- Executive Summary

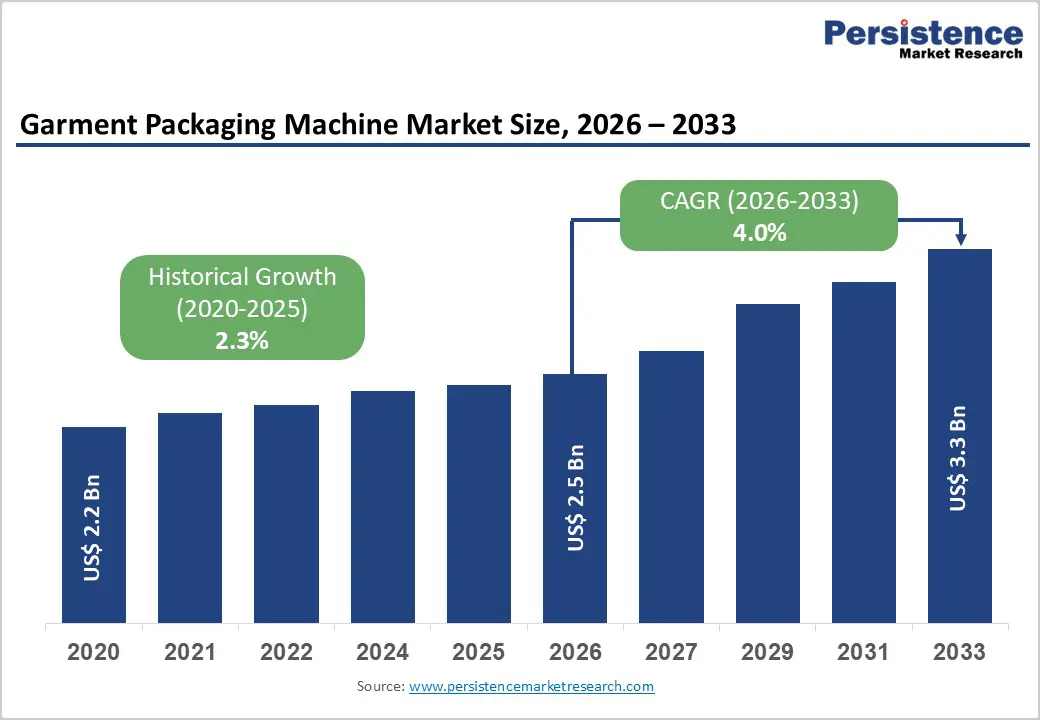

- Global Garment Packaging Machine Market Snapshot 2026 and 2033

- Market Opportunity Assessment, 2026-2033, US$ Bn

- Key Market Trends

- Industry Developments and Key Market Events

- Demand Side and Supply Side Analysis

- PMR Analysis and Recommendations

- Market Overview

- Market Scope and Definitions

- Value Chain Analysis

- Macro-Economic Factors

- Global GDP Outlook

- Global Prison Growth Outlook

- Global Crime Rates by Country

- Global Prison Population by Country

- Global Private Prison Market Growth Outlook

- Other Macro-economic Factors

- Forecast Factors - Relevance and Impact

- COVID-19 Impact Assessment

- PESTLE Analysis

- Porter's Five Forces Analysis

- Geopolitical Tensions: Market Impact

- Regulatory and Technology Landscape

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Trends

- Price Trend Analysis, 2020 - 2033

- Region-wise Price Analysis

- Price by Segments

- Price Impact Factors

- Global Garment Packaging Machine Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Global Garment Packaging Machine Market Outlook: Machine Type

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by Machine Type, 2020-2025

- Current Market Size (US$ Bn) Forecast, by Machine Type, 2026-2033

- Standalone Systems

- Integrated-Line Systems

- Market Attractiveness Analysis: Machine Type

- Global Garment Packaging Machine Market Outlook: Packaging Technology

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by Packaging Technology, 2020-2025

- Current Market Size (US$ Bn) Forecast, by Packaging Technology, 2026-2033

- Vacuum Packaging Machines

- Heat Shrink Packaging Machines

- Poly Bag/Poly Wrap Packaging Machines

- Zipper/Resealable Bag Packaging Machines

- Stretch Film Packaging Machines

- Market Attractiveness Analysis: Packaging Technology

- Global Garment Packaging Machine Market Outlook: Output Capacity

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by Output Capacity, 2020-2025

