Comprehensive Snapshot of Flight Simulator Market including Regional and Country Analysis in Brief.

Industry: Automotive & Transportation

Published Date: April-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 180

Report ID: PMRREP35191

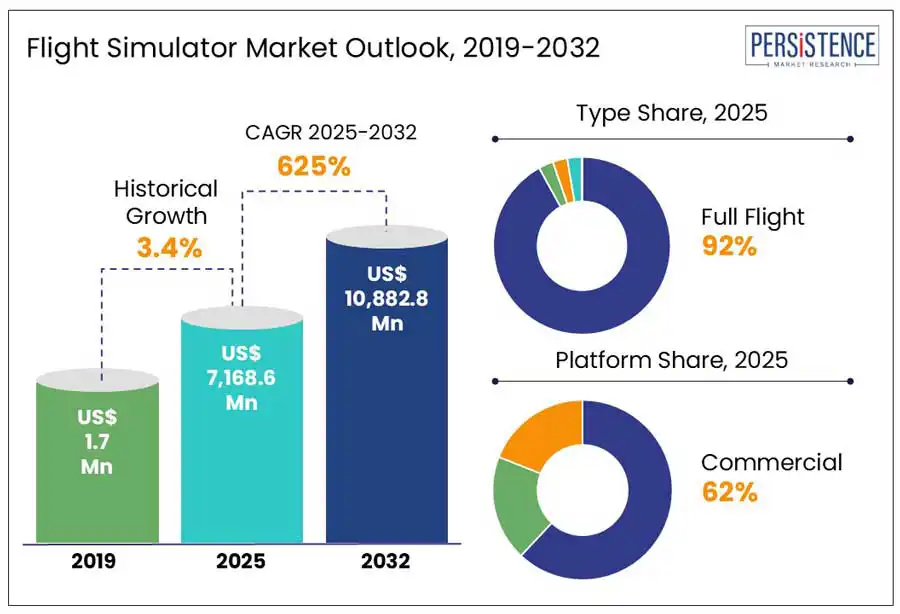

The global flight simulator market size is estimated to grow from US$ 7,168.6 Mn in 2025 to US$ 10,882.8 Mn by 2032. The market is projected to record a CAGR of 6.2% from 2025 to 2032.

To counter the volume of air crash incidents the adoption of flight simulators across the aviation industry is on rise says a Persistence Market Research, report. According to the International Air Transport Association (IATA), in 2024, there were seven fatal accidents among 40.6 million flights, leading to 244 onboard casualties. This resonates to an accident rate of 1.13 per million flights, slightly higher than in 2023.

Flight simulators are extremely useful not just as training tools but as critical assets that ensure safety, efficiency, and innovation across the aviation industry. Companies operating in the airplane simulator space are experiencing significant growth driven by rising safety concerns, regulatory trends, technological innovation, and the global demand for pilots.

Key Industry Highlights

|

Global Market Attribute |

Key Insights |

|

Flight Simulator Market Size (2025E) |

US$ 7,168.6 Mn |

|

Market Value Forecast (2032F) |

US$ 10,882.8 Mn |

|

Projected Growth (CAGR 2025 to 2032) |

6.2% |

|

Historical Market Growth (CAGR 2019 to 2024) |

3.4% |

The COVID-19 pandemic accelerated the retirement of many senior pilots as global airlines were grounded. However, post-COVID, air travel has rebounded sharply, especially in Asia Pacific, North America, and Middle East. IATA forecast 4.7 billion people to travel through air in 2025, up from 4 billion in 2023.

