Industry: Healthcare

Published Date: November-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 185

Report ID: PMRREP25480

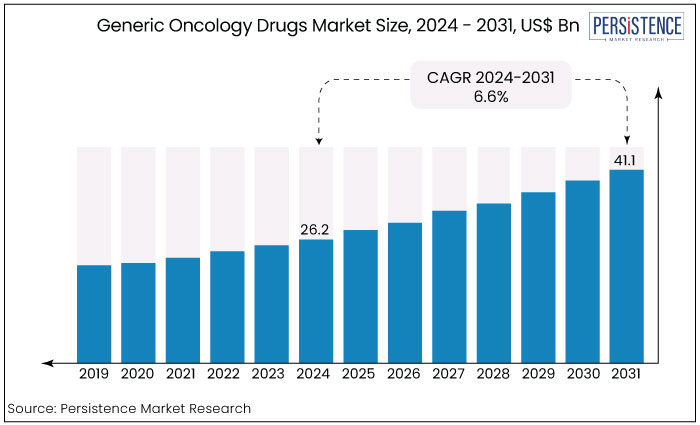

The global generic oncology drugs market is projected to witness a CAGR of 6.6% during the forecast period from 2024 to 2031. It is anticipated to increase from US$ 26.2 Bn recorded in 2024 to a staggering US$ 41.1 Bn by 2031.

Rising cancer rates are driving demand for affordable treatment options, significantly impacting the generic oncology drugs market. The growing acceptance of biosimilars, on the other hand, enhances competition, fostering innovation within the oncology segment.

The shift toward value-based care models encourages healthcare providers to adopt cost-effective generic therapies. Together, these factors create a dynamic landscape that promotes the growth and accessibility of generic oncology treatments, ultimately benefiting patients and providers alike.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Market Size (2024E) |

US$ 26.2 Bn |

|

Projected Market Value (2031F) |

US$ 41.1 Bn |

|

Global Market Growth Rate (CAGR 2024 to 2031) |

6.6% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

5.3% |

|

Country |

CAGR through 2031 |

|

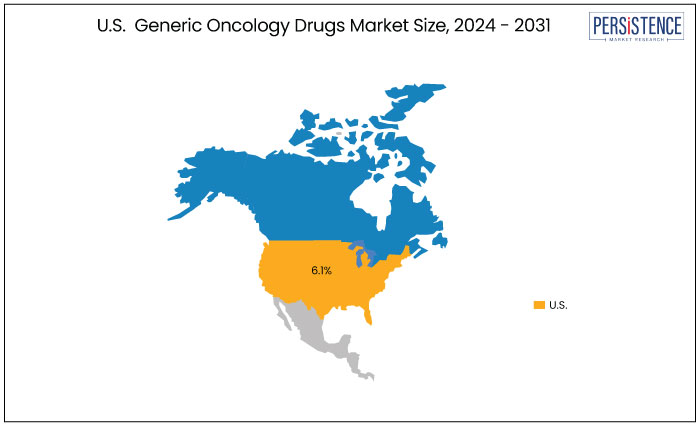

U.S. |

6.1% |

In North America, the United States is anticipated to record a considerable CAGR of 6.1% through 2031. The rising incidence of cancer drives the demand for effective treatment options, leading to increased utilization of generic oncology drugs. Additionally, growing consumer awareness of the benefits of generics, coupled with the emphasis on cost-effectiveness in healthcare, supports this trend.

Leading pharmaceutical companies are also expanding their portfolios to include a wider range of generic therapies, fostering competition and innovation. Also, supportive regulatory policies are enhancing market accessibility, further propelling growth in this segment.

|

Country |

CAGR through 2031 |

|

India |

7.7% |

In Asia Pacific, the generic oncology drugs market growth is estimated to rise in India, which is set to exhibit a CAGR of around 7.7% through 2031. The country's high cancer burden necessitates affordable treatment options, fueling demand for generic therapies. India’s pharmaceutical sector is characterized by a strong emphasis on research and development, enabling the introduction of a diverse range of oncology drugs.

Supportive government policies and initiatives aimed at enhancing healthcare infrastructure and access to medications are significant contributors. Growing patient awareness about the effectiveness of generic drugs further supports market expansion in the region.

|

Category |

CAGR through 2031 |

|

Molecule - Small Molecule |

5.3% |

In terms of molecule, small molecule category is anticipated to lead in the foreseeable future by capturing a CAGR of around 5.3%. Small molecules are generally easier to manufacture and distribute, making them more accessible to patients and healthcare providers. Their established efficacy and well-understood mechanisms of action also contribute to their popularity in oncology.

The increasing focus on cost containment in healthcare is encouraging the use of small molecule drugs, as they often present a more budget-friendly option compared to larger biologics and biosimilars.

|

Category |

CAGR through 2031 |

|

Distribution Channel- Hospital Pharmacies |

6% |

Based on distribution channel, the hospital pharmacies segment is projected to exhibit a CAGR of 6% during the period from 2024 to 2031. This growth can be attributed to the increasing number of cancer cases requiring specialized treatment, leading hospitals to expand their pharmacy services.

Hospital pharmacies play a crucial role in providing immediate access to generic oncology drugs, ensuring that patients receive timely and effective treatment. Additionally, the rise of personalized medicine and the growing focus on integrated healthcare services within hospitals are further driving demand. As hospitals enhance their capabilities to manage complex cancer therapies, the reliance on hospital pharmacies is expected to strengthen significantly.