- Current Market Size (US$ Bn) Forecast, by Output Capacity, 2026-2033

- Up to 500 pcs/hour

- 501-1,000 pcs/hour

- 1,001-2,000 pcs/hour

- Above 2,000 pcs/hour

- Market Attractiveness Analysis: Output Capacity

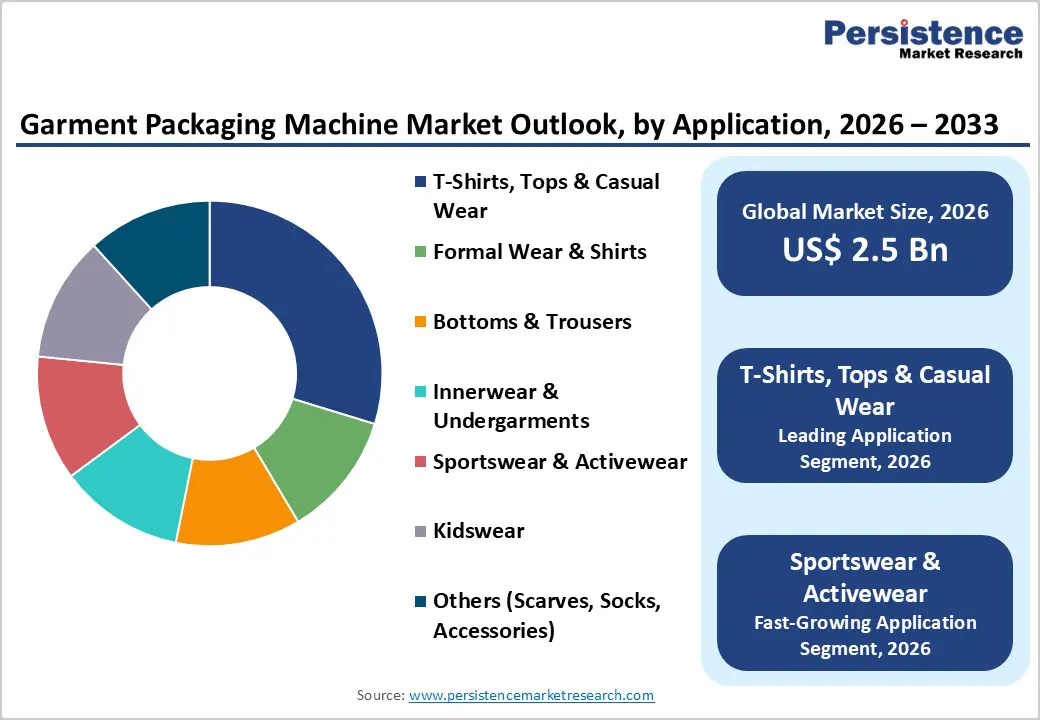

- Global Garment Packaging Machine Market Outlook: Application

- Introduction/Key Findings

- Historical Market Size (US$ Bn) Analysis by Application, 2020-2025

- Current Market Size (US$ Bn) Forecast, by Application, 2026-2033

- T-Shirts, Tops & Casual Wear

- Formal Wear & Shirts

- Bottoms & Trousers

- Innerwear & Undergarments

- Sportswear & Activewear

- Kidswear

- Others (Scarves, Socks, Accessories)

