest more heavily in consumer education, packaging innovation, and value-engineering strategies to justify premium positioning. These dynamics reinforce a structural restraint, as premium pricing narrows the addressable audience and restricts the category’s ability to scale at the pace required for mass-market penetration.

Technological advancements in fortification and blends create a significant growth avenue by enhancing the nutritional profile of plant-based beverages. Modern techniques allow precise enrichment with vitamins, minerals, proteins, and probiotics, catering to the increasing consumer demand for functional nutrition. Innovative blending methods enable manufacturers to combine multiple plant sources, balancing taste, texture, and nutrient density, resulting in products that meet diverse dietary preferences. These advancements also improve product stability, shelf life, and sensory attributes, which strengthen brand differentiation and consumer loyalty in a highly competitive landscape.

The integration of advanced fortification and blending technologies allows companies to target specific health-conscious segments, including children, seniors, and fitness enthusiasts, offering tailored solutions that align with lifestyle choices. It also opens doors for premium product lines that command higher margins and reinforce brand positioning as innovators in health-driven offerings. By leveraging scientific innovation in formulation, businesses can accelerate adoption, build trust among discerning consumers, and establish long-term competitive advantage while responding to global trends in wellness, personalized nutrition, and sustainable food alternatives.

Almond milk is poised to be the leading segment, projected to maintain the highest non-dairy milk market share at approximately 38% in 2026. Its dominance stems from widespread consumer familiarity, low-calorie content, and strong adoption in North America and Europe. Retail channels and coffee shop integrations reinforce its position as a mainstream plant-based option. Shelf stability, versatility in flavor applications, and consistent quality make it attractive for consumers transitioning from dairy. Well-established supply chains in key producing regions such as the U.S., Spain, and Australia ensure steady production, reliable distribution, and global accessibility.

Oat milk is expected to emerge as the fastest-growing segment through 2033, driven by the increasing demand for sustainable, health-conscious alternatives. Its creamy texture and superior performance in barista-prepared beverages enhance adoption in coffee shops and foodservice channels. Cultivation of oats requires fewer environmental resources compared to nut-based crops, appealing to sustainability-focused consumers. Nutritional benefits, including beta-glucans, strengthen its health positioning, while expanding retail partnerships and online availability accelerate its uptake. Growth is anticipated across North America, Europe, and the Asia-Pacific markets, highlighting its rising prominence.

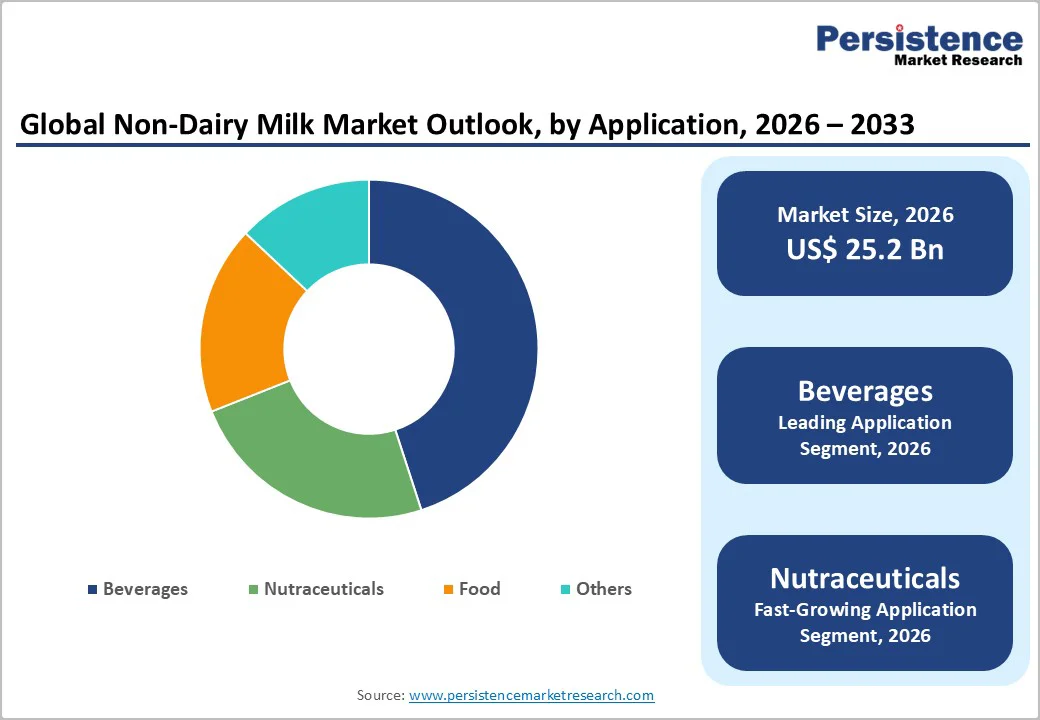

The beverages segment is projected to hold the largest market share at approximately 45% in 2026, establishing it as the leading application category. Its dominance is driven by widespread incorporation in ready-to-drink beverages, smoothies, coffees, and teas, supported by strong retail presence and expanding urban cafe culture. Consumer preference for convenient, nutritious options reinforces demand, while beverage manufacturers increasingly integrate plant-based milks into mainstream products to align with evolving health trends. Consistent innovation and broad accessibility ensure the segment’s sustained leadership through 2033.

