Margarine Market Segmented By Soybean Oil, Palm Oil, Corn Oil, Sunflower Oil, Canola Oil source for GMO Margarine, Non-GMO Margarine Nature in Salted Margarine and Unsalted Margarine Type

Industry: Food and Beverages

Published Date: April-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 300

Report ID: PMRREP33051

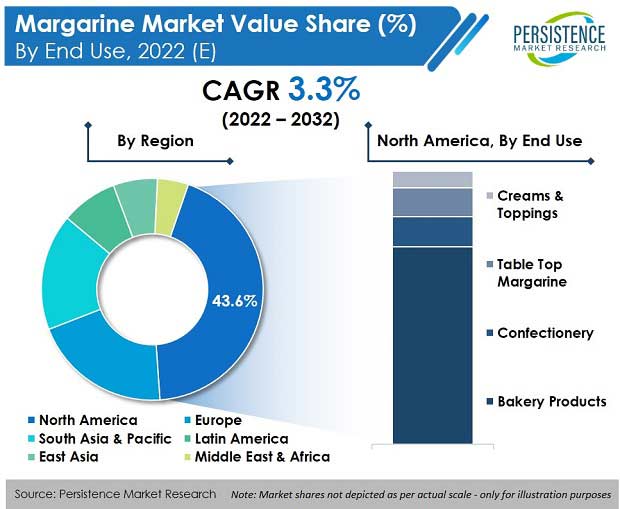

During the projection period of 2022-2032, the global margarine market is expected to expand at a CAGR of 3.3%, and increase from its current valuation of US$ 19 Bn to US$ 26.36 Bn by the end of 2032.

| Attribute | Key Insights |

|---|---|

|

Margarine Market Size (2022E) |

US$ 19 Bn |

|

Projected Sales of Margarine (2032F) |

US$ 26.36 Bn |

|

Value CAGR (2022-2032) |

3.3% |

|

Value Share of Top 5 Countries (2021A) |

54.3% |

Worldwide margarine consumption accounts for roughly 10% to 15% value share of the global food ingredients market at present.

Volume CAGR of the global margarine market was 1.9% over the historical period of 2017-2021. Volume consumption of margarine is anticipated to increase at a CAGR of 2.6% over the forecast period of 2022-2032. Demand for margarine is anticipated to increase from major end-use segments such as bakery and confectionery due to their increasing sizes.

Demand for food ingredients in the food processing and manufacturing sector is anticipated to increase more due to the ever-growing sizes of these industries. Due to this, margarine, being a key ingredient, will register steady market growth over the forecast period.

Growing sizes of end-use industries tend to have an optimistic growth outlook over the entire market for margarine during the forecast period. The millennial population is acting as a demand accelerator for bakery products such as patisserie, breads, and baked rolls, in which margarine is widely used.

Moreover, demand for non-GMO margarine is sure to observe an increase during the forecast period due to increasing consumer inclination toward such labeled products. The non-GMO margarine market is worth US$ 1.33 Bn in 2022, and is anticipated to register growth at a CAGR of 4.2% over the forecast period to top a valuation of US$ 2 Bn by the end of 2032.

“Rising Margarine Usage in Bakery Products across the World”

Margarine butter is used in numerous applications in bakery products due to its ease of spreading and scooping. It is among the top priorities for bakers when it comes to oils & fats due to its soft texture, which makes it light to whip up into buttercream frosting or the cream into sugar for making a sponge cake.

Margarine can contain animal-derived milk or water; the choice greatly depends on the end-use consumer. For vegan purposes water-based margarine is used in baking, and milk-based margarine is used for non-vegan applications.

In bakery applications, margarine is a common butter substitute that can be used as an ingredient and a spread. Like other fats, margarine is used to improve the mouthfeel and flavour of baked goods. For industrial baking applications, there are margarine varieties available such as buttercream margarine, cake margarine, croissant margarine, puff pastry margarine, and hard puff margarine. The most important functionalities offered by margarine in baked goods include texture, mouthfeel, and other sensory attributes.

“Margarine Sales Benefiting from Growing Consumption of Patisserie”

Patisserie includes both cakes and pastries, and the use of margarine in this category is driving their consumption and making them more desirable to mainstream consumers. Margarine benefits the dough layering in the manufacture of semi-finished products such as puff pastries, croissants, yeast, and yeast-free dough.

Moreover, other margarine usage benefits include a high lift of the final product, clear separation of the layers during baking, pleasant creamy flavors, better aroma of the finished products, negligible mixing of other flour, and the dough remains pliable when cooled between the rolling stages (yeast and yeast-free dough).

Furthermore, these attributes are supported by easy usage of margarine, such as before using it needs to be tempered at 16-20 degrees Celsius, with layering obtained by multiple folding and rolling processes as well as the existence of a fat layer between the dough layers, which tend to offer a good height to the finished food product.

“Increasing Vegan Population Aiding Margarine Demand Growth”

Margarine is an oil-water/milk emulsion that contains almost 80% vegetable oil, and the rest being water or milk. These days, most margarine products are completely hydrogenated in terms of processing and contain water instead of milk, as key manufacturers are targeting to offer their products that cater to a versatile consumer base.

Rising vegan population is one such consumer base that is deprived of consuming any animal-derived product.

This situation has posed a new challenge to food & beverage manufacturers to cater to this specific group of population with ideal ingredients, and margarine is one such ideal ingredient.

Bakery products that are loaded with water-based margarine are in-line with the rising need for vegan ingredients, and hence, their consumption, especially bakery ingredients, is sure to rise.

