Industry: Chemicals and Materials

Published Date: June-2024

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Number of Pages: 168

Report ID: PMRREP21379

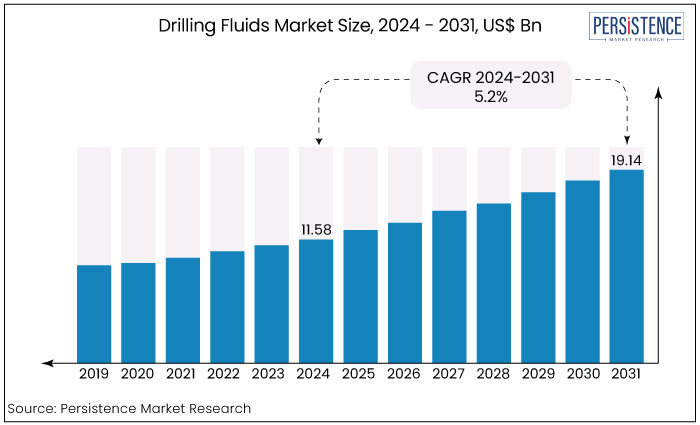

The global market is estimated to reach a valuation of US$19.14 Bn by 2033, up from a valuation of US$11.58 Bn in 2024, at an estimated CAGR of 5.2 % during the forecast period 2024-2033.

Key Highlights of the Market

|

Attributes |

Key Insights |

|

Global Market Size (2024) |

US$11.58 Bn |

|

Market Size (2033) |

US$19.14 Bn |

|

Forecast Growth Rate (CAGR 2024 to 2033) |

5.2% |

|

Historical Growth Rate (CAGR 2019 to 2023) |

2.6% |

Drilling fluids, commonly known as drilling mud, are specially engineered fluids employed in the process of drilling oil and gas wells in the petroleum industry.

These fluids play a pivotal role in facilitating drilling operations by offering a range of functions and properties that contribute to effective drilling, well control, and wellbore stability.

With the increased expenditure in offshore oil and gas exploration and production, the drilling fluids market size is said to increase over the forecast period.

Companies in the oil and gas industries are continuously improving on the durability of drill pipes along with the breakthroughs in the drilling fluids.

The precise composition of drilling fluids varies depending on factors such as the geological formation being drilled, wellbore conditions, and environmental considerations.

Focussing on developing advance drilling fluid chemicals is a growing trend in the global market

Prominent entities in the oil and gas industry are actively investigating deep and ultra-deep water prospects in some of the regions across the world to fulfil the increasing demand for oil and gas.

Prominent stakeholders are investing in the development of technologically advanced synthetic drilling fluids that effectively function in challenging weather conditions.

With the continuously growing need of oil and gas globally, the drilling activities are increasing rapidly to cater to the ever-increasing energy and power demand.

From 2019 to 2023, the drilling fluids market grew at a sluggish CAGR of 2.6% but is projected to expand at a 5.2% CAGR from 2024 to 2033.

With the resumption of offshore exploration activities in the South Asian countries, there has been a surge in demand for drilling fluids and it has seen a steep rise since 2022.

The functional, operational, and economic benefits of drilling fluids make them an essential component in deep drilling activities, thereby the market associated with drilling fluids is generating high revenues.

Furthermore, the use of drilling fluids for onshore drilling activities is witnessing a steady growth through the historical period from 2019 to 2022, owing to the streamlined operation and reduced drilling time.

As water and mineral scarcity become more prevalent globally, drilling and exploration ventures are projected to expand in several countries, and the market is expected to grow at a steady pace throughout the forecast period 2023 to 2033.

Rising Oil & Gas Exploration

The rising demand for oil and gas as an energy source has forced to explore new oil and gas sites, which is a major driving element for the market.

A substantial increase in exploration activities creates a wide range of opportunities for well-drilling operations across the world, which will eventually aid the growth of the drilling fluids market.

Countries like Russia and Saudi Arabia have the second-highest production rate for offshore-derived crude oil. Besides, several other nations are allocating specific resources for the investigation of unexplored oil and gas deposits, which marks new entrants into the market.

