ID: PMRREP34410| 234 Pages | 15 Dec 2025 | Format: PDF, Excel, PPT* | Chemicals and Materials

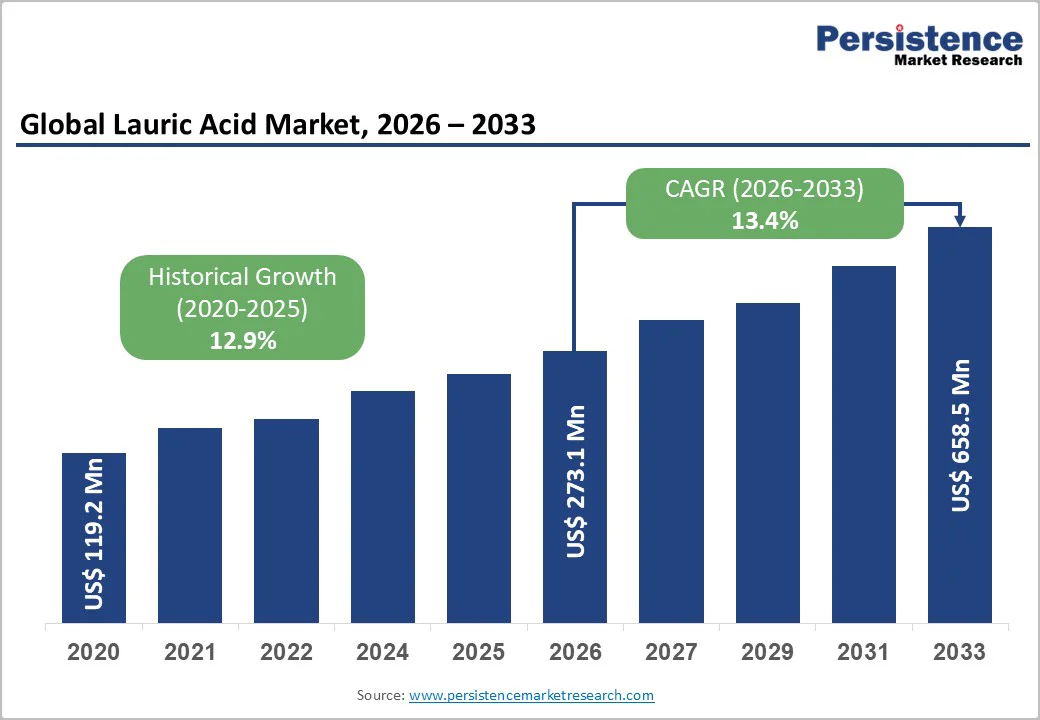

The global lauric acid market size is likely to be valued at US$273.1 million in 2026 and is expected to reach US$658.5 million by 2033, growing at a CAGR of 13.4% during the forecast period from 2026 to 2033, driven by the rising demand for cosmetics, personal care, and food sectors, which drives expansion, supported by abundant palm kernel oil supplies. Growing consumer preference for natural, plant-based, and biodegradable ingredients is significantly boosting lauric acid consumption, especially in skincare, haircare, soaps, and clean-label food formulations. It has versatile functional benefits, including antimicrobial activity, emulsification, foaming, and stabilizing properties.

| Key Insights | Details |

|---|---|

| Lauric Acid Market Size (2026E) | US$273.1 Mn |

| Market Value Forecast (2033F) | US$658.5 Mn |

| Projected Growth (CAGR 2026 to 2033) | 13.4% |

| Historical Market Growth (CAGR 2020 to 2025) | 12.9% |

Rising Demand in Personal Care and Cosmetics

Rising demand in personal care and cosmetics is one of the strongest drivers of the market, as the ingredient is widely valued for its natural origin, skin compatibility, and multifunctional performance. Lauric acid is a key fatty acid derived from coconut oil and palm kernel oil, making it a preferred choice for brands shifting toward plant-based and sustainable formulations. The antimicrobial, cleansing, and foaming properties make it essential in producing soaps, shampoos, cleansers, lotions, and high-performance skincare products.

