Comprehensive Snapshot of Iodine Market Research Report, Including Country and Regional Analysis in Brief.

Industry: Chemicals and Materials

Published Date: April-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 190

Report ID: PMRREP3591

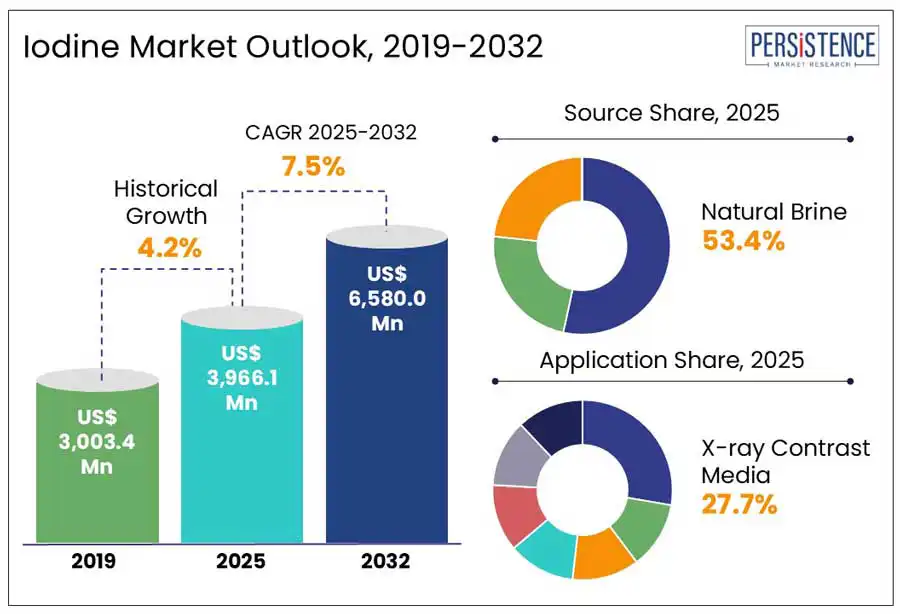

According to Persistence Market Research, the global iodine market is poised for significant expansion, with its size projected to grow from USD 3,966.1 million in 2025 to USD 6,580.0 million by 2032, reflecting a robust CAGR of 7.5% during the forecast period. This trajectory is due to the rising demand for contrast media in diagnostic imaging, the growing use of derivatives in the pharmaceutical and specialty chemical sectors, and increasing adoption in biocides, paints, and coatings. Chile and Japan are leading producers, together accounting for over 90% of global output, while the top five manufacturing companies hold 60% to 65% of the market share in 2024, reflecting a consolidated landscape. Opportunities are emerging across high-purity applications in electronics and sustainable agriculture, with trends highlighting capacity expansions, advanced extraction technologies, and a focus on R&D to support iodine-sufficient areas and drive innovation.

|

Global Market Attribute |

Details |

|

Global Iodine Market Size (2024A) |

US$ 3,689.4 Million |

|

Estimated Market Size (2025E) |

US$ 3,966.1 Million |

|

Projected Market Value (2032F) |

US$ 6,580.0 Million |

|

Value CAGR (2025 to 2032) |

7.5% |

Between 2019 and 2024, the market witnessed steady growth driven by expansion in pharmaceutical, nutrition, and industrial sectors, with companies enhancing production capacity and entering strategic collaborations.

Growing healthcare needs, stable pricing, and consistent demand for derivatives in biocides and coatings supported overall market resilience. Looking ahead to 2025–2032, the industry is poised for continued advancement, backed by technological innovations and expanding end-use applications in diagnostics, electronics, and agrochemicals.

Rising investments in R&D and contrast media manufacturing, along with global efforts toward clean energy transitions, are set to unlock new opportunities across diverse sectors.

Iodine is widely utilized as a contrast agent in radiographic modalities due to its high atomic number and density, which enhance contrast between tissues, organs, and blood vessels. Iodinated contrast media, especially non-ionic and water-soluble variants, are preferred for their safety and rapid absorption. Their temporary interaction with imaging tools makes them essential in various diagnostic procedures, including gastrointestinal and cardiovascular imaging.

Reinforcing this clinical reliance, in Oct 2022, GE Healthcare entered a supply agreement with Sociedad Química Minera (SQM) with year-on-year basis to secure essential inputs for contrast media production used in X-ray and CT imaging. The partnership includes a new production line in Ireland and is projected to support an additional 30 million patient doses annually by 2025, demonstrating the growing demand and strategic investment in advanced medical imaging solutions.

Iodine is extensively employed as a catalyst in organic synthesis due to its environmental stability and efficiency in driving key reactions such as esterification, acylation, allylation, cycloaddition, and oxidation of benzylic alcohols. These processes are essential in producing organic acids and intermediates like acetic acid, which serve as building blocks for a wide range of industrial chemical applications. Its non-toxic catalytic profile makes it a preferred alternative to transition metals, aligning well with sustainability goals in modern chemical manufacturing.

Reflecting these advantages, companies are expanding production and derivative capabilities. Calibre Chemicals strengthened its position through the acquisition of RheinPerChemie GmbH and the laboratory division of Tina Life Sciences, enhancing R&D and custom manufacturing expertise. Iofina plc is scaling up capacity with a new facility in Western Oklahoma, leveraging IOsorb® technology, while also experiencing rising demand for biocide derivatives in coatings. Further upstream, HELM AG’s joint venture with ACF Minera in Chile is increasing output of iodine-rich potassium nitrate, signaling sustained industrial momentum within the market.

The growing availability of alternatives such as bromine, chlorine, antibiotics, and boron for applications like biocides, colorants, and inks is expected to suppress global demand. In addition, persistent price volatility, fluctuating annually and quarterly, creates uncertainty for manufacturers and affects long-term profitability.

Potential toxicity risks from excessive intake, along with low public awareness of its nutritional importance in developing regions, continue to act as barriers. Furthermore, limited investments in mining and extraction activities, influenced by the global economic slowdown, are restricting supply-side expansion and impeding overall market growth.

The expanding application of radiopharmaceuticals in oncology propels demand for iodine-based isotopes, particularly Iodine-131 and Iodine-123. These isotopes are essential in treating thyroid cancer and hyperthyroidism, with global thyroid cancer cases projected to rise by 4.2% annually through 2030. In the U.S., nearly 44,000 new thyroid cancer cases are expected in 2025, supporting a parallel surge in demand for therapeutic isotopes.

Companies focusing on precision oncology are investing in scalable isotope supply chains, and the growing preference for targeted radionuclide therapy reinforces the relevance of iodine in cancer care. Radiopharmaceutical players are integrating advanced isotope production facilities, including cyclotron and nuclear reactor-based synthesis methods. Strategic collaborations between medical institutions and nuclear technology providers accelerate access to iodine-based isotopes in North America and Europe.

As governments increase funding for cancer care, and diagnostic accuracy becomes more critical in early-stage detection, iodine-based medical isotopes are positioned as essential components in next-generation therapeutic frameworks.

The iodine market in the United States is projected to expand at a CAGR of 7.3% during the forecast period, driven by robust expansion across industrial and manufacturing sectors.

Growth is fueled by increasing usage in multiple applications, including as a disinfectant and a stabilizer in plastic manufacturing. Its role as a catalyst in chemical production further supports its rising demand. With industries prioritizing functional additives that offer stability and antimicrobial benefits, sales are expected to maintain an upward trajectory, reinforcing the material's industrial relevance in the country.

The government's salt iodization program launched to combat iodine deficiency disorders (IDD) has led to significant improvements with 76.3% of households now consuming adequately iodized salt. Hence, demand is shaped by the dual drivers of public health initiatives and rising industrial applications. This intervention has contributed to a notable decline in Total Goiter Rate (TGR), though disparities persist across states and union territories.

Despite being one of the largest producers globally, with an annual output of 65 lakh metric tonnes of iodized salt, India still faces challenges such as limited access in rural areas and a lack of awareness regarding IDD. Over 200 million people remain at risk, and 263 out of 324 surveyed districts are still classified as IDD-endemic indicating a continued need for intervention.

On the industrial front, usage continues to rise in sectors such as pharmaceuticals, chemicals, and nutrition, reinforcing its relevance beyond healthcare. As national health goals converge with expanding industrial demand, the market is poised for sustained growth supported by both policy and production capacity.

The X-ray contrast media segment is projected to account for a dominant position, growing at a CAGR of 7.7% during the forecast period. This growth is primarily fueled by the rising use of imaging technologies such as X-ray and CT scans, where contrast agents improve the visualization of organs and tissues. The rise in aging population and the increasing prevalence of chronic conditions like heart disease, cancer, and diabetes are further boosting demand for these procedures, particularly in developed healthcare systems.

Advanced imaging modalities are witnessing rapid growth, with CT scans increasing from 52 to 149 and MRI scans from 17 to 65 per 1,000 people. Ultrasound use has also grown significantly, reinforcing the trend toward greater diagnostic imaging reliance. Additionally, around 350 million imaging exams are conducted annually on children under 15, highlighting the need for safe and effective contrast agents in pediatric care. This is expected to continue driving segment demand across global medical settings.

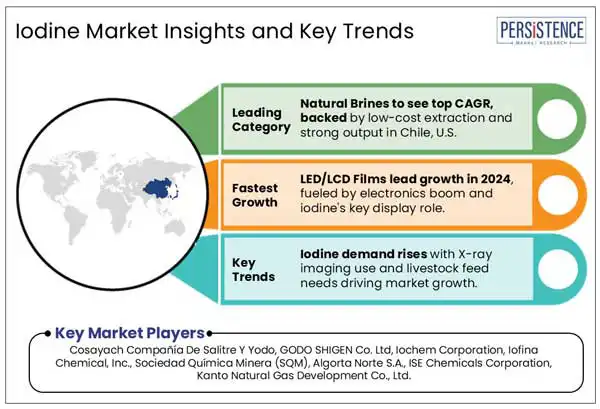

Natural brine stands out as the leading source, accounting for 53.4% of global supply in 2024. Sourced from underground reservoirs and coastal deposits, this brine is rich in inorganic compounds essential for thyroid function and hormone regulation. Its high concentration makes it a preferred raw material for producing iodized salt and various food-grade additives, supporting nutritional health on a large scale.

Countries such as the United States and Japan, endowed with iodine-rich brine reserves, play a vital role in meeting global demand. The use of brine-derived resources extends beyond food and nutrition, supporting applications in pharmaceuticals and contrast media production. This growing reliance on naturally occurring sources ensures a stable and efficient supply chain for diverse industries.

The global iodine market is consolidated, with a small number of players holding significant shares due to control over critical raw material sources and established distribution networks.

Competition is shaped by the need for supply security, regulatory compliance, and technological capabilities in refining and derivative development. Players focus on scaling production and maintaining cost efficiency, creating high entry barriers for new participants. The overall structure supports stable pricing and long-term supply contracts with end-use industries.

|

Report Attribute |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data |

2019 to 2024 |

|

Market Analysis |

Value (US$ Million), Volume (Tons) |

|

Key Countries Covered |

United States, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, Benelux, Nordics, Poland, Russia, China, Japan, South Korea, India, ASEAN, Australia & New Zealand, GCC Countries, Türkiye, South Africa |

|

Key Market Segments |

|

|

Key Companies Profiled |

|

|

Report Coverage |

Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunity Analysis, Challenges, Strategic Growth Initiatives, Customization and Pricing (Available upon Request) |

By Source

By Application

By Region

To know more about delivery timeline for this report Contact Sales

The global market is projected to be valued at US$ 3,966.1 Million in 2025.

The X-ray contrast media segment is projected to capture a 27.7% share in 2024, driven by rising demand for advanced diagnostic imaging procedures. Its widespread use in CT and X-ray scans supports early disease detection and treatment planning.

The market is poised to witness a CAGR of 7.5% from 2025 to 2032.

The growing demand for iodine in X-ray contrast media for medical imaging and its rising use in animal feed additives for livestock industry are key drivers fueling the iodine market growth.

The opportunities include expansion in brine-based extraction, growth in LED/LCD polarizing films, advancements in catalysts for chemical synthesis, and growth in human nutrition via iodized salt, driven by increasing demand for sustainable extraction methods, booming consumer electronics, advancements in industrial processes and global health initiatives promoting iodine fortification.

The leading players include Cosayach Compañía De Salitre Y Yodo, GODO SHIGEN Co. Ltd, Iochem Corporation, Iofina Chemical, Inc., Sociedad Química Minera (SQM), Algorta Norte S.A., ISE Chemicals Corporation, Kanto Natural Gas Development Co., Ltd.