ID: PMRREP30715| 188 Pages | 4 Sep 2025 | Format: PDF, Excel, PPT* | Healthcare

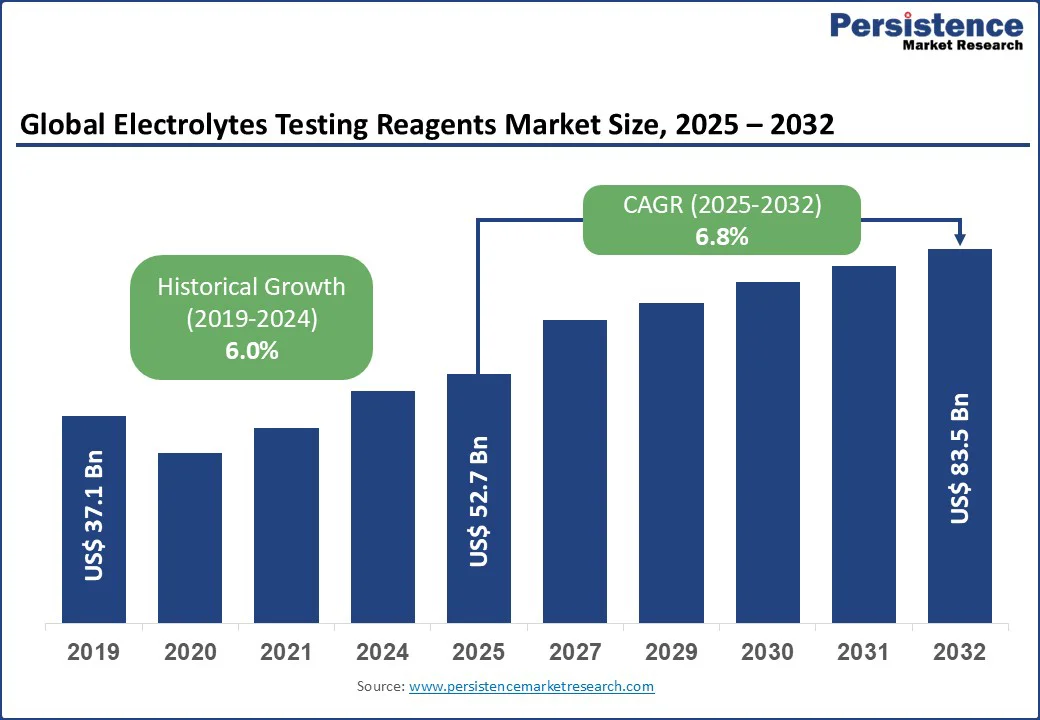

The global electrolytes testing reagents market size is valued at US$52.7 Bn in 2025 and is projected to reach US$83.5 Bn by 2032, registering a CAGR of 6.8% during the forecast period from 2025 to 2032.

The electrolytes testing reagents market has experienced steady growth, driven by the increasing prevalence of chronic diseases, advancements in diagnostic technologies, and rising demand for point-of-care (POC) testing solutions. The growing emphasis on personalized medicine, early disease detection, and automation in diagnostic systems further propels market expansion across hospitals, laboratories, and biopharmaceutical sectors. Innovations in reagent formulations, such as high-precision clinical chemistry reagents, and the integration of digital health platforms are key trends supporting market growth, particularly in regions with advanced healthcare infrastructure.

Key Industry Highlights:

|

Global Market Attribute |

Key Insights |

|

Electrolytes Testing Reagents Market Size (2025E) |

US$52.7 Bn |

|

Market Value Forecast (2032F) |

US$83.5 Bn |

|

Projected Growth (CAGR 2025 to 2032) |

6.8% |

|

Historical Market Growth (CAGR 2019 to 2024) |

6.0% |

The electrolytes testing reagents market is significantly driven by the rising prevalence of chronic diseases and advancements in diagnostic technologies. According to the World Health Organization, chronic diseases such as diabetes, cardiovascular diseases, and kidney disorders account for over 41 Mn deaths annually, necessitating frequent electrolyte testing to monitor conditions such as hyponatremia, hyperkalemia, and acid-base imbalances. In the U.S., the Centers for Disease Control and Prevention (CDC) reports that a majority of adults have at least one chronic disease, driving demand for accurate and rapid diagnostic reagents. Clinical chemistry reagents, used in blood and urine analysis, are critical for managing these conditions, with companies such as Abbott and Siemens reporting a notable increase in sales due to growing demand for electrolyte testing kits in hospital and laboratory settings.

Technological advancements in automated diagnostic systems and point-of-care (POC) testing are propelling market growth. Modern systems, such as Roche’s Cobas analyzers, offer high-throughput electrolyte testing with improved precision, significantly reducing turnaround times. A recent study published in the Journal of Clinical Chemistry highlighted that automated analyzers enhance diagnostic accuracy for electrolyte imbalances compared to manual methods, which is boosting adoption in hospitals and laboratories. The integration of digital health platforms, such as cloud-based diagnostic systems, further supports market expansion by enabling real-time data analysis and remote monitoring. For example, Siemens’ Atellica Solution integrates AI-driven analytics, enhancing test efficiency and clinical decision-making. Government initiatives, such as the U.S. Precision Medicine Initiative and India’s Ayushman Bharat program, promote early disease detection, increasing demand for advanced reagents. In North America, regulatory approvals from the FDA for novel diagnostic reagents incentivize manufacturers to invest in high-quality formulations, further fueling market growth.

High costs associated with advanced electrolyte testing reagents continue to hinder widespread adoption, particularly in emerging markets. Premium reagents, such as those used in molecular diagnostics and flow cytometry, require sophisticated production processes, which significantly increase prices. Beyond the initial purchase, ongoing expenses for quality control, calibration, and compliance with stringent regulations, including international standards such as the FDA’s Quality System Regulation and the EU’s In Vitro Diagnostic Regulation (IVDR), add to the overall cost burden. For laboratories and hospitals in resource-limited areas, these financial challenges limit scalability and restrict access to advanced testing solutions. Smaller laboratories, which make up a large share of diagnostic facilities globally, often resort to lower-cost, less precise reagents due to budget limitations.

Regulatory challenges further add to the restraints. Compliance with complex standards requires extensive documentation, clinical validation, and frequent audits, extending production timelines and increasing costs. The shortage of skilled personnel for handling advanced diagnostic systems adds to operational difficulties, as training requirements raise expenses. Supply chain disruptions, particularly in the procurement of high-purity chemicals essential for reagent production, also constrain growth. Shortages of critical components have affected the production of automated analyzers, leading to cost escalations and delayed integration of reagents. Collectively, these barriers limit the adoption of innovative reagents, especially in cost-sensitive markets.

Innovations in point-of-care (POC) testing and sustainable reagent development present significant growth opportunities for the electrolytes testing reagents market. The development of portable diagnostic devices, such as Hologic’s POC electrolyte analyzers, enables rapid testing in underserved areas, addressing the needs of aging populations and patients with chronic diseases. These devices, capable of delivering results within minutes, are gaining adoption as healthcare access expands. Sustainable reagent formulations, using eco-friendly chemicals and recyclable packaging, align with global sustainability goals, including initiatives led by organizations such as the EU’s Green Deal and the U.S. Environmental Protection Agency, appealing to environmentally conscious healthcare providers.

The rise of personalized medicine further strengthens market potential. Reagents tailored to specific patient profiles, such as Thermo Fisher Scientific’s precision diagnostic kits, are increasingly used in biopharmaceutical research. Growing demand for customized reagents in clinical trials is driving expansion and encouraging innovation. The integration of AI and IoT in diagnostic systems enhances reagent efficiency by improving test accuracy and minimizing waste, with companies such as Siemens leveraging these technologies to strengthen their competitive edge. In addition, government-backed healthcare modernization plans are opening new opportunities for reagent manufacturers to expand their presence, with companies such as Shenzhen Mindray introducing cost-effective solutions to meet rising demand.

The global electrolytes testing reagents market is segmented into Chromatography Reagents, Molecular Diagnostic Reagents, Immunoassay Reagents, Clinical Chemistry Reagents, Flow Cytometry Reagents, Cell and Tissue Culture Reagents, Hematology and Hemostasis Reagents, Microbiology Reagents, and Others. Clinical Chemistry Reagents dominate, holding approximately 35% of the electrolytes testing reagents market share in 2025, due to their critical role in routine electrolyte analysis for conditions such as diabetes, kidney disease, and cardiovascular disorders. Products such as Abbott’s Alinity reagents are widely used for their high accuracy and compatibility with automated systems, supporting their dominance in hospital and laboratory settings.

Molecular Diagnostic Reagents are the fastest-growing segment, driven by increasing demand for precision diagnostics in personalized medicine. Innovations in PCR-based electrolyte testing, such as those from Thermo Fisher Scientific, enhance sensitivity and specificity, boosting adoption in research institutes and biopharmaceutical companies focused on biomarker discovery and disease profiling.