The market is being driven by the shift toward clean beauty and natural surfactants, with lauric acid emerging as a safer alternative to synthetic chemicals. Simultaneously, growing hygiene awareness and increased use of personal wash products are fueling demand, particularly in developing regions. Additionally, the expansion of specialized skincare, such as acne-care products, is boosting the market, as lauric acid’s potent antimicrobial activity against acne-causing bacteria improves product effectiveness.

Raw Material Price Volatility

Production depends heavily on coconut oil and palm kernel oil, both of which are highly sensitive to environmental and supply-chain fluctuations. Variations in crop yields due to weather patterns, climate change, and seasonal productivity directly impact the availability and cost of these oils. Any disruption in major producing countries such as Indonesia, Malaysia, or the Philippines can trigger immediate price instability, creating uncertainty for manufacturers that rely on stable input costs for consistent production.

The vulnerability of the supply chain to geopolitical tensions, export policies, and labor shortages in plantation regions. Sudden shifts in trade regulations or sustainability requirements can also elevate production costs, affecting overall supply. As lauric acid demand continues to rise across cosmetics, food, and pharmaceuticals, strained raw material availability may intensify competitive pressure among buyers. This volatility complicates pricing and margin planning, especially for producers serving cost-sensitive sectors such as soaps, detergents, and mass-market personal care.

Emerging Bio-Based Pharmaceuticals

Emerging bio-based pharmaceuticals offer a significant growth opportunity for the lauric acid market, as the sector shifts toward natural, renewable raw materials in drug development. Lauric acid's antimicrobial, antiviral, and stabilizing properties position it as a key ingredient in active pharmaceutical ingredients (APIs), excipients, and intermediates, aligning with green chemistry and clean-label regulatory trends.

Interest in medium-chain fatty acids such as lauric acid is surging for therapeutic applications, including controlled-release systems, lipid-based drug delivery, and antimicrobial coatings valued for biodegradability and efficacy. Specific examples include monolaurin derivatives for antiviral treatments against influenza, herpes, and HIV; nanogel formulations with lauric acid for oral cancer therapy and wound healing; and excipients enhancing the bioavailability of hydrophobic drugs in skincare and anti-inflammatory products.

Ongoing R&D, such as lauric acid's role in inhibiting aldose reductase for diabetic complications and EGFR downregulation in tumor cells, underscores its potential. With rising demand for sustainable nutraceuticals and formulations, lauric acid producers stand to benefit from expanded pharmaceutical adoption globally.

The high purity segment is expected to dominate the lauric acid market, accounting for approximately 35% of the total revenue in 2026, primarily due to its essential role in industries requiring superior emulsification, consistency, and stringent quality control. In cosmetics, high purity grades are indispensable in facial creams, serums, and premium cleansers where product stability and skin compatibility are critical.

For example, the pharmaceutical sector, where controlled-release tablets and antimicrobial ointments utilize high-purity lauric acid to meet strict pharmacopoeia requirements. Its ability to enhance formulation performance while maintaining safety standards makes it the backbone of high-end applications. Growing consumer demand for clean beauty, combined with rising regulatory emphasis on ingredient transparency, further cements high purity lauric acid as the preferred grade.

The ultra high purity segment is likely to represent the fastest-growing purity types in 2026, driven by the rising adoption in next-generation pharmaceuticals and high-precision industries where ultra-clean ingredients are mandatory. In pharmaceutical R&D, this grade supports innovations in lipid-based drug delivery systems, enabling stable encapsulation and improved absorption of active compounds.

For example, several advanced formulations, including antimicrobial gels and sterile medical coatings, rely on ultra-pure lauric acid to achieve higher efficacy without compromising safety. Industries increasingly prioritize bio-based, high-purity materials to meet both performance standards and sustainability goals, driving escalating demand for ultra-refined lauric acid. This shift supports applications in premium cosmetics, advanced nutraceuticals, and clean-label pharmaceuticals, where its antimicrobial efficacy and stability enhance product quality without synthetic additives. Producers investing in purification technologies can capture growth in these high-value segments.