- Market Attractiveness Analysis: Application

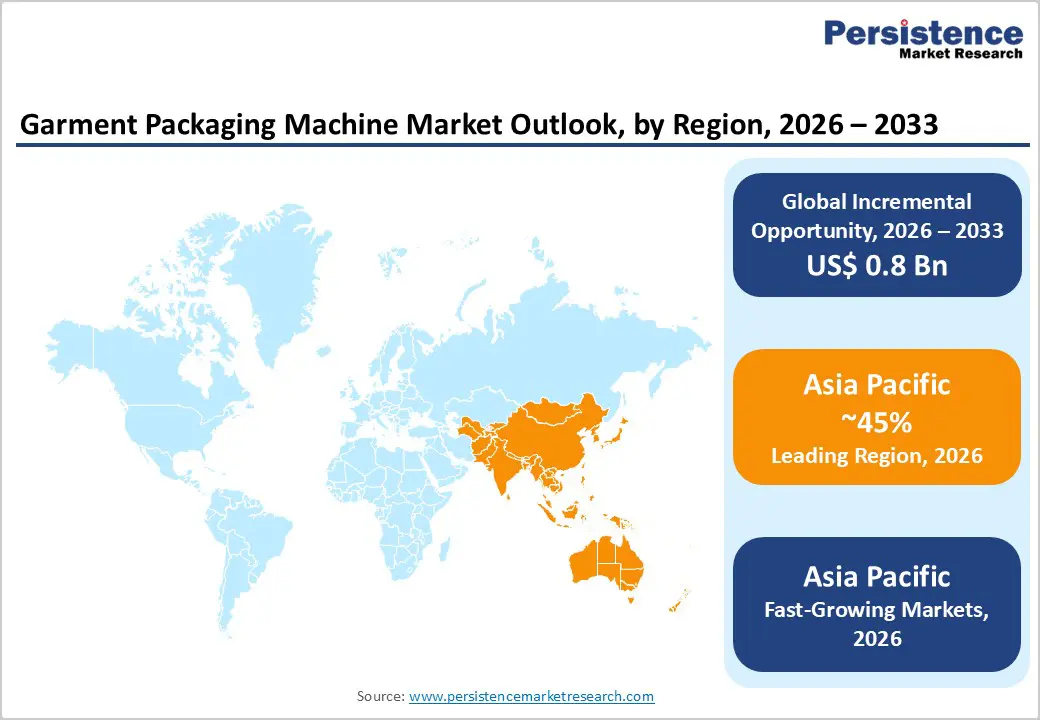

- Global Garment Packaging Machine Market Outlook: Region

- Key Highlights

- Historical Market Size (US$ Bn) Analysis by Region, 2020-2025

- Current Market Size (US$ Bn) Forecast, by Region, 2026-2033

- North America

- Europe

- East Asia

- South Asia & Oceania

- Latin America

- Middle East & Africa

- Market Attractiveness Analysis: Region

- North America Garment Packaging Machine Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Pricing Analysis

- North America Market Size (US$ Bn) Forecast, by Country, 2026-2033

- U.S.

- Canada

- North America Market Size (US$ Bn) Forecast, by Machine Type, 2026-2033

- Standalone Systems

- Integrated-Line Systems

- North America Market Size (US$ Bn) Forecast, by Packaging Technology, 2026-2033

- Vacuum Packaging Machines

- Heat Shrink Packaging Machines

- Poly Bag/Poly Wrap Packaging Machines

- Zipper/Resealable Bag Packaging Machines

- Stretch Film Packaging Machines

- North America Market Size (US$ Bn) Forecast, by Output Capacity, 2026-2033

- Up to 500 pcs/hour

- 501-1,000 pcs/hour

- 1,001-2,000 pcs/hour

- Above 2,000 pcs/hour

- North America Market Size (US$ Bn) Forecast, by Application, 2026-2033

- T-Shirts, Tops & Casual Wear

- Formal Wear & Shirts

- Bottoms & Trousers

- Innerwear & Undergarments

- Sportswear & Activewear

- Kidswear

- Others (Scarves, Socks, Accessories)

- Europe Garment Packaging Machine Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Pricing Analysis

- Europe Market Size (US$ Bn) Forecast, by Country, 2026-2033

- Germany

- Italy

- France

- U.K.

- Spain

- Russia

- Rest of Europe

- Europe Market Size (US$ Bn) Forecast, by Machine Type, 2026-2033

- Standalone Systems

- Integrated-Line Systems

- Europe Market Size (US$ Bn) Forecast, by Packaging Technology, 2026-2033

- Vacuum Packaging Machines

- Heat Shrink Packaging Machines

- Poly Bag/Poly Wrap Packaging Machines

- Zipper/Resealable Bag Packaging Machines

- Stretch Film Packaging Machines

- Europe Market Size (US$ Bn) Forecast, by Output Capacity, 2026-2033

- Up to 500 pcs/hour

- 501-1,000 pcs/hour

- 1,001-2,000 pcs/hour

- Above 2,000 pcs/hour

- Europe Market Size (US$ Bn) Forecast, by Application, 2026-2033

- T-Shirts, Tops & Casual Wear

- Formal Wear & Shirts

- Bottoms & Trousers

- Innerwear & Undergarments

- Sportswear & Activewear

- Kidswear

- Others (Scarves, Socks, Accessories)

- East Asia Garment Packaging Machine Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Pricing Analysis

- East Asia Market Size (US$ Bn) Forecast, by Country, 2026-2033

- China

- Japan

- South Korea

- East Asia Market Size (US$ Bn) Forecast, by Machine Type, 2026-2033

- Standalone Systems

- Integrated-Line Systems

- East Asia Market Size (US$ Bn) Forecast, by Packaging Technology, 2026-2033

- Vacuum Packaging Machines

- Heat Shrink Packaging Machines

- Poly Bag/Poly Wrap Packaging Machines

- Zipper/Resealable Bag Packaging Machines

- Stretch Film Packaging Machines

- East Asia Market Size (US$ Bn) Forecast, by Output Capacity, 2026-2033

- Up to 500 pcs/hour

- 501-1,000 pcs/hour

- 1,001-2,000 pcs/hour

- Above 2,000 pcs/hour

- East Asia Market Size (US$ Bn) Forecast, by Application, 2026-2033

- T-Shirts, Tops & Casual Wear

- Formal Wear & Shirts

- Bottoms & Trousers

- Innerwear & Undergarments

- Sportswear & Activewear

- Kidswear

- Others (Scarves, Socks, Accessories)

- South Asia & Oceania Garment Packaging Machine Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Pricing Analysis

