Industry: Healthcare

Published Date: January-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 182

Report ID: PMRREP3226

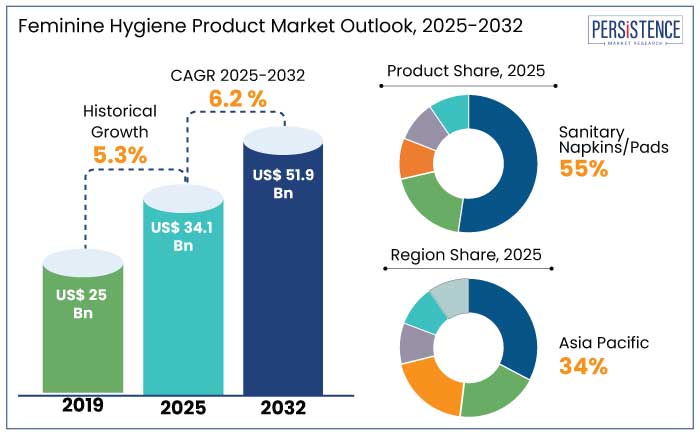

The feminine hygiene product market is estimated to increase from US$ 34.1 Bn in 2025 to US$ 51.9 Bn by 2032. The market is projected to record a CAGR of 6.2% during the forecast period from 2025 to 2032.

The global market is a dynamic and rapidly evolving segment, with significant growth projected globally. Innovations like biodegradable products, period underwear with a carbon footprint 5 times smaller than traditional products, and diagnostic technologies like Qvin's FDA-approved menstrual pad blood test exemplify the market's technological developments. Global campaigns like P&G's ‘Always Keeping Girls in School’ have significantly increased product adoption, especially in underserved regions.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Feminine Hygiene Product Market Size (2025E) |

US$ 34.1 Bn |

|

Projected Market Value (2032F) |

US$ 51.9 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

6.2% |

|

Historical Market Growth Rate (CAGR 2019 to 2023) |

5.3% |

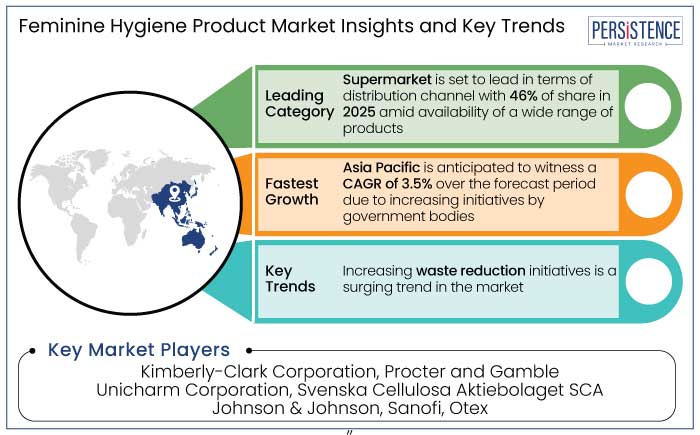

Asia Pacific is projected to lead the market, accounting for a total share of 34% in 2025, and is projected to see a CAGR of 3.5% during the forecast period from 2025 to 2032. Increasing youth demographic in the region is the primary driver of market growth.

The government is implementing programs and activities to eradicate the stigma, enhance knowledge among women, and promote the use of feminine hygiene products. For instance,

Increasing disposable income, knowledge of feminine hygiene, and government initiatives propel market growth in India. In July 2024, the Ministry of Health and Family Welfare implemented a promotion strategy for feminine hygiene targeting adolescent girls in rural areas, as the National Health Mission (MHS) data reported.

Various foundations and NGOs, including the Pinkishe Foundation, strive to eradicate menstruation taboos, advocate for healthy practices, and supply complimentary menstrual products in schools to enhance awareness in remote regions of the country.

The Government of India is advocating for hygienic products. For example,

Various companies and organizations are engaged in the sector, delivering sustainable and reusable products, including Anandi, Eco Femme, Saathi, and Avni Wellness.

Based on product, the market is divided into sanitary napkins/pads, tampons, panty liners, menstrual cups, and feminine hygiene wash. Out of these, the sanitary napkins/pads segment dominates the market their widespread usage, ease of availability, and suitability for diverse cultural and economic contexts. The segment will likely hold a feminine hygiene product market share of 55% in 2025.