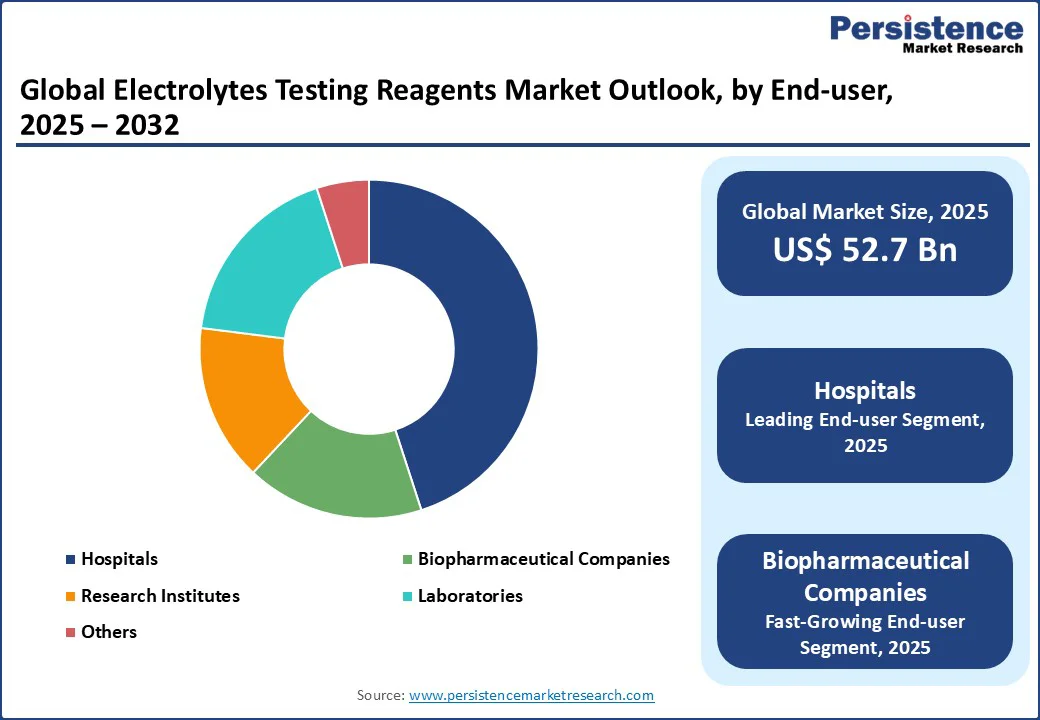

The global electrolytes testing reagents market is divided into Hospitals, Research Institutes, Laboratories, Biopharmaceutical Companies, and Others. Hospitals lead with a 45% share in 2025, driven by their extensive use in routine and emergency electrolyte testing for patient care. High-throughput analyzers in hospital settings, such as those from Siemens, support this dominance by enabling rapid and accurate diagnosis of electrolyte imbalances.

Biopharmaceutical Companies are the fastest-growing segment, fueled by rising investments in drug development and clinical trials requiring precise electrolyte analysis. The increasing use of reagents in biomarker discovery and therapeutic monitoring, particularly by companies such as BD, drives demand in this sector, with applications in oncology and metabolic disease research.

