Europe, U.K., and Australia Electric Blanket Market Segmented By Over Blankets, Under Blankets, Electric Pads Product Type in Economy, Mid and Premium Range in Wool, cotton, Polyester, Acrylic Electric Blankets Marterial

Industry: Consumer Goods

Published Date: April-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 300

Report ID: PMRREP33027

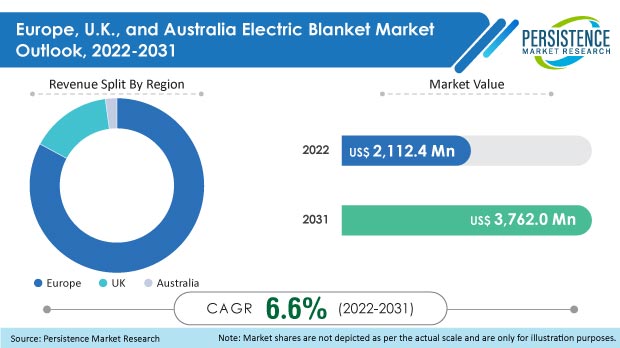

Sales of electric blankets across Europe, U.K., and Australia are estimated to increase at a CAGR of 6.6% from 2022 to 2031. The Europe, U.K., and Australia electric blanket market is currently worth US$ 2.11 Bn, and is projected to surge to a valuation of US$ 3.76 Bn by the end of 2031.

| Attribute | Key Insights |

|---|---|

|

Europe, U.K., and Australia Electric Blanket Market Size (2022) |

US$ 2.11 Bn |

|

Sales Forecast (2031) |

US$ 3.76 Bn |

|

Global Market Growth Rate (2022-2031) |

6.6% CAGR |

|

Europe Market Share |

82.9% |

Electric blanket consumption in Europe, U.K., and Australia accounted for 20% share of the global electric blanket market in 2021. Increasing use of technology in these consumer products is anticipated to be a major trend that drives demand for electric blankets through 2031.

Technology has become one of the most crucial aspects of our lives, and increasing digitization will further propel technological proliferation in all walks of life. Electric blankets are new innovative products that provide more comfortable heating for customers.

From 2016 to 2021, shipments of electric blankets rose at a CAGR of 5.2% across Europe, U.K., Australia, and held a net worth of US$ 1.99 Bn in 2021.

Increasing technological advancements, rising disposable income, high prices of room heaters, extreme winters with low temperatures, and increasing demand for electric blankets with unique features are some of the major trends that will influence the consumption of electric blankets in Europe, U.K., and Australia.

However, seasonal sales of electric blankets will have a constraining effect on Europe, U.K., and Australia electric blanket market growth. Another factor that could hamper electric blanket sales is their improper use, which could lead to detrimental effects on children and pregnant women.

Demand for electric blankets in Europe, U.K., and Australia is anticipated to exhibit expansion at a CAGR of 6.6% from 2022 to 2031.

“Increasing Geriatric Population to Propel Sales of Electric Blankets”

The geriatric population is increasing across the globe, and this trend is also prominently impacting the markets in Europe, U.K., and Australia. Older people are more sensitive to changes in weather, and extreme cold or heat can lead to further complications for their health.

Increasing focus on elderly care is expected to drive the sales of electric blankets in the aforementioned regions. Growing preference for electric blankets over room heaters by the geriatric population will also favour market growth through 2031.

“Lower Cost of Electric Blankets than Room Heaters to Boost Demand”

Room heaters have been extensively used across the world and have been a popular heating choice; however, the emergence of electric blankets has offered a low-cost alternative to consumers, and thereby propelled demand for the same.

Unique features and more cost-effective heating properties of electric blankets are driving the popularity of these products over room heaters, which are relatively costlier.

“Improper Use Could Lead to Overheating & Adverse Impact on Health”

Electric blankets are a value proposition if they are used as instructed, but they can have detrimental effects on human health if used in an improper manner. Especially for pregnant women, overheating could cause serious complications in their health as electric blankets produce low-frequency electromagnetic fields that could potentially harm the foetus.