Sanitary pads are a staple feminine hygiene product globally, particularly in regions like Asia Pacific, where they form the primary choice for menstrual hygiene due to their affordability and accessibility. Sanitary napkins are available across urban and rural areas and cater to a wide range of income groups. Several governments and organizations distribute them at subsidized rates or for free in low-income regions, boosting their adoption.

Compared to other products like tampons or menstrual cups, sanitary pads are considered more user-friendly, particularly among first-time users and in cultures where internal products are less accepted. Their external application makes them a preferred choice in many developing countries.

Leading manufacturers are investing in product innovations, such as ultra-thin pads with high absorption, biodegradable options, and designs tailored for specific age groups or lifestyles. These developments have reinforced the popularity of sanitary pads.

Based on distribution channel, the market is divided into supermarket, convenience stores, department stores, retail pharmacies, and online purchase. Out of these, the supermarket segment dominates the market due to its convenience and accessibility.

Supermarkets offer a one-stop shopping experience, allowing consumers to purchase a wide range of feminine hygiene products alongside other household necessities. It provides an extensive selection of brands and product types, catering to diverse consumer preferences and budgets.

Supermarkets often feature discounts and promotional offers, making products more affordable and appealing to a broad customer base. The extensive network of supermarkets ensures product availability across various regions, including urban and suburban areas.

Supermarkets dominate the distribution of feminine hygiene products due to their convenience, variety, and accessibility. However, the rising prominence of online retail channels indicates a dynamic market poised for further evolution.

The feminine hygiene product market is a vital segment of the global personal care industry, catering to the diverse needs of women across all age groups. It encompasses a wide range of products, including sanitary napkins, tampons, panty liners, menstrual cups, and feminine hygiene washes, essential for managing and maintaining menstrual health.

Rising awareness of women's health and hygiene, increasing disposable income, and improved accessibility have created significant growth in the market globally. The market's growth is also fueled by several factors, including rising urbanization, increased female workforce participation, and supportive government initiatives.

Programs aimed at improving menstrual hygiene, such as free distribution of sanitary products in schools and public institutions, have raised market reach, particularly in underprivileged communities. The market has seen innovations in product design, including ultra-thin pads with superior absorbency, tampons with improved applicators, and menstrual cups with enhanced durability. Integrating AI and IoT into online retail platforms has revolutionized the consumer purchasing experience by offering personalized product recommendations. For example,

During the historical period from 2019 to 2024, the feminine hygiene product market experienced steady growth, driven by increasing awareness about menstrual hygiene, rising disposable incomes, and expanding access to hygiene products globally. Governments and NGOs played a vital role in raising awareness, particularly in emerging economies, through educational campaigns and initiatives like free sanitary product distribution in schools.

Key market players focused on product innovation, introducing ultra-thin pads, biodegradable materials, and improved tampons. The rise of e-commerce enabled greater accessibility, even in remote areas. However, cultural taboos and lack of awareness in certain regions posed challenges, limiting growth potential.

Over the forecast period, the market is likely to witness accelerated growth fueled by technological developments, sustainability trends, and changing consumer preferences. Products like reusable menstrual cups and period underwear are projected to gain significant traction, driven by environmental concerns.

Adopting AI and IoT in e-commerce will likely personalize consumer experiences, further boosting sales. Emerging economies in Asia-Pacific and Africa are poised for rapid market expansion as awareness increases and governments introduce supportive policies. Innovations such as menstrual health tracking apps and smart hygiene products are likely to revolutionize the market further, solidifying its growth trajectory.

Rising Awareness and Education on Menstrual Hygiene is a Key Market Driver

One of the most significant growth drivers for the feminine hygiene product industry is the increasing awareness and education around menstrual hygiene. Over the years, global campaigns and government initiatives have aimed to break the stigma surrounding menstruation, particularly in developing regions where cultural taboos and lack of awareness hinder access to hygiene products.

Organizations like UNICEF, WHO, and local NGOs have played a pivotal role in educating women and girls about the importance of menstrual health. Educational programs in schools have normalized discussions on menstruation, encouraging young girls to adopt safe and hygienic practices.

