Comprehensive Snapshot for Guacamole Market Analysis Including Regional and Country Analysis in Brief.

Industry: Food and Beverages

Published Date: April-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 140

Report ID: PMRREP32514

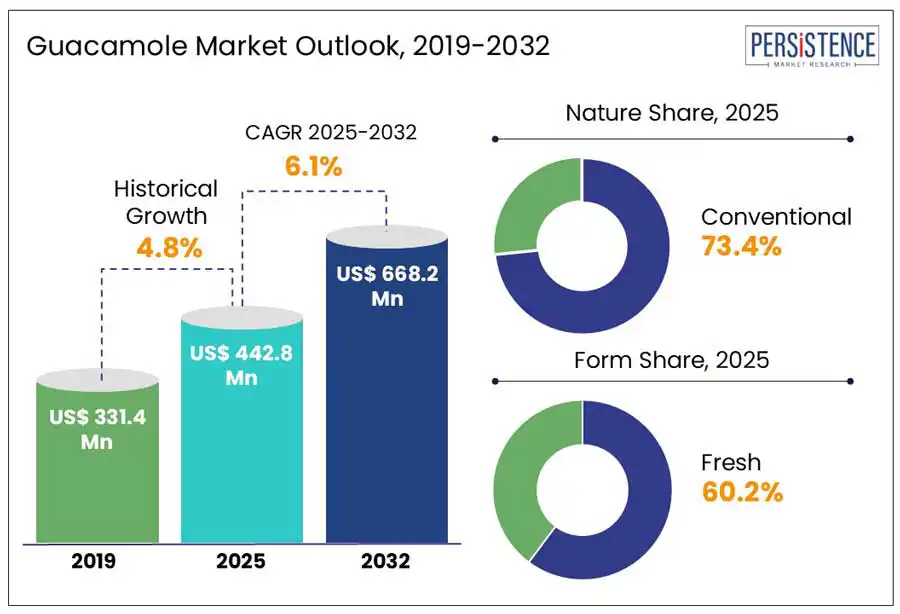

The global guacamole market is estimated to grow from US$ 442.8 million in 2025 to US$668.2 million to record a CAGR of 6.1% by 2032. According to the Persistence Market Research report, the market is expected to reveal substantial growth due to increasing consumer interest in plant-based, nutritious foods and the global popularity of avocado-based products as part of healthy diets.

Rising demand for convenient, ready-to-eat snacks continues to accelerate market expansion, particularly in urban areas where consumers seek nutritious choices with minimal preparation. Innovation in flavor profiles, packaging formats, and organic options is attracting a broader consumer base across demographics and regions. As Mexican and Tex-Mex cuisine grows in global popularity, guacamole is increasingly featured in a wide range of dishes beyond traditional pairings, supporting its expansion across the world.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Guacamole Market Size (2025E) |

US$ 442.8 Mn |

|

Market Value Forecast (2032F) |

US$ 668.2 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

4.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.1% |

The global rise of Tex-Mex cuisine, as part of a broader cross-cultural culinary exploration, continues to fuel the guacamole market. Tex-Mex dishes like tacos, burritos, and nachos have become everyday favorites across North America, Europe, and Asia driven by a growing snacking culture, international interest in bold flavors, and product innovations that cater to modern lifestyles. Guacamole, a staple in Tex-Mex offerings, has gained mainstream popularity as a fresh, plant-based dip and topping. A prime example is UK-based chain Tortilla Mexican Grill PLC., which has become the country's largest fast-casual Mexican brand. In December 2024, Tortilla became the first fast-casual chain in the UK to launch Beyond Steak with its new plant-based Chimichurri Burrito highlighting the fusion of Tex-Mex with global dietary trends and strengthening guacamole’s role in international food service.

A key restraint for the guacamole market is the increasing availability and popularity of alternative dips and spreads, such as hummus, salsa, tzatziki, and bean dips. These options often come with similar health benefits, competitive pricing, and longer shelf lives, making them appealing substitutes for consumers. For example, hummus has gained widespread popularity in both Western and global markets due to its high protein content, plant-based profile, and diverse flavor offerings. As retailers continue to expand shelf space for a broader range of dips to meet varied consumer tastes, guacamole faces growing competition that could limit its market share and slow overall growth, particularly in regions where avocado-based products are not yet deeply embedded in local food culture.