The nutraceutical segment is expected to emerge as the fastest-growing segment between 2026 and 2033, fueled by the rising demand for functional and fortified products. Plant-based milks such as soy, pea, and hemp serve as bases for protein shakes, meal replacements, and clinical nutrition formulations. Consumers are increasingly focused on preventive healthcare, immunity enhancement, and overall wellness, accelerating adoption. Enhanced fortification with vitamins, minerals, and plant proteins, coupled with growing clinical validation, strengthens the segment’s appeal, making it a high-potential growth avenue across health-conscious markets worldwide.

Supermarkets and hypermarkets are projected to control an estimated 52% of the market revenue share in 2026, solidifying their position as the dominant distribution channels. Extensive product variety, prominent shelf visibility, and strategic promotional campaigns drive consumer engagement and repeat purchases. Major retail chains in North America and Europe support private label offerings, health-focused merchandising, and in-store tastings, reinforcing brand awareness. These stores serve as primary touchpoints for bulk purchases and product discovery, ensuring continued dominance by combining convenience, trust, and high consumer footfall.

Online retail is expected to be gain the highest traction during the 2026-2033 forecast period, backed by the proliferation of e-commerce platforms and a growing adoption of subscription-based delivery models. Digital platforms provide seamless access to product comparisons, consumer reviews, and specialty brands not widely available in physical stores. Free home delivery, bulk ordering options, and regular promotional campaigns enhance convenience and affordability. Rapid mobile commerce growth in Asia Pacific further accelerates adoption. Increasing consumer preference for flexible, on-demand purchasing positions online retail as a high-potential channel for expansion.

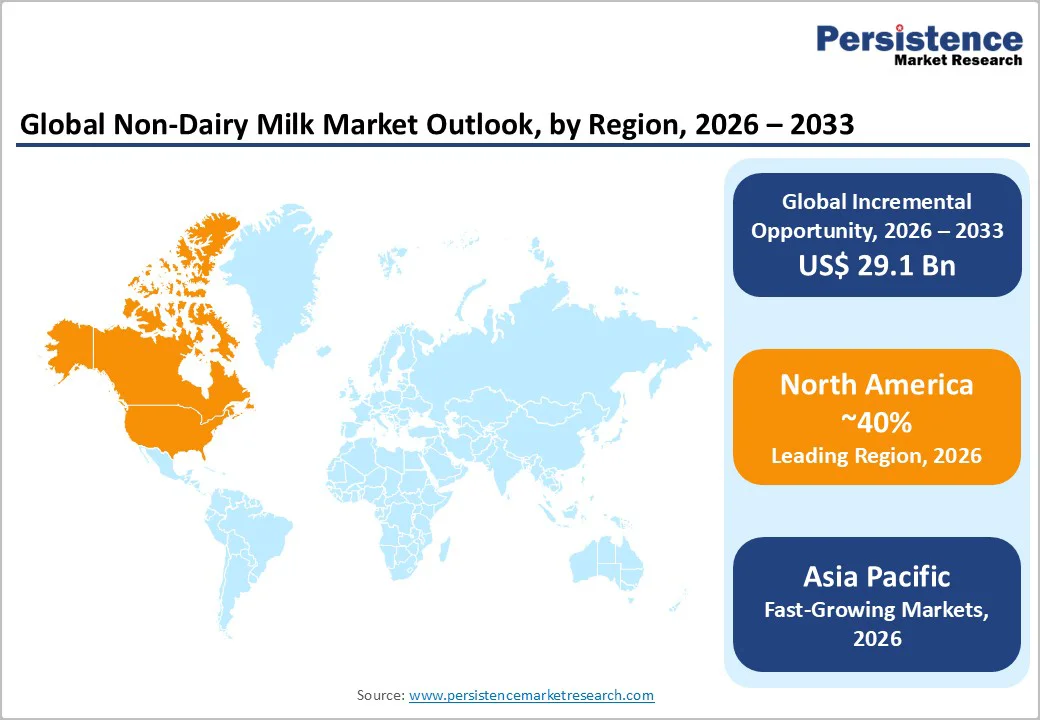

North America is projected to dominate the non-dairy milk market share in 2026, commanding an estimated 40%. The region’s leadership is underpinned by a combination of mature retail infrastructure, strong consumer education, and early adoption of plant-based diets. Health-conscious consumers are increasingly prioritizing lactose-free, low-calorie, and protein-enriched alternatives, creating a stable demand base for almond, soy, and oat milk. The presence of established supply chains ensures consistent quality, wide availability, and rapid distribution, which further strengthens market penetration. In addition, North American consumers demonstrate a high willingness to pay a premium for innovative blends, fortified products, and barista-quality formulations, supporting growth in both mainstream and specialized segments.

