Industry: Consumer Goods

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Report Type: Ongoing

Report ID: PMRREP34409

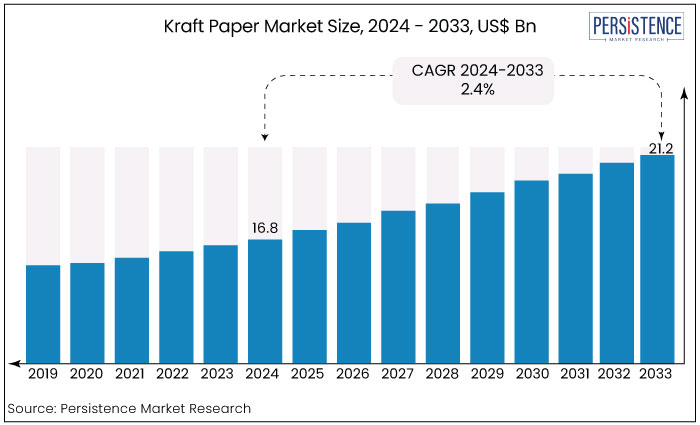

The global market for kraft paper is forecast to expand at a CAGR of 2.4% and thereby increase from a value of US$ 16.8 Bn in 2024, to US$ 21.2 Bn by the end of 2033.

|

Attributes |

Key Insights |

|

Market Size (2024E) |

US$ 16.8 Bn |

|

Projected Market Value (2033F) |

US$ 21.2 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2033) |

2.4% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

2.2% |

The kraft paper market stands as a pivotal sector within the global packaging industry, characterized by its unique features and growing significance in sustainable packaging solutions.

Kraft paper, renowned for its strength, durability, and eco-friendliness, has emerged as a preferred choice for packaging materials across various industries.

Its inherent ability to withstand high tensile strength and resist tearing makes it ideal for packaging heavy goods, as its recyclability and biodegradability align with the increasing demand for environment-friendly packaging options.

The market has witnessed a surge in demand driven by the escalating e-commerce sector, where sturdy packaging materials are essential for safe transit.

Moreover, the rising consumer consciousness towards sustainability has propelled the adoption of kraft paper-based packaging solutions among businesses aiming to reduce their carbon footprint.

Beyond its utility in packaging, kraft paper finds applications in various sectors, such as food and beverage, retail, logistics, and construction. Its versatility, coupled with advancements in manufacturing technologies, further enhances its appeal in diverse industries.

The market share is witnessing growth as it addresses the immediate packaging needs of industries and aligns with global sustainability goals, making it a pivotal player in the ever-evolving landscape of packaging materials.

The growing trend of online shopping is boosting the kraft paper demand as the rise in the popularity of buying products from online platforms has resulted in the enhancement of the quality and value of kraft packaging.

Prominent participants are thus expected to experience substantial growth prospects as a result of the extensive adoption of e-commerce.

Kraft paper is extensively utilized as a primary material in the packaging sector due to its distinctive characteristics, including strong resistance to folding, durability, exceptional tear resistance, and superior compression capabilities.

The growth of the e-commerce industry is complementing the sales of paper and paperboard packaging items, including bags, envelopes, boxes, and cartons, which is driving market growth.

Consequently, the expansion of the e-commerce industry is expected to propel the global market for kraft paper during the forecast period.

The kraft paper market was valued at US$15.3 Bn in the year 2019 and experienced a staggering growth rate of 2.2% during the historical period 2019 to 2023, to reach a valuation of US$16.4 Bn in the year 2023.

The use of kraft paper is increasing in several industries, such as building and construction, food and beverage, personal care, cosmetics, and e-commerce, due to numerous benefits such as cost-effectiveness, recyclability, convenient shipping, easy customization, and compatibility.

The increasing need for functional packaging solutions to safeguard items during transportation is generating positive opportunities for the kraft paper industry.

Due to its strength, durability, eco-friendliness, aesthetics, and functionality, kraft paper is experiencing increased demand in several industrial domains, eventually earning a substantial market share.