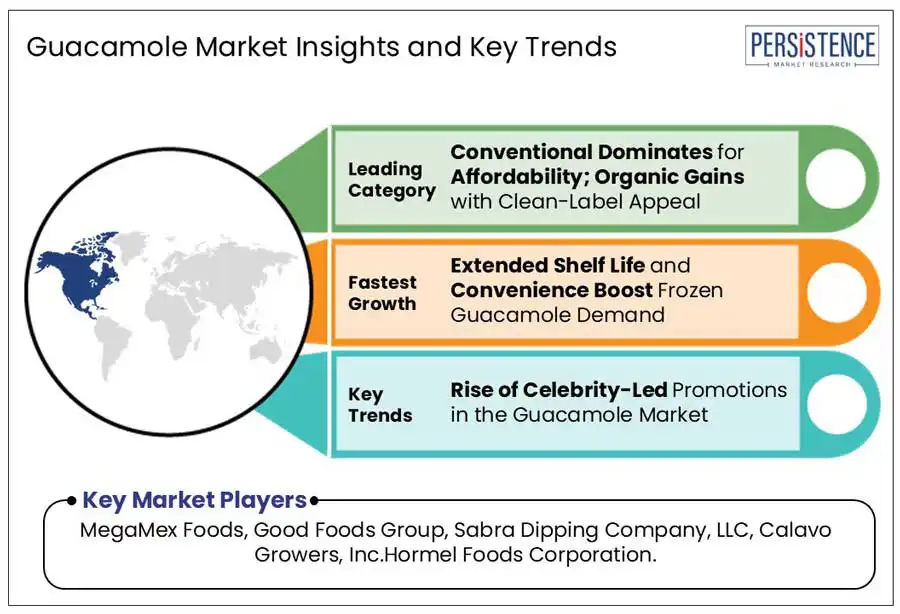

The development of long shelf-life and frozen guacamole variants presents a key opportunity. As demand grows for convenient, preservative-free foods, extending guacamole’s shelf life without compromising quality has become a strategic focus for producers. Technological innovations such as High Pressure Processing (HPP) have enabled this advancement by using cold water and pressure to inactivate bacteria while maintaining freshness, flavor, and nutrients. For instance, ¡Yo Quiero! applies HPP to its guacamole products, allowing them to stay fresh longer without artificial preservatives. This not only supports clean-label positioning but also helps the brand expand into broader retail and foodservice markets.

Celebrity-led promotions are emerging as a key trend in the market. In January 2025, Avocados from Mexico teamed up with NFL icon Rob Gronkowski for a Super Bowl campaign featuring the "Gronkamole Challenge." This partnership exemplified how brands are increasingly leveraging star power to boost engagement and position guacamole as a must-have for game day gatherings. Such collaborations reflect a broader shift toward experience-driven marketing, where celebrity influence is used to enhance product appeal and drive seasonal consumption.

Conventional guacamole is projected to lead the global market in 2025 with a share of around 73.4%, driven by its affordability, scalability, and widespread availability across retail and foodservice channels. Its mass-market appeal makes it the go-to choice for bulk buyers. However, organic guacamole is fueled by the rising demand for clean-label, sustainably sourced foods. Brands like Yucatan Foods and ¡Yo Quiero! are expanding their organic offerings, supported by advancements in cold-press and vacuum-sealed packaging that extend shelf life. As consumer awareness grows, the organic segment is expected to witness robust and sustained growth.

Fresh guacamole is expected to lead the market in 2025, accounting for approximately 60.2% of the total share. Its appeal lies in its taste, texture, and association with freshness, making it a preferred choice among consumers and foodservice outlets. It is commonly found in deli sections and restaurants, consumed immediately or shortly after purchase. Meanwhile, frozen guacamole is gaining traction due to its extended shelf life, convenience, and suitability for export and institutional use. Technological advancements such as High Pressure Processing (HPP) helps in preserving quality in frozen products, gradually increasing acceptance among retailers, foodservice providers, and international distributors.

North America is expected to dominate the global guacamole market in 2025, capturing around 41.5% of the total market share. This dominance is largely driven by the strength of the U.S. guacamole market, where consumer demand for healthy, convenient, avocado-based products remains high. In February 2023, Flagship Food Group, LLC acquired Yucatan Foods to expand its fresh guacamole and dips portfolio, highlighting ongoing investment in product diversification and distribution. Similarly, in 2023, Good Foods was named the official national guacamole partner of Seltzerland, a popular U.S. beverage-tasting tour, boosting brand visibility and consumer engagement. These developments reflect North America's role as a leader in guacamole innovation, marketing, and retail expansion.

Latin America accounts for a significant position in the global guacamole market, primarily as a major production hub. Countries such as Mexico, Peru, and Chile are leading avocado producers, supplying to both local and international markets. Mexico is the world's largest exporter of avocados and plays a central role in guacamole production, backed by its established infrastructure and year-round harvesting.

In addition to strong export volumes, domestic consumption of guacamole is also rising, especially in urban centers where modern retail formats and health-focused eating habits are growing. For instance, companies such as Grupo Guacamolito in Mexico are expanding their product lines to cater to local demand through ready-to-eat guacamole in retail packs, highlighting the region’s dual role in both supply and consumption.

Europe is emerging as a growing market for guacamole, driven by increasing consumer interest in healthy, plant-based foods and the expanding availability of avocado-based products. The region is witnessing innovation and investment, such as the launch of the first olive guacamole by Hispaniola, which blends Mediterranean flavors with traditional guacamole to appeal to European taste preferences. Additionally, Westfalia Fruit’s acquisition of a Belgian avocado company signals a strategic move to strengthen avocado processing and distribution capabilities within the region. These developments highlight Europe's shift from being primarily an import destination to a dynamic market focused on product innovation and local value addition.

The global guacamole market is fragmented with numerous players competing across product types, consumer segments, and distribution channels. As demand grows for clean-label and health-oriented options, companies are increasingly adopting technologies such as High-Pressure Processing (HPP) and Modified Atmosphere Packaging (MAP) to enhance shelf life while preserving freshness, flavor, and nutrients. Innovation such as single-serve and on-the-go formats in packaging facilitates the brands meet modern snacking trends and appeal to convenience-focused consumers. Online retail and modern trade outlets are also expanding product accessibility. With a strong growth in North America and rising interest across Europe and Latin America, competition continues to intensify, fueled by evolving consumer preferences, sustainability demands, and technological advancements.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis Units |

Value: US$ Mn, Volume: Tons |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Nature

By Form

By End-user

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

The global guacamole market is estimated to grow from US$442.8 Mn in 2025 to US$ 668.2 Mn in 2032.

The guacamole market is driven by the mainstream adoption of Mexican cuisine globally and the growth of on-the-go snacking trends.

The market is projected to record a CAGR of 6.1% during the forecast period from 2025 to 2032.

Top key opportunities include innovative preservation methods expanding guacamole’s shelf life and market reach, and growing demand in non-traditional markets like Asia-Pacific.

Key players in guacamole market include MegaMex Foods, Good Foods Group, Sabra Dipping Company, LLC, Calavo Growers, Inc.Hormel Foods Corporation.