- Executive Summary

- Global Industrial Racking System Market Snapshot, 2026 and 2033

- Market OpportRacksy Assessment, 2026 - 2033, US$ Mn

- Key Market Trends

- Future Market Projections

- Premium Market Insights

- Industry Developments and Key Market Events

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definition

- Market Dynamics

- Drivers

- Restraints

- OpportRacksy

- Challenges

- Key Trends

- Product Lifecycle Analysis

- Industrial Racking System Market: Value Chain

- List of Raw Material Suppliers

- List of Manufacturers

- List of Distributors

- Profitability Analysis

- Forecast Factors - Relevance and Impact

- Covid-19 Impact Assessment

- PESTLE Analysis

- Porter Five Force’s Analysis

- Geopolitical Tensions: Market Impact

- Regulatory and Carrying Capacity Landscape

- Macro-Economic Factors

- Global Sectorial Outlook

- Global GDP Growth Outlook

- Global Parent Market Overview

- Price Trend Analysis, 2020 - 2033

- Key Highlights

- Key Factors Impacting Product Prices

- Prices By Design/Composition/Carrying Capacity

- Regional Prices and Product Preferences

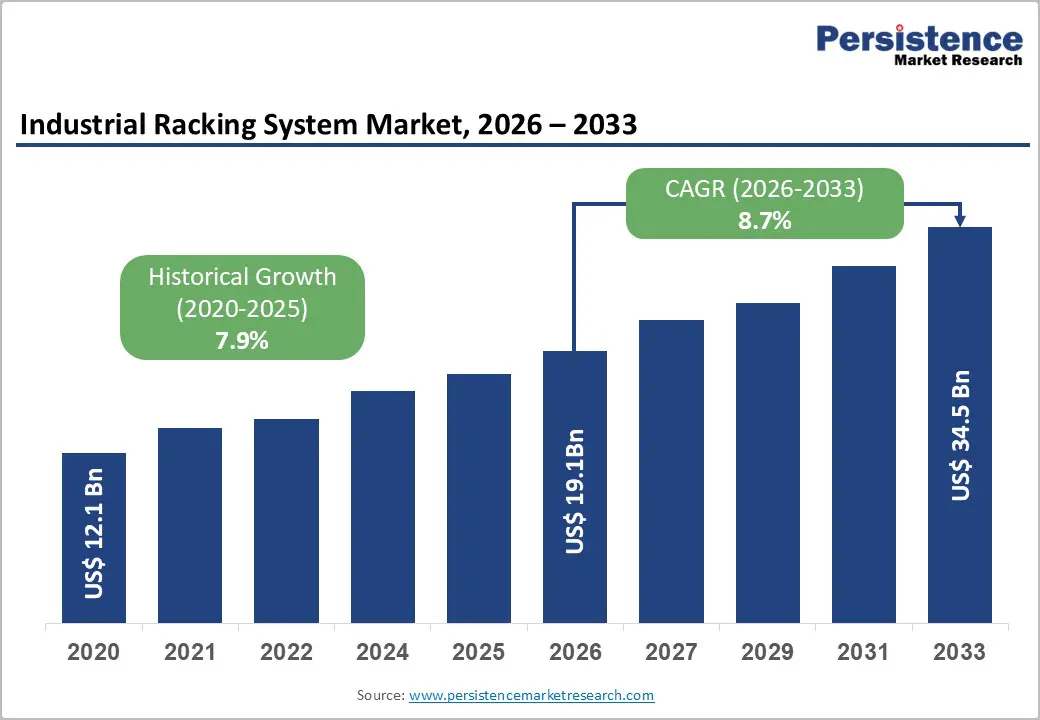

- Global Industrial Racking System Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Market Size and Y-o-Y Growth

