PMR Foresees a Promising Outlook of Growth for the Diesel Gensets Market Given the Critically Rising Need for Incessant Power Back-up Across Industries

Industry: Industrial Automation

Format: PPT*, PDF, EXCEL

Delivery Timelines: Contact Sales

Report Type: Ongoing

Report ID: PMRREP2984

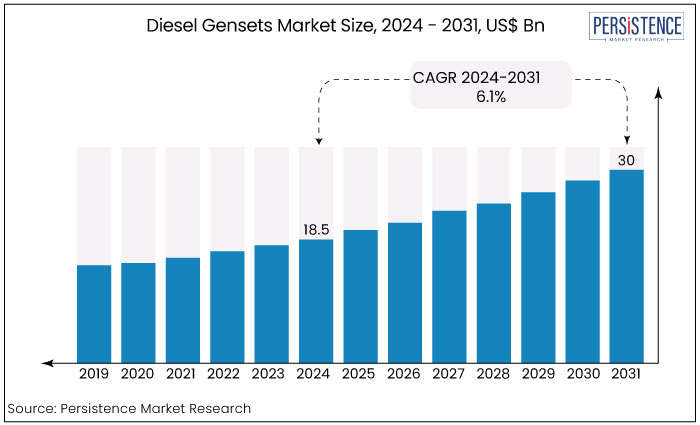

The global market for diesel gensets is expected to surge ahead at a CAGR of 6.1%, thereby increasing from a value of US$ 18.5 billion in 2024 to US$ 30 billion by the end of 2031.

|

Attributes |

Key Insights |

|

Market Size (2024E) |

US$18.5 Bn |

|

Projected Market Value (2031F) |

US$30 Bn |

|

Forecast Growth Rate (CAGR 2024 to 2031) |

6.1% |

|

Historical Growth Rate (CAGR 2019 to 2023) |

5.7% |

Diesel generators (or gensets) have remained a mainstay for dependable back-up power for decades. The global diesel gensets market is experiencing steady growth and will significantly gain from the incessant demand for reliable power supply against the frequent power outages – especially in critical sectors like healthcare, telecom, and data centers.

The future of diesel gensets hinges on clean technology, and efficient use. Construction sites, remote locations, and regions with limited grid access are expected to largely benefit from the versatile and portable attributes of these gensets.

Leading the consumer charge are commercial and industrial sectors, with healthcare and telecommunication industries prioritizing uptime for vital services. Geographically, regions prone to power instability are at the forefront, with developing economies showing significant growth potential.

While concerns about environmental impact remain, the near-future outlook for diesel gensets is optimistic. As the world strives for a balance between reliable power and sustainability, solid developments in cleaner technologies, and focus on efficient use are expected. The rise of renewable back-up options will also be a significant growth influencer.

Key Trends Shaping the Market

The diesel gensets market saw moderate growth between 2019 and 2023 at a value CAGR of 5.7%. Unreliable grids, especially in developing regions, fueled demand for diesel gensets as a back-up power solution. Increasing healthcare and data center needs continued to drive genset adoption.

Growth of industrialization, and infrastructural expansion also directly influenced the market performance in the historical period.

As far as the growth forecast is concerned, the increasing demand for uninterrupted power across critical-serving industries is expected to create tailwinds for the growth of the market.

While the development of cleaner burning engines, and efficient models will trend through 2031 and beyond, strict environmental regulation, and the rise of multiple renewable back-up solutions will present the longstanding challenges.

Pre-pandemic, factors like rising power outages, and industrialization in Asia Pacific fueled demand. However, COVID-19 caused a temporary dip due to supply chain issues, and project slowdowns.

However, reliance on backup power in essential services kept the gensets demand afloat. The post-pandemic period saw a rebound as the industry’s focus shifted to infrastructure and economic recovery.

Over the period of projection, the market for diesel gensets is expected to reach around US$30 Bn at a healthy, promising CAGR through the end of 2031. The need for uninterrupted power, and advancements in cleaner engines will drive the demand ahead.

Unwavering Demand for Reliable Power Supply

The relentless need for uninterrupted power across industries is a key driver for the diesel genset market. This will be especially true for critical sectors like healthcare, data centers, and telecommunications, where downtime can have severe consequences.

Frequent power outages, especially prevalent in developing regions with unreliable grids, further amplify the demand for reliable backup solutions. Diesel gensets offer a quick and dependable way to ensure continuous power supply, safeguarding vital operations and minimizing downtime costs.

As reliance on technology and automation increases, the demand for uninterrupted power is expected to rise steadily, propelling the growth of the diesel genset market.

Evolving Needs in Developing, and Fast-Developing Economies

Rapid industrialization, and infrastructural developments in regions like Asia Pacific are driving significant growth in the diesel genset market. These projects often take place in remote locations with limited or non-existent access to main electricity grids.

Diesel gensets provide a versatile and portable solution, offering primary or secondary power sources for construction sites, manufacturing facilities, and remote operations.

Developing economies often face challenges with grid instability and frequent power outages. Businesses and communities in these regions rely heavily on diesel gensets for back-up power, ensuring continuity of operations and facilitating economic growth.

As these regions continue to develop, the demand for reliable and efficient power solutions like diesel gensets is projected to remain strong, fueling the diesel gensets market growth.

Environmental Regulations

Governments worldwide are implementing stricter emission regulations to combat air pollution. This puts pressure on diesel genset manufacturers to develop cleaner-burning engines or face potential restrictions on their products.

Rise of Renewable Back-up Options

Technological advancements and falling costs are making renewable energy sources like solar and wind power increasingly attractive alternatives to diesel generators.

These solutions offer the benefit of clean energy generation, potentially leading to a shift in consumer preference away from diesel gensets, especially in regions with reliable grid access.

