- Executive Summary

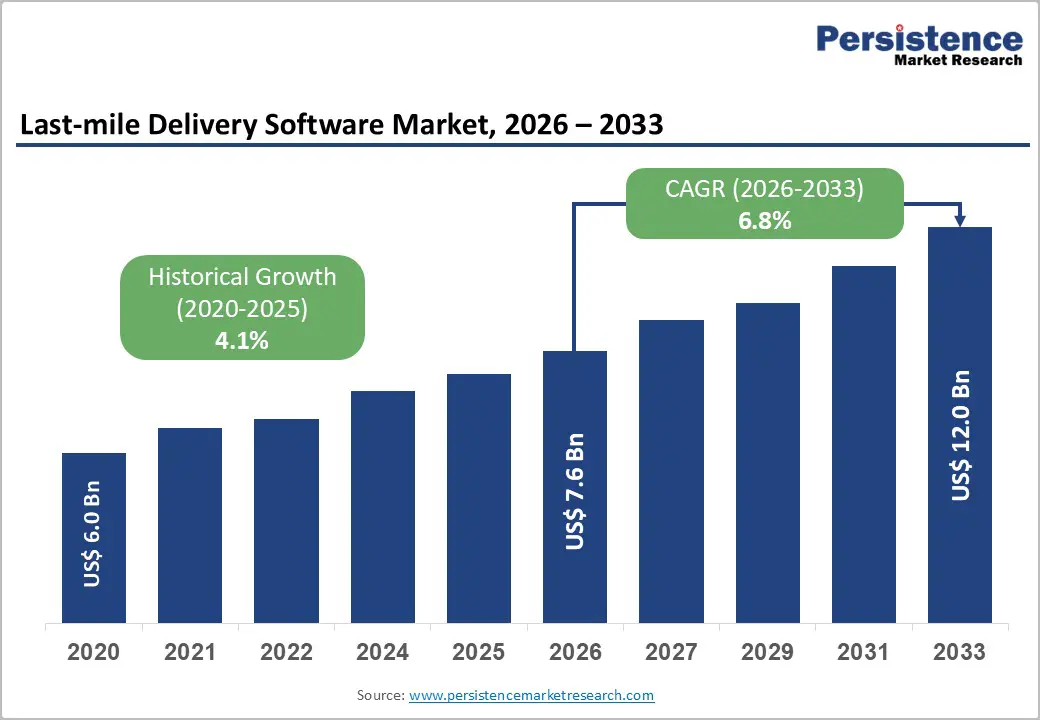

- Global Last-mile Delivery Software Market Snapshot 2026 and 2033

- Market Opportunity Assessment, 2026-2033, US$ Bn

- Key Market Trends

- Industry Developments and Key Market Events

- Demand Side and Supply Side Analysis

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definitions

- Value Chain Analysis

- Macro-Economic Factors

- Global GDP Outlook

- Global IT Industry Overview

- Forecast Factors – Relevance and Impact

- COVID-19 Impact Assessment

- PESTLE Analysis

- Porter's Five Forces Analysis

- Geopolitical Tensions: Market Impact

- Regulatory and Technology Landscape

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Trends

- Price Trend Analysis, 2020 – 2033

- Region-wise Price Analysis

- Price by Segments

- Price Impact Factors

- Global Last-mile Delivery Software Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

