Industry: Automotive & Transportation

Published Date: December-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 188

Report ID: PMRREP35001

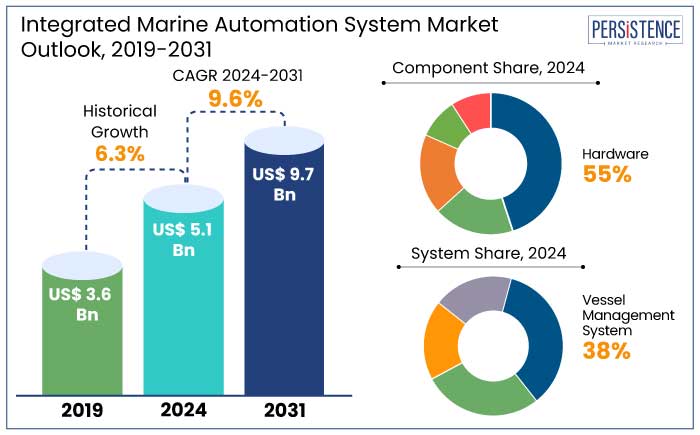

The global integrated marine automation system market is estimated to reach a valuation of US$ 5.1 Bn by 2024. It is anticipated to experience a CAGR of 9.6% during the assessment period to reach a value of US$ 9.7 Bn by 2031.

Approximately, 70% of new vessels are predicted to incorporate advanced automation systems by 2031 thereby reflecting an increasing penetration across commercial, defense, and offshore sectors. Prominent projects like Mayflower Autonomous Ship 2.0 along with the ongoing expansion of Yara Birkeland operations are likely to accelerate the demand for fully integrated automation systems.

Autonomous ships are projected to account for 25% of all new ship deliveries by 2030, thereby improving navigation, propulsion, and control system integration. Rolls Royce is progressively investing in autonomous vessel technology, aiming to commercialize intelligent ships that are equipped with advanced sensors, AI, and machine learning capability by 2035.

Automation systems are likely to play a pivotal role in optimizing fuel consumption, enhancing engine efficiency, and monitoring compliance. Investments in automation systems for emission reductions are likely to grow by 12% to 15% annually.

Key Highlights of the Industry

|

Market Attributes |

Key Insights |

|

Integrated Marine Automation System Market Size (2024E) |

US$ 5.1 Bn |

|

Projected Market Value (2031F) |

US$ 9.7 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

9.6% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

6.3% |

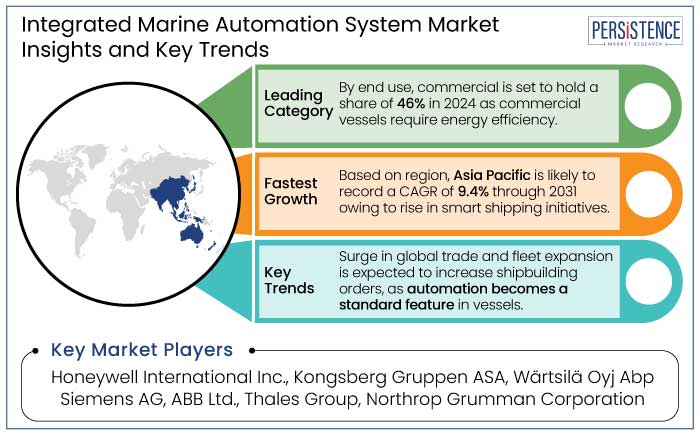

Asia Pacific is anticipated to emerge as the leading region with a value share of 41.4% in 2024. The region accounts for 80% of the global shipbuilding capacity. Countries including China, Japan, and South Korea are home to the largest shipyards and are also prominent exporters of commercial vessels.

China alone accounts for 40% of global shipbuilding output. Around 60% to 70% of new vessels ordered in Asia Pacific in the next decade are likely to integrate IMAS solutions to optimize operations, improve fuel efficiency, and cater to the increasing regulatory standards. The region is witnessing a rise in smart shipping initiatives that focus on integrating autonomous and automated technologies in their fleets.

The Smart Shipyard initiative of South Korea, launched by shipbuilders like Hyundai Heavy Industries and Samsung Heavy Industries focuses on incorporating AI and automation in new ship designs.

Asia Pacific is a leader in digital connectivity and IoT, with countries like Japan, South Korea, and China already investing in 5G technology, thereby improving connectivity of vessels. Port Authority of Singapore is integrating automated container terminals that rely on smart technologies for port operations.

