Industry: Healthcare

Published Date: December-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 188

Report ID: PMRREP11032

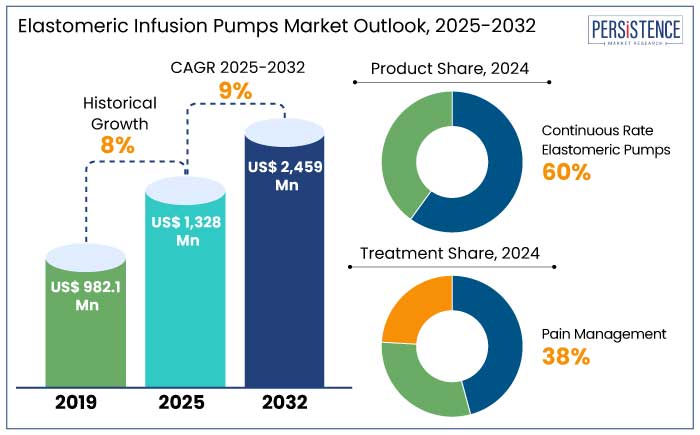

The elastomeric infusion pumps market is estimated to increase from US$ 1328 Mn in 2025 to US$ 2459 Mn by 2032. The market is projected to record a CAGR of 9% during the forecast period from 2025 to 2032.

Elastomeric infusion pumps reduce treatment costs by up to 25% compared to electronic pumps, making them a preferred choice for home care and outpatient settings. Recent innovations in pump materials have resulted in 99.9% biocompatibility and a 50% reduction in drug adsorption, ensuring effective drug delivery with minimal side effects. Elastomeric pumps provide an affordable and efficient drug delivery option to people suffering from chronic conditions such as cancer and diabetes.

Key Highlights of the Market

|

Market Attributes |

Key Insights |

|

Elastomeric Infusion Pumps Market Size (2025E) |

US$ 1328 Mn |

|

Projected Market Value (2032F) |

US$ 2459 Mn |

|

Global Market Growth Rate (CAGR 2025 to 2032) |

9% |

|

Historical Market Growth Rate (CAGR 2019 to 2024) |

8% |

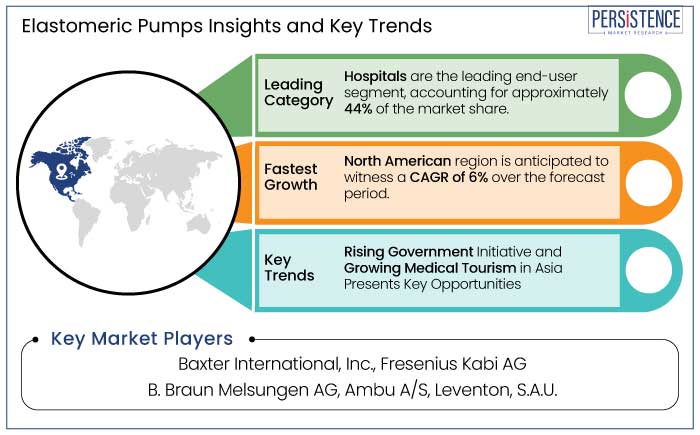

A combination of superior healthcare infrastructure, a growing focus on outpatient care, and the rising incidence of chronic diseases fuels the dominance of North America in the market. The region is estimated to hold a share of 35% in 2024. Region's healthcare providers are early adopters of innovative devices, ensuring consistent demand for elastomeric pumps. The region is projected to showcase a 6% CAGR over the forecast period.

Chronic illnesses like cancer and diabetes are prevalent in the U.S. and Canada. In the U.S. alone, over 1.7 million new cancer cases were diagnosed in 2023, driving the demand for chemotherapy solutions such as elastomeric pumps. North America healthcare facilities are highly developed, enabling fast adoption of innovative medical devices.

The U.S. sees over 25 million ambulatory surgeries annually, with elastomeric pumps used in more than 60% of cases for post-operative pain management. Healthcare providers and patients in North America prioritize cost-efficient solutions, with elastomeric pumps reducing hospital stays and lowering overall treatment costs. An aging population and preference for home-based care have boosted the adoption of portable, patient-friendly elastomeric pumps.

