Industry: IT and Telecommunication

Published Date: December-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 170

Report ID: PMRREP18928

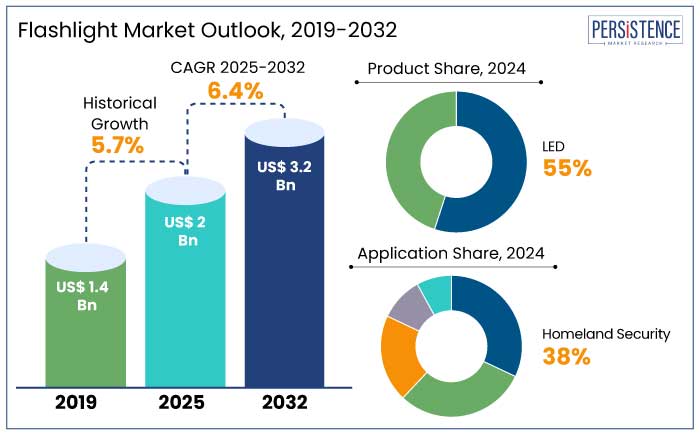

The global flashlight market is estimated to reach a value of US$ 2 Bn by 2025. It is anticipated to experience a CAGR of 5.7% during the forecast period to reach a size of US$ 3.2 Bn by 2032. Solid-state batteries are estimated to become mainstream by the end of the assessment period as they offer a 2x to 3x higher energy density compared to lithium-ion batteries.

Smart flashlights are estimated to account for 20% of the flashlight market by the end of 2032 as consumers’ demand IoT connectivity, voice activation, and motion sensors in flashes. Advancements in solar panel efficiency are predicted to make solar-powered flashes a viable alternative for developed as well as developing markets. Tactical and specialized flashlights designed for hazardous environments are likely to see increased adoption in mining and petrochemical industries.

Key Highlights of the Industry

|

Market Attributes |

Key Insights |

|

Flashlight Market Size (2025E) |

US$ 2 Bn |

|

Projected Market Value (2032F) |

US$ 3.2 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

5.7% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

6.4% |

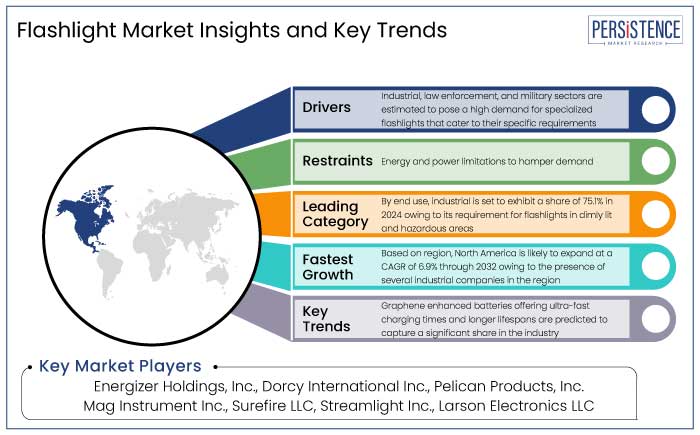

Flashlight market in North America is estimated to hold a share of 26.5% in 2024. The region has a robust outdoor recreation culture with millions of people participating in activities like fishing, hiking, hunting, and camping. Almost 50 million people in the U.S. participated in outdoor activities like camping in 2023, thereby driving the demand for portable lighting solutions.

Consumers in North America favor flashlights that are compact, durable, and multifunctional with preferences for LED technology owing to its energy efficiency and longevity. The region has a robust industrial base with a high demand for flashlights in sectors like construction, law, enforcement, mining, and emergency services.

Several industries in the region are subject to stringent safety and compliance regulations that drive the demand for high-quality and specialized flashlights. Industrial-grade flashlights that are explosion-proof, tactical, and rechargeable, accounted for 55% of total flashlight sales in North America in 2023.

Companies in North America like Streamlight, Dorcy, and Energizer are mainly investing in research and development to bring innovative, energy-efficient, and durable flashlight products in the market.

LED flashlights are emerging as a dominant product in the industry with a predicted share of 55% in 2024. They are more energy-efficient compared to incandescent lights as they use up to 80% less energy, resulting in a long battery life and decreased need for frequent replacements. LEDs are more durable due to their solid state.

