Mine Backfill Services Market

Industry: Chemicals and Materials

Published Date: December-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 195

Report ID: PMRREP35017

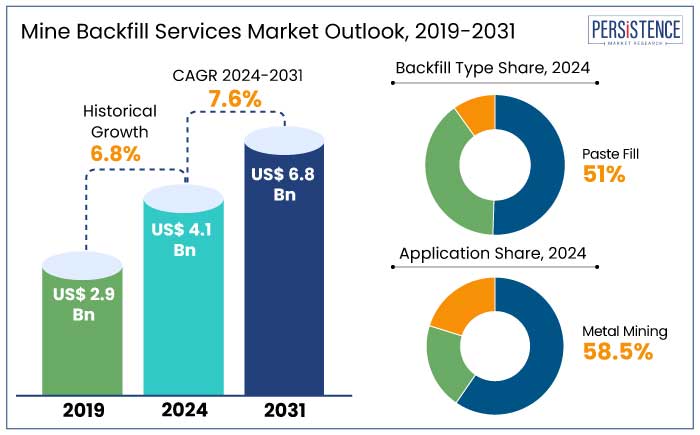

The mine backfill services market is projected to witness a CAGR of 7.6% during the forecast period from 2024 to 2031. It is anticipated to increase from US$ 4.1 Bn recorded in 2024 to a considerable US$ 6.8 Bn by 2031.

The industry is witnessing robust growth, driven by the mining sector's increasing focus on sustainability and environmental stewardship. As mining activities continue to rise to meet the high demand for critical minerals, there is a significant emphasis on eco-friendly practices such as backfilling to minimize land degradation.

The trend is further fueled by developments in construction and infrastructure, which demand high-quality metals like aluminum, steel, and copper. Such requirements underscore the importance of backfill services in managing mining waste effectively.

In 2023, India's finished steel consumption reached over 136 million tons, reflecting the country's robust infrastructure development and industrial activities. Similarly, other nations have recorded higher production and usage rates of infrastructural metals, indicating a global surge in demand for essential minerals.

Increased consumption necessitates sustainable mining practices, including effective backfilling techniques, to manage the environmental impact and ensure the longevity of mining operations. Regulatory initiatives, such as India's Offshore Areas Mineral Conservation and Development Rules 2024, highlight the global push for sustainable mining practices. These frameworks aim to integrate environmental protection with industrial growth, ensuring compliance and promoting innovative backfill technologies in mining operations. ?

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Mine Backfill Services Market Size (2024E) |

US$ 4.1 Bn |

|

Projected Market Value (2031F) |

US$ 6.8 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

7.6% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

6.8% |

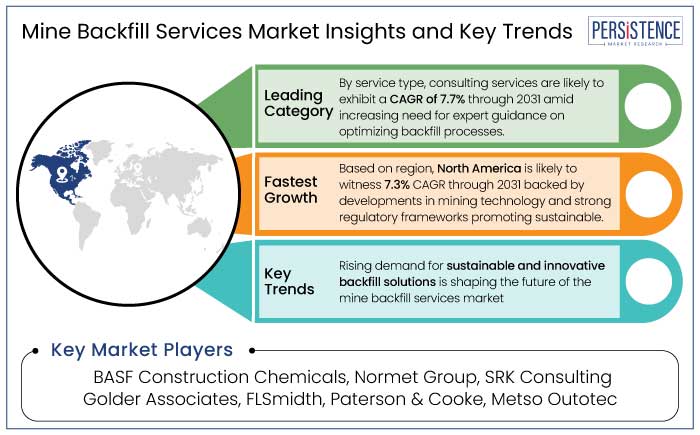

North America is set to achieve a robust CAGR of 7.3% through 2031, reflecting its leadership in the mine backfill services market. It is projected to hold a share of 21% in 2024. This dominance is attributed to the well-established mining infrastructure in the U.S. and its role as a hub for leading metal mining operations.

Increasing investments in sustainable mining practices, coupled with stringent environmental regulations, have propelled adoption of eco-friendly backfill solutions such as paste fill and cemented rock fill. These help in ensuring underground stabilization while minimizing environmental impact.

The U.S. leads North America by integrating unique backfill technologies, particularly in metal mining for copper, gold, and iron ore, which dominate its mining sector. Compared to Canada and Mexico, the U.S. benefits from a higher concentration of large-scale mining operations and stronger industrial demand for metals. These factors drive the adoption of efficient and sustainable backfill practices, ensuring both safety and compliance.