Key factors fostering the dominance of North America include robust partnerships between non-dairy milk manufacturers and major coffee chains, cafes, and retail giants. Integration of private-label offerings by supermarkets and hypermarkets enhances accessibility while reinforcing brand loyalty. The region also benefits from advanced processing technologies, enabling longer shelf life, improved sensory attributes, and functional fortification. Combined with strong marketing campaigns emphasizing wellness, sustainability, and ethical sourcing, these elements create a competitive environment that sustains North America’s leadership in the global market.

Europe is projected to maintain a strong market position in 2026, supported by high consumer awareness of health, sustainability, and ethical consumption. Countries such as Germany, the U.K., France, and the Netherlands have well-established retail networks and a long-standing culture of plant-based diets, driving steady adoption. Consumers increasingly seek beverages that are fortified, low-calorie, or free from allergens, creating consistent demand. Premiumization trends, including barista-style options and flavored variants, appeal to urban and affluent demographics, reinforcing the region as a key player in the alternative beverage space.

Growth is further supported by stringent food safety and quality regulations, which enhance consumer confidence, along with well-developed distribution channels across supermarkets, hypermarkets, and specialized stores. Collaborations between beverage producers and cafés or restaurant chains facilitate product trial and integration into daily routines. Innovation in blends, fortification, and sustainable packaging strengthens differentiation. These structural, regulatory, and consumer-driven factors combine to ensure the continued relevance and steady expansion of plant-based beverages throughout Europe.

The Asia Pacific market is forecasted to experience the fastest growth from 2026 to 2033, supported by evolving dietary patterns and increasing health-conscious consumption. Rising awareness of plant-based nutrition among millennials and Gen Z is driving experimentation with alternative beverages in daily routines, particularly in urban centers. Local agricultural innovation, including improved oat, soy, and legume crop yields, enhances product availability and reduces dependence on imports. The region’s increasingly dynamic cafe culture, along with the expansion of coffee chains and specialty beverage offerings, encourages trial of creamy, barista-friendly plant-based options, boosting demand across both premium and mainstream categories.

E-commerce platforms and mobile commerce are accelerating growth by providing convenient access to fortified and functional products that may be limited in traditional retail. Subscription-based deliveries and targeted social media campaigns are shaping consumer preferences toward sustainable and health-focused beverages. Regulatory initiatives promoting plant-based nutrition in schools, hospitals, and workplace wellness programs further strengthen adoption. Combined, these structural, cultural, and technological factors position Asia Pacific as the leading growth frontier for alternative beverages.

The global non-dairy milk market landscape is moderately fragmented, comprising both multinational beverage corporations and regional plant-based brands. Leading companies hold a substantial share of global revenues, leveraging extensive distribution networks, strong retail presence, and targeted marketing initiatives. Their strategies focus on continuous product innovation, introducing fortified and flavored variants, and emphasizing sustainability credentials to align with evolving consumer preferences. Collaborations with cafés, restaurants, and foodservice chains further strengthen market penetration and brand visibility, creating a competitive edge in both mainstream and premium segments.

Emerging players are gaining traction by targeting health-conscious and environmentally aware consumers. These companies focus on clean-label offerings and incorporate alternative ingredients such as hemp, pea, and other plant sources to differentiate their products. Agile operations and digital marketing campaigns allow smaller brands to build direct-to-consumer relationships, capture regional demand, and respond quickly to trends, enhancing overall market dynamism and competitive intensity.

The global non-dairy milk market is projected to reach US$ 25.2 billion in 2026.

Health awareness, lactose intolerance, sustainability preferences, and rising demand for plant-based nutrition are driving the market.

The market is poised to witness a CAGR of 11.6% from 2026 to 2033.

Innovative fortification technologies, blended formulations, and expanding e-commerce and foodservice adoption present major opportunities.

Some of the key market players include Danone SA, Oatly Group AB, Blue Diamond Growers, Califia Farms LLC, Vitasoy International, and Nestlé SA.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 – 2025 |

| Forecast Period | 2026 – 2033 |

| Market Analysis | Value: US$ Bn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Product Type

By Application

By Distribution Channel

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author