- Absolute $ OpportRacksy

- Market Size (US$ Mn) Analysis and Forecast

- Historical Market Size Analysis, 2020-2025

- Current Market Size Forecast, 2026-2033

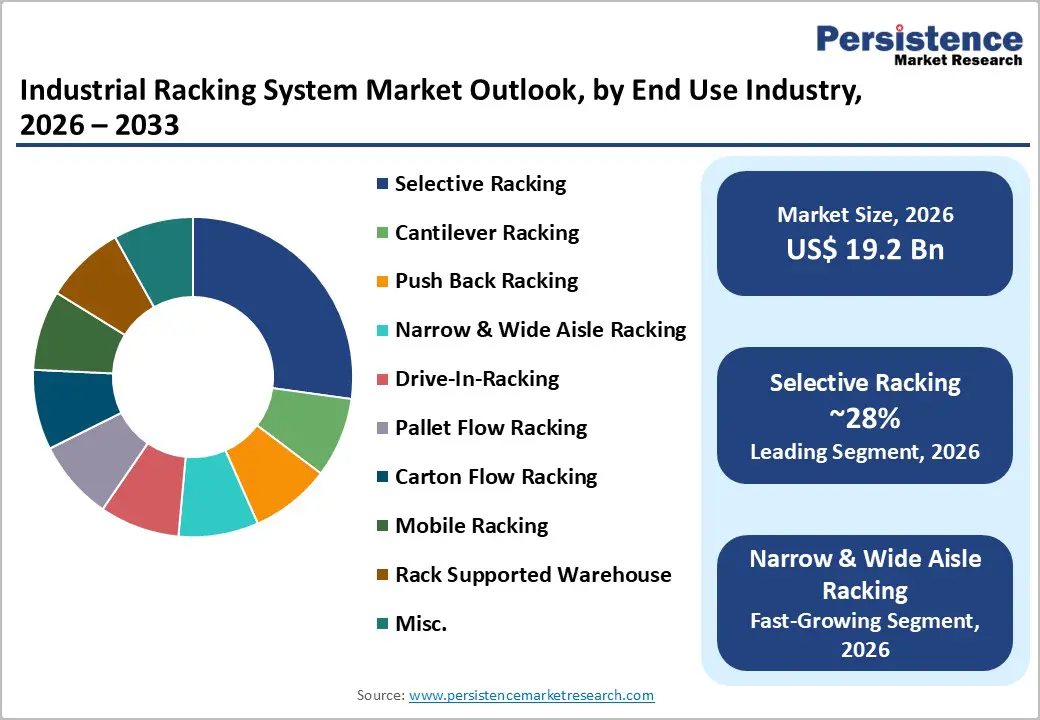

- Global Industrial Racking System Market Outlook: Design

- Introduction / Key Findings

- Historical Market Size (US$ Mn) and Volume (Racks) Analysis By Design, 2020 - 2025

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Design, 2026 - 2033

- Selective Racking

- Cantilever Racking

- Push Back Racking

- Narrow & Wide Aisle Racking

- Drive-In-Racking

- Pallet Flow Racking

- Carton Flow Racking

- Mobile Racking

- Rack Supported Warehouse

- Misc.

- Market Attractiveness Analysis: Design

- Global Industrial Racking System Market Outlook: Carrying Capacity

- Introduction / Key Findings

- Historical Market Size (US$ Mn) and Volume (Racks) Analysis By Carrying Capacity, 2020 - 2025

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Carrying Capacity, 2026 - 2033

- Light Duty (40 to 200 kg)

- Medium Duty (0.25 to 1 Ton)

- Heavy Duty (2-4 Racks)

- Market Attractiveness Analysis: Carrying Capacity

- Global Industrial Racking System Market Outlook: Ownership

- Introduction / Key Findings

- Historical Market Size (US$ Mn) and Volume (Racks) Analysis By Ownership, 2020 - 2025

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Ownership, 2026 - 2033

- Direct Ownership

- Rentals

- Market Attractiveness Analysis: Ownership

- Global Industrial Racking System Market Outlook: Ownership

- Introduction / Key Findings

- Historical Market Size (US$ Mn) and Volume (Racks) Analysis By End Use, 2020 - 2025

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By End Use, 2026 - 2033

- Automotive

- Construction

- Chemical & Pharmaceutical

- Food & Beverage

- Ecommerce

- 3PLs

- Textile

- Paper & Pulp

- Defense & Railways

- Cold Storage

- Other Manufacturing

- Market Attractiveness Analysis: End Use

- Key Highlights

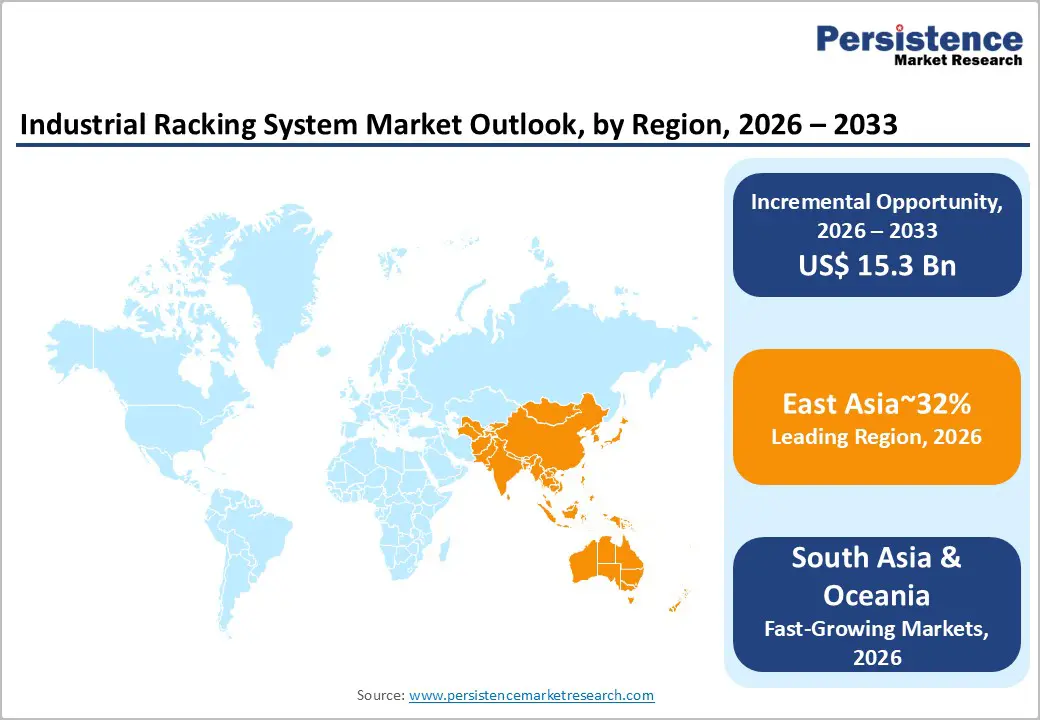

- Global Industrial Racking System Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Mn) and Volume (Racks) Analysis By Region, 2020 - 2025

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Region, 2026 - 2033

- North America

- Europe

- East Asia

- South Asia and Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Industrial Racking System Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Pricing Analysis

- Historical Market Size (US$ Mn) and Volume (Racks) Analysis By Market, 2020 - 2025

- By Country

- By Design

- By Carrying Capacity

- By Ownership

- By End Use

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Country, 2026 - 2033

- U.S.

- Canada

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Design, 2026 - 2033

- Selective Racking

- Cantilever Racking

- Push Back Racking

- Narrow & Wide Aisle Racking

- Drive-In-Racking

- Pallet Flow Racking

- Carton Flow Racking

- Mobile Racking

- Rack Supported Warehouse

- Misc.

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Carrying Capacity, 2026 - 2033

- Light Duty (40 to 200 kg)

- Medium Duty (0.25 to 1 Ton)

- Heavy Duty (2-4 Tons)

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Ownership, 2026 - 2033

- Direct Ownership

- Rentals

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By End Use, 2026 - 2033

- Automotive

- Construction

- Chemical & Pharmaceutical

- Food & Beverage

- Ecommerce

- 3PLs

- Textile

- Paper & Pulp

- Defense & Railways

- Cold Storage

- Other Manufacturing

- Market Attractiveness Analysis

- Europe Industrial Racking System Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Pricing Analysis

- Historical Market Size (US$ Mn) and Volume (Racks) Analysis By Market, 2020 - 2025

- By Country

- By Design

- By Carrying Capacity

- By Ownership

- By End Use

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Country, 2026 - 2033

- Germany

- France

- U.K.

- Italy

- Spain

- Russia

- Rest of Europe

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Design, 2026 - 2033

- Selective Racking

- Cantilever Racking

- Push Back Racking

- Narrow & Wide Aisle Racking

- Drive-In-Racking

- Pallet Flow Racking

- Carton Flow Racking

- Mobile Racking

- Rack Supported Warehouse

- Misc.

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Carrying Capacity, 2026 - 2033

- Light Duty (40 to 200 kg)

- Medium Duty (0.25 to 1 Ton)

- Heavy Duty (2-4 Tons)

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Ownership, 2026 - 2033

- Direct Ownership

- Rentals

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By End Use, 2026 - 2033

- Automotive

- Construction

- Chemical & Pharmaceutical

- Food & Beverage

- Ecommerce

- 3PLs

- Textile

- Paper & Pulp

- Defense & Railways

- Cold Storage

- Other Manufacturing

- Market Attractiveness Analysis

- East Asia Industrial Racking System Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Pricing Analysis

- Historical Market Size (US$ Mn) and Volume (Racks) Analysis By Market, 2020 - 2025

- By Country

- By Design

- By Carrying Capacity

- By Ownership

- By End Use

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Country, 2026 - 2033

- China

- Japan

- South Korea

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Design, 2026 - 2033

- Selective Racking

- Cantilever Racking

- Push Back Racking

- Narrow & Wide Aisle Racking

- Drive-In-Racking

- Pallet Flow Racking

- Carton Flow Racking

- Mobile Racking

- Rack Supported Warehouse

- Misc.

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Carrying Capacity, 2026 - 2033

- Light Duty (40 to 200 kg)

- Medium Duty (0.25 to 1 Ton)

- Heavy Duty (2-4 Tons)

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Ownership, 2026 - 2033

- Direct Ownership

- Rentals

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By End Use, 2026 - 2033

- Automotive

- Construction

- Chemical & Pharmaceutical

- Food & Beverage

- Ecommerce

- 3PLs

- Textile

- Paper & Pulp

- Defense & Railways

- Cold Storage

- Other Manufacturing

- Market Attractiveness Analysis

- South Asia & Oceania Industrial Racking System Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Pricing Analysis

- Historical Market Size (US$ Mn) and Volume (Racks) Analysis By Market, 2020 - 2025

- By Country

- By Design

- By Carrying Capacity

- By Ownership

- By End Use

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Country, 2026 - 2033

- India

- Southeast Asia

- ANZ

- Rest of South Asia & Oceania

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Design, 2026 - 2033

- Selective Racking

- Cantilever Racking

- Push Back Racking

- Narrow & Wide Aisle Racking

- Drive-In-Racking

- Pallet Flow Racking

- Carton Flow Racking

- Mobile Racking

- Rack Supported Warehouse

- Misc.

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Carrying Capacity, 2026 - 2033

- Light Duty (40 to 200 kg)

- Medium Duty (0.25 to 1 Ton)

- Heavy Duty (2-4 Tons)

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Ownership, 2026 - 2033

- Direct Ownership

- Rentals

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By End Use, 2026 - 2033

- Automotive

- Construction

- Chemical & Pharmaceutical

- Food & Beverage

- Ecommerce

- 3PLs

- Textile

- Paper & Pulp

- Defense & Railways

- Cold Storage

- Other Manufacturing

- Market Attractiveness Analysis

- Latin America Industrial Racking System Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Pricing Analysis

- Historical Market Size (US$ Mn) and Volume (Racks) Analysis By Market, 2020 - 2025

- By Country

- By Design

- By Carrying Capacity

- By Ownership

- By End Use

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Country, 2026 - 2033

- Brazil

- Mexico

- Rest of Latin America

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Design, 2026 - 2033

- Selective Racking

- Cantilever Racking

- Push Back Racking

- Narrow & Wide Aisle Racking

- Drive-In-Racking

- Pallet Flow Racking

- Carton Flow Racking

- Mobile Racking

- Rack Supported Warehouse

- Misc.

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Carrying Capacity, 2026 - 2033

- Light Duty (40 to 200 kg)

- Medium Duty (0.25 to 1 Ton)

- Heavy Duty (2-4 Tons)

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Ownership, 2026 - 2033

- Direct Ownership

- Rentals

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By End Use, 2026 - 2033

- Automotive

- Construction

- Chemical & Pharmaceutical

- Food & Beverage

- Ecommerce

- 3PLs

- Textile

- Paper & Pulp

- Defense & Railways

- Cold Storage

- Other Manufacturing

- Market Attractiveness Analysis

- Middle East & Africa Industrial Racking System Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Pricing Analysis

- Historical Market Size (US$ Mn) and Volume (Racks) Analysis By Market, 2020 - 2025

- By Country

- By Design

- By Carrying Capacity

- By Ownership

- By End Use

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Country, 2026 - 2033

- GCC

- South Africa

- Northern Africa

- Rest of Middle East & Africa

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Design, 2026 - 2033

- Selective Racking

- Cantilever Racking

- Push Back Racking

- Narrow & Wide Aisle Racking

- Drive-In-Racking

- Pallet Flow Racking

- Carton Flow Racking

- Mobile Racking

- Rack Supported Warehouse

- Misc.

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Carrying Capacity, 2026 - 2033

- Light Duty (40 to 200 kg)

- Medium Duty (0.25 to 1 Ton)

- Heavy Duty (2-4 Tons)

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By Ownership, 2026 - 2033

- Direct Ownership

- Rentals

- Current Market Size (US$ Mn) and Volume (Racks) Forecast By End Use, 2026 - 2033

- Automotive

- Construction

- Chemical & Pharmaceutical

- Food & Beverage

- Ecommerce

- 3PLs

- Textile

- Paper & Pulp

- Defense & Railways

- Cold Storage

- Other Manufacturing

- Market Attractiveness Analysis

- Competition Landscape

- Market Share Analysis, 2024

- Market Structure

- Competition Intensity Mapping By Market

- Competition Dashboard

- Apparent Production Capacity

- Company Profiles (Details - Overview, Financials, Strategy, Recent Developments)

- SSI Schaefer

- Overview

- Segments and Products

- Key Financials

- Market Developments

- Market Strategy

- Interlake Mecalux

- Jungheinrich

- Daifuku

- Kardex

- Stow

- Gonvarri

- Ridg-U-Rak

- Steel King

- Frazier

- UNARCO

- Hannibal

- Godrej

- Nilkamal

- Kirby.

- Note: The List of companies is not exhaustive. It is subject to further augmentation during the course of research

- SSI Schaefer

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment