Industry: Food and Beverages

Published Date: January-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 181

Report ID: PMRREP14005

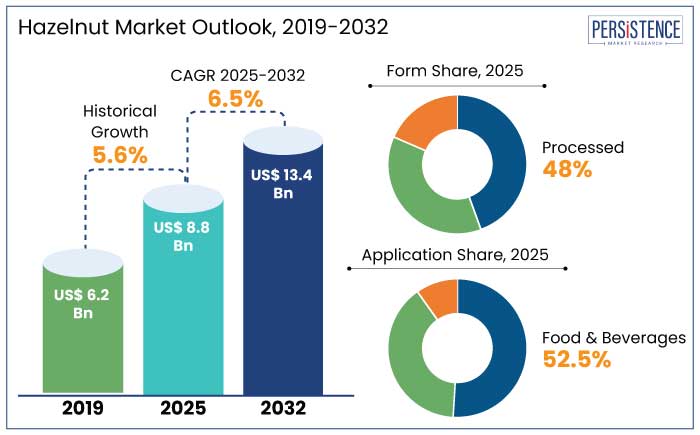

The global hazelnut market is anticipated to reach the size of US$ 8.8 Bn by 2025. It is anticipated to witness a CAGR of 6.5% during the assessment period to attain a value of US$ 13.4 Bn by 2032.

Europe is predicted to emerge as the most prominent market for hazelnuts, accounting for 60% of the global consumption. Hazelnut market growth is anticipated to be driven by increasing consumption in premium confectionery and spreads.

The cosmetics and personal care industry is estimated to progressively adopt hazelnut-based oils for their antioxidant, moisturizing, and anti-aging properties. Hazelnut oil is reportedly included in 15% of anti-aging skincare products launched globally in 2023.

Sales of vegan hazelnut spreads are estimated to witness robust growth driven by increased health and ethical awareness. The trend toward premiumization in food is encouraging manufacturers to use hazelnuts in gourmet desserts and beverages.

Key Highlights of the Industry

|

Market Attributes |

Key Insights |

|

Hazelnut Market Size (2025E) |

US$ 8.8 Bn |

|

Projected Market Value (2032F) |

US$ 13.4 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

6.5% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

5.6% |

Hazelnut market in North America is estimated to lead with a share of 43.8% in 2025. Hazel nuts are valued for their nutritional benefits that align well with consumer preferences for functional foods in the region. Hazel nut snacks are especially popular among health-conscious millennials. For instance,

Consumers in the region are willing to pay a premium for clean-label, diary-free alternatives, thereby boosting the demand for hazel nut products in the beverage and spread categories. North America accounts for 20% of global chocolate consumption, thereby driving demand for hazelnuts in fillings, coatings, and inclusions.

Processed is anticipated to emerge as the leading form with a share of 48% in 2025. Demand for ready-to-consume products like pre-packaged snacks, spreads, and convenience foods has fueled sales of processed hazelnuts.

Pre-packed hazelnut spread remains a popular product in households across the globe. The processed form of this nut is convenient, easy to use, and offers consistent product quality.

Roasted, salted, and flavored hazelnut snacks are gaining traction in developed regions like North America and Europe, aligning with the demand for healthy snacking options. Processed hazelnuts have a longer shelf life compared to raw hazelnuts, making them suitable for packaging and retail distribution.

The food and beverages segment is estimated to hold a share of 52.5% in 2025. These nuts are integral in the global confectionary industry, especially chocolate products.

Hazelnut milk is gaining traction as a plant-based option owing to its creamy and nutty flavor. They are a common ingredient in plant-based spreads, diary-free chocolates, and protein bars, catering to the rising demand for vegan and gluten-free options.

Hazel nuts are widely used in bakery products like cakes, cookies, pastries, and muffins. Its rich flavor profile and texture improve the taste and appeal of baked goods, making them a popular choice for premium and artisanal products. Hazelnut oil is also used in gourmet products and is often seen as a premium alternative to other oils owing to their nutritional benefits and subtle flavor.

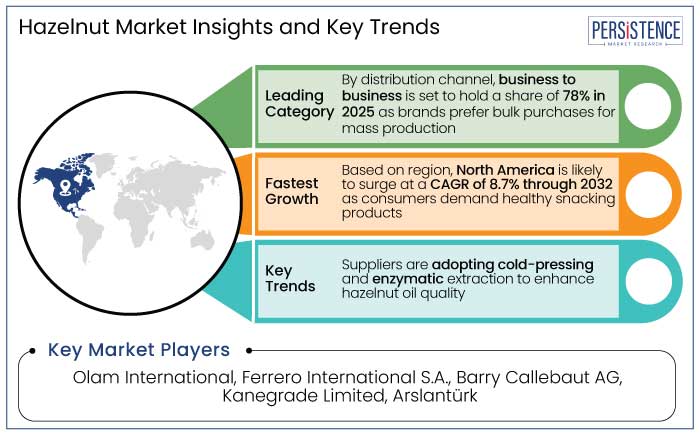

Business to business segment is estimated to emerge as the leading distribution channel with a share of 78% in 2025. B2B distribution model enables companies to purchase the nuts in bulk for mass production.

Prominent brands like Ferrero and Lindt rely on B2B suppliers for their hazelnut requirements. The hazelnut supply chain for confectionery is largely driven by B2B transactions between suppliers and manufacturers.

The snack and bakery industries are prominent drivers of B2B sales in the market. Companies involved in large-scale snack production and bakery operations purchase hazelnuts in bulk. B2B suppliers provide cost-effective solutions for sourcing, processing, and distribution.

Potential growth in the global hazelnut industry is predicted to be driven by the rising popularity of plant-based diets. Suppliers in the industry are investing in advanced processing techniques like cold pressing for hazelnut oil and flavor improvement for roasted nuts to enhance product quality and diversify offerings.

Emerging markets including India and China are estimated to experience a growth in consumption as western-style confectionery and snacks gain popularity. Consumers are progressively prioritizing sustainably sourced hazelnuts. The Sustainable Nut Initiative (SNI) and the Fairtrade Hazelnut Program are likely to enhance the market appeal to eco-conscious buyers.

The hazelnut market growth was considerable at a CAGR of 5.6% during the historical period. Growth during the period was highly attributed to increasing use of hazelnuts in premium confectionery products like baked goods, chocolates, and spreads.

Despite disruptions caused by the COVID-19 pandemic, the demand for hazelnut products remained resilient. The rise of at-home consumption during the pandemic bolstered the demand for hazelnut spreads while health-conscious consumers showed interest in raw and roasted hazelnuts.

The food and beverage industry accounted for 80% to 85% if the global hazelnut consumption with chocolate, confectionery, and spreads leading the demand. Rising awareness regarding the health benefits of nuts including hazelnut rich content of healthy fats, vitamins, and antioxidants boosted demand for snacking and nutritional products.

Use of Hazelnut Oil in Cosmetics and Personal Care Industry to Push Sales

Hazelnut oil is increasingly used in haircare and skincare products. Its high content of essential fatty acid assists in moisturizing and nourishing the skin. Antioxidants present in the oil assist in protecting skin and hair from damage, thereby making it popular in anti-aging formulations as well.

Increase in consumer demand for clean and organic ingredients in personal care products is predicted to benefit the growth of hazel nut oil. The oil is also popular for enhancing hair texture by adding softness and shine without being greasy.

Antioxidants in the oil protect skin from environmental stressors like UV rays and pollution. The nuts’ ability to hydrate, soothe, and brighten the skin has increased its use in facial masks and serums.

Oil of hazelnut also contains anti-inflammatory properties that assist in soothing irritated or sensitive skin. The oil’s ability to nourish the skin while providing a smooth finish makes it suitable in market products like foundations and lip balms.

Innovative Processing Techniques to Boost Demand Worldwide

Traditional roasting methods for hazelnuts involving high heat can lead to the loss of flavor and texture. Novel roasting technologies like fluidized bed roasting or vacuum roasting, assist in maintaining the nut’s natural flavor, thereby preventing over-roasting, and reducing the risk of acrylamide formation.

