Industry: Energy & Utilities

Published Date: March-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 250

Report ID: PMRREP35144

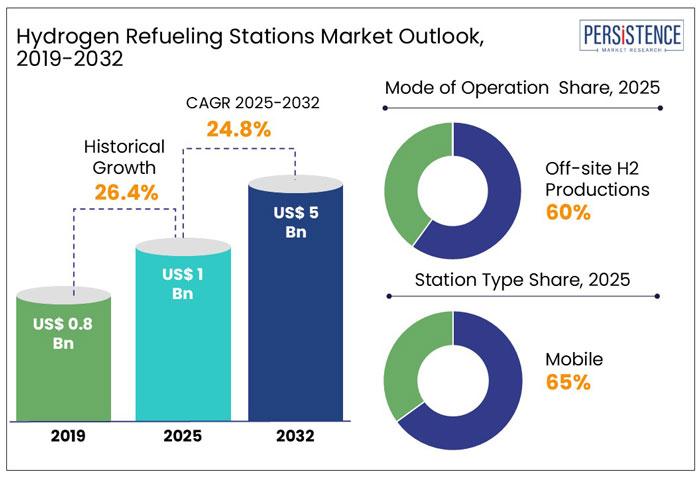

The global hydrogen refueling stations (HRS) market size is anticipated to rise from US$ 1 Bn in 2025 to US$ 5 Bn by 2032. It is projected to witness a CAGR of 24.8% from 2025 to 2032.

Persistence Market Research (PMR) anticipates that the growing acceptance to Hydrogen as an alternative and clean fuel is bolstering the demand for hydrogen fuel from various transport applications, thereby driving the growth of hydrogen infrastructure including refueling stations.

Key Highlights of the Hydrogen Refueling Stations Market

|

Global Market Attributes |

Key Insights |

|

Hydrogen Refueling Stations Market Size (2025E) |

US$ 1 Bn |

|

Market Value Forecast (2032F) |

US$ 5 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

24.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

26.4% |

Government Support for Hydrogen Infrastructure in Post Covid Era Propels Market

The global hydrogen refueling infrastructure growth witnessed a CAGR of 26.4% in the historical period between 2019 and 2024. Particularly in the Post-Covid period, the policy support for developing hydrogen infrastructures peaked in North America and European region. For instance, Biden-Harris administration announced more than US$ 600 Mn in grant to build hydrogen refueling infrastructure and EV charging network across the United States.

Similarly, in 2023 alone, Europe built over 37 new H2 refueling stations. Such developments are possible only due to strong support from the governments as well as a collective step towards reducing emissions from transport sector.

Global Race towards Green Hydrogen and High efficient Fuels to Shape the HRS market

Over the forecast period, the HRS market is expected to grow with a similar growth rate of 24.8% between 2025 and 2032. The market will benefit from the expansion of production capacities for green hydrogen from renewable energies.

The high energy storage of hydrogen fuel and ease of transportation in liquid state are the key advantage for adopting H2 fuel in diverse transport applications. With the development of H2 powered rails, airplanes, heavy duty as well as passenger vehicles and ships, the demand for hydrogen refueling infrastructure is anticipated to flourish over the forecast years.

Growth Driver

Growing Penetration of Hydrogen Powered Vehicles for Heavy Duty Operations Drive Market Demand

With the rising concerns and stringent regulations regarding the emission from automotive industry, the global market is witnessing a paradigm shift towards zero-emission mobility solutions such as (Electric Vehicles) EVs and Fuel Cell Electric Vehicles (FCEVs).

While EVs are leading the market intrusion in two-wheeler, three-wheeler and passenger cars segment, the hydrogen powered FCEVs are dominating the penetration in heavy duty and public transport automotive segments.

The global on-road fleet of FCEVs grew from 25,212 units in 2019 to 34,804 units in 2020 resembling 38% Y-o-Y growth. With the forecast projected to 200,000 units of FCEVs on road by the end of this decade, the installations of HRS, both stationary and mobile operated stations, will foster in the coming years.

Deploying a Sustainable Hydrogen Refueling Infrastructure Faces Methodological and Practical Challenges

The deployment of sustainable hydrogen refueling station is a cost intensive process and also poses some standardization challenges. The design and cost of the HRS as well the environmental impact depends on how the hydrogen is produced and delivered to the stations.

If hydrogen is created using renewable energy from water and transferred to refueling stations in liquid form via pipes, HRS operations would have minimal environmental impact, resulting in sustainable deployment. However, worldwide only 1% of H2 is generated from renewable energy.

The rest is based on more energy intensive processes that uses fossil fuels to generate hydrogen. Another challenge for development of hydrogen infrastructure is lack of coordination between different countries and manufacturers to assign appropriate codes for co-evolution of refueling networks and FCEVs.