Moreover, seasonal nature of the sales of electric blankets is also expected to hinder market potential in the long run. These factors could restrain the adoption of electric blankets to a certain extent across the areas of Europe, U.K., and Australia over the next ten years.

“Increasing Geriatric Population & High Costs of Room Heaters to Boost Electric Blanket Shipments”

Europe is expected to hold a dominant market share in the Europe, U.K., and Australia electric blanket landscape. Sales of electric blankets in this region currently account for 82.9% of the overall market share in 2022.

Demand in this region is expected to be driven by the rising geriatric population and increasing technological advancements in consumer products.

Majority of electric blanket sales in this region are through indirect sales channels, and this trend is expected to be prevalent in the Europe electric blanket market over the coming years as well.

Will Australia Be a Lucrative Market for Electric Blanket Manufacturers?

“Increasing Preference of Electric Blankets Over Room Heaters to Boost Market Potential”

Electric blankets have proven to be more cost-effective than room heaters and also have low operational costs as compared to the latter. This factor has propelled the popularity of electric blankets in Australia and is expected to continue through the forecast period.

Currently, the Australia electric blanket market accounts for a market share of 2.1% in the overall Europe, U.K., and Australia market for electric blankets. Electric blanket suppliers are focusing on launching new products and boosting their sales potential in the nation.

Which Sales Channel Will Have a Dominant Outlook?

“Indirect Sales of Electric Blankets to Remain High”

Indirect sales of electric blankets are expected to account for a majority of the market share, and are anticipated to maintain this trend through 2031.

The prospect of physically accessing and checking electric blankets is a popular purchasing trend that is only accessible via some indirect sales channels. This factor alone will prominently influence electric blanket market growth in Europe, U.K., and Australia through indirect sales channels.

Did the COVID-19 Pandemic Affect Electric Blanket Demand in Europe, U.K., and Australia?

In 2020, as coronavirus infections plagued the world, it led to a downfall of the world economy and also the downfall of several markets. The electric blanket market in Europe, U.K., and Australia also experienced a downfall as lockdown restrictions made it difficult for electric blanket manufacturing companies to continue with their manufacturing and distribution activities.

Restricted industrial activity due to lockdowns led to a downfall in the production of electric blankets, and the same restrictions also resulted in the closure of various sales channels across the world. These factors hampered electric blanket market growth in Europe, U.K., and Australia.

However, as restrictions were lifted and the world returned to a new normal, electric blanket sales in Europe, U.K., and Australia have started progressing at a steady pace in the post-pandemic era.

Key electric blanket market players are investing in the research and development of new products and are launching these products to boost their sales revenue.

More recent developments related to key electric blanket suppliers have also been tracked by analysts at Persistence Market Research, which will be accessible in the full report.

| Attribute | Details |

|---|---|

|

Forecast Period |

2022-2031 |

|

Historical Data Available for |

2016-2021 |

|

Market Analysis |

|

|

Key Regions Covered |

|

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Pricing |

Available upon Request |

Europe, U.K., and Australia Electric Blanket Market by Product Type:

Europe, U.K., and Australia Electric Blanket Market by Price Range:

Europe, U.K., and Australia Electric Blanket Market by Size:

Europe, U.K., and Australia Electric Blanket Market by Material:

Europe, U.K., and Australia Electric Blanket Market by End Use:

Europe, U.K., and Australia Electric Blanket Market by Sales Channel:

Europe, U.K., and Australia Electric Blanket Market by Region:

To know more about delivery timeline for this report Contact Sales

The Europe, U.K., and Australia electric blanket market holds a net value of US$ 2.11 Bn in 2022.

From 2022 to 2031, the electric blanket market in Europe, U.K., and Australia is projected to expand at a CAGR of 6.6%.

By 2031, electric blanket sales across Europe, U.K., and Australia are estimated to reach US$ 3.76 Bn.

Europe accounts for a dominant market share of 82.9% in the Europe, U.K., and Australia electric blanket industry in 2022.

Prominent electric blanket suppliers are Shanghai Shenda Co. Ltd., Beurer GmbH, Morphy Richards Ltd., Biddeford Blankets LLC, Snugnights UK LLP, Slumberdown Company, PIFCO, Shavel Associates Inc., and Silentnight Group Ltd.