Modern processing methods ensure the retention of key nutrients that can be degraded by excessive heat. Cold-pressed hazelnut oil is in high demand in the food and beverages as well as cosmetics and personal care industry. This high demand is owing to the rising consumer preference for organic and clean-label products.

Nitrogen flushing and modified atmosphere packaging are used to preserve the freshness of the hazel nuts while extending their shelf life. Freeze-dried hazelnuts have a longer shelf life compared to regular nuts and are lighter. This feature is advantageous in packing and shipping.

Limited Global Cultivation and Regional Dependence May Hamper Demand

The global hazelnut market is highly dependent on only five countries including Türkiye, Italy, United States, Georgia, and Azerbaijan as they contribute to 90% of the hazel nut supply, thereby leaving the market highly dependent on these regions. For example,

Hazelnuts thrive in areas with temperate climates, requiring well-distributed rainfall and moderate winters. This limits the areas where these nuts can be cultivated.

Attempts to extend hazelnut production in new regions face challenges like high initial investments costs, longer time frames, and lack of expertise. Over-reliance on Türkiye makes the global supply chain highly vulnerable to climatic and environmental challenges in the region. For instance,

Rising Demand for Plant-based Products to Boost Opportunities

As consumers adopt plant-based diets, there is a rising demand for dairy alternatives made from nuts, seeds, and other plant-based sources. Hazelnut milk, owing to its naturally creamy texture, mild flavor, and nutritional content, is gaining traction as an alternative to cow milk.

Hazel nut milk has a rich nutritional profile, thereby making it an appealing option for health-conscious consumers. Several companies are offering plant-based versions of hazelnut-chocolate spreads to cater to the rise of plant-based diets.

Hazelnut spreads are often marketed as a healthier alternative to decreased sugar and inclusion of other plant-based ingredients like coconut oil and organic sweeteners. Several consumers are turning to hazel nuts as a lactose-free alternative. These nuts are a great source of plant-based protein, thereby making them attractive for consumers that follow flexitarian, vegan, and vegetarian diet.

Increasing Awareness of Nut-based Products to Create Avenues

Studies have shown that regular consumption of nuts, including hazel nuts, can enhance heart health by decreasing cholesterol levels and inflammation. Nut-based products like hazelnuts are more sustainable compared to animal-based products and they require fewer natural resources and have a lower carbon footprint.

Hazelnuts, along with other nuts, are increasingly being used as an ingredient in packaged foods like snacks, cereals, and breakfast products. Hazelnut-based snacks along with other on-the-go nut products are being marketed as high-protein, high-fiber, and low-sugar alternatives to conventional snacks.

This is due to the increasing number of consumers seeking healthier snack options. As nut-based beverages gain traction, hazel nut milk and hazelnut-flavored drinks are becoming popular.

Companies in the hazelnut market are diversifying in different product forms to cater to varied consumer preferences. Several businesses are ensuring that their nuts are sourced from farms that follow sustainable farming practices. Companies usually position their products as premium by emphasizing high-quality sourcing and processing.

A few brands control their entire supply chain from growing hazelnuts to processing and packaging to ensure enhanced quality controls, cost savings, and ability to manage supply disruptions. Manufacturers are also progressively partnering with chocolate, confectionery, and bakery companies to enable suppliers to secure long-term controls and ensure a stable demand for their products.

Suppliers are also collaborating with brands in the food industry to create co-branded hazel nut products to increase their visibility and consumer trust. Hazelnut suppliers are investing in modern processing technologies to maintain consistent quality and improve flavors.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Form

By Application

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

The market is anticipated to reach a value of US$ 13.4 Bn by 2032.

Türkiye is the world’s leading hazelnut producer as it accounts for 72.9% of the total world supply.

Ferrero is the world’s biggest buyer of hazelnuts using 25% of the world’s supply.

North America is predicted to emerge as the leading region in the industry with a share of 43.8% in 2025.

Olam International, Ferrero International S.A., and Barry Callebaut AG are the prominent companies in the industry.

The market is predicted to witness a CAGR of 6.5% through the assessment period.