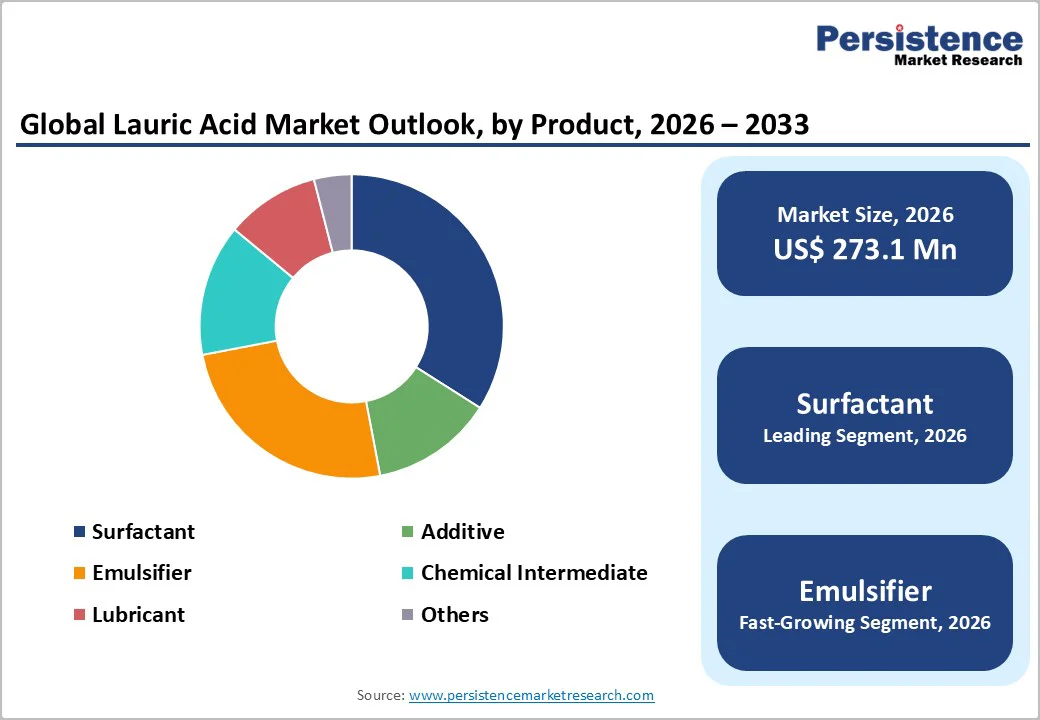

Surfactants are projected to lead the lauric acid market, capturing around 30% of the total revenue share in 2026, driven by their critical role in soaps, detergents, and cleansing formulations where foaming, emulsification, and mildness are essential. Lauric-acid-based surfactants are widely used in household detergents because they offer excellent cleaning power while remaining biodegradable and skin-friendly.

For example, many leading global FMCG brands utilize lauric-derived surfactants in their liquid soaps and dishwashing liquids to achieve rich foam and effective grease removal. This segment’s dominance is supported by rising hygiene awareness and expanding demand for natural surfactants in both emerging and developed markets.

Emulsifiers are likely to be the fastest-growing purity type in 2026, driven by escalating demand across food, beverages, cosmetics, and pharmaceutical formulations that require stability and consistency. In food applications, lauric-based emulsifiers are increasingly used in bakery creams, confectionery coatings, and plant-based dairy substitutes to enhance texture and extend shelf life.

For example, clean-label bakery brands often incorporate lauric-derived emulsifiers as they offer natural functionality without artificial additives. The shift toward cleaner formulations accelerates demand, as manufacturers seek plant-derived emulsifiers that support natural product claims.

The cosmetics & personal care segment is projected to lead the market in 2026, capturing around 29.5% of the total revenue share, driven by rising demand for gentle, natural, and antimicrobial ingredients in skin and hair formulations. Lauric acid is widely used in moisturizers, cleansers, acne-care products, and shampoos due to its mildness and strong antimicrobial effects.

