Comprehensive Snapshot of Energy Storage Systems Market Research Report, Including Regional and Country Analysis in Brief.

Industry: Energy & Utilities

Published Date: April-2025

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 190

Report ID: PMRREP35235

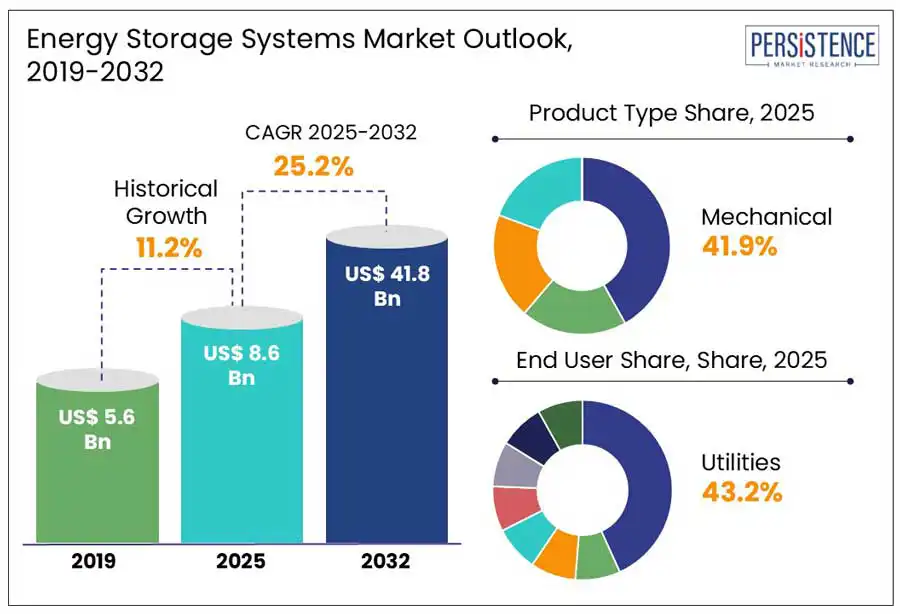

According to the Persistence Market Research report, the global Energy Storage Systems (ESS) market is expected to surge from US$8.6 billion in 2025 to US$ 41.8 billion at a CAGR of 25.2% by 2032. Factors such as rising global energy demand, ongoing grid modernization efforts, the rapid adoption of renewable energy storage solutions, and increasing focus on cost optimization and demand charge reduction for commercial and industrial users, which encourage the growth. In addition, strong regulatory support and government incentives are vital in accelerating ESS deployment worldwide.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Energy Storage Systems Market Size (2025E) |

US$ 8.6 Bn |

|

Projected Market Value (2032F) |

US$ 41.8 Bn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

25.2% |

|

Historical Market Growth Rate (CAGR 2019 to 2024) |

11.2% |

The global push toward decarbonization is accelerating the adoption of renewable energy sources such as solar and wind power. However, the intermittent nature of these sources, such as less sunlight poses significant challenges to grid stability. Energy storage systems (ESS) have emerged as a prominent solution to this variability, enabling load balancing, and backup power support.

In 2023, global renewable capacity additions surpassed 500 GW with solar PV accounting for over 60%. According to the International Energy Agency (IEA), to remain on track with net-zero goals, the battery storage capacity is anticipated to increase sixfold by 2030. Countries such as the U.S., China, Germany, and India have introduced ambitious renewable energy targets that require robust storage backup. For example, India plans to install 50 GW of battery storage capacity by 2030 under its Energy Storage Initiative.

Commercial developments also echo this demand. BYD’s 12.5 GWh battery storage project in Saudi Arabia, part of the country’s Vision 2030 plan, highlights the global momentum. Similarly, LG Energy Solution’s 981 MWh deal with Poland’s PGE will support a grid-scale facility in ?arnowiec, aiming to improve energy reliability.

Despite growing demand and technological advancement, high initial capital expenditure remains a major barrier to large-scale ESS adoption. Costs include battery modules, power conversion systems, software, installation, and operation & maintenance. For utility-scale installations, upfront costs can reach $300 – $600/kWh, depending on location, technology, and safety requirements.