LED flashlights are available in a range of 500 to 2000 lumens, thereby making them suitable for a wide range of tasks compared to incandescent flashlights. They are also more environment-friendly as they do not contain any harmful chemicals like mercury and are 100% recyclable.

LEDs are essentially used in industrial applications like construction, mining, and search and rescue owing to their robustness, long operational life, and brightness, even in harsh environments. LED flashlights are predicted to hold 70% of the industrial flashlight market share in the coming years.

Homeland security is estimated to become the leading application with a projected share of 32% in 2024. Growth in concerns regarding homeland security is increasing the need for equipment that can ensure safety and effectiveness of first responders, military personnel, law enforcements, and emergency services.

Flashlights are crucial tools in these sectors as they provide the required illumination during nighttime operations, disaster response efforts, and search and rescue missions. Flashlights ensure that security operations are carried safely and effectively.

Demand for flashlights with advanced features like long battery life, adjustable brightness, and infrared capabilities is witnessing robust growth. Government authorities have ramped up investments in national security and disaster preparedness, thereby boosting the demand for reliable lighting solutions for emergency operations.

The industrial sector is predicted to lead the end use segment with a predicted share of 75.1% in 2024. Flashlights are crucial in a variety of operations in industrial environments for maintenance and repair work as well as inspection tasks in poorly lit or hazardous areas.

Industrial-grade flashlights are required to be highly durable, able to withstand shocks, extreme temperatures, and exposure to dust and moisture. Industrial sectors are progressively adopting lighting technologies like LED and rechargeable battery systems that offer longer operational hours, enhanced energy efficiency, and great sustainability. Smart flashlights with motion sensors and adjustable brightness are gaining traction in industries like manufacturing and oil and gas for improved efficiency and safety.

Potential growth in the global flashlight industry is predicted to be driven by technological innovations including the introduction of LEDs with higher lumen-per-watt efficiency and enhanced heat management. Government authorities and consumers worldwide are estimated to push for environment-friendly materials and manufacturing processes amid the shift toward sustainability.

Solid-state batteries and graphene-based solutions are estimated to gain traction as they improve performance and decrease charging times. Consumers will likely have a high demand for flashlights integrated with IoT and AI for smart features like sensing, automatic diming, and remote control. Customization is a rising trend in the market as both consumers and corporates demand personalized flashlights.

The flashlight market growth was robust at a CAGR of 6.4% during the historical period. The period witnessed a transition to LED technology as they became standard for flashlights owing to their superior energy offering, brightness and durability. LED accounted for 85% of flashlight sales by 2023. Lithium-ion and NiMH batteries gained traction for their extended runtime and eco-friendly properties.

Rechargeable flashlights accounted for 45% of market in 2023. The period witnessed a shift in consumer preference toward compact and lightweight designs, multi-functionality, and sustainability, thereby influencing purchasing decisions. Customization and branding opportunities attracted several corporate buyers and gift-giving markets.

Integration with Consumer Electronics

A survey conducted in 2023 revealed that 68% of consumer prefer multifunctional gadgets over single-purpose devices while purchasing outdoor or travel equipment. Flashlights are progressively being combined with power banks, emergency alms, and radios. This versatility and multifunctional use make the attractive to outdoor enthusiasts, travellers, and emergency preparedness kits.

Manufacturers are designing Bluetooth enabled flashlights that enable users to control light settings or monitor battery life through smartphone applications. These flashes are being connected to smart home systems or IoT networks to improve convenience. For example, these flashes could be programmed to be activates automatically during power outages.

Power banks integrated with flashlight functionality are becoming a common choice for travellers and outdoor users. Emergency radios equipped with flashlights and charging ports cater to the demand of preparedness-focused consumers. A survey conducted in 2022 indicated that 75% of households in the U.S. keep at least one multipurpose emergency tool.

Compliance with Health and Safety Standards in Products Launches by Manufacturers

Compliance with health and safety standards remains a is a crucial factor in the flashlight market especially for industries and applications that require specialized lighting solutions. A study conducted in 2023 revealed that 73% of industrial buyer prioritize safety certifications while purchasing equipment, including lighting tools.

Standards like the ANSI/NEMA FL1, set by the American National Standards Institute and the National Electrical Manufacturers Association, define performance criteria like water resistance, impact resistance, runtime, and brightness. Almost 85% of manufacturers of tactical and industrial flashlight comply with ANSI/NEMA FL1 to cater to buyer expectations.

Flashlights used in workplaces are required to comply with OSHA (Occupational Safety and Health Administration) standards for particular environment in the U.S. The European Union (EU) mandates CE marketing for flashlights sold within its jurisdiction to comply with health safety, and environmental protection standards.

Energy and Power Limitations Remain a Key Barrier

Energy and power limitations of flashlights are crucial restraining factors in the industry, especially as consumer demand long battery life, energy-efficient solutions, and high brightness levels. Several flashlights still depend on disposable batteries that deplete quickly, contribute to e-waste, and add to the long-term operational costs.

Sales of non-rechargeable battery are predicted to decline at a CAGR of 2.4% through the forecast period as rechargeable alterative gain traction. Temperature sensitivity of batteries is another major concern in the market.

Cold weather is noted to register battery performance with lithium-ion batteries witnessing 30% to 50% capacity loss at temperatures below freezing. High temperatures, on the other hand, can result in overheating and damage, thereby decreasing the lifespan of the battery while posing safety risks.

Expanding Outdoor Recreation Fuels Demand for Reliable Lighting Solutions

According to the Outdoor Industry Association (OIA), about 160 million people in America participated in at least one outdoor activity in 2022. As hands-free lighting is essential for activities like night hiking and climbing, the head flashlight market is witnessing robust expansion.

Backpackers mostly favor lightweight and pocket-sized flashlights owing to their portability. According to the statistics provided by Kampgrounds of America (KOA), the number of households camping in the U.S. reached 58 million in 2023.

Night camping and stargazing are gaining traction among the Gen-Z and millennial demographics. This is increasing the demand for reliable lighting solutions like flashlights and lanterns with adjustable brightness and red-light modes to preserve night vision.

Growing Demand for Customized and Personalized Flashlights by Consumers and Businesses

Customization and personalization are gaining traction in the flashlight market as consumers and businesses seek customized solutions that reflect their unique requirements, branding requirements, and preferences. This trend aligns with a shift toward individualized products in serval consumers and industrial sectors.

A study conducted in 2023 revealed that 36% of consumers are willing to pay more for personalize products, reflecting a growing preference for unique items. Consumers value the ability to customize flashlight aesthetics like colour, engraving, and casing materials.

Based on Promotional Production Association International (PPAI), 72% of consumer recall branding on promotional products, thereby making customized flashlights a high-impact advertising tool. Businesses and institutions often order flashlights with their logos for giveaways, customer rewards, and employee incentives.

Industrial users like construction, law enforcement, mining often require flashlights with specialized features like improved durability, explosion-proof designs, and specific beam types. Retailers and distributors request private-label flashlights with custom branding to differentiate their offerings.

Companies in the flashlight market are incorporating modern features like LED technology, solar charging, smart connectivity, and rechargeable batteries. Thy are using high quality materials like aircraft-grade waterproofing, ergonomic designs, and aluminium. They are designing flashlights for specific use cases like tactical flashlights for law enforcement, headlamps for outdoor enthusiasts, or compact models for everyday carry (EDC).

Businesses are targeting diverse customer groups like adventurers, professionals, and emergency responders. They are providing a range of products at different price points to appeal to budget-conscious consumers and premium buyers. Companies are also using sustainable materials and processes in manufacturing to offer eco-friendly options like rechargeable or solar-powered flashlights.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Product

By Application

By End Use

Region

To know more about delivery timeline for this report Contact Sales

The market is anticipated to reach a value of US$ 3.2 Bn by 2032.

Increased adoption of LED flashlights in residential and commercial sectors is a prominent factor propelling flashlight market growth.

Innovations to increase battery life is predicted to play a substantial role in fostering expansion.

North America is estimated to emerge as the leading region with a CAGR of 6.9% in 2024.

Energizer Holdings, Inc., Dorcy International Inc., and Pelican Products, Inc. are the prominent companies in the industry.