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Country, 2026-2033

- India

- Southeast Asia

- ANZ

- Rest of SAO

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Machine Type, 2026-2033

- Standalone Systems

- Integrated-Line Systems

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Packaging Technology, 2026-2033

- Vacuum Packaging Machines

- Heat Shrink Packaging Machines

- Poly Bag/Poly Wrap Packaging Machines

- Zipper/Resealable Bag Packaging Machines

- Stretch Film Packaging Machines

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Output Capacity, 2026-2033

- Up to 500 pcs/hour

- 501-1,000 pcs/hour

- 1,001-2,000 pcs/hour

- Above 2,000 pcs/hour

- South Asia & Oceania Market Size (US$ Bn) Forecast, by Application, 2026-2033

- T-Shirts, Tops & Casual Wear

- Formal Wear & Shirts

- Bottoms & Trousers

- Innerwear & Undergarments

- Sportswear & Activewear

- Kidswear

- Others (Scarves, Socks, Accessories)

- Latin America Garment Packaging Machine Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Pricing Analysis

- Latin America Market Size (US$ Bn) Forecast, by Country, 2026-2033

- Brazil

- Mexico

- Rest of LATAM

- Latin America Market Size (US$ Bn) Forecast, by Machine Type, 2026-2033

- Standalone Systems

- Integrated-Line Systems

- Latin America Market Size (US$ Bn) Forecast, by Packaging Technology, 2026-2033

- Vacuum Packaging Machines

- Heat Shrink Packaging Machines

- Poly Bag/Poly Wrap Packaging Machines

- Zipper/Resealable Bag Packaging Machines

- Stretch Film Packaging Machines

- Latin America Market Size (US$ Bn) Forecast, by Output Capacity, 2026-2033

- Up to 500 pcs/hour

- 501-1,000 pcs/hour

- 1,001-2,000 pcs/hour

- Above 2,000 pcs/hour

- Latin America Market Size (US$ Bn) Forecast, by Application, 2026-2033

- T-Shirts, Tops & Casual Wear

- Formal Wear & Shirts

- Bottoms & Trousers

- Innerwear & Undergarments

- Sportswear & Activewear

- Kidswear

- Others (Scarves, Socks, Accessories)

- Middle East & Africa Garment Packaging Machine Market Outlook: Historical (2020 - 2025) and Forecast (2026 - 2033)

- Key Highlights

- Pricing Analysis

- Middle East & Africa Market Size (US$ Bn) Forecast, by Country, 2026-2033

- GCC Countries

- South Africa

- Northern Africa

- Rest of MEA

- Middle East & Africa Market Size (US$ Bn) Forecast, by Machine Type, 2026-2033

- Standalone Systems

- Integrated-Line Systems

- Middle East & Africa Market Size (US$ Bn) Forecast, by Packaging Technology, 2026-2033

- Vacuum Packaging Machines

- Heat Shrink Packaging Machines

- Poly Bag/Poly Wrap Packaging Machines

- Zipper/Resealable Bag Packaging Machines

- Stretch Film Packaging Machines

- Middle East & Africa Market Size (US$ Bn) Forecast, by Output Capacity, 2026-2033

- Up to 500 pcs/hour

- 501-1,000 pcs/hour

- 1,001-2,000 pcs/hour

- Above 2,000 pcs/hour

- Middle East & Africa Market Size (US$ Bn) Forecast, by Application, 2026-2033

- T-Shirts, Tops & Casual Wear

- Formal Wear & Shirts

- Bottoms & Trousers

- Innerwear & Undergarments

- Sportswear & Activewear

- Kidswear

- Others (Scarves, Socks, Accessories)

- Competition Landscape

- Market Share Analysis, 2025

- Market Structure

- Competition Intensity Mapping

- Competition Dashboard

- Company Profiles

- Neumann Packaging Services LLC.

- Company Overview

- Product Portfolio/Offerings

- Key Financials

- SWOT Analysis

- Company Strategy and Key Developments

- U-Pack Machinery Technology Co. Ltd.

- PAC Machinery Group.

- KHS Group.

- KETE Group Limited & Zhejiang KETE Machinery Co., Ltd.

- Mollers North America Inc.

- Hangzhou Youngsun Intelligent Equipment Co. Ltd.

- STEFAB India Ltd.

- CMC Packaging Automation

- Frain Industries Inc.

- Suntech Industries Inc.

- Vijay Pack Group

- Nexgen Packaging LLC.

- Harry Rosen Inc.

- Audion Elektro BV

- SIPA Packaging Solutions

- Minipack-Torre S.p.A.

- Robopac S.p.A. (Aetna Group)

- Neumann Packaging Services LLC.

- Appendix

- Research Methodology

- Research Assumptions

- Acronyms and Abbreviations

Loading page data

Please wait a moment