Industry: Healthcare

Published Date: March-2022

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 186

Report ID: PMRREP3427

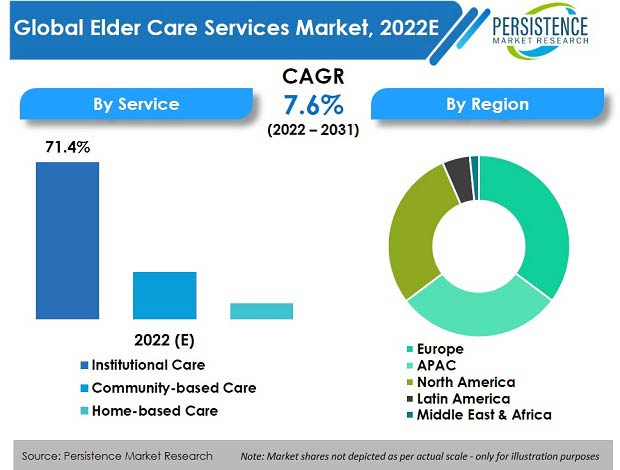

Revenue from worldwide elder care services reached US$ 1.23 Bn at the end of 2021. As per detailed analysis, the global elder care services market is anticipated to expand at a CAGR of 7.6% and reach US$ 2.56 Bn by 2031-end.

| Attributes | Key Insights |

|---|---|

|

Elder Care Services Market Size (2022) |

US$ 1.32 Bn |

|

Projected Market Value (2031) |

US$ 2.56 Bn |

|

Global Market Growth Rate (2022-2031) |

7.6% CAGR |

|

Share of Top 5 Countries |

58.9% |

According to in-depth industry analysis conducted by Persistence Market Research, a majority of elder care services are financed through public expenditure, which accounted for 65.5% of the global senior care market share. Elder care services accounted for less than 1% of the global healthcare services market in 2021.

According to latest projections, institutional care is the most preferred way of accessing elder care services and holds more than 70% share in the market.

The elder care services industry was worth US$ 759.6 Mn in 2014 and expanded 1.6X by 2021, which exhibited an incremental opportunity of US$ 474.1 Mn from 2014 to 2021. This boiled down to equate a CAGR of 7.2% over the last eight years.

According to WHO statistics, the proportion of the world's geriatric population will nearly double from 12% to 22% between 2015 and 2050. In 2020, the number of people aged 60 and more outweighed youngsters under the age of five. By 2050, 80% of the world's elderly would live in low- and middle-income countries.

The aging population is booming at a considerably higher rate than in the past. Rapidly increasing number of senior citizens is offering the necessary boost for the development of the elder care services sector.

Improved day-care facilities and increase in the number of aged care centers are boosting revenue generation. Several day care centers are prepared to give medicine and medical supervision by trained medical workers. The senior care industry's day care facilities sector is expanding because of increased use of day care services due to busy lives and the overall cost-effectiveness of such facilities.

Development of cell phone technologies and use of artificial intelligence in healthcare have given rise to various tracking applications and software, which are now used to monitor the medicine, diet, and even the movement of elderly patients. Few applications allow users to get notified about sudden body movements, such as a fall or an impending hazard. Diabetes-targeted applications and messaging tools are emerging as niche markets because of chronic illnesses among the elderly and advances in preventative care technologies.

Hospitalization fees for the elderly are a source for financial restrain on their families, because of the unavailability of end-to-end reimbursement policies for them. Discharged elderly patients opt for home-assisted living or long-term care by elderly caregivers. This approach is both, cost-effective and offers superior results.

Elderly individuals are more susceptible to hospital-acquired infections, and studies have shown that they are less anxious at home. Hospitals are involved in stabilizing patients before referring them to assisted living service providers for their comfort.

The global market for elder care services is expected to magnify 1.9X by 2031.

“Snowballing Global Demand for Retirement Living”

Patients discharged from hospitals that require intensive care is something that can be provided by professional home care service providers. Patients that require professional care frequently choose home healthcare services. Several businesses are springing up offering a variety of pay-per-use homecare services, respite care, and home nursing services.

Growing public awareness of such services is driving market growth, thereby providing many opportunities for business expansion in the industry.

The U.S. exhibits a trend of retirement villages or communities designed to facilitate independent living for the elderly. These retirement centers are well-equipped with various amenities. Retirement communities have initiated to offer multiple levels of care at the same location. This feature allows residents to transition from independent living facilities to serviced apartments for higher-level care needs.

With the rise in disposable income of consumers, numerous benefits of these retirement communities are providing the necessary boost of opportunities for key providers of elder care solutions.

The Australian government has played a significant role in subsidizing and regulating the delivery of elderly care through private and not-for-profit providers. Non-government service providers supply both, residential and community-based care services, in Australia. Grants, user contributions, and volunteer care are all available as government subsidies for aged care services.