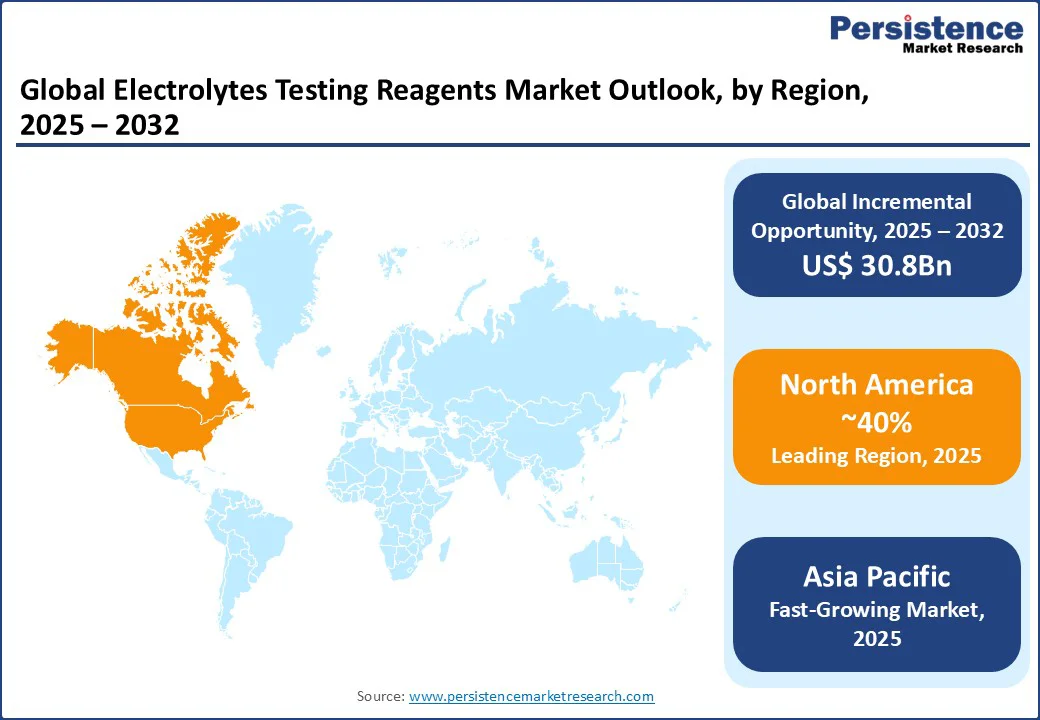

North America is the leading region in the global electrolytes testing reagents market, holding a 40% market share in 2025, driven by high healthcare expenditure and a robust diagnostic industry in the U.S. Demand for high-precision reagents is rising, fueled by the increasing prevalence of chronic diseases, with 60% of U.S. adults affected, according to the CDC. Leading brands such as Abbott and Thermo Fisher Scientific offer innovative solutions, such as automated analyzers and POC testing kits, to meet these needs. Consumer preferences are shifting toward sustainable and high-throughput reagents, with companies such as Quest Diagnostics incorporating eco-friendly formulations to enhance credibility. Stringent FDA regulations encourage the adoption of high-quality reagents, while government initiatives such as the Precision Medicine Initiative promote investment in advanced diagnostic technologies, supporting market growth.

Europe holds a significant share, led by Germany, the U.K., and France, driven by advanced healthcare systems and regulatory support. Germany’s market is propelled by strong sales from Siemens and Roche, with innovations in automated analyzers driving growth in reagent adoption. The EU’s IVDR fosters compliance and innovation, encouraging the use of high-quality reagents. In the U.K., demand for POC testing reagents is rising, with Hologic’s portable kits gaining popularity for their rapid results. France is witnessing increased adoption in biopharmaceutical research, with BD offering specialized reagents for clinical trials. Regulatory support for sustainable practices across Europe further enhances market prospects.

Asia Pacific remains the fastest-growing region, with China, India, and Japan as key contributors. In India, rising healthcare awareness and government programs such as Ayushman Bharat are fueling demand for affordable reagents, with Sysmex India leading the supply of cost-effective solutions for hospitals and laboratories. China’s growth is underpinned by expanding diagnostic infrastructure, where Shenzhen Mindray provides high-throughput reagents for large-scale testing. Japan is carving a niche in precision diagnostics, with Shimadzu Medical offering advanced molecular diagnostic reagents for research applications. Rising healthcare investments and digital procurement platforms, such as cloud-based supply chain systems, further bolster regional market expansion.

The electrolytes testing reagents market is highly competitive, with global and regional players focusing on innovation, mergers, and global expansion to capture market share. Companies emphasize product diversification and sustainability, offering eco-friendly and high-precision reagents to meet evolving healthcare demands. Strategic partnerships, regulatory certifications, and investments in AI-driven diagnostics are key differentiators in this dynamic market.

The electrolytes testing reagents market is projected to reach US$52.7 Bn in 2025.

Rising prevalence of chronic diseases, advancements in diagnostic technologies, and government healthcare initiatives are key drivers.

The electrolytes testing reagents market is poised to witness a CAGR of 6.8% from 2025 to 2032.

Innovation in point-of-care testing and sustainable reagent development present significant growth opportunities.

Siemens, Abbott, and Thermo Fisher Scientific are among the key players.

|

Report Attribute |

Details |

|

Historical Data/Actuals |

2019 - 2024 |

|

Forecast Period |

2025 - 2032 |

|

Market Analysis |

Value: US$ Bn, Volume: As Applicable |

|

Geographical Coverage |

|

|

Segmental Coverage |

|

|

Competitive Analysis |

|

|

Report Highlights |

|

|

Customization and Pricing |

|

By Product Type

By End-user

By Region

Delivery Timelines

For more information on this report and its delivery timelines please get in touch with our sales team.

About Author