A key competitor in the U.S. is Paterson and Cooke, which recently developed enhanced slurry transport solutions to optimize backfill delivery systems. This innovation supports safer and more cost-effective operations in underground mining.

South Asia and Oceania is experiencing steady growth, particularly in Australia and New Zealand, with a projected CAGR of around 8.4% through 2031. Australia stands out as a key growth contributor in the region, propelled by its thriving mining industry, which focuses on coal, gold, and iron ore production.

The country’s technologically unique mining sector places a strong emphasis on sustainable practices. It is currently prioritizing backfill solutions to minimize environmental impact and optimize resource utilization.

Australia leads by implementing innovative backfill methods like paste fills and hydraulic fills, particularly in its large-scale mining operations. With key players like BHP and Rio Tinto, the country adopts cutting-edge technologies for mine waste management, which sets it apart from other countries in the region such as New Zealand and Papua New Guinea.

A key competitor in Australia is MineFill Services, which recently extended its operations to offer novel cemented rock fill solutions. This development is focused on enhancing the efficiency of backfill systems in large mining projects, ensuring environmental compliance and cost-effectiveness.

The paste fill segment is poised to dominate the global mine backfill services market and is likely to witness a CAGR of 7.3% in the coming years. It will likely hold a share of 51% in 2024.

Growth is driven by its exceptional efficiency in stabilizing underground mines while significantly reducing environmental impact. Paste fill leverages mine waste, such as tailings, making it an eco-friendly and cost-effective solution that enhances mine safety while addressing sustainability concerns.

Globally, paste fill is extensively used in metal mining, particularly for copper, gold, and zinc, where it is applied in deep, high-volume underground mines. It is favored for its superior strength and ability to fill voids in mined-out areas, compared to other backfill types like hydraulic and cemented rock fill. Widespread adoption across regions like North America, Oceania, and South America is a testament to its effectiveness.

The consulting services segment is anticipated to exhibit a strong CAGR of 7.7% between 2024 and 2031, reflecting its key role in the global mine backfill services industry. The segment is likely to hold a share of 40.2% in 2024.

Growth is fueled by increasing demand for expert guidance on optimizing backfill processes, enhancing safety measures, and adhering to stringent regulatory requirements. Consulting services are indispensable for mine operators seeking customized strategies to implement efficient and sustainable backfilling solutions.

Consulting services are widely adopted across regions, particularly in complex and large-scale mining operations. They help miners design effective backfill systems, ensure compliance with environmental regulations, and reduce operational costs.

Compared to other service types like material delivery or on-site backfill system implementation, consulting offers a strategic advantage, making it especially popular in North America and Australia. Mining companies in these areas are focused on innovative, sustainable solutions.

The mine backfill services industry is poised for significant growth, with future opportunities emerging from increasing demand for sustainable mining practices and regulatory pressures to minimize environmental impact. As the global mining industry extends to meet the rising demand for essential metals, need for efficient, eco-friendly backfill solutions becomes critical. Innovations in backfill materials and systems are also driving opportunities, particularly in regions with large-scale mining operations.

The global market is currently witnessing a prominent trend toward the adoption of paste fill and cemented rock fill technologies. These materials not only enhance underground mine stability but also reduce waste and mitigate environmental risks.

Growing awareness of the environmental impact of mining activities is pushing companies to implement these solutions in compliance with stringent environmental regulations. It is particularly evident in North America, Australia, and parts of South America.

The developing trend of adopting sustainable and technologically advanced backfill systems aligns with rising applications in metal mining, particularly for copper, gold, and zinc. This trend is especially evident in large-scale underground mining projects. Companies are prioritizing both safety and environmental sustainability while optimizing operational efficiency through innovative backfill methods.

The mine backfill services market experienced steady growth over the past decade at a CAGR of 6.8%. It was driven by the expansion of mining operations and a growing emphasis on environmental responsibility. Initially, methods like hydraulic fill and cemented rock fill were widely used, but over time, more sustainable solutions such as paste fill have gained prominence.

The market’s trajectory has been shaped by a combination of technological developments in backfill methods and increasingly stringent environmental regulations. These factors have led to a shift toward more efficient, eco-friendly backfilling processes. For example,

Demand for mine backfill services are estimated to record a CAGR of 7.6% during the forecast period between 2024 and 2031.

Sustainability to be a Key Catalyst Driving Growth in the Market

Rising emphasis on sustainability in the mining industry has emerged as a critical driver for the mine backfill services market. Mining operations are under increasing pressure to minimize their environmental footprint.