The market is divided into continuous rate elastomeric pumps and variable rate elastomeric pumps. Out of these two prominent product types, the continuous rate elastomeric pumps led the market, accumulating around 60% market share in 2024.

The dominance of the continuous-rate elastomeric infusion pumps is attributed to their consistent and regulated flow of medications, making them ideal for treatments requiring constant drug delivery, such as antibiotic therapies and pain management. Their simplicity and operational effectiveness rendered them a favoured option in diverse healthcare environments, contributing to their substantial market share.

Continuous rate pumps are widely employed in hospitals and home healthcare environments due to their reliability and ease of use, stimulating demand and driving market growth. In April 2024, Baxter International Inc. launched advanced elastomeric infusion pumps with enhanced durability and user-friendly designs, reinforcing its status as a provider of infusion treatment solutions.

Based on treatment, the market is further classified into pain management, antibiotic/antiviral, and chemotherapy. Among these, the pain management treatment dominates the market with significant share. Pain management treatment type to attain a 38% of market share.

The rising incidence of chronic pain problems worldwide is resulting in an escalating demand for efficient pain treatment options. The increasing elderly population susceptible to numerous chronic conditions necessitating pain management substantially drives market expansion in the sector.

Elastomeric infusion pumps are extensively utilized for pain management in both acute and chronic contexts, allowing patients to self-administer drugs as required and offering efficient and convenient analgesia. A study in the Journal of Pain Research demonstrated that elastomeric infusion pumps for post-operative pain management enhanced patient satisfaction and decreased opioid usage.

Elastomeric infusion pumps, commonly called disposable balloon pumps, are utilized to administer intravenous (IV) medications, including local anaesthetics, antibiotics, and anti-neoplastic agents. Such mechanical, gravity-independent devices are utilized for single infusions.

Elastomeric infusion pumps use a flexible balloon reservoir loaded with medication, and the pressure from the elastic walls facilitates fluid administration at a reasonably constant pressure until the infusion nears completion. The increasing prevalence of chronic diseases, including cancer, diabetes, and cardiovascular ailments, is a key catalyst for market expansion.

Statistics from the World Health Organization (WHO) indicate that chronic diseases are the primary cause of mortality worldwide, representing 71% of all global fatalities. It increased demand for continuous medication delivery devices, such as elastomeric pumps, to guarantee successful treatment and management of various disorders.

In 2024, Baxter International introduced advanced elastomeric infusion pumps tailored for oncology and post-surgical applications, focusing on biocompatibility and user-friendly designs to enhance patient comfort.

The elastomeric infusion pumps market witnessed steady growth during the historical period from 2019 to 2023. The market is mainly driven by the rising prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders.

The increasing adoption of outpatient care and home healthcare propelled demand for cost-effective, portable, and user-friendly drug delivery solutions. Technological advancements in pump design enhanced precision and safety, encouraging broader adoption.

The growing emphasis on reducing hospital stays, particularly in developed markets like North America and Europe, significantly contributed to market expansion. However, challenges such as limited awareness in emerging regions and competition from electronic infusion pumps somewhat restricted growth.

The market is poised for accelerated growth with 9% CAGR over the forecast period, driven by advancements in biodegradable and eco-friendly elastomeric pump designs. Increased investment in emerging economies and the rising penetration of healthcare infrastructure in Asia-Pacific are projected to expand the geographic footprint of the market.

The shift toward value-based care and the emphasis on reducing healthcare costs will amplify the adoption of elastomeric infusion pumps for chronic disease management and post-operative care. Regulatory support for innovative medical devices and expanding oncology and pain management applications further underscore the robust growth trajectory.

Increasing Prevalence of Chronic Diseases Drives the Market Forward

The rising prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders is a significant growth driver for the elastomeric infusion pumps market. According to the World Health Organization (WHO), chronic diseases account for 71% of all global fatalities, creating a pressing need for efficient long-term care solutions.

Elastomeric pumps, known for their ease of use, portability, and ability to deliver continuous medication are increasingly used in home care and outpatient settings. In cancer care, these pumps allow for precise chemotherapy dosing without requiring hospital stays, improving patient convenience and reducing healthcare costs.

Use of elastomeric pumps in managing diabetes and cardiovascular conditions through consistent infusion of medications ensures effective treatment and better patient compliance. As the global population ages and chronic diseases become more widespread, the demand for elastomeric infusion pumps is expected to grow exponentially.