Furthermore, the presence of large oil and gas reserves in several locations across the globe can cater to the ever-evolving needs of oil and gas from the industrial sectors, which aids oil and gas exploration and eventually boost the market.

High Energy Consumption

High energy consumption is a major driving element for the global drilling fluids market, as the growing energy needs is forcing to search for more sites for oil and gas deposits.

Rapid industrialization is one of the most pivotal factors for the market’s growth as the per day energy consumption of an industry is at the higher level, which creates the necessity for more energy sources, eventually boosting the exploration industry and helping the market grow and have a substantial market share.

According to the studies carried out, fossil fuels supply about 85% of the total energy consumed worldwide.

Hence, oil and gas extraction has increased globally, which eventually gives rise to the investments in exploration and propels the adoption of drilling fluids in the extraction process.

Harsh Environmental Impact

The extraction of oil and gas requires drilling deep holes into the earth's surface and onshore disposal procedures. During the injection, the drilling fluids produce hazardous substances that can have drastic impacts on the groundwater, the level of groundwater and releasing of some hazardous chemicals as well.

Drilling operation creates effluent and garbage and when this enters the environment again, it severely pollutes the soil, disrupts marine ecosystems, and negatively impacts aquatic life in the ocean.

To stop the hazardous impacts of fluid on people's health, safety, and environment, several government agencies globally are putting strict controls on drilling chemicals into place.

About the discharge of pollutants into water from oil and gas drilling operations related to the use of synthetic-based fluids and other non-aqueous fluids, these effluent guidelines set new source performance standards (NSPS) and best available technology and economically achievable limitations.

Increased Drilling Operations in Deep Waters

An increase in the amount of deep water and ultra-deep water drilling activity is projected to take place in the not-too-distant future due to recent discoveries that have been made in the regions of Latin America, West Africa, and the Asia Pacific regions.

Most of offshore activities are centred in deep water zones, which include those found in Angola, the US, Brazil, Nigeria, Malaysia, and Norway.

Recent discoveries in frontier locations that are still in the process of developing, such as the east coast of Africa, the eastern Mediterranean Sea, and the west coast of Australia, will greatly accelerate the increase of offshore reserves. This is due to the abundance of natural resources that can be found in these areas.

With this, the overall progress of the long-term contracts is expected to propel the overall demand for deep and ultra-deep water drilling activities, which eventually aids the growth of the market.

Water-Based Drilling Fluids Account for 49% Market Share

|

Market Segment by Type |

Market Value Share |

|

Water-Based |

49% |

Based on type, the global drilling fluids market is further sub-segmented into water-based, oil-based and synthetic-based categories, among which the water-based segmentation dominates the global market share.

The overall demand for water-based fluids is rapidly increasing owing to being the most cost-effective and the safest considering the environmental impact of its discharged cuttings and muds.

Following the water-based fluids, the synthetic-based fluids are said to witness steady growth during the forecast period owing to their excellent thermal stability, penetration rates, borehole control and lubrication during the drilling operation.

Onshore Segment accounted for 60% of the market share

|

Market Segment by Type |

Market Value Share |

|

Onshore |

60% |

Based on the application, the drilling fluids market is further sub-segmented into onshore and offshore, where the onshore segment dominates the market share.

The key reason behind the onshore segment's dominance is the increased oil drilling activities to cater to the growing energy needs.

With an increase in the number of research and development activities, there has been a rapid increase in the revival of abandoned oil wells in several onshore oilfields, which is eventually aiding the market’s growth.

Apart from this, the growing onshore oil & gas exploration in countries like Saudi Arabia, the US, China and Russia, the market is said to witness robust growth during the forecast period.