For developing economies or small-scale residential customers, these expenses pose significant affordability challenges. Grid operators also struggle with long payback periods, making investments less appealing without substantial government support. While prices have decreased over the past decade, energy storage systems still lag behind solar PV in terms of rapid price parity.

Moreover, energy storage often lacks comprehensive financial incentives. In many regions, there's no clear revenue stream for ESS owners. While systems can support grid services such as frequency regulation or peak shaving, compensation models remain inconsistent.

The global energy storage systems market is poised for significant growth as countries and corporations ramp up efforts to reduce carbon emissions and enhance energy security. Brazil’s commitment to maintaining a mandatory 14% Energy Storage Systems blend by 2025 signals a strong and sustained demand for energy storage systems.

In addition, India's progress in energy storage systems adoption further enhances market potential. IndianOil recently achieved a blending of 23.24 crore liters of energy storage systems, surpassing the 0.43% blending ratio of other Oil Marketing Companies (OMCs) and reaching 0.73% this year. This accomplishment demonstrates growing momentum for biofuel integration and highlights the scalability of energy storage systems blending programs, as well as the increasing willingness of major oil players to align with sustainability goals.

These initiatives are anticipated to create significant lucrative opportunities for global energy storage systems producers and technology providers to enter or expand in these rapidly evolving markets.

Pumped Hydro Storage (PHS) dominates the global energy storage system market in 2025 due to its high capacity, reliability, and long operational history. The segment accounted for approximately 90% of the market's storage volume in 2025, with a global capacity of around 300 GW. PHS is projected to grow at a CAGR of 12.8% from 2025 to 2032, supported by its cost-effectiveness and ability to stabilize grids with increasing renewable energy penetration.

Lithium-ion Batteries, within the electrochemical storage segment, are the fastest-growing due to declining costs, high energy density, and versatility. This segment is expected to expand at a CAGR of 26.2% from 2025 to 2032. In 2024, global battery energy storage additions reached 45 GW/97 GWh, with lithium-ion dominating due to its use in electric vehicles (EVs), grid storage, and residential applications.

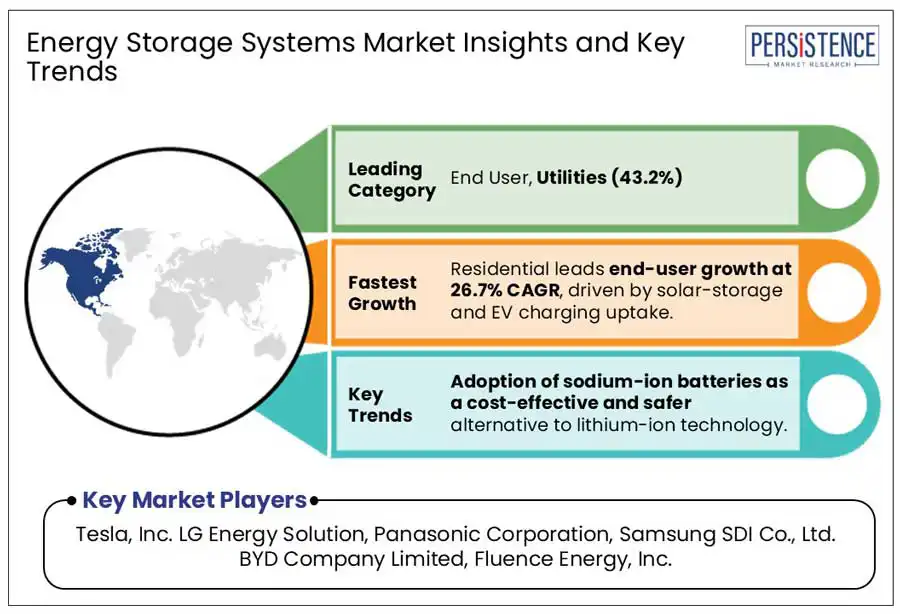

Utilities are expected to account for a leading market share of 43.2% in 2025. This dominance stems from utilities’ critical role in grid stabilization, renewable energy integration, and managing peak demand. The segment benefits from significant investments in utility-scale power plants and rural electrification projects particularly in the Asia Pacific.