Backfilling solutions, such as paste fill and cemented rock fill, help reduce tailings storage needs and enhance waste management. The global push for greener practices and the need to comply with stringent environmental regulations are driving demand for efficient and eco-friendly backfill methods.

Shift toward sustainable mining is particularly prominent in regions like North America, Europe, and Australia, where companies are adopting new technologies to manage mining waste. With rising concerns about water contamination, land degradation, and environmental safety, sustainable backfilling methods are becoming integral to modern mining practices. For instance,

Technological Innovations Propel Growth with Focus on Efficiency and Automation

Technological developments in backfill materials and delivery systems have significantly contributed to market growth. Innovations like automated slurry handling systems and more efficient backfill mixing technologies allow for faster, safer, and cost-effective operations. These improvements help mining companies reduce operational costs, enhance mine stability, and ensure regulatory compliance, further driving adoption of novel backfill solutions.

Integration of automation and digital monitoring in backfill systems is transforming the global market. This trend is particularly evident in large-scale, deep mining operations where the need for reliable and efficient backfill solutions is paramount. Automation ensures a consistent quality of the backfill material and reduces human error. On the other hand, digital monitoring enables real-time adjustments, making the process more efficient. For example,

Limited Availability of Suitable Materials Emerges as a Key Challenge

One of the primary restraints in the mine backfill services industry is the limited availability of suitable materials for backfilling. In several mining regions, especially those with more remote or less-developed infrastructure, accessing high-quality tailings or sustainable backfill materials is challenging. The mining process generates large volumes of waste material, and not all of it is viable for use in backfilling due to differences in composition and quality.

Lack of infrastructure to properly process or transport these materials to mines can delay backfill operations, reducing efficiency. Inconsistent or poor-quality materials can lead to unreliable backfill performance, which compromises stability and safety.

It creates additional risks, as unstable backfill can lead to structural failures in underground mines, posing potential safety hazards and operational delays. As a result, mining companies must invest in sourcing and processing high-quality materials, which can limit the adoption of backfill technologies in certain areas.

Australia Accelerates Adoption of Sustainable Backfill Solutions to Support Mining

Australia's commitment to sustainable mining practices presents a significant opportunity for the mine backfill services market. The country, with its extensive mining operations, particularly in gold, copper, and iron ore, is increasingly adopting eco-friendly solutions to manage waste and stabilize mines.

Stringent environmental regulations and the push for sustainable operations have driven demand for innovative backfill technologies, such as paste fill and cemented rock fill. These solutions not only improve mine stability but also reduce the environmental impact by utilizing tailings efficiently.

Canada Pioneers Automation in Mine Backfill Services to Boost Efficiency and Safety

Canada's developments in mining technology have created opportunities for integrating automation in backfill services. As one of the leading mining economies globally, the country emphasizes enhancing efficiency and safety through automation and digital technologies in mining operations.

Automated backfill systems, which ensure consistent material quality and optimize delivery, are increasingly adopted in the country's high-volume underground mines. This trend aligns with Canada's focus on innovation and operational excellence in its mining sector.

A Canada-based mining company recently introduced a fully automated backfill management system, utilizing real-time monitoring to optimize material flow and reduce downtime. This development reflects the country’s leadership in adopting cutting-edge solutions for mine backfill applications.

The global mine backfill services industry is highly competitive, with key players such as Paterson and Cooke, Hatch Ltd., and Golder Associates dominating the landscape. These companies compete by offering novel backfill solutions, including paste fill, hydraulic fill, and cemented rock fill systems.

They are catering to diverse mining operations worldwide. Regional players in emerging markets like Australia and South Africa are also gaining prominence by providing cost-effective and localized services, creating a dynamic competitive environment.

To gain market share, leading players are focusing on strategic collaborations, technological innovation, and extending their service portfolios. For instance, several companies are investing in automated backfill systems and sustainable technologies to align with regulatory trends and client demands, thereby securing long-term market opportunities.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Backfill Type

By Service Type

By Application

By Region

To know more about delivery timeline for this report Contact Sales

Yes, the market is set to reach US$ 6.8 Bn by 2031.

Paste fill is the leading backfill type in the mine backfill services industry, holding a prominent share.

India is projected to experience a robust CAGR of around 8% during the forecast period.

BASF Construction Chemicals is considered the leading player.

As of 2024, the metal mining application holds a prominent market share of 58.5%.