Hardware is estimated to account for 55% of market share in 2024. Hardware components like GPS, radars, control systems, actuators, and electronic sensors form the backbone of IMAS by allowing automated functions like propulsion, navigation, and cargo management.

Autonomous and semi-autonomous vessels require highly advanced sensors and control systems to navigate, monitor, and respond to their environment without human intervention. Hardware-based Integrated Bridge Systems (IBS) are integral to the smooth operation of marine automation. For instance,

Rise in pressure from international maritime regulators like IMO and EU for stringent emission standards has resulted in the development of automation solutions that incorporate hardware-based emission control systems. As global shipping fleets modernize to comply with the IMO 2020 sulphur cap and IMO 2050 decarbonization targets, the demand for hardware is predicted to spike.

Vessel management system is estimated to emerge as the leading systems with a value share of 38% in 2024. VMS centralizes the control of several onboard systems, thereby assisting operators to optimize fuel consumption, decrease emissions, and enhance overall efficiency. A study revealed that VMS can decrease fuel consumption by 10% to 15% by optimizing engine load, speed, and route planning., leading to significant cost savings.

The rise of autonomous ships is further posing a demand for VMS as they enable remote and automated operation of vessels. VMS plays a crucial role in ensuring that vessels meet the International Maritime Organization (IMO) regulations and targets. These systems also enable the optimization of fuel consumption, reduction of harmful emission, and management of waste treatment systems.

Commercial segment is estimated to lead the end use with a share of 46% in 2024. Vessels in the commercial sector rely on VMS and EMS (energy management systems), which are both a part of IMAS, to monitor and optimize engine performance, fuel consumption, and power management.

Commercial vessels like container ships and bulk carriers that are used to transport goods across the globe require sophisticated automation systems to manage logistics, decrease delays, and ensure safety.

Container ships are predicted to account for 40% of the total global fleet by 2030, thereby boosting the demand for integrated automation systems. Studies revealed that energy efficiency management systems (EEMS) integrated in IMAS can enhance fuel efficiency by 10% to 12%, which is particularly important for commercial vessels operating on long voyages and with large payloads.

Potential growth in the global integrated marine automation system industry is predicted to be driven by increasing investments in autonomous shipping and digital twins. Fully autonomous vessels are predicted to make up 15% of newbuilds by 2030, owing to advancements in AI and sensor technologies.

Automation systems with a focus on energy efficiency and emissions reduction are likely to see a huge adoption. Rising prevalence of flexible businesses models are predicted to decrease upfront costs, thereby expanding adoption among small operators.

The integrated marine automation system market growth was robust at a CAGR of 6.3% during the historical period. In 2021, Yara Birkeland, the world’s first autonomous and zero-emission container ship commenced operations. The project highlighted the potential of automation to decrease operational costs and emissions, spurring interest in similar initiatives.

By 2023, an estimate of 10% of new ships were recorded to integrate semi-autonomous systems, thereby reflecting a growing demand for intelligent navigation and control systems. IMOs 2020 Sulfur Cap regulations required ships to decrease sulfur emissions by 85%, thereby pushing operators to adopt fuel-efficient systems.

Operators progressively adopted automation systems to optimize fuel consumption and ensure regulatory compliance. Maritime investments in IoT grew by 25% annually, allowing real-time data exchange, predictive maintenance, and enhanced safety features.

Rising Demand for Smart and Autonomous Vessels

The maritime industry is witnessing a push toward automation and autonomy owing to the need to improve operational efficiency, decrease costs, and address workforce challenges. By 2030, 50% of newbuild vessels are predicted to incorporate some level of automation or autonomy.

The industry is estimated to face a shortage of 89,510 officers by 2026, according to the statistics provided by the BIMCO-ICS Seafarer Workforce Report. Autonomous systems are seen as a viable solution to address this gap. Labor accounts for 30% to 50% of operations costs for conventional vessels and autonomous systems can assist in decreasing the reliance on onboard crew, thereby lowering expenses.

Smart vessels equipped with integrated automation systems can achieve 15% of fuel savings through optimized route planning and engine performance. Companies are progressively adopting smart vessels to meet the IMO 2050 decarbonization goals that mandate 70% reduction in carbon intensity by 2050.

Growth in Cruise and Luxury Yacht Markets

Rising consumer demand for personalized experience is driving growth in cruise and luxury yacht market. Cruise ship capacity is predicted to surpass 32 million passengers across the globe by 2024, exceeding pre-pandemic levels.

Wealthy individuals are investing in large and technologically advanced yachts, thereby driving the demand for automation systems that offer seamless integration of navigation, entertainments and energy systems. Luxury yachts are being equipped with smart systems for remote monitoring, integrated entertainment systems, and automated docking.

Automation enables owners to operate vessels with minimal crew, thereby enhancing privacy and convenience. Cruise ships and luxury yachts are adopting hybrid and electric propulsion systems to meet IMO regulations for decarbonization.

Automated energy management systems can decrease fuel consumption by 10% to 20%, making these vessels environment-friendly. In 2024, Royal Caribbean’s Icon of the Seas launched the world’s largest cruise shop with advanced automation systems for safety, energy management, and passenger comfort.

Absence of Robust Security Measures to Increase Cybersecurity Risks

Integrated marine automation systems leverage IoT sensors, AI-driven algorithms, and cloud platforms for real-time data processing and control. This interconnected nature makes IMAS systems susceptible to cyberattacks, especially in the absence of robust security measures.

According to reports, 31% of shipping companies witnessed cyberattacks in 2022. Maritime cybersecurity breaches can result in operational disruptions, navigation errors, and even loss of vessel control, thereby posing serious safety risks.

In 2020, a ransomware attack on CAM CGM, one of the largest container shipping companies, disrupted its IT systems and online services, costing millions of dollars. Crew or shore-based personnel are often tricked into providing access credentials or clicking on malicious links. Human error remains a significant weak point and is responsible for 90% of successful cyber breaches.

Modernization of Aging Fleets

Average age of the global merchant fleet is approximately 21 years by 2024, with several vessels nearing the end of their operational lifespan. According to the United Nations Conference on Trade and Development (UNCTAD), 40% of vessels in operation today are more than 20 years old. Around 30% of aging vessels are predicted to undergo automation retrofits by 2030 to comply with tightening environmental a safety standard.

Energy Efficiency Ship Index (EEXI) and Carbon Intensity Indicator (CII) regulations require older ships to enhance fuel efficiency and decrease emissions. Retrofitted automation systems can optimize engine performance, enhance energy management, and decrease carbon emissions by 10% to 30%. IMO targets a 70% reduction in carbon intensity by 2050, compelling shipowners to modernize aging fleets.

Flexible Business Models

Installing integrated automation systems can cost US$ 500,000 and 5 million per vessel, depending on complexity and vessel size. This upfront investment often deters small and medium-sized shipowners that make up 80% of the global shipping operators. Shipowners and operators are increasingly shifting from capital expenditure (CAPEX) to operational expenditure (OPEX) models.

Flexible payment structures enable companies to adopt IMAS solutions without heavy initial investments. Shipping companies are looking for customized solutions that fit specific operational and regulatory requirements. Flexible businesses models allow vendors to offers modular systems and scalable solutions to cater to varying requirements.

IMAS as a subscription service (SaaS model) assists in decreasing upfront costs while providing access to latest technologies. Shipowners further benefit from continuous updates, thereby ensuring compliance with new regulations.

Pay-as-you-go models of these solutions basis payment on usage metrics like operational hours or data consumption, thereby making automation systems affordable for smaller operators. This model is particularly beneficial for companies with irregular operational schedules or limited routes.

Companies in the integrated marine automation system market are focusing on developing systems with modern features like AI-driven navigation, remote monitoring, and predictive maintenance. They are developing customized solutions for specific vessel types including cargo ships, luxury yachts, and naval vessels.

Businesses are also developing eco-friendly and energy-efficient marine automation systems to cater to the growing demand for greener maritime solutions. They are collaborating with shipbuilders to integrate automation systems during the design phase itself.

Organizations are also partnering with software and hardware companies to leverage technologies like AI, IoT, and machine learning. They are also engaging in joint research and development projects with universities, maritime organizations, and research institutions to stay at the forefront of innovation.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Component

By System

By End Use

By Region

To know more about delivery timeline for this report Contact Sales

The market is anticipated to reach a value of US$ 9.7 Bn by 2031.

Integrated marine automation systems refer to the use of automated systems and technologies to control and manage several processes and operations on ships and other marine vessels.

Automated systems onboard a ship assist in raising the awareness of the crew and therefore avoid accidents when a critical situation is detected.

Asia Pacific is predicted to emerge as the leading region in the industry with a share of 41.4% in 2024.

Some of the leading industry players in the market are Honeywell International Inc., Kongsberg Gruppen ASA, and Wärtsilä Oyj Abp.