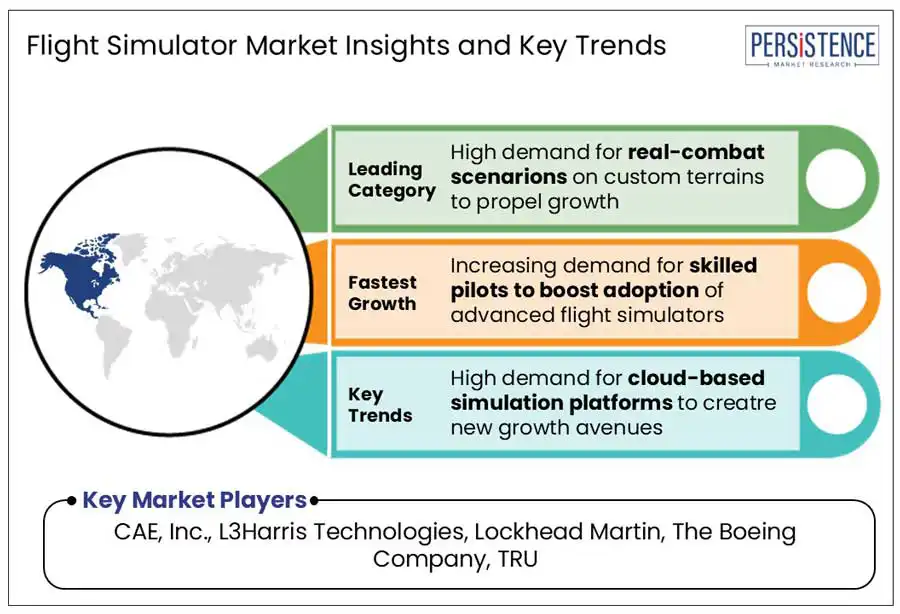

Globally, airlines are expanding their routes and investing in new aircrafts driving the need for seasoned pilots. But a large segment of commercial pilots in many countries is hitting the mandatory retirement age, i.e. 65 years. The shortage of pilots is anticipated to boost the adoption of flight simulators as they aid in training more pilots in less time without compromising on safety and quality. Companies such as L3Harris, CAE, and Boeing Training Solutions experience high orders for simulators and training-as-a-service modules, driven by the increasing global demand for pilots. For instance, in July 2023, Boeing announced investing US$100 million to develop training infrastructure in India. This investment was aimed at addressing the need of over 31,000 trained pilots in the next two decades.

Simulator companies are heavily dependent on OEMs for accurate, up-to-date technical data. However, when OEMs delay releasing updates due to various reasons. For instance, when the aircraft is still undergoing inspection, they charge high licensing fees for using proprietary systems, followed with frequent software updates. At such scenarios, simulators cannot be timely developed, certified, and delivered. These hurdles slow the adoption of pilot training, and further disrupts airline operations.

On the contrary, flight simulation companies are focusing on adopting growth strategies to limit the negative impact of delayed aircraft updates. For example, Flight International, a flight sim company, works closely with Boeing and Airbus to ensure early access to updates. Some regulatory bodies are pushing for standardization so that simulator developers can get access to the updates much faster. Besides, simulators are developed with a modular approach, wherein the software updates are integrated like plug-ins instead of rebuilding the entire system from scratch.

Cloud-based simulation platforms allow pilot training and flight scenarios to be delivered through the internet through cloud infrastructure. These platforms include browser-based or downloadable training modules, cloud-hosted full cockpit environments, and remote instructor access. The increasing adoption of cloud-based platforms due to their lower cost, easy accessibility, faster adoption, and easy integration of Artificial Intelligence (AI) is projected to present a considerable growth opportunity for the market players.

Software companies and startups can gain significantly by building lightweight, cloud-native simulators. Partnering with Edtech and cloud providers such as AWS and Google Cloud further provides these companies to expand and enhance their infrastructures and analytics. For instance, Microsoft Flight Simulator offers a cloud-based scenery streaming and physics engine. Powered by Microsoft Azure, the simulator uses 2.5 petabytes of satellite and terrain data from Bing maps. It allows stunning global coverage and realism by depicting terrains, airports, cities, and even trees in real-time through cloud.

Based on type, the full flight segment is anticipated to hold a share of about 92.0% in 2025. The dominance of the segment is attributable to the high demand for full flight simulation (FFS) in the defense sector. Military flight involves high-risk environments such as combat zones, formation flying, aerial refueling, night operations, and low-altitude maneuvers. FPS allows defense pilots to train faster, prepare for modern asymmetric threats, and to stay ahead in tactics and technology from enemy countries. This is possible through pre-flight rehearsals of real-combat scenarios, coordination with ground forces, UAVs, and naval units, and providing training on custom terrains and enemy threats.

Fixed-base segment, on the other hand, is projected to witness considerable growth, driven by increasing demand for a low cost simulation program and high frequency training in emerging markets.

Based on platform, the commercial segment is likely to hold a share of approximately 63% in 2025. The rising demand for air travel, increasing investments in research and development activities, and high reliance on upskilling and training of commercial pilots are factors expected to drive the demand for the segment in the forthcoming years. Moreover, the growing impetus on commercial fleet expansion by major airlines is anticipated to drive the demand for simulators. As per studies, commercial aircraft fleet is expected to double by 2042. There were 22,000 aircraft in 2023, which is projected to touch 47,000 by 2042.