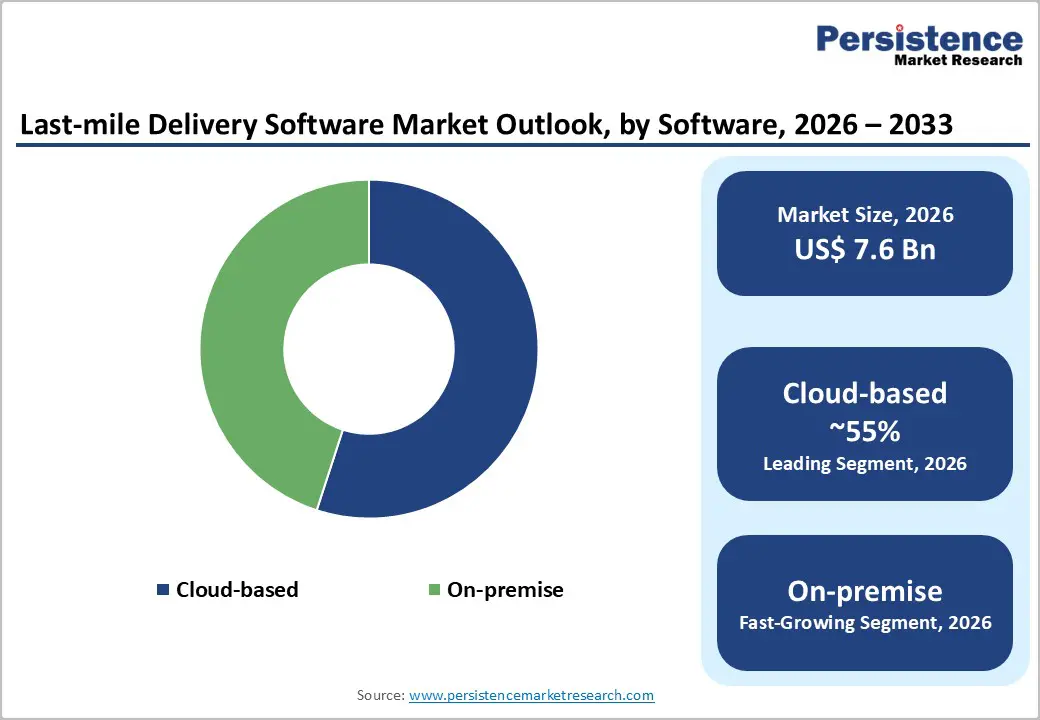

- Global Last-mile Delivery Software Market Outlook: By Software

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by By Software, 2020-2025

- Current Market Size (US$ Bn) Forecast, by By Software, 2026-2033

- On-premise

- Cloud-based

- Market Attractiveness Analysis: By Software

- Global Last-mile Delivery Software Market Outlook: By Application

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by By Application, 2020-2025

- Current Market Size (US$ Bn) Forecast, by By Application, 2026-2033

- Courier, Express, and Parcel

- Retail and FMCG

- Transportation

- BFSI

- E-commerce

- Manufacturing

- Pharmaceutical

- Market Attractiveness Analysis: By Application

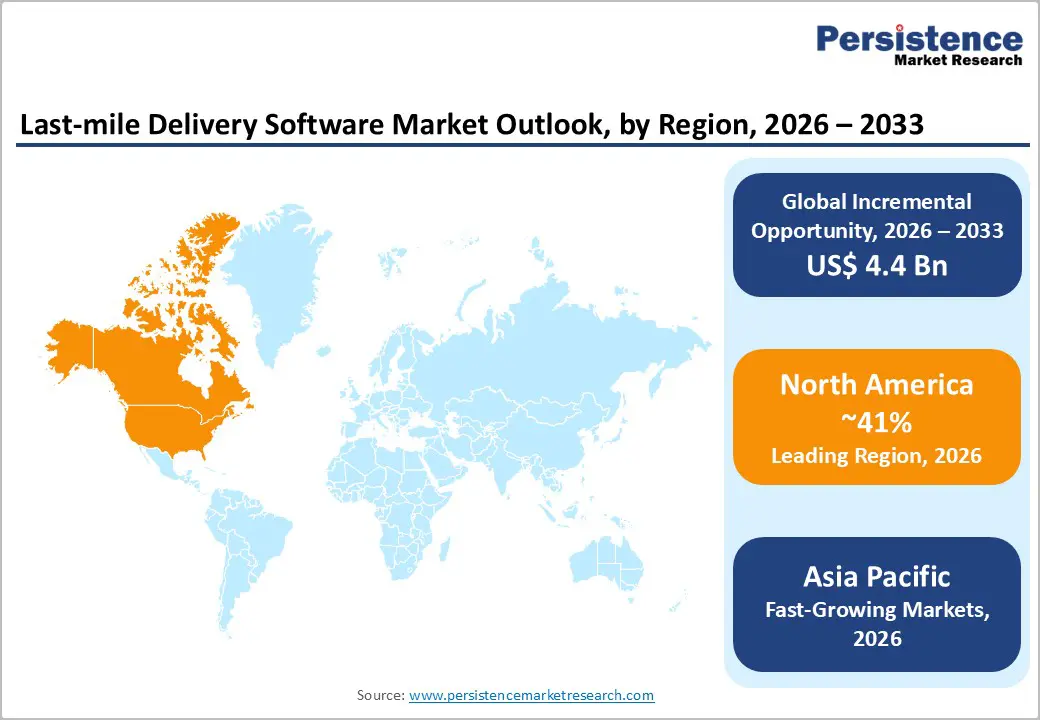

- Global Last-mile Delivery Software Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Bn) Analysis by Region, 2020-2025

- Current Market Size (US$ Bn) Forecast, by Region, 2026-2033

- North America

- Europe

- East Asia

- South Asia & Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Last-mile Delivery Software Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- North America Market Size (US$ Bn) Forecast, by Country, 2026-2033

- U.S.