Growth of e-Commerce industry

The exponential growth of the e-commerce sector stands as a primary driver propelling the expansion of the global kraft paper market. With the increasing preference for online shopping, the need for secure and durable packaging solutions has surged during the historical period.

Kraft paper, with its exceptional strength and tear resistance, addresses this demand effectively, ensuring the safe transit of goods from seller to buyer, eventually aiding the growth of the market size during the forecast period.

The rise of sustainable packaging initiatives in the e-commerce sector further amplifies the demand for kraft paper-based solutions as businesses strive to align with environment-friendly goals while maintaining packaging integrity and customer satisfaction.

Consumer Preferences for Eco-friendly Packaging Solutions

A significant driving element for the global market share globally is the shifting consumer preferences towards eco-friendly packaging solutions.

With increased awareness regarding environmental conservation, consumers are increasingly favoring products packaged in materials that are recyclable, biodegradable, and sourced sustainably.

Kraft paper, being inherently eco-friendly and renewable, perfectly aligns with these preferences.

As consumers actively seek out products with minimal environmental impact, businesses across industries are turning to kraft paper-based packaging solutions to meet this demand, driving the expansion of the market and fostering a more sustainable packaging ecosystem.

Availability of Raw Materials

The limited availability of raw materials is one of the major growth restraining factors for the kraft paper market, with limited production capacity being another crucial restraint.

The manufacturing of kraft paper heavily relies on wood pulp, which is susceptible to fluctuations in supply due to factors such as forestry practices, climate change impacts, and regulatory restrictions.

Further, the expanding production capacity to meet growing demand entails substantial investments in infrastructure and machinery, which may pose challenges for market players, particularly smaller manufacturers.

Consequently, the constrained availability of raw materials and production capacity can impede the market's ability to fully capitalize on the burgeoning demand for Kraft paper-based packaging solutions, restraining its growth potential.

High Production Costs

One of the major market-impeding factors for the global kraft paper market is the high costs incurred for its production and adoption.

While kraft paper is known for its strength and eco-friendliness, its manufacturing process often involves higher production costs compared to conventional packaging materials.

Fluctuations in raw material prices, particularly in the pulp and paper industry, can further exacerbate production expenses.

As a result, businesses may be hesitant to fully embrace kraft paper-based packaging solutions, especially when cost competitiveness is a critical factor in their decision-making process, thereby hindering the market's widespread adoption.

Soaring Popularity of Sustainable Packaging Formats

The rise of a more sustainable packaging solution is an emerging opportunity for global kraft paper manufacturers.

With increasing awareness of environmental issues and consumer preferences shifting towards eco-friendly products, there's a growing demand for sustainable packaging solutions.

Kraft paper, being recyclable, biodegradable, and sourced from renewable materials, is well-positioned to capitalize on this trend.

Manufacturers of kraft paper can leverage this opportunity by innovating with eco-friendly packaging designs, promoting the environmental benefits of kraft paper, and collaborating with brands committed to sustainability, thus tapping into a burgeoning market segment and establishing a competitive edge.

Exceptional Rise in e-Commerce Packaging Solutions

Another prominent opportunity for the market lies in the expansion of e-commerce packaging solutions.

The booming e-commerce sector, fuelled by changing consumer shopping habits and digitalization, requires robust packaging materials to ensure the safe and secure delivery of goods.

Kraft paper, known for its strength, durability, and ability to withstand shipping stresses, presents an ideal solution for e-commerce packaging needs.

Kraft paper market companies can capitalize on this opportunity by offering customized kraft paper packaging solutions tailored to the unique requirements of online retailers, enhancing brand visibility and customer satisfaction, and positioning kraft paper as the go-to choice for e-commerce packaging.

Speciality Kraft Paper Retains Dominance with 82% Value Share

|

Market Segment by Product Type |

Market Value Share (2023) |

|

Speciality Kraft Paper |

82% |

Based on product type, the global kraft paper market is further sub-segmented into speciality kraft paper and sack kraft paper, where speciality kraft paper dominates the market share.

The dominance of the speciality kraft paper segment is attributed to the growing demand for visual aesthetics and high-quality paper packaging materials for packaging luxury items, gourmet foods and drinks.

Further, the increased initiatives by major kraft paper manufacturers to develop innovative speciality kraft paper products with enhanced properties like printability, strength and barrier coatings are helping the growth of the market share on a global note.

With such key initiatives, the end products are creating new opportunities for the kraft papers to be used in a multitude of applications.

F&B Spearheads with a Market Share of over 26%

|

Market Segment by End User |

Market Value Share (2023) |

|

Food & Beverages |

26% |

Based on end user segmentation, the market is further divided into food & beverages, buildings & construction and healthcare & pharmaceuticals, where the food & beverages segment own the major market share.

This is due to the extensive use of kraft paper in packaging perishable goods, such as fruits, vegetables, and dairy products.

The retail & consumer goods segment follows closely, driven by the demand for eco-friendly packaging solutions in the retail industry.

Additionally, the healthcare & pharmaceuticals sector shows promise for growth, spurred by the need for sterile and hygienic packaging materials for medical supplies and pharmaceutical products.

North America Leads the Way with a Market Share of 35%

|

Region |

Market Value Share |

|

North America |

35% |

North America stands as one of the leading regional markets for the kraft paper market. The region's robust manufacturing sector, coupled with stringent environmental regulations promoting sustainable practices, fosters a conducive environment for the adoption of kraft paper-based packaging solutions.

Moreover, the growing e-commerce sector and increasing consumer preference for eco-friendly packaging materials drive the demand for kraft paper in North American region.

Europe emerges as a prominent regional market for kraft paper, propelled by the region's strong emphasis on environmental sustainability and recycling initiatives.

The European Union's stringent regulations promoting the use of renewable and recyclable materials further bolster the demand for kraft paper-based packaging solutions across various industries.

The presence of key players in the packaging industry and the rising trend of eco-conscious consumer behaviour contribute to the growth of the market share in Europe.

Further, the Asia Pacific region represents a rapidly growing regional market for kraft paper, fuelled by the region's expanding manufacturing sector, particularly in countries like India, and China.

The burgeoning e-commerce industry, coupled with increasing urbanization and disposable incomes, drives the demand for kraft paper packaging solutions in the region.

The growing awareness regarding environmental conservation and the adoption of sustainable packaging practices contribute to the uptake of market size in Asia Pacific.

October 2022 –

Mondi PLC signed a partnership deal with Reckitt to launch paper-based packaging for dishwater tabs with less than 75% plastic, aiming to provide an eco-friendly packaging solution.

June 2022 –

Stora Enso Oyj introduced its premium white top kraft liner called, ‘AvantForte WhiteTop’ for packaging premium segments like fresh food, e-commerce goods and shelf-ready packaging.

April 2022 –

WestRock Company signed a partnership deal with Swiss Chalet and launched recyclable paperboard packaging for a restaurant chain using recycled fiber.

The major competitors in the kraft paper market are primarily evaluated based on their product or service offerings, their financial statements, developments and the approaches implemented, the company's position in the global market scenario and its geographical reach.

Apart from this, the key competitors studied have also been accessed through the SWOT analysis to understand their strengths, weaknesses, opportunities and threats.

Apart from this, the key competitors in the industry employ crucial strategies like partnership deals, mergers and acquisitions, and business expansion deals to strengthen their hold on a particular region or a particular service offering.

|

Attributes |

Details |

|

Forecast Period |

2024 - 2033 |

|

Historical Data Available for |

2019 - 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Countries Covered |

|

|

Key Companies Profiled |

|

|

Pricing |

Available upon request |

By Product Type

By End Use

By Grade

By Region

To know more about delivery timeline for this report Contact Sales

The global kraft storage market size was valued at US$16.8 billion as of 2024.

North America holds the major market share.

Europe is predicted to exhibit the highest growth rate during the forecast period.

WestRock Company, Mondi Group Plc., Canfor Corporation, Natron-Hayat d.o.o., and International Paper Company are some of the top players in this industry.

The food & beverages segment continues to hold a dominant share of the market.