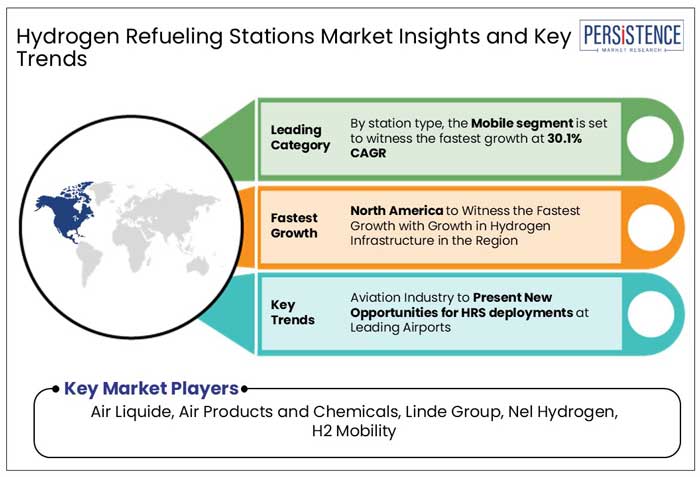

Aviation Industry to Present New Opportunities for HRS deployments at Leading Airports

Hydrogen as a fuel is not only powering the automotive sector but also it prevails as a key zero-emission fuel for aviation, marine and railway industry. Particularly, in aviation industry, the development and adoption of H2 powered aircrafts is gaining traction due to its high energy storage and zero emissions.

Burning hydrogen as a fuel in jet engines would result in water vapor as a byproduct resulting in no harm to the environment. Key aircraft manufacturers are investing in research and development to develop propulsion engines that can use hydrogen as an alternative fuel to power long flights and reduce environmental impact.

Mode of Operation Insights

The Off-site H2 Generations Remains the Preferred Choice for Operating Hydrogen Refueling Stations with 60% Market Share

Based on mode of operation, the HRS can be classified as on-site and off-site operations. The key difference between both the operations lies in the production of hydrogen. In on-site mode the hydrogen is produced and utilized locally at the refueling station, while in off-site operations, the hydrogen is received either by pipelines or through tankers.

As per the PMR analysis, the off-site mode is more preferred in new H2 refueling stations. The key reason for this dominance is the less requirement of space and less investment as compared to liquid hydrogen refueling stations. The segment is anticipated to grow with a remarkable CAGR of 29.5% during the forecast period.

Station Type Insights

Development of On-Demand Mobile Hydrogen Refueling Stations to Witness Higher CAGR

The development of mobile stations capable of storing sufficient amount of hydrogen and making it available at remote locations can be a game changer in HRS market.

The current need for hydrogen power stations is skewed around the areas with high penetration of FCEVs. However, with the mobile HRS systems, the supply of H2 fuel can be achieved in diverse locations eventually supporting the growth of fuel cell electric vehicles.

Most of the current fleet of FCEVs consist of heavy duty vehicles, which are operated on remote sites such as mines, and construction sites. PMR anticipates that the market for Mobile HRS will grow with 30.1% CAGR between 2025 to 2032.

Asia Pacific Leads the Expansion of Hydrogen Refueling Stations Market with 50% Share

PMR analysis suggests that the Asia Pacific region will lead the deployment of Hydrogen Refueling Stations due to higher penetration of FCEVs. China, Japan and South Korea accounts about 50% of the global FCEV fleet. The countries are leading hubs for manufacturing and technological innovations in automotive industry.

Key firms from the region such as Toyota and Hyundai have excelled in the design and manufacturing of hydrogen powered fuel cell engines. The FCEV variants launched by these firms have gained traction in the region, followed by the higher deployments of hydrogen refueling stations in Asia Pacific Region.

Europe Ranks Second in the Deployment of HRS

European countries as a whole have lead the path for sustainable developments in 21st century. Countries like Germany, France, and Netherlands have pioneered the hydrogen infrastructure in Europe. By the end of 2022, Germany had 105 operational HRS followed by 51 in France and 22 in Netherlands. In 2023, Europe commissioned 37 new HRS to their tally.

PMR estimates that the new HRS installations in Europe will grow with 26.4% CAGR during 2025 and 2032. Key firms such as H2 Mobility, TotalEnergies, Air Liquide, and Colruyt Group are leading expansion of Europe hydrogen refueling stations market.

North America Likely to Witness Significant Growth in Hydrogen Infrastructure Over the Forecast Period

The North America hydrogen refueling stations market is highly concentrated in selected regions, with stringent emission policies and higher support for transition to alternate fuels.

The Canadian hydrogen refueling stations market is expected to witness higher CAGR than the U.S. due to government initiatives.

The global HRS market is evolving rapidly, with new players entering through strategic collaboration with hydrogen suppliers. Due to the lack of consolidation and expansion in the sector, the market appears fragmented and slightly unorganized.

With the growing hydrogen infrastructure, the market will move towards consolidation through the merger and acquisitions of regional players by global leaders. This transition could lead to a more structured and competitive market landscape.

Some of the leading FCEV manufacturers collaborate with the HRS companies to accelerate their deployment and boost sales. These collaborations are expected to be crucial in expanding hydrogen mobility infrastructure.

The market is expected to get a boost from government policy support, followed by financial incentives to establish hydrogen infrastructure for energy transition. Companies that closely monitor these opportunities and re-align themselves could gain a significant competitive edge in this evolving market.

Key Industry Developments

|

Report Attributes |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Bn/Mn, Volume: As applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Fuel type

By Mode of Operations

By Station Type

By End User

By Region

To know more about delivery timeline for this report Contact Sales

The Hydrogen Refueling Stations (HRS) market is estimated to be valued at US$ 1 Bn in 2025.

Growing fleet of hydrogen powered FCEVs is the key demand driver for Hydrogen Refueling Stations market

Asia Pacific region dominates the market with ~50% share in the global market.

Off-site H2 generation segment is expected to grow rapidly at 29.5% CAGR from 2025-2032.

Air Liquide, Air Products and Chemicals, Linde Group and H2 Mobility are some of the leading players in Hydrogen Refueling Stations market.