- Canada

- North America Market Size (US$ Bn) Forecast, by By Software, 2026-2033

- On-premise

- Cloud-based

- North America Market Size (US$ Bn) Forecast, by By Application, 2026-2033

- Courier, Express, and Parcel

- Retail and FMCG

- Transportation

- BFSI

- E-commerce

- Manufacturing

- Pharmaceutical

- Europe Last-mile Delivery Software Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- Europe Market Size (US$ Bn) Forecast, by Country, 2026-2033

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- Rest of Europe

- Europe Market Size (US$ Bn) Forecast, by By Software, 2026-2033

- On-premise

- Cloud-based

- Europe Market Size (US$ Bn) Forecast, by By Application, 2026-2033

- Courier, Express, and Parcel

- Retail and FMCG

- Transportation

- BFSI

- E-commerce

- Manufacturing

- Pharmaceutical

- East Asia Last-mile Delivery Software Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- East Asia Market Size (US$ Bn) Forecast, by Country, 2026-2033

- China

- Japan

- South Korea

- East Asia Market Size (US$ Bn) Forecast, by By Software, 2026-2033

- On-premise

- Cloud-based

- East Asia Market Size (US$ Bn) Forecast, by By Application, 2026-2033

- Courier, Express, and Parcel

- Retail and FMCG

- Transportation

- BFSI

- E-commerce

- Manufacturing

- Pharmaceutical

- South Asia & Oceania Last-mile Delivery Software Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Country, 2026-2033

- India

- Southeast Asia

- ANZ

- Rest of SAO

- South Asia & Oceania Market Size (US$ Bn) Forecast, by By Software, 2026-2033

- On-premise

- Cloud-based

- South Asia & Oceania Market Size (US$ Bn) Forecast, by By Application, 2026-2033

- Courier, Express, and Parcel

- Retail and FMCG

- Transportation

- BFSI

- E-commerce

- Manufacturing

- Pharmaceutical

- Latin America Last-mile Delivery Software Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- Latin America Market Size (US$ Bn) Forecast, by Country, 2026-2033

- Brazil

- Mexico

- Rest of LATAM

- Latin America Market Size (US$ Bn) Forecast, by By Software, 2026-2033

- On-premise

- Cloud-based

- Latin America Market Size (US$ Bn) Forecast, by By Application, 2026-2033

- Courier, Express, and Parcel

- Retail and FMCG

- Transportation

- BFSI

- E-commerce

- Manufacturing

- Pharmaceutical

- Middle East & Africa Last-mile Delivery Software Market Outlook: Historical (2020 – 2025) and Forecast (2026 – 2033)

- Key Highlights

- Pricing Analysis

- Middle East & Africa Market Size (US$ Bn) Forecast, by Country, 2026-2033

- GCC Countries

- South Africa

- Northern Africa

- Rest of MEA

- Middle East & Africa Market Size (US$ Bn) Forecast, by By Software, 2026-2033

- On-premise

- Cloud-based

- Middle East & Africa Market Size (US$ Bn) Forecast, by By Application, 2026-2033

- Courier, Express, and Parcel

- Retail and FMCG

- Transportation

- BFSI

- E-commerce

- Manufacturing

- Pharmaceutical

- Competition Landscape

- Market Share Analysis, 2025

- Market Structure

- Competition Intensity Mapping

- Competition Dashboard

- Company Profiles

- Oracle Corporation

- Company Overview

- Product Portfolio/Offerings

- Key Financials

- SWOT Analysis

- Company Strategy and Key Developments

- Kahnua

- FarEye

- Locus Robotics Corp.

- DESCARTES

- Track-POD

- Google LLC

- BRINGG Delivery Technologies

- Final Mile

- Amazon.com, Inc.

- Uber Technologies, Inc.

- Microsoft Corporation

- SAP SE

- LogiNext

- Zippykind

- Oracle Corporation

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment