ID: PMRREP28051| 177 Pages | 7 Nov 2025 | Format: PDF, Excel, PPT* | Industrial Automation

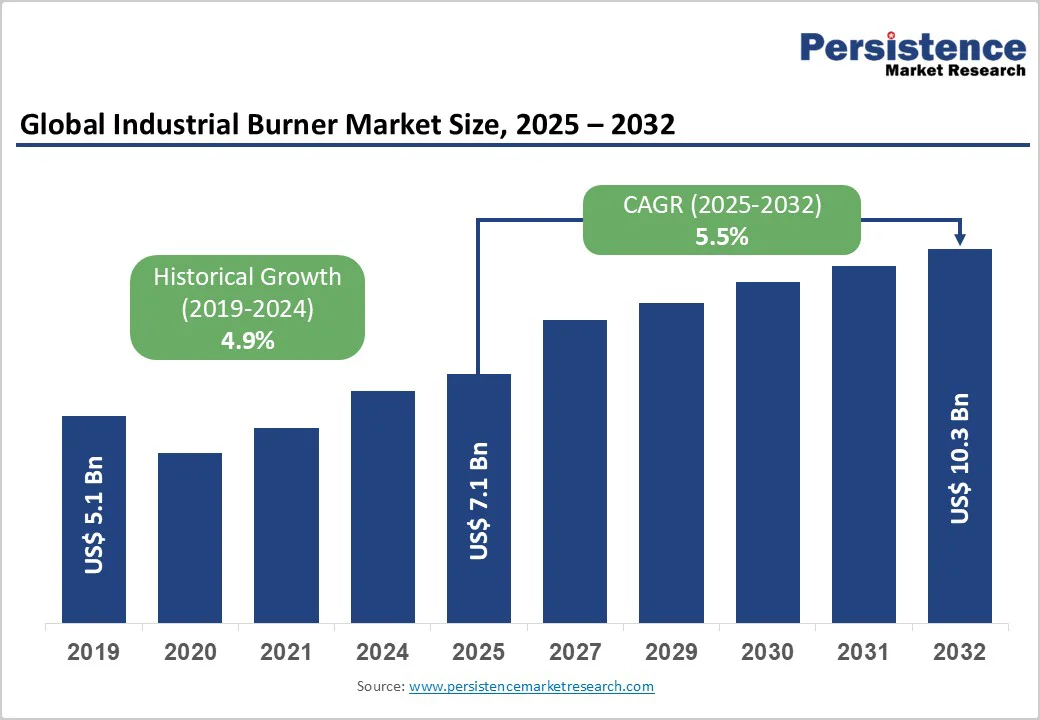

The industrial burner market size is likely to value US$ 7,089.4 million in 2025 and is projected to reach US$ 10,294.1 million at a CAGR of 5.5% during the period from 2025 to 2032. The market for industrial burners is expected to grow due to industrialization, mining, and petrochemical activities. Leading companies are also investing in burner capabilities to reduce pollution and carbon footprints.

| Key Insights | Details |

|---|---|

|

Market Size (2025E) |

US$ 7,089.4 Mn |

|

Projected Market Value (2032F) |

US$ 10,294.1 Mn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

5.5% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

4.9% |

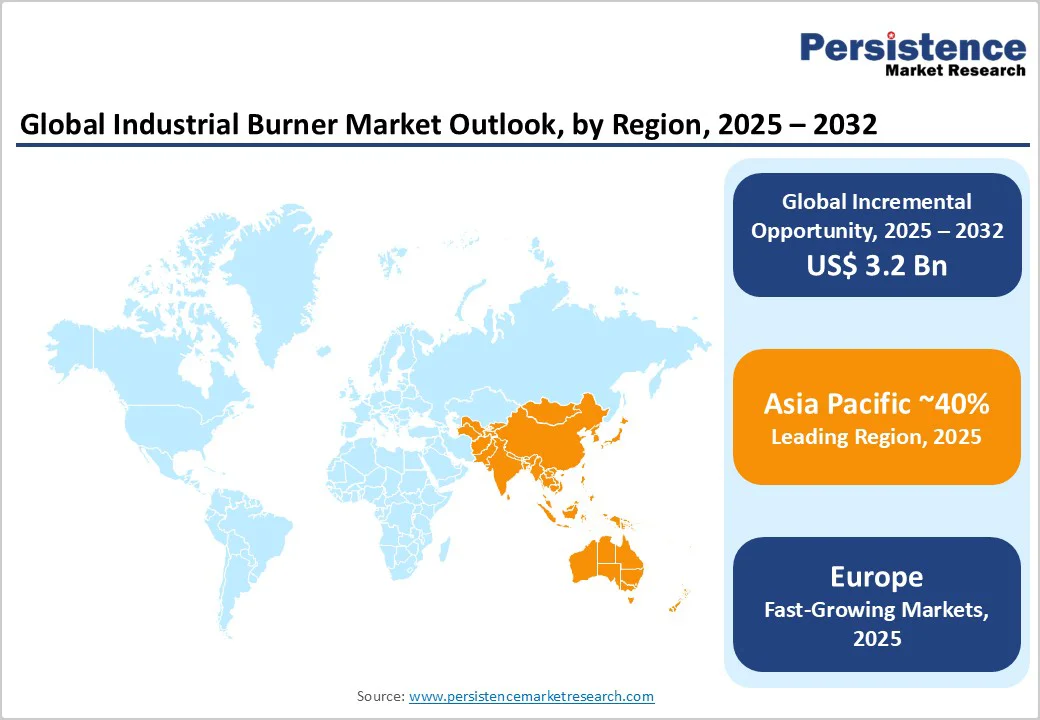

Asia Pacific is poised to dominate the industrial burner market and anticipated to hold a substantial 73.4% market share in 2025. This surge is driven by growing industrialization, mining, and petrochemical activities, particularly in China and India.

Asia Pacific market is projected to achieve a remarkable CAGR of 5.6% in 2025, driven by increased applications in steam boilers, heat exchangers, and hot water systems showcasing the region's expanding industrial capabilities.

China is expected to account for over 57.2% of East Asia market by 2032. With an industry value added exceeding $6.92 trillion, China is one of the world's largest consumers of industrial burners. The global manufacturers are investing more in product innovation to expand their market reach globally. For instance,

|

Country |

CAGR through 2032 |

|

U.S. |

5.6% |

North America is set to experience the significant growth in the market in the coming years, driven by rising demand across various sectors like power generation, chemicals, and food and beverages. The focus on sustainability and energy efficiency is accelerating the adoption of low-energy systems, with the U.S. industrial burner market growing substantially with a CAGR of 5.6% through 2032. The market players are also investing in the product development for better energy efficiency. For instance,

Recent regulations from the U.S. Environmental Protection Agency have significantly improved burner design standards, encouraging manufacturers to develop low-emission and high-efficiency burners further boosting the market expansion.

|

Category |

CAGR through 2032 |

|

Burner Type - High Velocity Burners |

5.9% |

High-velocity burners are projected to lead the industrial burner market over the forecast period, with demand expected to grow at a CAGR of 5.9%. These burners are essential in applications requiring a high rate of recirculation of combustion products. They achieve excellent heat penetration by generating a high-velocity stream of hot gases within a furnace, resulting in enhanced efficiency and reduced fuel costs.

The manufacturers are increasingly investing in the high velocity burners to expand their portfolio and market reach. For instance,

According to the U.S. Department of Energy, utilizing high-velocity burners can significantly improve industrial energy efficiency, further driving widespread adoption globally.

|

Category |

Market Share in 2025 |

|

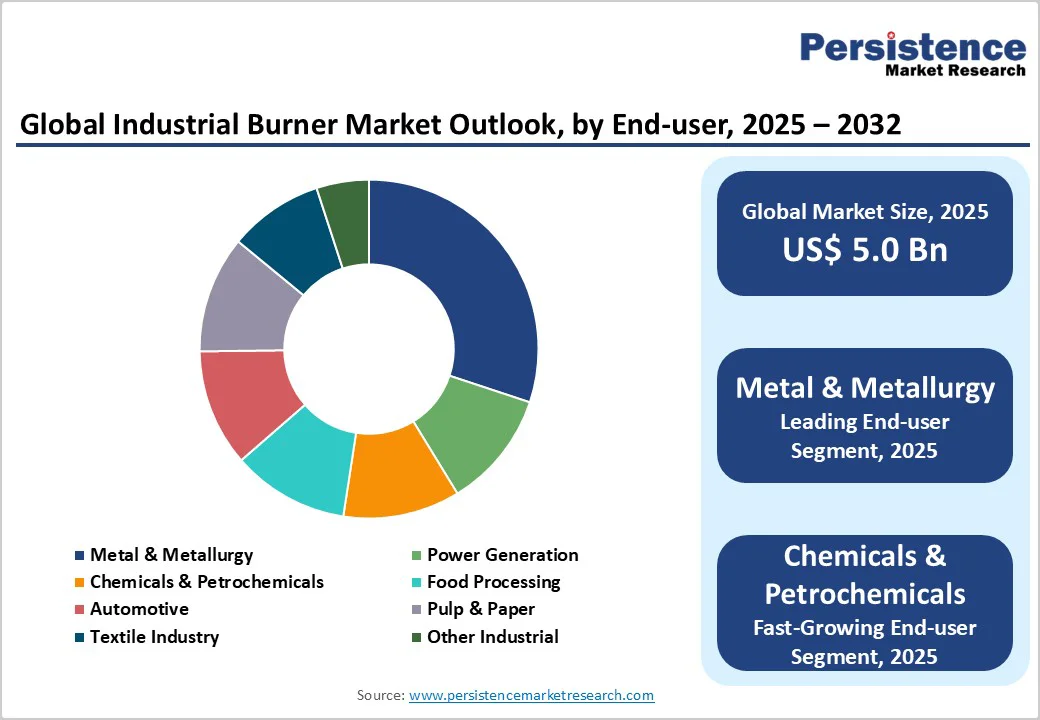

End-use Industry - Metal & Metallurgy |

25.3% |

The metal and metallurgy sector is projected to capture over 25.3% of the industrial burner market by 2032. Industrial burners play a crucial role in steel, aluminum, and other metal production facilities, making this sector a significant contributor to the global market. For instance,

The U.S. Department of Commerce reports that advancements in burner technology are essential for enhancing energy efficiency and reducing emissions in metal production further solidifying the industry's importance in the market landscape.

The market is fueled by several industry trends and factors. Industrial burners are specialized devices designed to generate heat through the combustion of fuel. These burners are essential in sectors including food processing, metalworking, and petrochemicals, where high-temperature applications are required. Their efficiency and ability to operate in different capacities make them invaluable tools for enhancing productivity and reducing energy consumption in industrial processes.

The industrial burner market is showing a surge in demand, particularly in South Asia. This growth is driven by robust industrial growth in India and ASEAN countries. The region's increasing energy needs and rising activities in automotive production and mining are greatly contributing to market expansion.

Industrial burner sales currently account for 30% to 40% of the burner market share. As industries increasingly focus on sustainability, innovations in burner technology that promote energy efficiency and reduce emissions are becoming pivotal. This trend highlights the industry's adaptability to evolving regulatory standards and growing environmental concerns, positioning it for sustained growth in the coming years.

Between 2019 and 2023, the industrial burner market exhibited a 4.9% CAGR. This increase can be largely attributed to the rebound in manufacturing and industrial activities following the COVID-19 pandemic in 2020.

For years, managing the fuel-to-air ratio has been a crucial challenge in large-scale industrial applications. Today, nearly every industrial burner comes equipped with advanced electronic modules that facilitate precise control of this ratio. Leading companies are taking advantage of technologies to expand their product line. For example,

The demand for industrial burners is projected to expand at a CAGR of 5.5% from 2025 to 2032 with new advancements. Regenerative power generation emerges as a foundational element of the future energy system with industrial burners playing a pivotal role in energy efficiency and sustainability.

Leading companies in the industrial burner sector are ramping up investments to enhance burner capabilities. It focuses on reducing pollutant levels and minimizing carbon footprints. With increasing regulatory pressures and a push for sustainability, burners that can significantly lower greenhouse gas emissions, such as nitrogen oxides (NOx) present substantial opportunities for market players. For example,

The electricity demand is rising greatly worldwide, and China leads the world in electricity consumption with a staggering 9,445 terawatt-hours (TWh) in 2023. This figure is more than double that of the second largest consumer. The United States ranks second, with an electricity demand of around 4,268 TWh. Meanwhile, India ranks third and shows rapid electricity demand growth due to its expanding economy and population.

According to the International Energy Agency (IEA), global electricity demand is forecasted to grow at an annual rate of 2.1% through 2040, double the growth rate of primary energy demand. Rising incomes, expanding industrial production, and a growing services sector are key drivers behind this trend.

Power plants rely on various fuels to generate high-pressure steam, making industrial burners essential components in this process. For instance,

Producing boiler-based industrial burners is a capital-intensive endeavor that demands meticulous planning. Companies must prioritize the identification of economically viable raw materials with a reliable long-term supply. This process involves significant research and development (R&D) investments, as well as securing auxiliary components for industrial boilers. For instance,

The construction of industrial boiler plants incurs substantial expenses related to engineering, procurement, and construction (EPC) services, alongside technology investments and fuel procurement. Moreover, ongoing maintenance and after-sales services also require hefty capital.

The cost of industrial boilers can vary widely based on design and support levels, with budget options often leading to shorter lifespans and less customer support. These factors collectively drive up the overall procurement and maintenance costs of industrial burners.

Industrial burners come in a diverse range of capacities, from 40 kW to over 30,000 kW, catering to various operational needs. Once these burners are installed, plant operators are tasked with optimizing their efficiency. However, many operators need to recalibrate their heating requirements, often pushing the limits of their existing systems. In response to this challenge, manufacturers are innovating by developing industrial burners with multi-stage capacity regulation capabilities. For instance,

As the need for flexible capacity management grows, producers face increasing pressure to deliver advanced solutions that meet these evolving requirements ensuring they remain competitive in a dynamic market.

The advent of 3D printing technology is transforming the production of industrial burners, significantly reducing costs while enabling the creation of complex designs. For instance,

3D-printed burners are increasingly utilized in the marine sector, where they play a crucial role in injecting diesel or oil into furnaces that ignite ship boilers. This process generates steam to power turbines that propel vessels. As industries continue to adopt innovative manufacturing techniques, the demand for sophisticated burners developed through 3D printing is expected to grow, opening up exciting opportunities in various sectors.

Environmental concerns and stringent emissions regulations are significantly shaping the global industrial burner market.

Governments and international organizations are increasingly focused on reducing air pollutants and greenhouse gas (GHG) emissions from industrial operations. For instance, The U.S. Environmental Protection Agency (EPA) has set ambitious targets to cut GHG emissions by 50% by 2030, prompting industries to invest in cleaner combustion technologies. As a result, burners with low nitrogen oxide (NOx) and carbon emissions have become essential for regulatory compliance.

Companies like Honeywell, based in Morris Plains, New Jersey, launched their SMART Burner, designed to minimize emissions while maximizing efficiency. The market is also witnessing a shift toward eco-friendly solutions such as regenerative burners and flue gas recirculation systems. These are crucial for reducing the environmental impact of industrial processes and driving market growth.

Top industrial burner manufacturers are increasingly committed to developing high-performance, low-emission, and connected burners. The rise of automation and Industry 4.0 is driving these companies to incorporate cutting-edge technologies and features into their products. For example,

Despite the focus on advanced solutions, the market comprises many small to medium-sized players dedicated to providing cost-effective industrial burners. These companies cater to businesses seeking reliable and budget-friendly options ensuring a diverse range of products is available to meet various customer needs.

By Burner Type

By Burner Design

By Application

By Fuel Type

By End-use Industry

By Region

The market is predicted to rise from US$ 6.4 Bn in 2024 to US$ 9.18 Bn by 2031.

Burners are employed in different sectors such as metal production, food processing, petrochemicals, and pharmaceuticals.

Maxon Corporation, Eclipse, Inc., Weishaupt Group, Oilon Group, and ANDRITZ AG are some leading manufacturers.

Industrial burners are used in different manufacturing industries such as automotive, food and beverage, petrochemical and more.

The high-velocity burner segment is estimated to lead the market exhibiting a CAGR of 3.9% through 2031.

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author