Technological Advancements in Elastomeric Pump Design to Spur its Demand

Advancements in elastomeric pump technology have played a pivotal role in driving elastomeric pumps market growth. Manufacturers are continually innovating to enhance pump performance, safety, and patient convenience.

Recent developments include pumps with higher drug stability, precise flow rates, and materials that minimize drug adsorption, ensuring consistent and reliable medication delivery. Biodegradable and eco-friendly pumps are also gaining traction, aligning with the global push for sustainable healthcare solutions.

User-friendly designs, such as easy-to-read indicators and customizable infusion rates, make these devices more accessible to non-specialist users, such as patients and caregivers in home settings. Such technological strides improve patient outcomes and expand the applications of elastomeric pumps beyond traditional use cases, such as in oncology, pain management, and antibiotic delivery.

Elastomeric pumps are set to play a critical role in shaping the future of efficient and sustainable drug delivery systems with continued investment in research and development.

Inaccurate Delivery and Choice of Alternatives Limit Market Expansion

Many kinds of studies and literature presented that the performance of elastomeric infusion pumps varied depending on the temperature and viscosity of the diluent or drug library despite all the advantages. Interestingly, as per a two-phase study, the infusion pump did not complete the flow on time in 50% of the cases for patients receiving ambulatory chemotherapy. It disrupted the treatment schedule in some cases in sub-therapeutic dosing.

Inaccurate flow rate, inability to trace the history of the administered drug demand by the patient, and detection of abnormal drug delivery are factors limiting the adoption. The availability of alternative infusion pumps can dent market growth over the coming years.

Elastomeric infusion pump devices are among the most recalled medical devices due to their design deficiency and product errors. Other errors associated with these pumps include alarm errors, software problems, inadequate user interface design, damaged components, fire, sparks, battery failure, searing, and electric shocks. These errors may impede elastomeric infusion pumps market growth.

Increasing Initiatives to Address Infusion Pump Safety Problems

Increasing initiatives of many institutes, organizations, and associations to mend elastomeric infusion pumps and address safety concerns will boost elastomeric infusion pumps market growth.

The US. Food and Drug Administration (FDA) launched the infusion pump improvement initiative to address infusion pump safety problems and foster the development of safe, effective infusion pumps across the industry. This initiative established additional requirements for infusion pump manufacturers.

The FDA aims to grow awareness regarding mitigating the risks associated with using existing infusion pumps by hospital staff, administrators, and home users. Regulatory approvals and support from funding will boost demand growth in the healthcare and medical device industries.

Elastomeric pump manufacturers are gradually focusing on advancements in their existing products, innovating new products, and introducing digital platforms to increase market penetration. Training staff to handle devices and administer drugs to patients and increase awareness would create goodwill and increase product adoption.

The elastomeric infusion pumps market is highly competitive, with major players focusing on innovation, geographic expansion, and strategic collaborations. Baxter International and B. Braun Melsungen lead the market, leveraging robust portfolios and advanced technologies.

ICU Medical and Nipro Corporation emphasize user-friendly designs and sustainable solutions, gaining traction in home healthcare and outpatient care. Regional players, particularly in Asia Pacific, are intensifying competition by offering cost-effective products tailored to emerging markets.

Companies like Terumo Corporation are expanding their presence in high-growth regions. At the same time, partnerships between manufacturers and healthcare providers aim to optimize the training and integration of elastomeric pumps in treatment regimens. Continuous research and development investments, eco-friendly product innovations, and a growing focus on chronic disease management shape the competitive landscape.

Recent Industry Developments in the Elastomeric Infusion Pumps Market

|

Attributes |

Details |

|

Forecast Period |

2025 to 2032 |

|

Historical Data Available for |

2019 to 2024 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled in the Report |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Product

By Treatment

By End User

By Region

To know more about delivery timeline for this report Contact Sales

The global elastomeric infusion pumps market is estimated to be valued at US$ 1328 Mn.

Insulin Pumps, Enteral Pumps, Patient-Controlled Analgesia Pumps are the most common infusion pumps.

The infusion rate of elastomeric pumps ranges from 0.5 – 500 mL/h.

Braun compact plus is a new generation infusion pump.

Centrifugal pumps are the most common type of pump used in industries.