Residential is the fast-growing segment, expected to expand at a CAGR of 26.7% from 2025 to 2032, driven by increasing adoption of solar-plus-storage solutions and electric vehicle (EV) charging infrastructure. The segment’s growth is further propelled by declining lithium-ion battery costs and incentives such as California’s NEM 3.0, encouraging energy storage for rooftop solar systems.

The energy storage system (ESS) market in North America, especially in the United States, has gained significant attention due to the growing penetration of renewable energy sources, increased frequency of extreme weather events, and the need for grid modernization to support the clean energy transition.

In 2024, the U.S. installed a record-breaking 12.3 gigawatts (GW) of energy storage capacity, totaling 37.1 gigawatt-hours (GWh). This marks a 33% increase in power capacity and a 34% rise in energy capacity compared to 2023. The grid-scale segment dominated, accounting for over 90% of deployments.

The U.S. Energy Information Administration (EIA, 2024) projects a near doubling of battery capacity by 2026, largely driven by state-level mandates, corporate decarbonization goals, and continued federal tax incentives through the Inflation Reduction Act (IRA) 2022.

The Europe energy storage system (ESS) market has experienced an unprecedented growth over the past few years, primarily driven by the region’s response to the energy crisis ignited by Russia’s invasion of Ukraine in early 2022. The residential sector has been at the forefront of this transition.

Countries such as Germany, Italy, and Austria have reported significant increases in residential PV-BESS attachment rates, with Germany achieving an 82% attachment rate in 2022. This trend is reinforced by robust government support schemes, including tax deductions and investment grants across various nations, such as VAT exemptions in Germany and the Netherlands, and Sweden’s Green Deduction programme.

On the commercial and industrial (C&I) front, soaring non-household electricity prices prompted businesses to invest in energy storage to mitigate operational risks. In 2023, Germany, the UK, and Italy recorded 150%, 60%, and 73% year-on-year growth in C&I BESS installations, respectively. The economic case for BESS was further strengthened by declining battery costs and improved product efficiency, though inconsistent policy frameworks still hinder wider adoption.

The energy industry in Asia Pacific is experiencing significant momentum driven by technological advancements and the scaling benefits from widespread electric vehicle (EV) adoption. China leads the energy storage system market, accounting for approximately 70% of Asia Pacific’s overall installed capacity. This is supported by strong policy mandates, with several governments requiring the co-location of energy storage systems with renewable energy projects.

Japan (3.5GW), South Korea (3.1GW), and Australia (2.2GW), are other key markets in the region, which together represent about 20% of the region’s battery storage assets as of 2024. These countries are also actively investing in storage technologies to support their clean energy goals and grid stability.

India is expected to become a major player in battery storage deployment by the 2030s. Under the Economic Transition Scenario (ETS), energy storage capacity is projected to reach 183GW by 2040, while the Net Zero Scenario (NZS) anticipates 322GW. This momentum continues through 2050, with capacity expected to grow to 375GW (ETS) and 636GW (NZS).

The global energy storage systems (ESS) market is intensely competitive, with leading players prioritizing technological innovation, strategic alliances, and sustainability-driven initiatives to reinforce their market foothold. Major companies are heavily investing in next-generation ESS technologies, smart energy management systems, and AI-enhanced thermal control to boost efficiency, scalability, and system longevity.

A notable trend in the industry is the pivot towards integrated and modular energy storage solutions tailored for residential, commercial, and grid-scale applications. This shift is accelerated by robust regulatory frameworks, state mandates, and government incentives that foster the adoption of clean and renewable energy sources.

|

Attribute |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Technology

By Power Rating

By Application

By End-user

By Region

To know more about delivery timeline for this report Contact Sales

The global energy storage system market is projected to value at US$ 8.6 Bn in 2025.

Key drivers fueling this growth include the rising global energy demand, ongoing grid modernization efforts, and the rapid adoption of renewable energy storage solutions.

The energy storage system market is poised to witness a CAGR of 25.2% from 2025 to 2032.

Growing off-grid energy demand opens rural market opportunities globally

Major players in the energy storage system market include Tesla, Inc., LG Energy Solution, Samsung SDI Co., Ltd., BYD Company Limited, Panasonic Corporation, and others.