Smart Technology Integration with Diesel Gensets

The smart genset revolution is a golden opportunity for manufacturers of diesel genset manufacturers in the years to come. The integration of smart technologies like remote monitoring, and data analysis allow for real-time performance optimization, preventive maintenance, and improved fuel efficiency.

With smart gensets, companies can cater to a growing demand for intelligent and data-driven power solutions, attracting tech-savvy customers, thereby establishing a competitive edge in the global diesel gensets market.

The Clean Technology Boom

With increasing stringency of environmental regulations, diesel genset companies eye leadership in clean technology. R&D investments targeting the development of cleaner-burning engines are expected to be a major highlight. The rise of alternative fuels like biodiesel also provides a strong impetus to this.

Tapping into the opportunities driven by clean technology, genset manufacturers are likely to explore emerging business avenues in newer market segments.

Low Power Rating Gensets to be the Sought-After Type

The low power rating (0-75 KVA) diesel genset category dominates the global diesel gensets market for its versatility and affordability. It caters to a wide range of applications, including back-up power for homes, small businesses, and temporary events.

The high demand for portable generators for remote locations, and disaster relief also fuels this segment's growth.

On the other hand, while medium power rating (75-375 KVA) gensets also continue to capture a sizeable share of the market, research shows they cater to niche sectors. These gensets typically provide back-up power solutions to larger businesses, factories, and construction sites.

The other two segments of the genset type category, i.e., high power rating (above 375 KVA), and very high power rating, remain the restricted ones as they mostly serve specific sectors like data centers, power plants, and large industrial facilities.

As high power and very high power diesel gensets demand substantial investments, as well as specialized expertise for both operation and maintenance, these two segments will observe a stable trail of growth in the global diesel genset market.

Highest Application Registered Across Data Centers, and Healthcare Sector

The need for uninterrupted power supply defines the position of various application segments in the diesel gensets market. The areas that are associated with continuous load, including data centers and healthcare facilities, will continue to represent the top-ranking category.

Data centers, and healthcare facilities especially need the incessant power supply so as to keep the critical operations like data storage, and patient care running, and uncompromised. This is where diesel gensets step in as an ideal, dependable, and faster back-up solution.

On the other hand, industries like manufacturing, and construction that heavily depend on diesel gensets as their primary source of power. In addition to providing the unwavering power supply, these gensets gain largely from their versatility, and portability.

While mining and petrochemical, and domestic segments also create sustained demand generation, the demand here will be relatively less as their primary source of power is typically the on-site power generation plant.

Asia Pacific Takes the Winning Sprint in Diesel Gensets Industry

Asia Pacific maintains a dominant position in the global diesel genset market and the lead will be driven by the rapid pace of industrialization, especially in the fast-developing economies, i.e., China, India, and some of the southeast Asian nations.

Several developing countries in the region still experience frequent power outages that highlight the critical need for back-up power solutions – for domestic, commercial, industrial, and other application areas alike. This is poised to keep the demand for diesel gensets upbeat in the long term.

An upsurge in industrial activity translates to further growing reliance on diesel gensets for both primary and back-up power solutions, especially in remote locations with underdeveloped grids. Temporary installations are also on the rise.

Moreover, the exceptional pace of large-scale infrastructural development projects in the subcontinent further continue to create strong demand for a reliable and portable power supply solution. This will work to the advantage of the diesel gensets market as adoption is likely to grow at construction sites.

Diesel Genset Sales Soar with North America’s Focus on Reliability

North America represents another major market for diesel gensets. Data centers, healthcare facilities, and telecommunication companies in the region prioritize uninterrupted power supply to safeguard their vital operations.

Extreme weather conditions in the North American region often lead to power outages, which necessitates the need for diesel gensets as a back-up power solution.

Cleaner-burning gensets are currently trending the market of North America, attributing to stringent environmental regulations in comparison with most developing regions.

March 2024

Recon Technologies Pvt. Ltd. introduced Mahindra Powerol CPCBIV+ diesel gensets in compliance with the latest CPCBIV+ emission norms in India that are stricter and focus on 90% reduction in harmful emissions.

June 2022

Kirloskar Oil Engines Ltd (KOEL) announced the launch of its new iGreen genset - iGreen version 2.0. The genset is powered by the R550 engine series. It is claimed to offer impressive fuel efficiency along with high power quality.

December 2021

The Government E-Marketplace (GEM) floated a tender for a diesel gensets installation project at the Ministry of Commerce & Industry in New Delhi, (India)’s head office.

December 2021

The UK-based diesel generator company Enregon signed an agreement to provide 30 MW of diesel generators to a Middle Eastern data center.

July 2021

Qulliq Energy Corp. hastened the replacement project at Grise Fiord's aging diesel plant. The project involved replacement of aged community diesel gensets with new diesel gensets post-decommissioning of the plant.

|

Attributes |

Details |

|

Forecast Period |

2024 to 2031 |

|

Historical Data Available for |

2019 to 2023 |

|

Market Analysis |

US$ Billion for Value |

|

Key Regions Covered |

|

|

Key Market Segments Covered |

|

|

Key Companies Profiled |

|

|

Report Coverage |

|

|

Customization & Pricing |

Available upon request |

By Type

By End Use

By Region

To know more about delivery timeline for this report Contact Sales

The global market for diesel gensets reached a valuation of US$18.5 Bn as of 2024-end.

The diesel gensets demand is anticipated to witness a growth rate of 6.1% over the forecast period of 2024 and 2031 in terms of value.

Some of the top companies in this market include Atlas Copco AB, Cummins Inc., AKSA Power Generation Company, Kirloskar Oil Engines Ltd., and Caterpillar.

Data centers, and healthcare sector currently lead the market by application.

The top countries driving the global protective coatings demand are Asia Pacific, and North America.