Increased awareness has led to a surging adoption of feminine hygiene products, such as sanitary pads and tampons, particularly in underserved communities. As a result, the market has witnessed significant growth, especially in emerging economies.

Since 2023, Procter and Gamble's brand, Always, has been instrumental in promoting menstrual hygiene education through its ‘Always Keeping Girls in School’ program. The initiative focuses on educating young girls about menstruation, providing sanitary products, and supporting menstrual health education in various countries, including Kenya and other nations in Africa.

Technological Developments and Product Innovations to Spur Market Growth

Technological developments and continuous product innovation have been key drivers in the feminine hygiene product industry. Companies are introducing a range of products tailored to meet the diverse needs of modern consumers. Biodegradable and organic sanitary pads cater to eco-conscious consumers, while menstrual cups and period underwear appeal to those seeking sustainable and cost-effective options.

Integrating smart technologies, such as apps for tracking menstrual health and IoT-enabled hygiene products, enhances consumer experience. Such innovations address practical concerns and align with evolving consumer preferences, making these products more appealing to a broader audience. As technology continues to shape the industry, the market is poised for sustained growth. For example,

Cultural Taboos and Social Stigma May Impede Market Growth

One of the most significant restraints for the feminine hygiene product market is the persistence of cultural taboos and social stigma surrounding menstruation. In several developing regions, menstruation is considered a taboo topic, often associated with shame and embarrassment. This stigma discourages open discussions about menstrual health, leading to a lack of awareness about available hygiene products.

Women and girls in these regions may use unsafe alternatives such as cloth or leaves, further limiting the market potential for commercial products. Efforts to combat these taboos, while increasing, require significant time and investment. Until societal attitudes shift more broadly, these cultural barriers will likely continue to hinder market growth and the adoption of feminine hygiene products in underpenetrated regions.

Increasing Waste Reduction Initiatives to Create New Opportunities

Reusable and alternative eco-friendly solutions are being advocated to mitigate the waste generated by single-use pads, tampons, and disposable deodorizing wipes. The United Nations Environment Program (UNEP) states that single-use plastic menstrual products require over 500 years to disintegrate.

Reusable menstrual cups, period underwear, and pads are becoming recognized as effective options for reducing waste production. The article ‘Making Menstrual Products Eco-friendly,’ published by Plastic Oceans International in February 2021, states that around 45 billion menstrual products are utilized globally each year, and an average pad user consumes 4,125 plastic bags during their lifetime.

Companies are actively promoting safer and less hazardous scent compounds in deodorizing products, biodegradable wipes, and recyclable packaging to clients. Bodywise (U.K.) Limited provides a range of Natracare products, including tampons, panty liners, wipes, and pads. These items are composed of 100% organic cotton, sustainably sourced wood pulp, and compostable bioplastic devoid of synthetic dyes, and are certified vegan.

The feminine hygiene product market is highly competitive, with global players focusing on product innovation, sustainability, and regional expansion. Key companies include Procter and Gamble (Always, Whisper), Kimberly-Clark (Kotex, Thinx), and Johnson and Johnson (Carefree, Stayfree), dominating through extensive product portfolios and robust marketing strategies.

Emerging brands like Luna Daily and WUKA are gaining traction by offering eco-friendly and reusable alternatives such as menstrual cups and period underwear. Regional players in Asia Pacific and Africa are increasingly addressing local needs with affordable products and distribution partnerships. The rise of e-commerce platforms has intensified competition, enabling small-scale players to reach wider audiences and fueling growth in innovative, sustainable, and consumer-centric solutions.

Recent Industry Developments

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization and Pricing |

Available upon request |

By Product

By Distribution Channel

By Region

To know more about delivery timeline for this report Contact Sales

The market is estimated to be valued at US$ 34.1 Bn in 2025.

Pads and tampons are the most popular hygiene products.

India sanitary napkin market size was valued at US$ 0.9 Bn in 2024.

The global market is estimated to exhibit a CAGR of 6.2% over the forecast period.

Kimberly-Clark Corporation, Procter and Gamble, and Unicharm Corporation are a few key players.