On the other hand, the military segment is forecast to witness significant growth in 2025. The modernization of defense sectors drives demand for simulators for F-35, C-130, Apache drones, and trainers. Countries such as the U.S., China, India, and others are focusing on adopting cutting edge LVC and AI-integrated simulators. For instance, the U.S. military is increasingly adopting networked simulators to link real airplanes, virtual pilots, and AI in joint scenario-based training.

North America is expected to witness robust growth and hold a share of about 35% in 2025. The growth in the region is attributable to the presence of major OEMs such as CAE, L3Harris Technologies, FlightSafety International, Lockhead Martin, TRU, others. These companies are focusing on strengthening their position by adopting advanced technology ecosystems that integrate AI, immersive environments, and data analytics. In addition, supportive government policies and initiatives are expected to boost the adoption of simulators in this region. For instance, The Department of Defense has collaborated with NASA to develop mixed-reality cockpits and combat training modules to train future eVTOL/UAM pilots.

The U.S. is projected to experience explosive growth during the forecast period. According to the Federal Aviation Administration (FAA), about 1200+ active simulators are present in the U.S. alone. More than half of all new Level D simulators are delivered to several training centers in North America, with hubs present in Dallas, Miami, Phoenix, and Atlanta. Besides, increasing spending in research and development activities by government and private companies is expected to drive market demand. For instance, FAA, Nasa, and Department of Defense spend approximately US$5 bn annually on simulation-related spending.

Canada, on the other hand, is expected to witness considerable growth, driven by increasing investment in research and development activities by the government in immersive training technology. Canada exports simulators globally for both military and commercial purposes and is the headquarter to the largest global flight simulator OEM, CAE, which is expected to favor regional market growth.

Asia Pacific is projected to be the fastest-growing region in the market in the forthcoming years. Factors such as high demand for skilled commercial pilots in countries such as India, China, Vietnam, and Indonesia, rapid-paced expansion of low-cost carriers (LCCs), active aircraft acquisition programs, and rising defense budgets. For example, in 2024, VietJet, a leading air carrier in Vietnam, placed an order for 200+ Boeing 737 MAX aircraft. The deal is estimated at US$25 Bn as new financing agreement was signed with AV AirFinance to accelerate the deliveries. This aircraft acquisition is anticipated to drive demand for various new pilots and VietJet will need access to multiple Boeing 737 MAX FFS units to cater to the demand. With no current Boeing-dedicated FFS centers, it presents a huge growth opportunity to set up simulation hubs in Hanoi, Da Nang, or Ho Chi Minh City.

Rapid growth in passenger traffic, fleet expansion activities by IndiGo, Air India, and Akasa Air, and increasing investment in aircraft infrastructure development are expected to drive the demand for flight simulators in India. Strong push for the development of local training hubs in cities such as Bengaluru, Delhi, Hyderabad, and Gurgaon, among others by HAL and DRDO is forecasted to boost the adoption of advanced simulators for mission and tactical purposes.

Europe is anticipated to experience substantial growth driven by the presence of stringent European Union Aviation Agency (EASA) regulations, civil fleet expansion, and sustainability-focused training. As per EASA, it is mandatory for pilots to undergo significant training hours that are conducted in approved flight simulation training devices (FSTDs). Further, for Airline Transport Pilot License and Type Ratings, use of Level D Full Flight Simulators (FFS) is mandatory.

Several non-EU training organizations consider EASA certification as a gold standard for international pilots. This makes European simulator OEMs and training centers highly competitive.

The global flight simulator market is moderately consolidated, while being dominated by a handful of established OEMs and training providers, with stiff competition from regional players, contractors, and startups. Companies in the market are focusing on adopting partnerships, investments in research and development activities, product innovation, and expansion of local manufacturing facilities. Moreover, companies are investing in AI-powered training to enhance efficiency, realism, and scalability of pilot training to maintain their dominance in the market.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Mn |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

Available upon request |

By Type

By Platform

By Method

By Solution

By Region

To know more about delivery timeline for this report Contact Sales

The Flight Simulator market size is US$ 7,168.6 Mn in 2025.

The industry will likely be valued at US$ 10,882.8 Mn in 2032.

A few of the leading players in the market are CAE, L3Harris Technologies, The Boeing Company, Thales Group, and Raytheon Technologies Corporation.

The industry is estimated to rise at a CAGR of 6.2% through 2032.

North America is projected to hold the largest share of the industry in 2025.