“Growing Demand for Non-GMO-based Margarine”

Non-GMO is a rising consumer trend that has been gaining traction since its inception due to several factors such as rising consumer awareness about the health complications that may arise by consuming GMO and similar products. GMOs are either plants or animals that have their DNA structure changed by scientific human intervention via a process called genetic modification or genetic engineering.

These modified organisms, when consumed, may become the leading cause of organ damage, infertility, etc. Hence, to cater to these concerns non-GMO-based products or GMO counterparts have been introduced into the market. Non-GMOs are free from toxic chemicals such as synthetic or chemical fertilizers, herbicides, pesticides, etc., free from antibiotics and growth hormones, fresher foods, better for the environment, nutrient profile is effective, and are 100% natural.

Margarine based on non-GMO raw materials such as non-GMO labeled vegetable oils is gaining traction in various end-use industries. Many manufacturers are offering non-GMO natured margarine as per this rising consumer trend. This, in turn, is helping end-use industries such as the bakery industry to cater to the demands of almost all consumers.

“Availability of Margarine Substitutes Harming Market Expansion”

When it comes to oils and fats, the market is already flooded with options that in some way or the other tend to hamper the target market growth. Margarine is a substitute for butter; likewise; other substitutes are prevailing in the margarine market.

The most widely available substitute for margarine is butter, and others on the list include lard, cocoa butter, nut butter, ricotta cheese, avocado oil, cream cheese, vegetable oil spread, olive oil spread, tofu, baby prunes unsweetened applesauce, and others.

These substitutes tend to offer almost the same properties offered by margarine across various end products, and especially is baked goods. The notion that margarine may contain up to some degree of trans-fat and its substitutes do not, is also one factor that is slowing down market growth of margarine.

What is the Status of Margarine Consumption in the U.S.?

North America is the top consumer of margarine with more than 40% of the global market share, and the U.S. is the top-consuming nation in this geography. The U.S. alone holds more than 95% share in the market in North America.

The overall margarine market in the U.S. is valued at US$ 8.1 Bn in 2022, and is expected to register growth at a value CAGR of 2.6% over the forecast period of 2022-2032.

Which Country is Emerging as a Leading Consumer of Margarine in South Asia & Pacific?

In South Asia & Pacific, India is emerging as a top consumer of margarine with a market share of approximately 25%.

In this region, India is estimated to register highest growth over the forecast period at a CAGR of 5.7% to reach US$ 1.42 Bn by the end of 2032. The market is currently valued at US$ 815.2 Mn.

Which Vegetable Oil is Popular for Margarine Production?

On the basis of source, soybean oil and palm oil are among the most popular vegetable oil categories that are used for manufacturing margarine. The soybean oil-based margarine market is estimated at US$ 5.29 Bn in 2022, and is expected to reach a valuation of US$ 7.57 Bn by 2032-end.

However, the palm oil-based margarine segment is expected to register growth at 4.1% over the decade.

Why is the Bakery Industry a Major Utilizer of Margarine?

Under the bakery industry, patisserie and breads & baked rolls are among the major utilizers of margarine.

The patisserie market is worth US$ 6 Bn and is anticipated to reach US$ 8.3 Bn by 2032-end. Likewise, the market for breads & baked rolls is worth US$ 5.1 Bn in 2022, and is anticipated to reach US$ 6.73 Bn by the end of the forecast period.

However, the biscuits & cookies segment is expected to register growth at a CAGR of 3.6% over the forecast period.

The COVID-19 pandemic dented the supply chain of margarine due to imposed lockdowns and no trading across borders. Measures taken by governments led to hindrances and delayed the restoration of the supply chain.

However, as governments offered some leniency to the food & beverage industry, the supply and value chains were restored to their pre-COVID potential; however a decline in the consumption of margarine was evident from 2020 to 2021.

As we move forward and things get back to normal, demand is almost certain to increase during the forecast period owing to growing sizes and consumption of margarine across major end-use industries.

Margarine suppliers are aiming at offering products that are in line with end-use industry demands. They are also utilizing production processes and raw materials that make their final margarine product scale up to industry benchmark standards.

Special emphasis is being given to making margarine trans-fat free due to regulations laid down by organizations such as the FDA. Manufacturers of margarine butter are also expanding their production capabilities as per rising demand.

Margarine brands are also entering into mergers and acquisitions to enhance their market presence across geographies.

| Attribute | Details |

|---|---|

|

Forecast period |

2022-2032 |

|

Historical data available for |

2017-2021 |

|

Market analysis |

USD million for Value |

|

Key regions covered |

|

|

Key countries covered |

|

|

Key market segments covered |

|

|

Key companies profiled |

|

|

Report coverage |

|

|

Customization & pricing |

Available upon request |

Margarine Market by Source:

Margarine Market by Nature:

Margarine Market by Type:

Margarine Market by End Use:

Margarine Market by Distribution Channel:

Margarine Market by Region:

To know more about delivery timeline for this report Contact Sales

The global margarine market is currently valued at over US$ 19 Bn.

Health benefits offered by margarine, versatile applications, cost-effective solution to other oils & fats, and ban on trans-fat products are factors driving market expansion.

From 2016 to 2020, margarine demand increased at a CAGR of 2.1%.

Sales of margarine are projected to be valued at US$ 26.26 Bn by 2032.

Wilmar International Ltd, Bunge Loders Croklaan, PURATOS, Richardson Food & Ingredients, and Vandemoortele are the top margarine manufacturers.

The U.S., Brazil, Russia, Nordic, and India account for most margarine butter consumption.

The Oceania margarine market is expected to reach US$ 169.5 Mn by the end of 2032.