For example, many acne-treatment brands incorporate lauric acid as it effectively targets acne-causing bacteria while remaining non-irritating compared to harsher chemicals. The clean-beauty movement strengthens this segment, as brands globally replace synthetic surfactants and emulsifiers with plant-based alternatives.

Pharmaceuticals are likely to be the fastest-growing end-user category in 2026, driven by increasing utilization of lauric acid in drug intermediates, antimicrobial formulations, lipid-based delivery systems, and bio-based APIs. In therapeutic development, lauric acid’s antimicrobial and antiviral properties enable its use in topical treatments, controlled-release dosage forms, and protective medical coatings.

For example, wound-care gels and medicated creams incorporate lauric acid for its ability to inhibit harmful pathogens while remaining skin-compatible. Increasing R&D investments, combined with the industry’s pivot toward natural excipients and sustainable processing, accelerate adoption.

North America Lauric Acid Market Trends

North America is likely to be a significant market for lauric acid in 2026, driven by rising adoption of lauric-based ingredients across personal care, home care, and specialty chemical applications. Consumers in the region increasingly prefer plant-derived, biodegradable, and non-toxic raw materials, which boosts the use of lauric acid in soaps, shampoos, skincare formulations, and cleansing products. Strong emphasis on skin-friendly and microbiome-safe formulations has encouraged manufacturers to incorporate lauric acid for its natural antimicrobial and stabilizing properties.

In the food and nutrition sector, North America is witnessing increasing use of lauric acid in functional foods, food-grade emulsifiers, and specialty fats, supported by the trend toward clean-label and plant-based ingredients. The region's well-established chemical manufacturing base also promotes innovation in laurate derivatives for industrial lubricants, plastic additives, and surfactants. The growing demand for premium personal care and natural cosmetics is prompting companies to shift toward sustainably sourced coconut- and palm-kernel-derived lauric acid, reinforcing regional market expansion.

Europe Lauric Acid Market Trends

Europe is likely to be a significant market for Lauric Acid in 2026, due to the increasing demand for sustainable and naturally derived ingredients across personal care, cosmetics, and household cleaning products. European consumers are highly attentive to ingredient transparency, pushing manufacturers to shift toward plant-based surfactants and fatty acids sourced from coconut and palm kernel oil. Lauric acid’s strong antibacterial and emulsifying properties make it a preferred choice for formulating eco-friendly soaps, sulfate-free shampoos, skincare emulsions, and specialty detergents.

Europe is seeing rising innovation in lauric-acid-based functional ingredients, especially in specialty esters and green surfactants used across cosmetics, food emulsifiers, and pharmaceutical excipients. R&D investments by regional chemical companies are enabling the development of higher-purity lauric derivatives that offer improved stability, mildness, and performance. This growing focus on advanced formulations is expanding the application scope of lauric acid, positioning Europe as a center for product innovation and sustainable ingredient development.

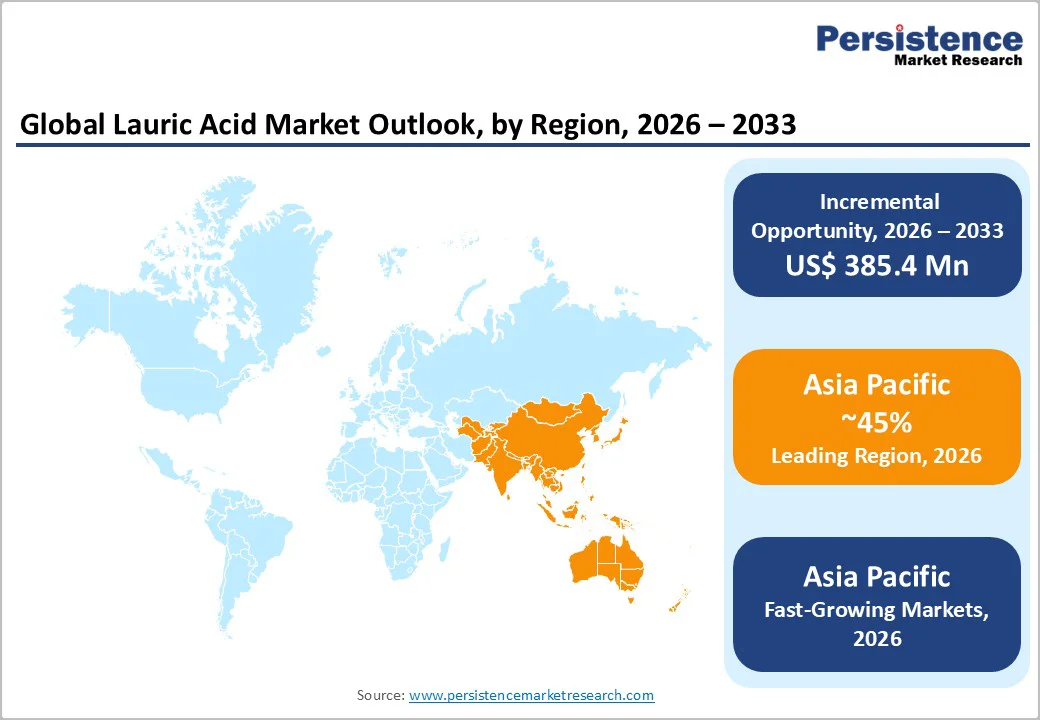

Asia Pacific Lauric Acid Market Trends

The Asia Pacific region is anticipated to lead, accounting for a 35% market share in 2026, driven by abundant raw material availability from major coconut- and palm-producing countries such as Indonesia, the Philippines, Malaysia, and India. This steady supply base supports large-scale manufacturing of lauric-acid–based derivatives, strengthening the region’s position in oleo chemicals and surfactants. Rapid expansion of the personal care, home care, and processed food industries fuels demand, as lauric acid is widely used in soaps, detergents, emulsifiers, and specialty surfactants.

Asia Pacific benefits from the rising industrial investments in downstream processing facilities and advancements in enzyme-based extraction technologies, which enhance quality and production efficiency. The shift toward sustainable and renewable chemical ingredients is encouraging manufacturers to expand lauric-acid–based green surfactants, particularly in Japan, South Korea, and Australia. Strong export activity, especially in refined lauric oils and value-added derivatives, supports regional market expansion.

The global lauric acid market exhibits a moderately fragmented structure, driven by expanding applications across personal care, food processing, industrial chemicals, and pharmaceuticals. Market competitiveness is shaped by factors such as raw material sourcing efficiency, sustainable production methods, and technological upgrades in fatty acid processing. With key leaders including IOI Oleochemical, Wilmar International, KLK Oleo, Musim Mas, Emery Oleochemicals, Pacific Oleochemicals, and Oleon, the competitive environment remains intense.

These players compete through innovations in specialty lauric acid derivatives, improved extraction efficiencies, and expanded global distribution networks. Strategic initiatives such as joint ventures in Southeast Asia, capacity expansions near feedstock hubs, and certifications for sustainability are increasingly utilized to strengthen market presence. Companies are also enhancing their product portfolios with customizable purity grades tailored for premium personal care, high-performance industrial surfactants, and food-grade emulsifiers, helping them secure long-term partnerships with major downstream manufacturers.

The global lauric acid market is projected to reach US$273.1 million in 2026.

The growing adoption of high-purity lauric acid in pharmaceuticals and clean-label food and cosmetic formulations present major market opportunities.

The lauric acid market is expected to grow at a CAGR of 13.4% from 2026 to 2033.

The lauric acid market lies in the rising demand for high-purity, bio-based ingredients in pharmaceuticals, personal care, and food applications.

Kao Corporation, Bakrie Group, KLK OLEO, Permata Hijau, Acme-Hardesty, Emery Oleochemicals, IOI Oleo GmbH, and Godrej Industries are the leading players.

| Report Attribute | Details |

|---|---|

| Historical Data/Actuals | 2020 - 2025 |

| Forecast Period | 2026 - 2033 |

| Market Analysis | Value: US$ Mn |

| Geographical Coverage |

|

| Segmental Coverage |

|

| Competitive Analysis |

|

| Report Highlights |

|

By Purity Type

By Application

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author