The growing demand for generic oncology drugs has transformed the cancer treatment landscape, offering patients affordable alternatives to high-cost branded therapies. As patents for numerous blockbuster drugs expire, generic manufacturers are seizing the opportunity to enter the market with effective and accessible options. This trend is driven by increasing global cancer rates and the demand for cost-effective solutions.

In recent years, the focus has shifted toward developing not just traditional generics but also complex generics and biosimilars, which mimic the efficacy of biologics. Regulatory bodies are supporting this shift by streamlining approval processes, further enhancing market entry. Additionally, as healthcare systems prioritize cost containment, the demand for generics is expected to rise, indicating a robust growth trajectory for the generic oncology drugs market in the coming years.

The global generic oncology drugs industry recorded a CAGR of 5.4% in the historical period from 2019 to 2023. Growing prevalence of cancer has been the key indicator driving the global market growth. Recently with the launch of biosimilars by leading players, post patent expiry of blockbuster drugs like REVLIMID® (lenalidomide), the market has seen an immense growth trajectory as well as increased savings from medications used to treat oncology conditions.

Based on therapeutic area, oncology segment is anticipated to see the most patent expirations until 2026, allowing oncology generic manufacturers to launch cost-effective alternatives. This will ultimately transform the market landscape, fostering growth and accessibility while benefiting patients and healthcare providers alike. Sales of generic oncology drugs are estimated to record a CAGR of 6.6% during the forecast period between 2024 and 2031.

Increasing Insurance Coverage for Generic Oncology Drugs

Increased insurance coverage for generic oncology drugs significantly enhances patient access to affordable cancer treatments. As more insurance plans include generics in their formularies, patients are encouraged to choose these cost-effective alternatives, reducing out-of-pocket expenses. This shift not only alleviates the financial burden on individuals but also promotes adherence to treatment regimens, improving health outcomes.

Insurers benefit from lower overall healthcare costs, as generics typically provide the same efficacy and safety as branded medications. As the demand for affordable cancer care rises, expanded insurance coverage for generics becomes a critical factor in fostering equitable access to essential oncology therapies.

Rising Cancer Incidence Fueling Demand for Generic Drugs

The growing incidence of cancer globally is significantly driving the market for cost-effective and affordable generic drugs.

The rising burden of cancer is intensified by an aging population, lifestyle choices, and environmental factors, leading to greater demand for cancer treatments. In such scenarios, generic oncology drugs are crucial for ensuring that patients receive timely and appropriate care. Additionally, as healthcare systems worldwide focus on cost containment and improving patient access, the importance of generics becomes increasingly prominent.

Regulatory Delays for Bioequivalence Approval in the Generic Oncology Drugs Market

Oncology drugs often contain high-potency active pharmaceutical ingredients (HPAPIs) and therefore require a detailed bioequivalence study, precise dosage adjustments, and compliance with toxicity profiles. Bioequivalence (BE) testing is essential for ensuring that generic oncology drugs have the same safety, efficacy, and pharmacokinetic properties as branded drugs.

Meeting the strict standards of regulatory bodies like the U.S.FDA and EMA is complex and can delay product launches. Additionally, regulatory authorities frequently update their BE guidelines to align with evolving scientific knowledge and pharmacovigilance requirements, complicating the process, especially for advanced drug delivery systems. Such evolving requirements can force manufacturers to redesign clinical trials mid-process, adding both time and cost burdens.

Growing Acceptance of Biosimilars in Cancer Care

The acceptance of biosimilar oncology drugs is growing significantly across the globe presenting a substantial opportunity for generic manufacturers. Biologics, particularly monoclonal antibodies like Rituxan, Avastin, and Herceptin, play a critical role in cancer treatment however, the high costs associated with these drugs might strain the healthcare systems.

With patents of these biologics approaching near, biosimilars are expected to gain great momentum, as they are the cost-effective alternatives with similar safety profile and drug efficacy. Countries such as India, Brazil, and China are rapidly adopting biosimilars to address cancer care affordability.

In Europe, biosimilars have already significantly reduced oncology expenses, while U.S. regulatory incentives are facilitating faster approvals, enhancing access in low- and middle-income regions. Increased insurance coverage and a shift toward value-based care further support the transition to these affordable options.

Capitalizing on Patent Loss in Oncology Drugs

The generic oncology drugs market is poised for significant growth as patents for numerous high-cost cancer treatments expire. This shift opens the door for generic manufacturers to introduce affordable alternatives, addressing the increasing demand for accessible cancer therapies worldwide. Key drugs, including Imbruvica and Revlimid, have already transitioned to generics, leading to price reductions and improved patient access.

The rise of biosimilars, particularly in regions like Southeast Asia, Latin America, and Africa, further enhances market opportunities. As governments and healthcare providers push for cost-effective solutions, generic oncology drugs are positioned to play a vital role in improving healthcare affordability while maintaining treatment quality.

The competitive landscape of the market is characterized by a mix of established leaders and smaller, local players. Leading companies with significant presence globally, leverage their resources and expertise to shape market trends and drive innovation.

Domestic firms contribute to the industry's dynamism by focusing on developing cost-effective formulations to meet local healthcare needs as well as improve access to cancer treatments. introducing products and specialized services that address specific regional needs.

As various branded drugs and biologics approach patent expiry, the market is set to provide significant opportunities for the generic manufacturers to develop biosimilars and other generics that uphold quality and efficacy.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Molecule

By Route of Administration

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

Yes, the market is set to reach US$ 41.1 Bn by 2031.

Hospital Pharmacies remain the preferred sales channel contributing more than 50% revenue share in 2023.

U.S is estimated to witness a high market share in 2031.

Sandoz Group AG is considered the leading player.

East Asia is expected to experience the most rapid growth.