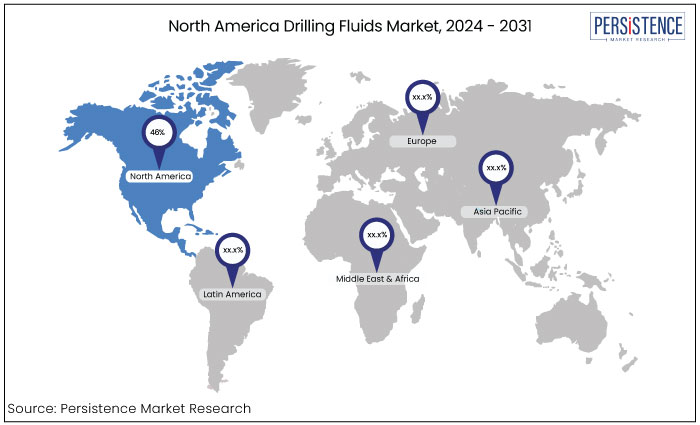

North America Registers Nearly 46% of Total Consumption

North America dominates the global consumption of drilling fluids with a 46% market share. Several drilling and exploration activities across the region for metals, minerals, and energy sources has boosted the demand for drilling fluids.

The US, and Canada have multiple untapped mineral and energy sources. The rising need for energy and the shortage of oil & gas across the globe has stimulated drilling activities in these countries.

Canada is listed as the fifth largest crude oil and natural gas producer globally, which is one of the key influencing factors in the growth of the drilling fluids market in the North American region.

Upsurge in Crude Oil Demand Elevates Prospects of Europe

Europe is estimated to propel with a steady growth rate during the forecast period, owing to the increasing demand for drilling fluids in countries like Italy, Norway, Denmark, France and the Netherlands.

The growing demand for crude oil has been primarily boosted due to the energy & power (E&P) industries in the region.

The E&P companies are mostly involved in extensive drilling activities onshore and offshore activities, which eventually propels the market’s growth in the region.

Apart from these two major regions, the Asia Pacific region is estimated to have a substantial market share during the forecast period owing to the new discoveries of oil fields from untapped sites.

Major developing nations like India, and China are investing huge amounts to find their own oil reserves and reduce their oil dependency on foreign countries.

With this, the Asia Pacific region is growing steadily and is said to be one of the leading regions in the drilling fluids market.

July 2023 –

Wyo-Ben Inc. signed an acquisition deal with M-I Swaco to acquire its bentonite operations. M-I Swaco is one of the divisions of Schlumberger, and the acquisition deal will help Wyo-Ben Inc. position the company as one of the prominent players in the industry and have growth opportunities on a global note.

November 2022 –

NanoMalaysia Bhd launched its new fluid loss additive product called Synergy 10AS Nano, which is aimed at reducing carbon emissions through energy efficiency enhancements.

June 2022 –

Paragon ISG, a leading energy and environmental service provider signed an acquisition deal with Spirit Drilling Fluids to strengthen its business operations and expand globally.

The major competitors in the global drilling fluids market are primarily evaluated based on their product or service offerings, their financial statements, developments and the approaches implemented, the company's position in the global market scenario and its geographical reach.

Besides, the key competitors studied have also been accessed through the SWOT analysis to understand their strengths, weaknesses, opportunities and threats.

Moreover, the key competitors in the industry employ crucial strategies like partnership deals, mergers and acquisitions, and business expansion deals to strengthen their hold on a particular region or a particular service offering.

|

Attributes |

Details |

|

Forecast Period |

2024 - 2033 |

|

Historical Data Available for |

2019 - 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Countries Covered |

|

|

Key Companies Profiled |

|

|

Pricing |

Available upon request |

By Type

By Application

By Region

To know more about delivery timeline for this report Contact Sales

The North American region dominates the global drilling fluids market with a market share of 46%.

The global drilling fluids market is estimated to exhibit a growth rate of 5.2% over the forecast period 2024 to 2033.

Water-based drilling fluids hold a significant market share.

Schlumberger Limited, Halliburton Company, Newpark Resources, Inc., Baker Hughes, and TETRA Technologies, Inc. are some of the leading market players.

The global drilling fluids market size is estimated to reach a valuation of US$19.14 billion by the year 2033-end.