The Australian government covers roughly 70-85% of the cost of aged care services through reimbursements. Such government funding for elderly care services is an important driving factor for the aged care services market, globally.

North America is witnessing low fertility rates and is falling below the replacement fertility rates. Unstable fertility rates influence the overall economic growth of any region. Lower fertility rates indicate that the new generation is smaller than the one that came before and will struggle to support retirees.

Increase in the elderly dependent population in the North American region will have economic issues, giving rise to the need for caregiving by various service providers, and such a demographic shift has created the need for a successful elder care model in the region.

“Low Profits Margins for Aged Care Facilities”

Despite growing demand for elderly care facilities due to the growing geriatric population, the challenge is to generate profits. In the United States, the government maintains strict care, safety, and lifestyle standards for geriatric care facilities.

Ongoing care and supported living facilities have many characteristics that can contribute to lower profit margins. In addition, some facilities receive low refunds through government programs and tightly controlled refunds from insurance companies. This results in low profits.

Providers offer premium services that do not fall under government-regulated structures to benefit from elderly care services.

Moreover, dearth of qualified professionals who can take care of elderly patients is another reason for the elderly care services market experiencing less significant demand, especially in emerging and low-income countries.

Why are Key Elder Care Service Providers Targeting the U.S. Market?

“Well-developed Aged Healthcare Facilities in the Country”

The U.S. market now accounts for more than 92% of North American sales and will continue to grow rapidly through 2031 due to numerous geriatric care facilities, favorable reimbursement policies, technological advances, and the aging of the local population.

How is the Market for Elder Care Services Faring in the U.K.?

“Developing Elderly Care Facilities in the U.K.”

Due to the presence of prominent players, the U.K. dominates the Europe elderly care services market. In addition, growth of social services for the elderly, such as counselling, referrals, day care, rehabilitation services, and health promotion boost market expansion.

In the year 2021, the U.K. accounted for 17.6% share of the European market.

In addition, in Europe, rising life expectancy over the years has increased the population of the elderly. Increasing population of the elderly experiences a greater burden of ailments such as suffering from a terminal illness, dementia, and other major disabilities, driving the need for elder care services.

Will India Emerge as a Lucrative Market for Elder Care Service Providers?

“Constantly Developing Healthcare Industry to Provide Essential Lift”

Improvements in caregiving for the elderly, such as caregiver availability and skills, increased innovation in caregiving, and the government's favourable policies for the elderly are key factors contributing to the growth of the India elderly care services market.

The senior care services market in India is estimated to expand at a CAGR of 12.9% owing to the tremendous healthcare advancements in the country.

Why are Institutional Care Services Most Preferred?

“Availability of Numerous Facilities That are Sought-after by Consumers”

When any family decides to opt for elder care services, institutional care provides them with the benefits of all-around care and management of patients.

Due to this, institutional care facilities captured 70.2% market share, in terms of revenue, in the year 2021, and the segment is projected to surge ahead at a CAGR of 8.9% over the forecast period (2022-2031).

How are Elder Care Services Most Commonly Financed?

“Good Reimbursement Schemes & Governmental Policies for Elder Care Services”

Public expenditure captured more than 65% revenue share of the overall elder care services market in 2021.

Availability of various schemes and reimbursement policies, improved healthcare facilities, and governmental strategies to aid the elderly are some of the key factors for this high market share of public expenditure on elderly care services.

Key elder care service providers are following strategies such as business expansion, certifications, and enhancing their services to improve their market position, globally.

| Attribute | Details |

|---|---|

|

Forecast Period |

2022-2031 |

|

Historical Data Available for |

2014-2021 |

|

Market Analysis |

US$ Million for Value |

|

Key Countries Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon Request |

Elder Care Services Market by Service:

Elder Care Services Market by Financing Source:

Elder Care Services Market by Region:

To know more about delivery timeline for this report Contact Sales

The global elder care services market was valued at US$ 1.23 Bn in 2021 and is expected to grow 1.9X by 2031.

The global market for senior care services is set to witness steady growth at a CAGR of 7.6% over the forecast period and be valued at US$ 2.56 Bn by 2031.

The market expanded at 7.2% during 2014 to 2021, as elder care service providers are gaining popularity in the global healthcare market.

Eldercare Services, Korian Group, Provita International Medical Center, LLC, Home Instead, Inc., and Econ Healthcare Group are prominent providers of elder care services, globally.

Institutional care providers are driving most demand and held 70.2% market share in 2021.

The U.S., Japan, China, U.K., and France drive most demand growth of elder care services and solutions.

The U.S. accounted for 92% of the North America elder care services market share in 2021.

The Europe elder care services market is expected to record a CAGR of 6.6%, with the U.K. accounting for the highest share of 17.6% in 2021.

The U.S. China, Japan, and India are major countries that are home to key elder care service providers.

The Japanese market held a share of 39.1% in APAC in 2021.